Long term ETF investing was very profitable during the last two decades. Exchange traded funds still give investors a bunch of unmatched opportunities. Will history repeat again? What may be new ETF trends on the horizon?

Long term ETF investing was very profitable during the last two decades. Exchange traded funds still give investors a bunch of unmatched opportunities. Will history repeat again? What may be new ETF trends on the horizon?

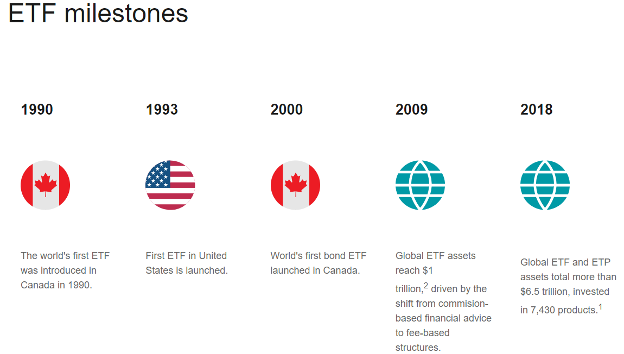

ETFs have grown in popularity over the past few decades. Since the first index fund was created in 1976 by Vanguard's John Bogle, they have sealed their permanent place among major global asset classes. 14 years later, after the first index fund Vanguard S&P 500 was created, the Toronto Stock Exchange introduced the first Exchange Traded Fund. Now thanks to ETFs, millions of investors around the world today have the opportunity to invest in well-defined asset classes.

The largest ETF issuer, BlackRock (iShares) recorded billion dollars in profits, due to rising ETF inflows. Diversified and simplified investment - possible on their own, without the high costs charged by mutual funds. Direct exposure on global markets is now easier than ever before.

Many investors are interested in the potential of ETFs given the long-term great streak of the US stock market. An index of the 500 largest U.S. companies listed on the New York Stock Exchange, the S&P 500 has returned 5 percentage points more to investors than yields of 10-year treasuries bonds over the long term (and average 10% yearly in the last 100 years).

This had to do with both the successful economic trend and monetary policy. Consequently, a massive amount of money fed into the S&P 500, and long-term holders of any ETFs in recent years had no arguments to complain.

ETFs have helped “democratise” financial markets by opening up access to the stock market for millions through index funds and funds that track company stocks and assets in select sectors. For example, commodity ETFs, new technology or bond ETFs. In the following post, we will list 7 popular ETFs and outline what are the advantages and disadvantages of investing in ETFs. These assets, together with Investment Plans, can significantly help you build a long-term investment portfolio. In what way? Let's find out.

ETF long term opportunities

Exchange-Traded Funds (ETFs) have gained significant popularity among investors seeking long-term growth opportunities. These funds, which pool together a collection of stocks, bonds, or other securities, offer a diversified approach to investing. When looking at the long-term potential of ETFs, several key advantages come into play, making them a possible choice for those aiming to build wealth over time. However, any investor should be aware that investing is risky, and also ETF investing may lead to significant capital loses.

Diversification Benefits

One of the most significant long-term advantages of ETFs is their inherent diversification. By investing in an ETF, investors can gain exposure to a wide range of assets with a single purchase. The diversification may be geographically, but also by segments; investors may collect completely different assets.

This diversification helps spread risk, as the performance of individual securities within the ETF may offset one another. For long-term investors, this reduces the impact of market volatility and the risk associated with holding individual stocks, which can be more susceptible to market swings.

Diversified ETFs, such as those tracking broad indices like the S&P 500 or MSCI World Index, allow investors to participate in the growth of entire markets rather than betting on individual winners. Following Ray Dalio, Bridgewater hedge fund founder, investors may focus also on investing in ‘uncorrelated’ assets. Even from this perspective, ETFs may be huge, investment tools.

Lower costs

ETFs are known for their low-cost structure compared to other investment vehicles, for example mutual funds. Most ETFs have lower expense ratios because they are typically passively managed, tracking a specific index rather than relying on active management. Over the long term, these cost savings can compound, enhancing an investor's returns. However, compared to individual stocks, ETFs are still much more expensive (investing in stocks is almost cost-free, the only ‘price’ is risk of the downside).

This cost-efficiency is particularly important for long-term investors, as even small fee differences can have a substantial impact on the growth of an investment portfolio over decades. Some active managed ETFs (by active portfolio manager, such as Cathie Wood’s ARK) may be more expensive (higher TER). Historically, almost none of them can compare returns to S&P 500 or Nasdaq 100 ETFs.

Compounding Growth

The power of compounding is a crucial element in long-term investing, and ETFs are well-positioned to take advantage of this effect. By reinvesting dividends and capital gains distributions, investors can generate returns on their returns, leading to growth over time. Remember also, that the ETF portfolio growth is not guaranteed and may lead to loses - especially if ETF is ‘constructed’ of companies with weak valued growth opportunities, or with wrong ‘weight’ inside the fund.

Many ETFs automatically reinvest dividends, allowing investors to benefit from compounding without additional effort. This feature is especially beneficial in the long term, as the reinvested income can significantly boost the overall value of an investment. What’s more, it's also simpler due to taxation.

Access to a Broad Range of Markets and Sectors

ETFs offer access to a variety of asset classes, sectors, and geographic markets, allowing investors to tailor their portfolios to specific long-term strategies. Whether an investor is interested in the technology sector, emerging markets, or sustainable investing, there is likely an ETF that fits the investment goals. This flexibility enables long-term investors to diversify not only across asset classes but also across industries and regions, capitalizing on global growth opportunities and trends.

Tax Efficiency

ETFs are generally more tax-efficient than mutual funds. Due to their unique structure, ETFs can minimize capital gains taxes through a process known as the creation and redemption mechanism. This process allows ETFs to manage inflows and outflows of capital more effectively, often resulting in lower tax liabilities for investors. Minimizing tax impact can contribute to higher net returns, making ETFs an option for tax-sensitive investors. Remember, that each investor should know his own residence tax policy.

Market Cycles

Investing in ETFs can provide stability through various market cycles. Because ETFs typically track broad indices or sectors, they are less likely to experience the sharp declines that individual stocks might face during market downturns.

Long-term investors who remain committed to their ETF strategies are often better positioned to weather market volatility. The stability may be crucial for maintaining a long-term investment horizon, as it reduces the temptation to make impulsive, unprofessional and emotionally-driven investment decisions during periods of market stress.

However, investors should remember that ETFs can underperform sector winners during the downtrends. Also, coming back to growth after a cyclical crash may be much longer and less dynamic, than rebound of the ‘beloved’ companies stocks.

ETF - Pros and Cons

ETF investing is simple, but is not easy. It requites self-confidence, risk awareness and patience. ETFs have some advantages and disadvantages, which we describe below. Here is the list of them.

Pros

- Solution for long-term investors who favour a passive approach to investing.

- Accessible due to low entry costs, low fees (TER depending on each ETF) and high liquidity

- Offers reduced overall risk due to uncorrelated assets investing and the potential for broader diversification

- Lower volatility in investment value fluctuations may be more comfortable for investors

- Suitable for both novice and experienced investing professionals

- Enables investment in a wide range of assets and equities such as gold, silver, indices, bonds and so on

- Provides assurance that an index fund will mirror the performance of major stock indices, such as the S&P 500, Nasdaq 100, DAX or FTSE

Cons

- May not suit traders or short-term investors who prefer a more aggressive strategy.

- Reduced risk may result in lower returns (for example, passive indices investors earn us much as annual growth rate of the index minus TER)

- An ETF selected by the investor could underperform compared to leading companies or indices during bull markets.

- Diversification does not guarantee profits and may also result in losses.

- Some underperforming ETFs in a portfolio can drag down the overall performance of those that are performing well.

- Potential risk of an ETF not aligning well within a portfolio's overall strategy.

- Overconcentration in passive investments could limit growth opportunities stopping allocating capital to riskier assets, potentially missing out on exceptional results

Most Popular ETFs

Exchange traded funds (ETFs) offer investors exposure to almost every asset class; from dividend investing, and new technologies through precious metals. This is also a reason of its increasing popularity. With ETF investing, investors can get exposure to:

- Stock market indices (U.S. indices, European indices, emerging markets, etc.)

- Selected sector ETFs (for example new technologies, banks, biotechnology etc.)

- Green and ESG investments (renewable energy, electric cars etc.)

- Bonds (from corporate high-yield bonds, US 10-year “treasuries”)

- Energy and materials (e.g. commodity etf on natural gas, copper)

- Precious metals (gold, silver)

Dividend stocks (by accumulating “distributing” model ETFs)

Popular ETFs examples

- iShares Nasdaq 100 UCITS SXRV.DE - stocks from Nasdaq 100 index - leading US technology companies index

- iShares S&P 500 UCITS SXR8.DE - shares of 500 biggest US companies, listed on S&P 500 index fund

- iShares Physical Gold IGLN.UK - ETF mirroring spot gold prices performance, 100% physically backed

- iShares Physical Silver ISLN.UK - mirroring spot silver prices, 100% physically backed

- iShares USD Treasury Bond 7-10yr UCITS CBU0.UK - tracking 7 to 10-year US treasuries bonds

- SPDR S&P Global Dividend Aristocrats GLDV.UK - tracking global companies with stable, high dividend ratio since decades

- SPDR S&P US Dividend Aristocrats SPYD.DE - US based dividend companies

- SPDR S&P Euro Dividend Aristocrats SPYW.DE - exposure to European dividend stocks

- iShares Core MSCI World UCITS EUNL.DE - diversified developed countries stock market exposure

- iShares Core MSCI Europe UCITS IMAE.NL - largest stock market companies in Europe

- iShares MSCI Asia EM UCITS CEBL.DE - Asian (also Chinese) companies

FAQ

FAQ

ETFs typically offer exposure to dozens or hundreds of different listed companies. Investing in individual stocks involves buying shares of only one company (or more if an investor buys more than one company stock). Because of the larger number of stocks that ETFs accumulate, usually they have lower volatility compared to stocks.

They are also not as prone to the risks associated with investing in only one company. Some index funds track the price movements of entire stock market indices, which include dozens to hundreds of stocks of different companies. Individual stocks are usually much more volatile than ETFs.

Some “Distributing” (Dist.) ETFs pay dividends to investors according to how much the companies in their portfolio pay out. Other so-called “Accumulating” (Acc.) ETFs, instead of paying out dividends, set aside the equivalent in the price of the ETF itself.

Among others, the German DAX index does this similarly, as a so-called “Performance Index”. Its prices take into account not only changes in stock prices, but also dividends paid by German companies.

ETFs may be suitable for passive investors who plan to reap long-term returns and are focused on wealth management. This is all thanks to easy diversification, low investment costs and the simplicity of managing a portfolio composed of such ETF assets.

At the same time also short term speculators or traders can also trade them. However, the investment result is never guaranteed and even buying the most popular ETFs does not guarantee investment returns. In fact, investing in the stock market in a bad moment, investors can lose money due to emotional reactions and assets underperformance, which trigger fear.

The stock market has responded positively to the trend of globalization, economic expansion, new technologies and stimulative policies of central banks like Fed or ECB. More and more investors joined the market since 2020 and made sure that ETFs were an interesting investment alternative. Capital inflows accelerated ETFs popularity. The great performance of the stock market has convinced investors that ETFs are what allow them to get instant exposure to stock market indices - even without the need for specialized knowledge and the ins and outs of company valuation.

First and foremost, the advantage of ETFs is their easier accessibility to markets such as bonds and stock indexes. If it weren't for ETFs on the S&P 500, an investor would have to select the companies himself and determine their weighting in his portfolio to reflect the behaviour of the index. Moreover, he would sometimes have to actively manage it and make changes - with ETFs, there is no need to do so. A powerful advantage of ETFs is also the low fees for holding them.

The most popular ETFs in the world are those providing exposure to the US stock market. The most popular are those issued by BlackRock, iShares Nasdaq 100 UCITS (CNDX.UK) and Vanguard S&P 500 UCITS (VUAA.DE). Some ETFs may be increasingly popular during crises (for example bond ETFs, or physically gold ETFs), while some may gain popularity during bull markets - especially those related with new technologies and more risky stocks.