Investing is often seen as either a long-term strategy, like Warren Buffett's approach, or as active speculation in the futures market. Both strategies have distinct pros, cons, and risks. Is passive investing more effective than active? This comparison examines both to determine which might be better.

Investing is often seen as either a long-term strategy, like Warren Buffett's approach, or as active speculation in the futures market. Both strategies have distinct pros, cons, and risks. Is passive investing more effective than active? This comparison examines both to determine which might be better.

In this article, you will learn

- Fundamentals of passive and active strategies

- Pros and cons

- Investment tools

- Summary

- FAQ

Key Takeaways

- Passive investing focuses on long-term growth by mimicking market indices, offering lower fees and a hands-off approach. Selling securities is not typical for a passive wealth manager, even if he invests in growth stocks. Active investing seeks to outperform the market through stock picking and market timing on the futures market. Traders us technical indicators and observe current data such as macro and political instability to gain on Wall Street.

- Historically, passive investing has often outperformed active investing over the long term, but active investing can potentially offer higher returns in the short term or in specific market conditions. It’s considered as more risky; strong overall performance may be achievable but can never be guaranteed, requires work and knowledge.

- The choice between passive and active investing should align with the investor's goals, specific risk tolerance, financial situation and investment horizon. It’s possible to mix investment strategy and approaches using investment plans as well as the risky CFD instruments, addressed to active traders

- Passive investors may use such instruments as ETFs (and other ETPs), bonds and eventually stocks. The goal of passive strategies is usually financial security through wealth management. ETFs may improve financial planning without financial advisor fees. Active investors may use the same instruments and observe stock prices but also look to cryptocurrencies, commodities, forex and other leveraged instruments. Financial markets give investors as well as wealth managers a bunch of opportunities.

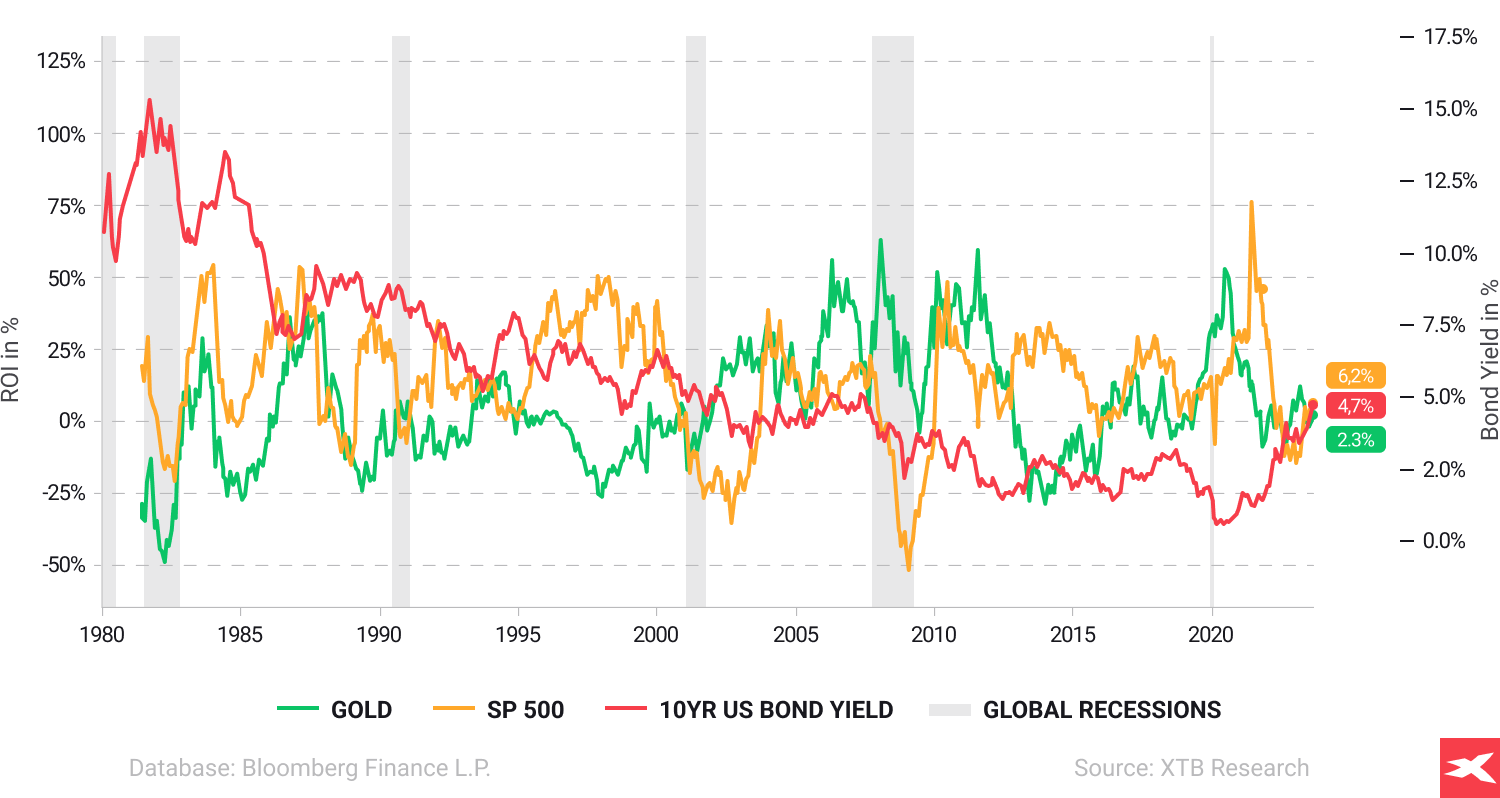

Past performance does not guarantee future results. Source: XTB Research

Annual Returns and US Treasury Bond Yields, Comparison

Average yearly yield from physical gold (golden line), S&P 500 (blue line), 10 year US treasuries (black line). Usually during recessions (grey colour) stock market and treasuries yields were under pressure and gold performance outperformed more risky assets. At the same time, as the economy tended to normalise, both stocks and bond yields outperformed gold yearly gains. We kindly remind that past performances do not guarantee future investment results. Source: XTB Research, Bloomberg Finance LP

Fundamentals of passive and active strategies

A close-up of a pile of coins beside a clock, symbolizing the relationship between time and money

In the realm of investment strategies, you’re likely pondering one critical decision: should you engage in active investing and attempt to outperform the market, or choose passive investing and aim to match market returns? Active investing demands a tactical, hands-on approach; passive investing favours a “set-it-and-forget-it” style. Understanding these strategies’ rewards, risks, and costs is key to aligning with your financial objectives. What’s most important during making this decision? Those are 5 fundamental aspects.

1. Personal Financial Situation

Active: May require more initial capital due to higher transaction fees and management costs. Suitable for investors who can afford these costs and are aiming for higher short-term gains.

Passive: More accessible for investors with varying financial backgrounds due to lower cost. Suitable for building wealth gradually with a smaller initial investment.

2. Risk Tolerance

Active: Best for those with a higher risk tolerance. Active strategies often involve more speculative investments and attempts to time the market, which can lead to significant volatility.

Passive: Ideal for investors with a lower risk tolerance. Passive strategies typically involve long-term investments in diversified portfolios that mirror the overall market, leading to potentially lower volatility.

3. Investment Horizon

Active: Often focused on short-term gains, it requires investors to actively monitor their investments and market conditions, making it more suited for those with a shorter investment horizon.

Passive: Designed for the long haul, it's best suited for investors with a longer investment horizon, allowing time for the compound growth of investments to materialize.

4. Market Knowledge and Involvement

Active: Requires a high degree of market knowledge and continuous involvement to make informed decisions about when to buy or sell. It's for those who enjoy researching and actively managing their investments.

Passive: Requires less time and knowledge to maintain, making it suitable for investors who prefer a "set it and forget it" approach or who do not wish to spend much time monitoring market fluctuations.

5. Financial Goals

Active: Suitable for investors with specific financial goals that require beating the market or achieving higher returns in a shorter timeframe.

Passive: Ideal for investors whose primary goal is to accumulate wealth over time or save for long-term objectives, such as retirement, without trying to outguess market movements.

When choosing between active and passive investing, it's crucial to consider these fundamentals in relation to your unique financial situation, goals, and preferences. There's no one-size-fits-all answer, and some investors may even find a combination of both strategies suits their needs best. Active managing money may be simple, but just can’t be easy. Financial market is a highly competitive game.

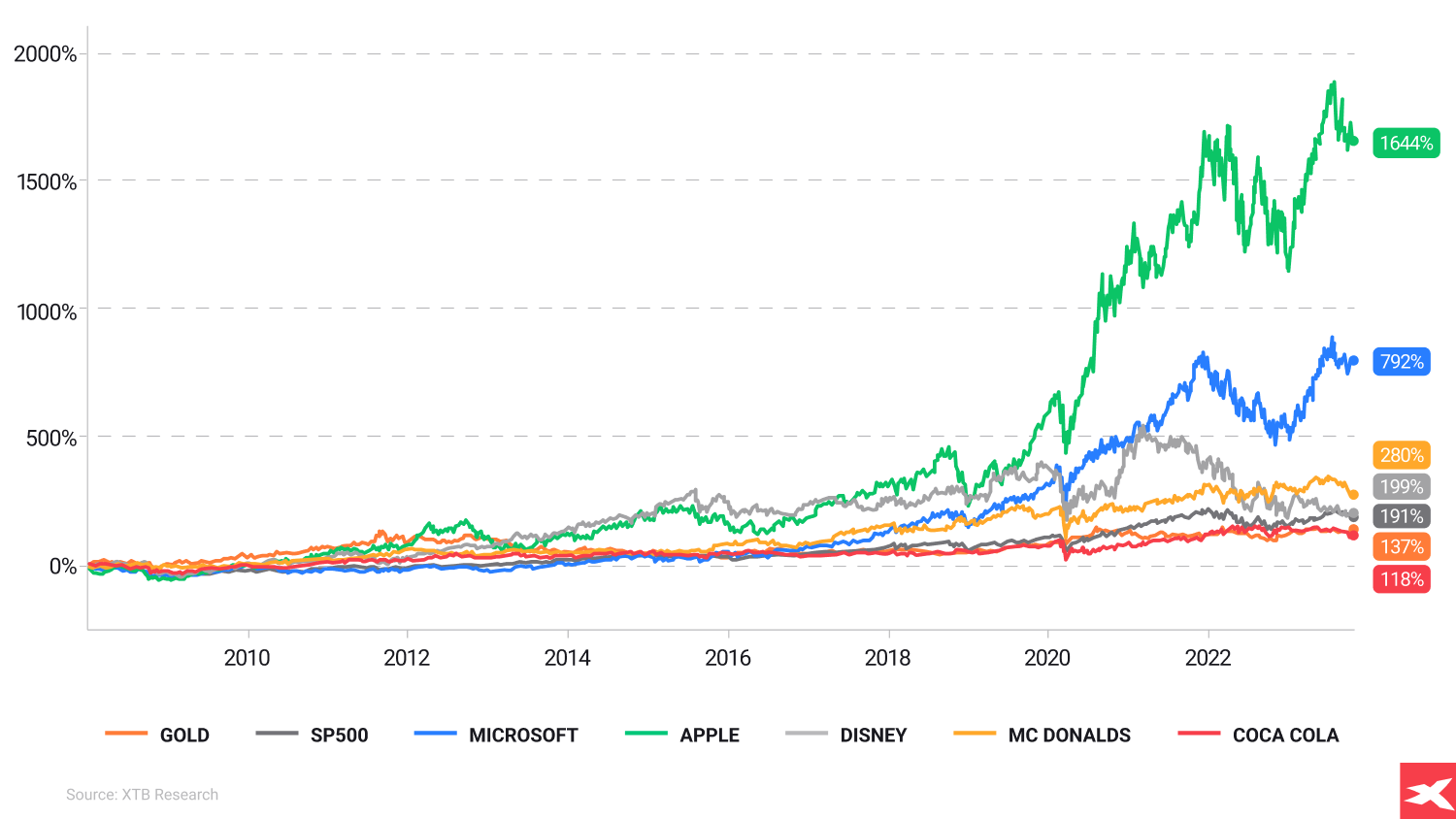

Past performance does not guarantee future results. Source: XTB Research

Return on Investment since Jan. 2008

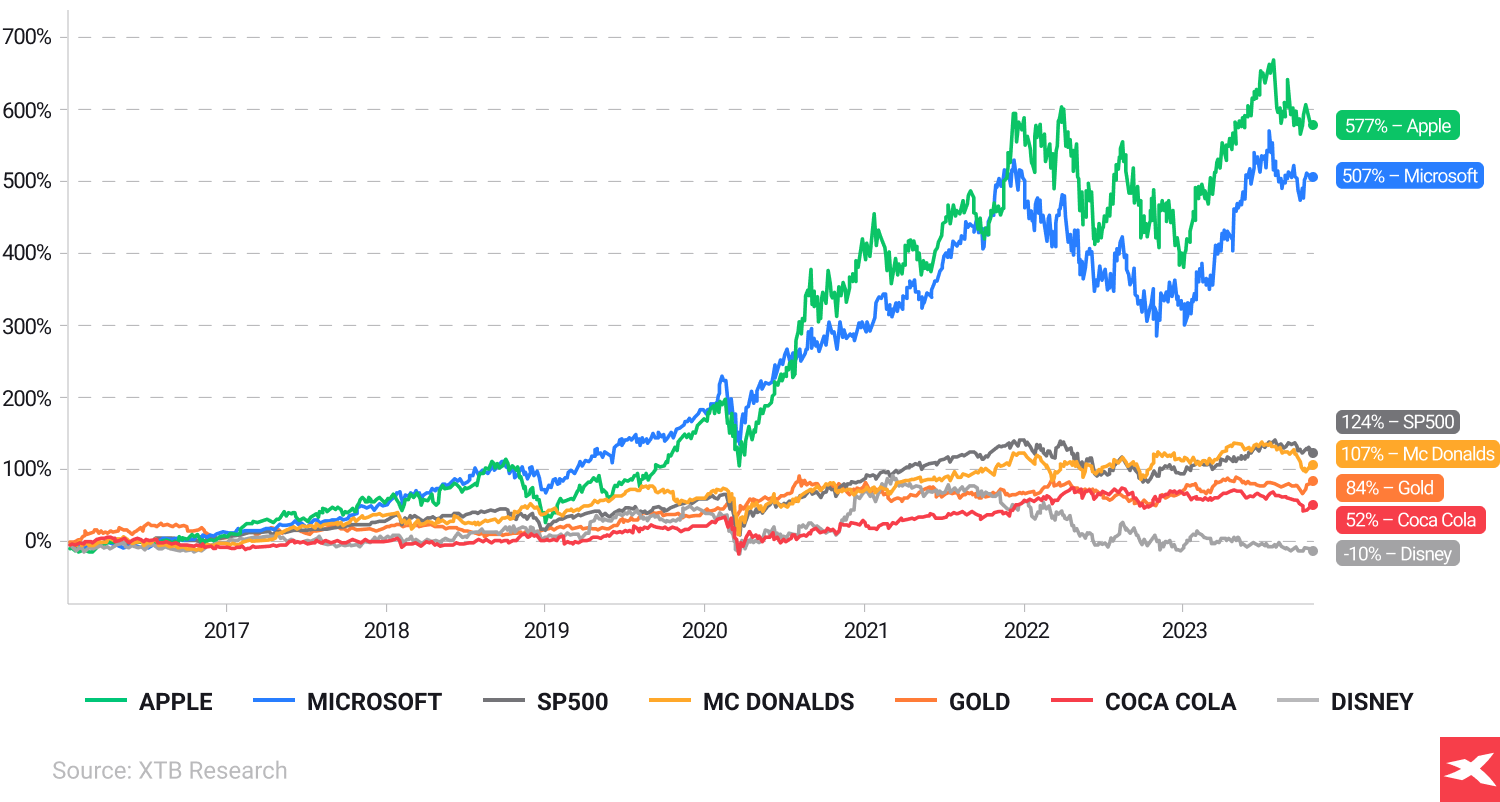

Past performance does not guarantee future results. Source: XTB Research

Return on Investment since Jan. 2016

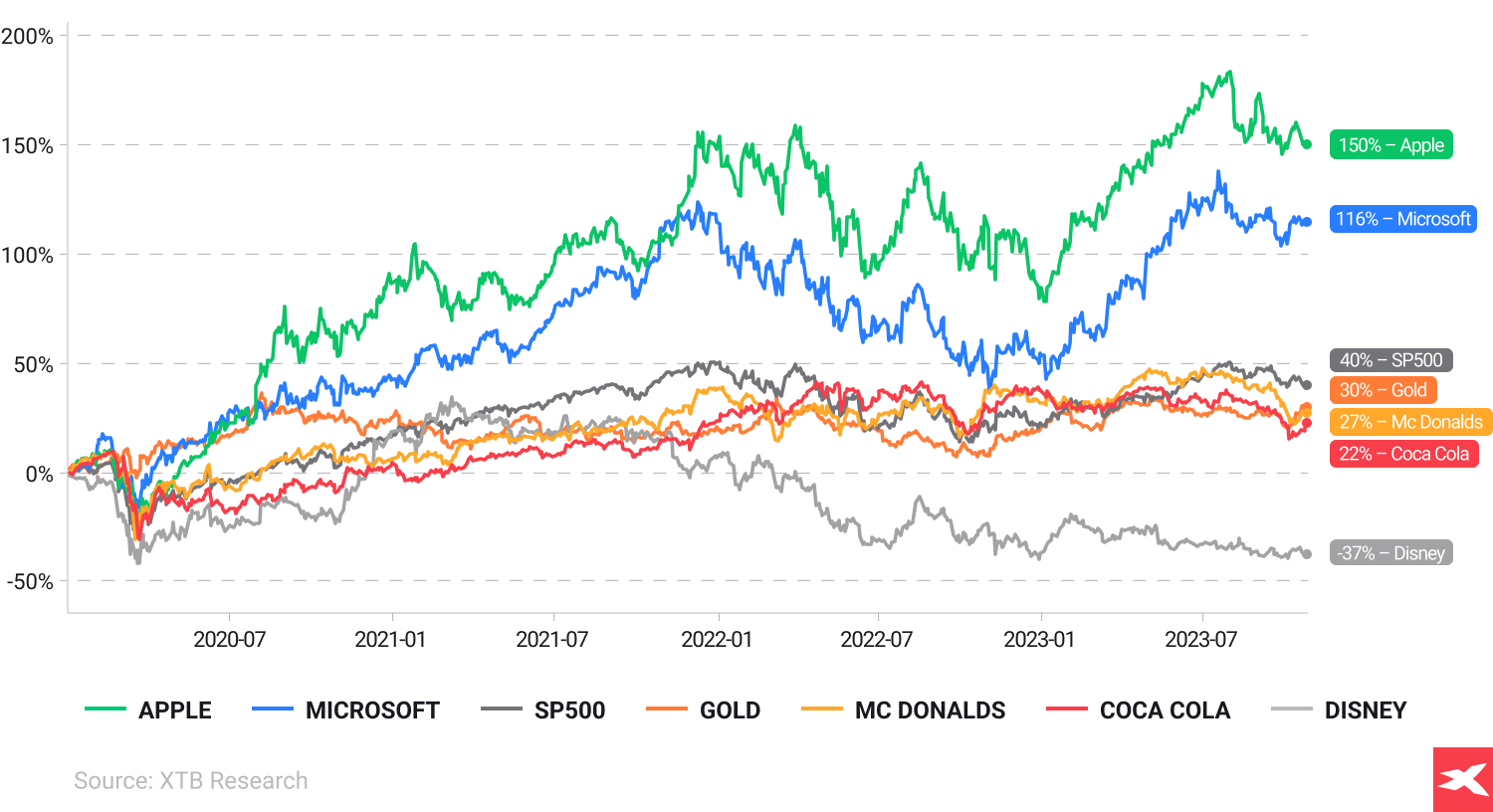

Past performance does not guarantee future results. Source: XTB Research

Return on Investment since Jan. 2020

Last years on the stock market were very good for investors in S&P 500, Microsoft, Apple, Mc Donald’s and Disney from 2008 / 2016 / 2020 to 25 October 2023. Past performance does not guarantee future results. Source: XTB Research

Important: Buy and sell trade strategies may work during time of economic expansion, while value of asset increases, but trend-tracking strategies may bring also significant risks. Markets are hard to predict and manage. Trend direction historically were one-sided (popularising passive investments). But it just can't be guaranteed. Any business may lose market share during a bear market. Risk management is still crucial. We kindly remind that past performances do not guarantee future investment results.

Pros and cons

A red and green square featuring a prominent white plus sign in the centre, symbolizing pros and cons

Active investing is addressed to passionate investors, who do their own research and gain significant knowledge, by reading about investing and valuations. And practice it risking, their own money. It requires a lot of time, and even huge effort can’t guarantee financial success and capital gains.

On the other hand, long term investment by passive investing methods does not require so much time. It’s usually used by both, active speculators and passive investors. The most popular asset classes for long term investors are for sure ETFs (f.e. On US S&P 500 index) and bonds. Some investors, who believe in the long term business potential of a given stock company. Let’s analyse the pros and cons of each investing style.

Passive investing

Advantages

- Simplicity: Easy to understand and manage, suitable for both professional and beginners

- Time effective: Because passive strategy is simple (for example through Investment Plans) it’s also time efficient; investing as a part of life, not full-time job

- Lower costs: Minimal fees due to less frequent trading and no need for active management.

- Tax efficiency: Fewer transactions mean potentially lower capital gains taxes. Holding assets in the long term mean

- Simplicity: Easy to understand and manage, suitable for both professional and beginners.

- Transparency: Investments mirror known indexes, so you know what you’re holding.

- Diversification: Broad market exposure reduces risk of significant loss from a single investment.

- Discipline: Strategy avoids market timing, sticking to a long-term investment plan.

- Historical success: Over the long term, tends to outperform most actively managed

Disadvantages

- Average-only results: Cannot beat the market, only aims to match market performance and average results (which may be more than satisfactory)

- Limited flexibility: Cannot quickly adapt to short-term market changes or opportunities.

- Market downturns: Fully exposed to market declines without active measures to mitigate losses.

- Concentration Risk: Some index funds may be heavily weighted towards certain sectors or stocks.

- Inflation Risk: Passive funds might not react quickly to inflationary pressures.

- Overdependence on Market Cap: Can lead to overexposure to the largest companies by market cap.

- Volatility: Passive investing is usually much less volatile but remember that stock market is volatile, and even Dow Jones lost more than 22% during 1987 crash

- Structure errors: Passive investing may expose investors to financial market biases, leading to too much exposure in some market sectors such as technology or energy

Active investing

Advantages

- Potential to outperform market: Aim to beat the market through strategic selection, timing and quality decision-making

- Flexibility: Can quickly adapt strategies based on market conditions.

- Risk management: Potential to avoid downturns or volatile sectors through active decision-making.

- Personalization: Can align investments with personal beliefs, values, or specific financial goals and personal situation

- Opportunistic: Ability to capitalize on short-term market inefficiencies, for example undervalued stocks

- Hedging options: Can use various techniques to protect against losses.

- Specialization: Focus on specific sectors or types of investments for potentially higher returns.

Disadvantages

- Higher costs: Management and transaction fees can erode returns.

- Inconsistent performance: Many active funds do not consistently outperform their benchmarks.

- Risk of human error: Relies on self or manager’s skill and decision-making, can lead to mistakes. Even high-quality decisions can’t guarantee future success due to market nature and randomness

- Tax Inefficiency: High turnover can lead to larger capital gains taxes.

- Self-confidence risk: Investors must have confidence in their own abilities, which may lead to overconfident behaviour

- Overtrading: Excessive trading can lead to higher costs and lower returns, as well as the psychological stress

- Market timing: Predicting market movements is challenging and may be unsuccessful, leading to capital losses.

Investment tools

Close-up view of a clockwork mechanism, featuring finely crafted gears and components, illustrating precision engineering.

A mechanic needs a whole set of tools to make a repair. In the same way, an investor needs to know what tools he can use to achieve his goals. The tools that long-term investors use are often different from those used by active investors. But it’s all about investing approach. Of course, the key to this topic is the approach and attitude to the asset type. Even ETFs can be used as tools for short-term speculation. But let's consider what role assets can play, depending on the investor's mindset. We will mention it below:

- Exchange Traded Funds (ETFs): ETFs as well as broader Exchange Traded Products (ETPs) sector is addressed to long term investors. Thanks to it, investors can invest in well-known from long term performance US indices such as S&P 500, or Nasdaq 100. Those products can give one also exposure on Bitcoin (through ETNs) or specific branches such as information technology, manufacturing, robotics, electric vehicles, semiconductor etc.

- Stocks: Long term investors see stocks as a real share in business. It means holding these for a long term, usually ignoring short term price actions on both sides. The stock market is auction-driven, and no one will force you to sell if you don’t accept the current price and don’t want to. This approach mimics Warren Buffett investing philosophy. But also risks, because companies may be underperforming and even loss the business battle with it peers. Investor can make mistakes, by choosing bad or too high valued businesses.

- Bonds: Investing in bonds is considered as less risky. It’s de facto being a lender, and borrowing money on a time (bond maturity), at a fixed rate. The biggest risk is that a creditor will go bankrupt and will not repay borrowed money. Bond investors invest in both private (for example high-yield bonds) and public debt (treasury bonds).

- Futures: Sometimes long term investors use futures market, to hedge exposure for example to exchange rate risk

Contracts for Differences (CFDs)

ETFs CFD - Although ETFs were created with the long-term investor in mind, short-term traders can use CFDs on ETFs, for example, to take positions on companies in a whole, specific industry. In this way, they can, for example, make money from the poor performance of the electric car sector, information technology, or stock declines of oil and gas companies.

Stocks CFD - Short term speculators may use CFD on stocks to benefit from volatility spikes such as: weak or very strong quarterly results, activist investors reports, companies profit warning signals, valuation or another specific events affecting stock price.

Futures - Short term investors usually use also commodities, forex and cryptocurrencies markets to achieve satisfactory returns.

Summary

As we come to the close of our exploration, we reflect on the rich tapestry of active and passive investing. From the hands-on approach of active management to the set-and-forget philosophy of passive strategies, we have traversed the landscape of portfolio growth, uncovering the intricacies of each path. The choice between passive and active investing should align with the investor's financial goals, risk tolerance, and investment horizon. A diversified investment approach, possibly blending both strategies, may be used to mitigate risks, while optimizing returns. But both strategies carry some risks and opportunities, which should be well understood.

- Passive investing focuses on long-term growth by mimicking market indices, offering lower fees and a hands-off approach. It’s considered as simpler than active. Passive investor should be also aware of market volatile nature and risks

- Active investing seeks to outperform the market by timing. Sometimes it requires unpopular decision-making, seeking to market's ineffectiveness and valuation bargains. But it's requiring more expertise and incurring higher costs.

- Historically, passive investing has often outperformed active investing over the long term. Especially when considering net returns after fees. Active investing can potentially offer higher returns in the short term or in specific market conditions. But with usually higher risk and volatility;

- Passive investing is cost-efficient, with lower management fees and transaction costs, boosting potential net investment returns over time. Active investing involves higher fees due to active management, which can erode returns if not offset by superior performance.

- Passive strategies typically have a lower risk profile and are more tax-efficient due to fewer transactions. Active strategies, while potentially more rewarding, carry higher risk and may lead to higher tax liabilities due to frequent trading.

FAQ

FAQ

It depends on your investment situation, goals and risk tolerance. Passive investing is often recommended for those seeking long-term growth with lower fees and minimal effort, while active investing might suit those looking for potential higher short-term gains and who are willing to take on more risk and involvement. Remember that the market is risky, and both strategies may bring You stress during weaker yields periods. The best recipe for it is awareness and sticking to strategy.

- Lower costs: Typically has lower management and transaction fees.

- Simplicity: Easy to understand and requires less time and effort to manage.

- Tax optimization: Less frequent trading means potentially lower capital gains tax.

- Transparency: Holdings reflect well-known indices, making it clear what you’re invested in.

- Historically strong performance: Over the long term, tends to perform well compared to actively managed funds, especially after fees.

- Limited potential: Only aims to match, not beat, market returns. Is like a guarantee of achieving market average

- No downside protection: During market downturns, passive investments will fully reflect the decline: With almost no option to outperform and create so-called ‘alpha’

- Flexibility: Cannot quickly adjust to take advantage of short-term market opportunities.

- Concentration risk: Some indices may be heavily weighted toward specific sectors or companies. Investing through market index may bring such ‘structural’ problem, with too much exposure to some sectors. Which may underperform other peers in the future

- Market cap bias: Index funds buy more of the largest companies, potentially overexposing the certain stocks. It’s like guaranteeing that investor's yield will not reflect future winners (but what’s important, also losers)

- Risk of investing errors: Dependent on the skill and decisions of the portfolio manager, which may lead to capital losses and errors

- Higher costs: Management and transaction fees are typically higher (spreads, swaps)

- Taxes: Frequent, profitable trading usually can lead to higher tax bills for capital gains.

- Performance inconsistency: Many active funds do not consistently outperform their benchmarks.

- Overconfidence: Managers may take unnecessary risks based on their market predictions.

The exact percentage varies by market and over time. It's important to note that the investment landscape is dynamic, and the balance between passive and active investors can shift due to various factors, including market conditions and investor sentiment. For the most current statistics, consulting recent financial reports or investment industry analyses would be necessary.

Passive investing is generally considered lower risk compared to active investing due to its diversified approach and long-term horizon. However, like all investments, it still carries some level of market risk. It may also be risk of few, poor years for long term investors. Such situation existed for example from 2000 to 2014 on Nasdaq from late 20s to 50s in US stock market. But the stock market increased after each, bad event and depressions periods.

It is better to blend both active and passive investing strategies to adapt to different market conditions and increase overall investment success. Combining active and passive strategies can help navigate through various market climates and potentially yield better outcomes.

Active investing involves an attempt to outperform a specific benchmark, while passive investing aims to match the market return by tracking a specific index (Investopedia).

Day traders aim to earn 1%-2.5% of their account balance daily, but taking higher risks can lead to higher returns and potential losses.

Financial advisors play a crucial role in active investing strategies by providing market research, technical analysis, and guidance on complex investment decisions. Their expertise helps investors navigate market cycles and select specialized investments like REITs.

Yes, active investing usually has higher fees due to frequent trading and in-depth research, while passive investing typically incurs lower fees as it involves less trading and aims to replicate market indices or holding stocks.