The major U.S. indices started the session in mixed moods but the University of Michigan data reading supported the bulls. However the last Friday of each month ending in the quarter is the so-called 'Tripe Witching Day'. Today the prices of index contracts and options will be set anew. This is usually associated with higher markets volatility so the bearish pressure may come back in later trading hours. Dow Jones (US30) is the strongest US benchmark today. The Nasdaq100 (US100) is much weaker.

Top US news:

Kezdjen befektetni még ma, vagy próbálja ki ingyenes demónkat

Élő számla regisztráció DEMÓ SZÁMLA Mobil app letöltése Mobil app letöltése- The University of Michigan data reading supported the bullish 'soft landing' scenario

- Hawkish statements from Waller and Barkin at the Fed - more hikes on the table?

- Micron (MU.US) warned investors of an outflow of up to half of the company's Chinese revenue

- Adobe (ADBE.US) gains after great results and raises forecasts

- Euphoria on Virgin Galactic (SPCE.US) shares after giving date for launch of commercial space tourism services

- BigTech companies under pressure, Microsoft (MSFT.US) pulls back from historic highs

- Nvidia (NVDA.US) gains after positive rating from Morgan Stanley. Big selling of shares by an insider linked to the company

Data from the University of Michigan indicated that annual inflation expectations are now at their lowest since 2021 - and expectations for long-term inflation have also fallen. At the same time, current sentiment and consumer expectations fared positively - markets see the data as supportive of a 'soft landing' scenario in the US.

- Consumer sentiment: 63.9. expected 60.2, previously 59.2

- Expectations Index: 61.3 Expected: 56.5, previous: 53,4

- 1-year inflation expectations: 3.3% Previously: 4.2%

- 5-year inflation expectations: 3% Previously 3.1%

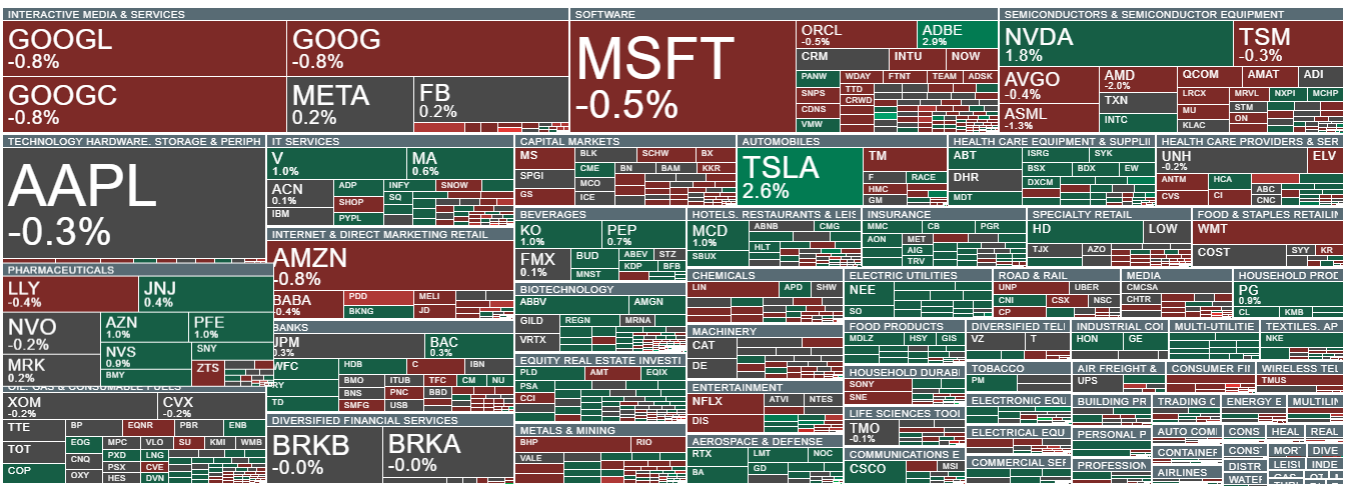

The Fed's Christopher Waller expressed his belief that the Fed needs to continue its policy and still 'sees no signs of credit tightening in banks'. He noted that the Fed should not change policy even if there are risks from the financial sector. He stressed that the Federal Reserve has the tools to respond appropriately and reduce any bank stress. Barkin was also positive about further increases, pointing out that as long as demand grows - rates will rise. Such an aggressive approach by Fed members may foreshadow that in the long term a recession in the US will be extremely difficult to avoid.Stocks from the S&P500 index, the size of the table reflects market capitalization.

The tech sector is performing poorly today, with gains for Nvidia (NVDA.US) and Adobe (ADBE.US). Shares of Mastercard (MA.US), Visa (V.US) and PayPal (PYPL.US) are up. Source: xStation5

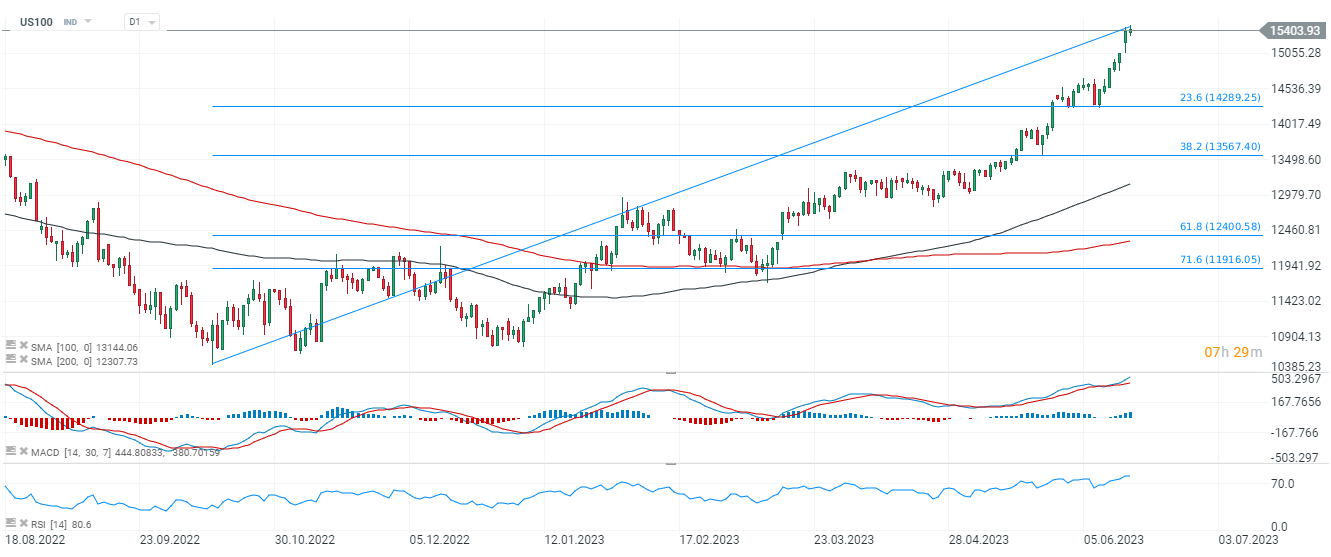

The US100 index is gaining 0.2%. In case of a deeper pullback, the first significant support is at 14,300 points, where the 23.6 Fibonacci retracement of the upward wave from the fall of 2022 and previous price reactions run. Source: xStation5

News from companies:

Morgan Stanley analysts expect Nvidia (NVDA.US) to be the main short-term beneficiary of the AI trend - the company has replaced their previous type, AMD (AMD.US). At the same time, news emerged of the sale of $48 million in shares by insider, Harvey C. Jones - the sale of 70,000 shares took place at an average price of $405 per share. The shares are currently trading at $435.

Shares of Virgin Galactic (SPCE.US), an sub-orbital tourism company, are gaining - the company intends to begin commercial tourist flights this summer and has presented a new official schedule with flights scheduled to fly in late June and August. The market sees the start of services as a breakthrough for the company, which has been burning through cash for more than a dozen years, subsidized by investor British billionaire Richard Branson.

Shares of chipmaker Mircon (MU.US) are losing ground after an announcement that half of the unit's revenues in China are at risk. In the company's overall structure, China accounts for nearly 11% of the company's total revenue. This is directly related to the ban on sales of the company's chips to Chinese customers. Interestingly, as recently as this morning, Micron representatives announced that the company intends to invest nearly $603 million over the next few years in an expanded plant in the city of Xian.

Adobe (ADBE.US) reported record quarterly revenue (up 13% y/y) and shared with investors an increased outlook for earnings per share and full-year revenue. Artificial intelligence has been one of the catalysts for positive sentiment around the company's services and capabilities.

Shares of iRobot (IRBT.US) surged 20% as the U.K. regulator indicated that the company's acquisition by Amazon (AMZN.US) should not create a situation raising monopolization concerns in the UK market.

Palantir (PLTR.US) loses despite news of a new $58 million contract with the US Air Force

SoFi Technologies (SOFI.US) shares under pressure amid lower ratings on the stock by Bank of America and Piper Sandler analysts, who see no room for upside in the short term after a powerful near-100% rally since the beginning of the year.

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.