- Fed will announce the first rate decision of 2024 today at 7:00 pm GMT

- Economists do not expect rates to be changed

- This meeting will not be accompanied by release of new economic projections

- US central bank may attempt to set expectations for the timing of the first rate cut

- Markets are speculating about possibility of slowdown or even pause in QT

- USD remain strong, while US indices trade near record highs

The Federal Reserve will announce the first rate decision of 2024 this evening (7:00 pm GMT). USD has been very strong as of late as market odds for a March rate cut diminished. Moreover, downward move on EURUSD was additionally fuelled by lack of hawkish comments from ECB. On top of that, rebound in oil prices and tensions in the Middle East are creating risk of the second wave of inflation and, at the same time, boost demand for safe haven assets, including US dollar. What should we expect from the FOMC meeting today? What will markets focus on?

Timing of the first rate cut

Investors were offered a number of macro reports from the United States recently, which hinted that the US economy is still in good shape and that the Fed may be able to wait with delivering the cut.

- NFP data for December came in at 216k, above 170k expected. Unemployment rate dropped to 3.7%

- US annualized Q4 GDP growth reached 3.3%, while market expected just 2.0%

- US CPI inflation accelerated to 3.4% YoY in December, while core measure slowed less than expected

- University of Michigan consumer sentiment rebounded from 69.7 to 78.8 in January

- Manufacturing PMI climbed back above 50 points threshold in January, while services index jumped to almost 53 points

- JOLTS report showed job openings back above 9 million in December

On the other hand, there are also some negative factors in play that may justify the need for quicker end to tight monetary policy

- Regional indices showed a collapse in economic activity, but it is not evidence by PMIs

- Core PCE inflation dropped to 2.9% YoY in December, while headline PCE inflation stayed unchanged at 2.6% YoY

- Falling PPI inflation suggests further negative impact on consumer prices

- ADP report for January showed 107k employment increase, below 145k expected

CPI inflation rebounded in December, while PCE inflation came in below market expectations. Source: Bloomberg Finance LP, XTB

CPI inflation rebounded in December, while PCE inflation came in below market expectations. Source: Bloomberg Finance LP, XTB

As one can see, positive factors are much more abundant than negative ones, therefore the chance of Fed delivering the first rate cut as soon as at March meeting is rather slim. Money markets are pricing in less-than-50% chance of such a development. However, timing of the first rate cut will not be the only thing investors will focus on. The decision on quantitative tightening (QT) will also be watched closely. It is rather unlikely that the Fed will announce any major changes today, but any hints may be an important mover for the US dollar.

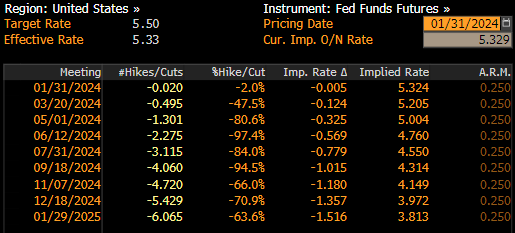

Money markets are pricing in less than 50% chance of Fed rate cut in March, while those odds stood at almost 90% as recently as in December. Source: Bloomberg Finance LP

Is balance sheet more important?

While discussions have mainly focused on the timing of interest rate cuts in recent months, Federal Reserve members addressed an important issue during the December meeting – the reduction of the Fed's balance sheet. Due to previous QE programs, particularly the pandemic-related one, the Fed's balance sheet has expanded to a massive level of 9 trillion dollars. Fed has been limiting its balance sheet by not reinvesting in bonds since mid-2022, resulting in a reduction of the balance by approximately 1.5 trillion dollars so far. Previously, the Fed indicated a desire to reduce the balance sheet by about 2.5 trillion dollars. However, concerns have arisen that further reduction could lead to a liquidity problem, as experienced in 2019. Demand for dollar liquidity has increased significantly, leading to a substantial rise in dollar lending rates. The Fed quickly intervened with an open market operations program, but at one point, there were noticeable movements in the debt market, a strengthening of the dollar, and a decline in the stock market.

The Fed suggested in its research that a balance reduction of $2.5 trillion would be equivalent to a 50 basis points increase in interest rates. Given the current level of inflation and interest rates, there is no need to reduce the balance at such a pace or even continue the entire QT.

Therefore, it is not ruled out that during today's meeting, there will be signals about the future of QT. If more specifics are presented, such as the possibility of slowing down in March or June or ending QT by the end of this year, it could lead to a weakening of the U.S. dollar and provide support for the stock market. However, if no concrete details are provided, signals about the first possible interest rate cut will be more crucial.

At present, liquidity in the market remains high, as evidenced by ongoing reverse repo operations that withdraw liquidity from the market. Simultaneously, there is a significant decrease in these operations, which may indicate that the moment to abandon QT is approaching.

What to focus on in the statement and during Powell's press conference?

- Changing wording of the statement to highlight that policy is in appropriate stance could be seen as a dovish development and may weaken the US dollar. Earlier, Fed's statement hinted at a need to strengthen policy stance

- Adding a phrase on increase in uncertainty related to jobs market and inflation - such a phrase was added in 2019 prior to the rate cut

- Investors should also look for similar statements that were present in January 2019, which heralded the end of QT. Back then it was hinted at a possibility of adjusting balance sheet normalization details to potential economic and financial changes

Inclusion of such statements would confirm the dovish turn from Fed and may lead to a potential weakening of the US dollar and more gains on Wall Street. Keeping the current status quo and lack of any changes in the statement would be positive for USD and may put pressure on equities. However, it should be said that performance of the stock market is driven mostly by earnings reports now.

How will markets react?

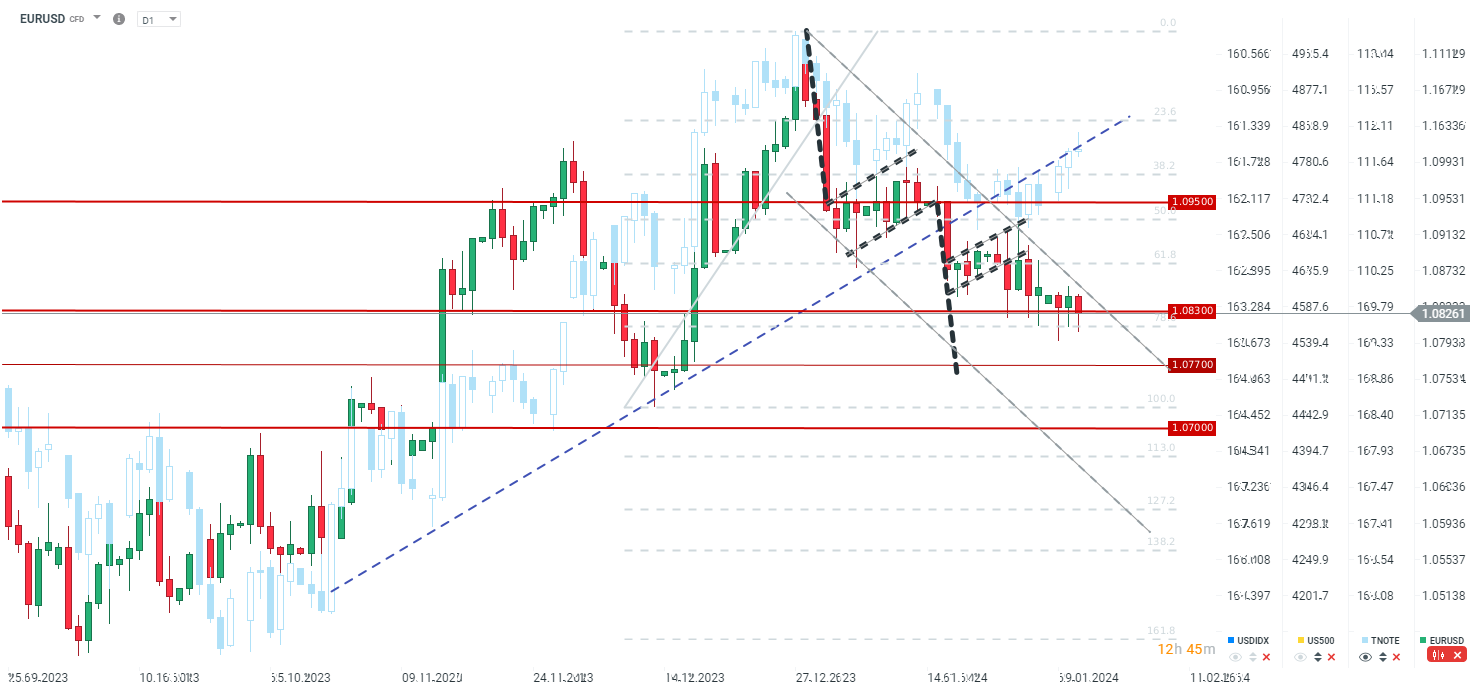

EURUSD

The main currency is trying to recover following a test of the 1.0800 mark, supported by falling bond yields. There is a significant divergence between EURUSD and bond markets, suggesting a potential for the pair to rebound. However, should Fed fail to deliver onto dovish expectations, USD may gain with the pair breaking below support market with 78.6% retracement in the 1.08 area.

Source: xStation5

Source: xStation5

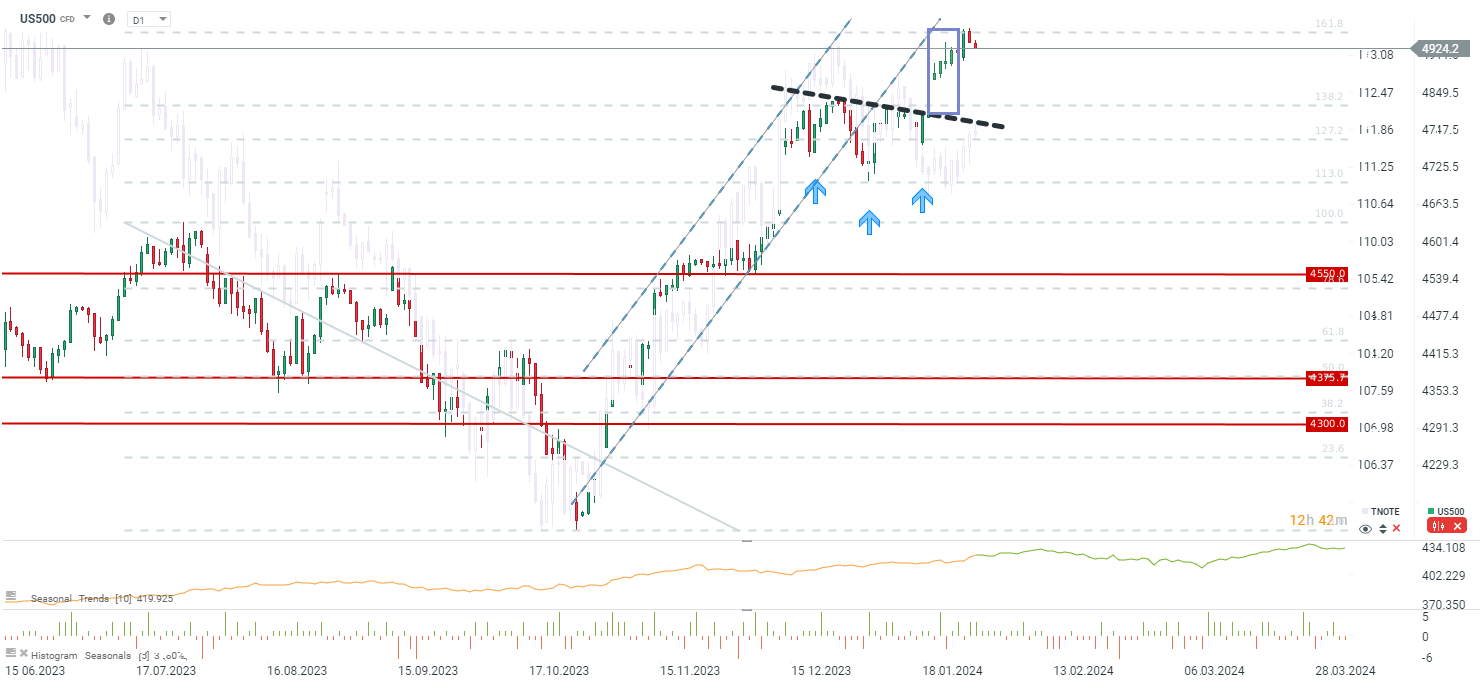

US500

US500 reached the range of the breakout from an inverse head and shoulders pattern, and is now pulling back from the 4,950 pts area. A drop in bond yields (pick-up on TNOTE market) can also be spotted. One cannot rule out divergence between stock and bond markets narrowing, but US500 may wait for the next set of top-tier tech earnings on Thursday (Apple, Amazon and Meta) before delivering the next big move. Should Fed fail to signal a change in their policy stance, one cannot rule out US500 pulling back to as low as 4,830 pts area. On the other hand, a dovish turn from Fed may allow the index to climb above the psychological 5,000 pts mark.

Source: xStation5

Source: xStation5

Gazdasági naptár: NFP-adatok és amerikai olajkészlet-jelentés 💡

Reggeli összefoglaló - 2026.02.11.

Live Trading - 2026.02.10.

A nap chartja 🗽

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.