- Newmont Mining is world's largest gold miner

- Newcrest Mining recommended takeover offer from Newmont to shareholders

- Deal expected to result in $500 million in annual synergies

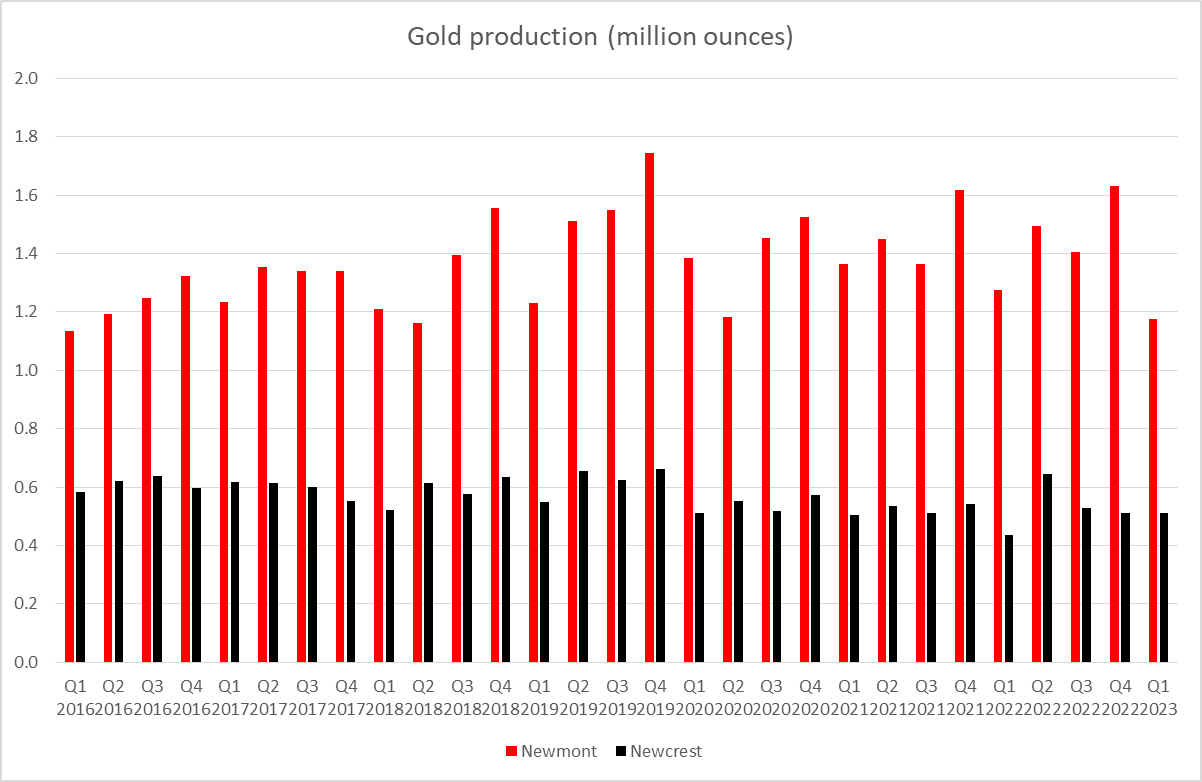

- Acquisition will help boost Newmont's gold output by around 40%

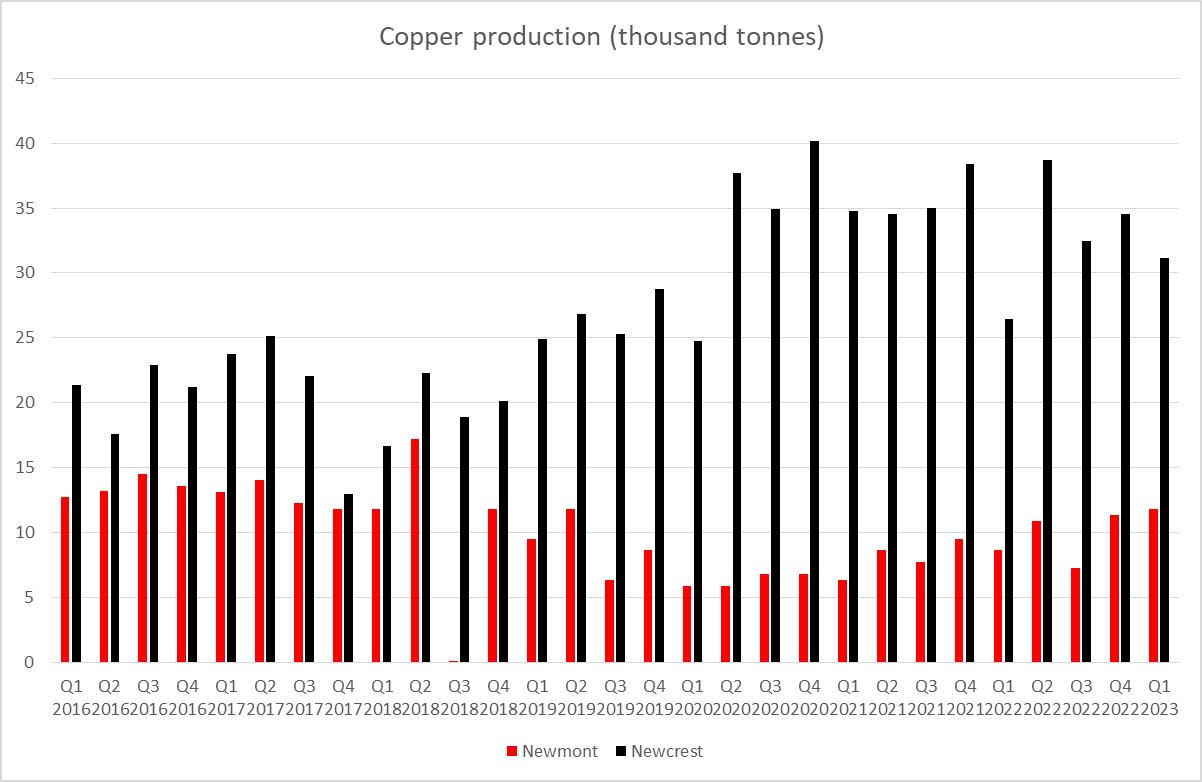

- Significant boost to Newmont copper output

- Newmont shares offer indirect exposure to gold market

- Stock is testing support zone marked with 61.8% retracement

Newmont Mining Corp (NEM.US) is set to strengthen its position as the world's largest gold miner in terms of output with a new acquisition. The Board of Newcrest Mining approved the takeover offer from Newmont Mining and recommended shareholders to accept it. Merger would not only boost Newmont's gold output but also significantly increase its copper output. Let's take a closer look at Newmont and the deal.

Newcrest Mining acquisition

Newmont Mining has been trying to acquire Australian company Newcrest Mining for some time already but Newcrest's Board was initially reluctant to embrace the offer. However, things have changed after the former Newcrest CEO stepped down from the role at the end of 2022 with the new board approving the takeover offer this week. Deal is valued at A$28.8 billion ($19.2 billion), or around 30% premium above Newcrest share price from February 5, 2023 when the deal was initially proposed.

While Newcrest Board approved and recommended the deal to shareholders, there are still some conditions to be met for it to go through. Most importantly, regulators must approve the deal as well as Newcrest shareholders. Annual shareholder meeting on which shareholders' decision will be made is likely to take place in September or October this year.

If the acquisition goes through, Newcrest shareholders will receive 0.4 shares of Newmont for each Newcrest share they own. As a result, Newcrest shareholders will own around 31% of the combined entity following the merger. On top of that, Newcrest shareholders will be eligible to receive a special tax-free dividend of $1.10 per share. Deal is expected to create $500 million in annual synergies and increase annual cash flows by $2 billion in the first two years after acquisition is completed.

Gold production of Newmont and Newcrest. Source: Bloomberg, XTB

Gold production of Newmont and Newcrest. Source: Bloomberg, XTB

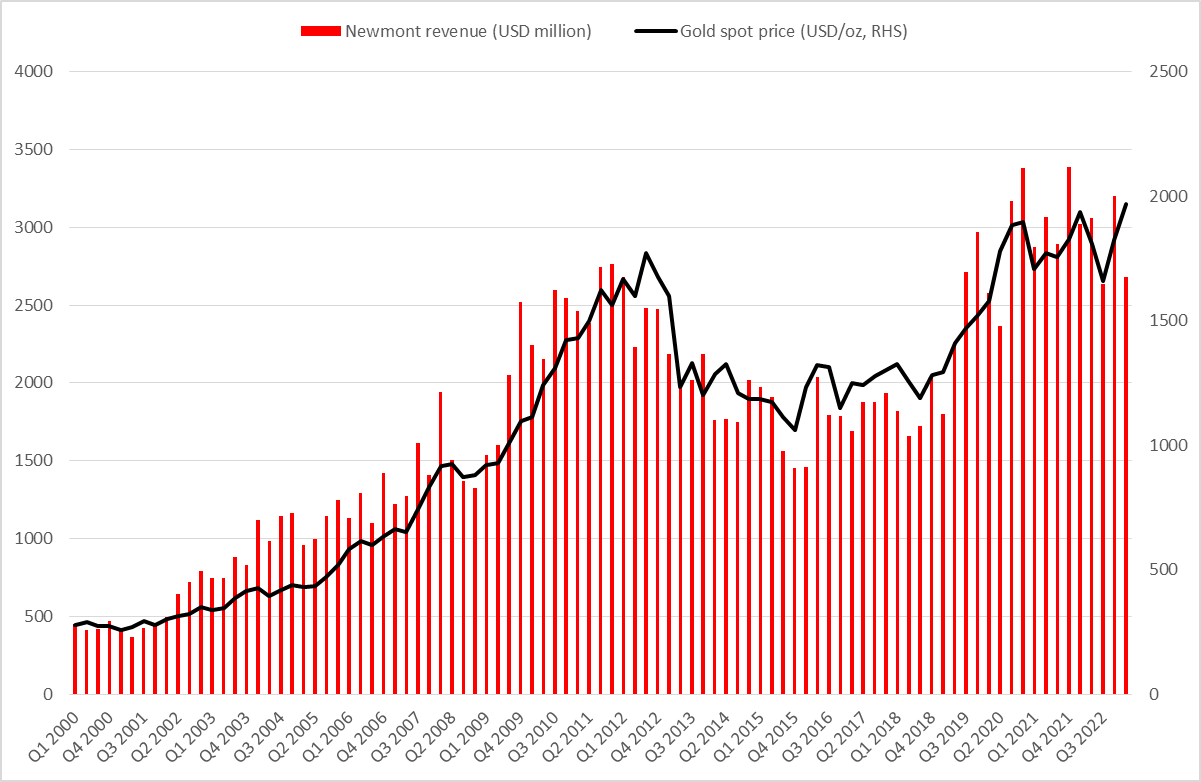

Gold price drives Newmont sales

Given that Newmont mining is the largest gold miner in the world and gold mining is its main business, it should not come as a surprise that the company's business performance is closely tied to the gold price. Gold sales accounted for over 85% of Newmont's sales in most of the quarters over the past 10 years. However, this share has been dropping recently as copper, silver and zinc climbed. Nevertheless, as gold still accounts for the majority of Newmont's sales, company's business performance closely follows developments on the gold market. A chart below shows just how closely changes in Newmont's revenue tracked changes in gold price since the beginning of 2000.

Unsurprisingly, Newmont's business performance is closely tied to moves in gold price. Source: Bloomberg, XTB

Unsurprisingly, Newmont's business performance is closely tied to moves in gold price. Source: Bloomberg, XTB

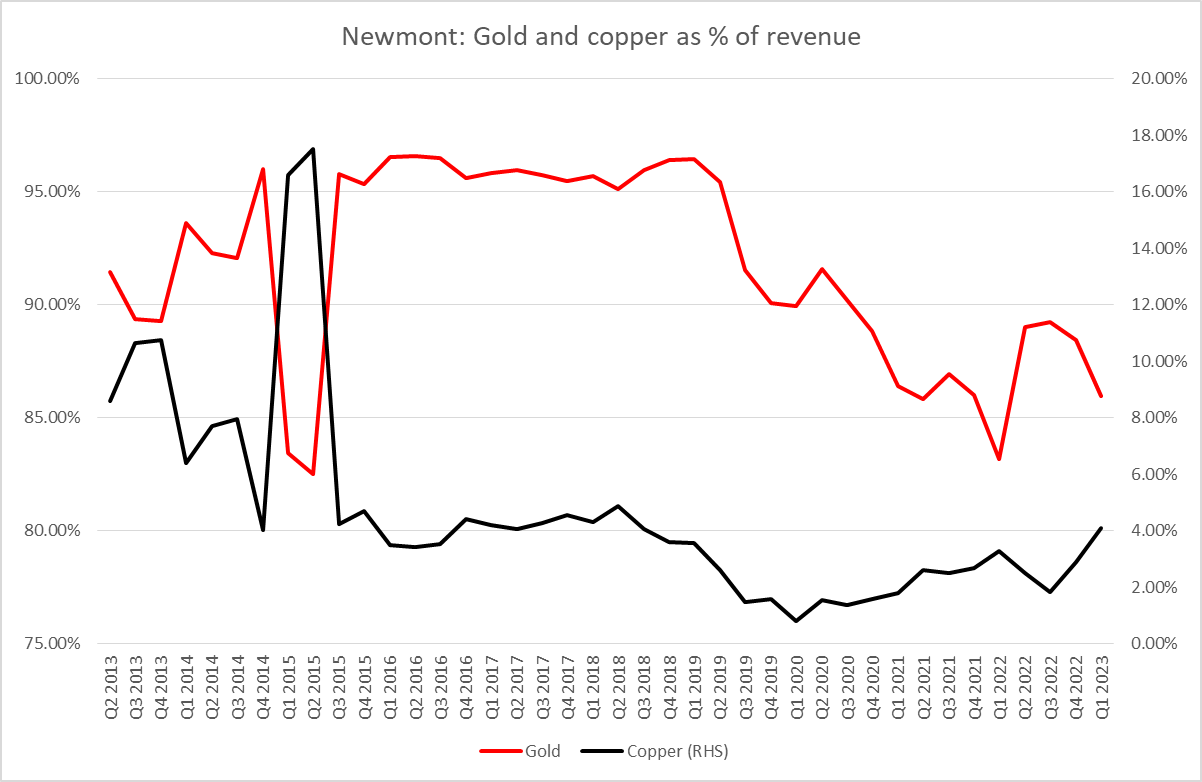

Gold accounts for over 85% of Newmont's revenue. However, a share of copper has been rising in recent quarters and years and will likely continue to do so after Newcrest acquisition. Source: Bloomberg, XTB

Gold accounts for over 85% of Newmont's revenue. However, a share of copper has been rising in recent quarters and years and will likely continue to do so after Newcrest acquisition. Source: Bloomberg, XTB

Not just about gold

While Newmont Mining Corporation and Newcrest Mining are two leading gold producers in the world, it should be noted that gold miners do not mine gold alone. A number of other metals, precious or base, is being mined as a byproduct of gold mining and those serve as additional source of profit for the company. Newmont in its most recent quarterly release (Q1 2023) reported that gold accounted for 86% of its sales. The remaining 14% was made up of silver, zinc, lead and copper sales.

Copper deserves a special mention here. While Newcrest acquisition will boost Newmont's gold output by around 40%, based on amounts mined in recent quarters, a boost to Newmont's copper output will be much greater. Newcrest's copper output was 2-3 times higher than Newmont's in recent quarters. Also, it should be noted that as green transition is progressing and copper is often used in new technologies associated with it, outlook for the base metal is promising with a number of analysts projecting that demand for copper will outpace supply. Having said that, increase in copper output via Newcrest acquisition will not only help better diversify Newmont's sales but may also turn out to be an important driver.

Newcrest acquisition will significantly increase Newmont's copper output. Source: Bloomberg, XTB

Newcrest acquisition will significantly increase Newmont's copper output. Source: Bloomberg, XTB

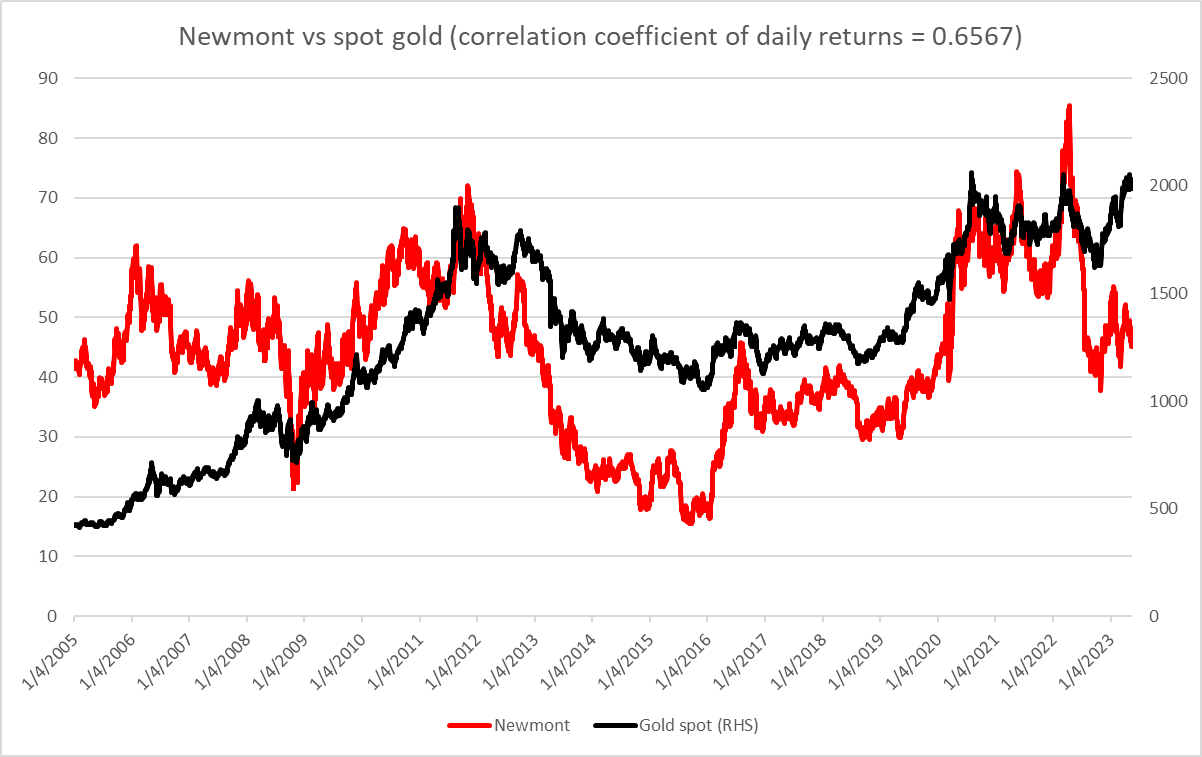

Indirect exposure to gold market

Shares of gold miners can be a good way to help stock traders diversify their portfolios. Investors who for some reason cannot add direct gold exposure to their portfolios, via bullion or futures contract, can look towards gold mining stocks for an indirect exposure to the gold market. We have already shown in one of previous paragraphs that there is a high correlation between gold price performance and Newmont's revenue patterns. A decent positive correlation can also be found between Nemont's stock price and spot gold price. Newmont's share price has been plotted against spot gold price and S&P 500 index on the charts below. As one can see, Newmont stock exhibited much greater correlation with gold during the research horizon (Jan 2005 - May 2023), for a correlation coefficient of daily returns of 0.6567, than with S&P 500 index (coefficient of 0.2807). While those correlations are not perfect, they show that Newmont shares behave more like gold rather than like broad stock market.

Source: Bloomberg, XTB

Source: Bloomberg, XTB

Source: Bloomberg, XTB

Source: Bloomberg, XTB

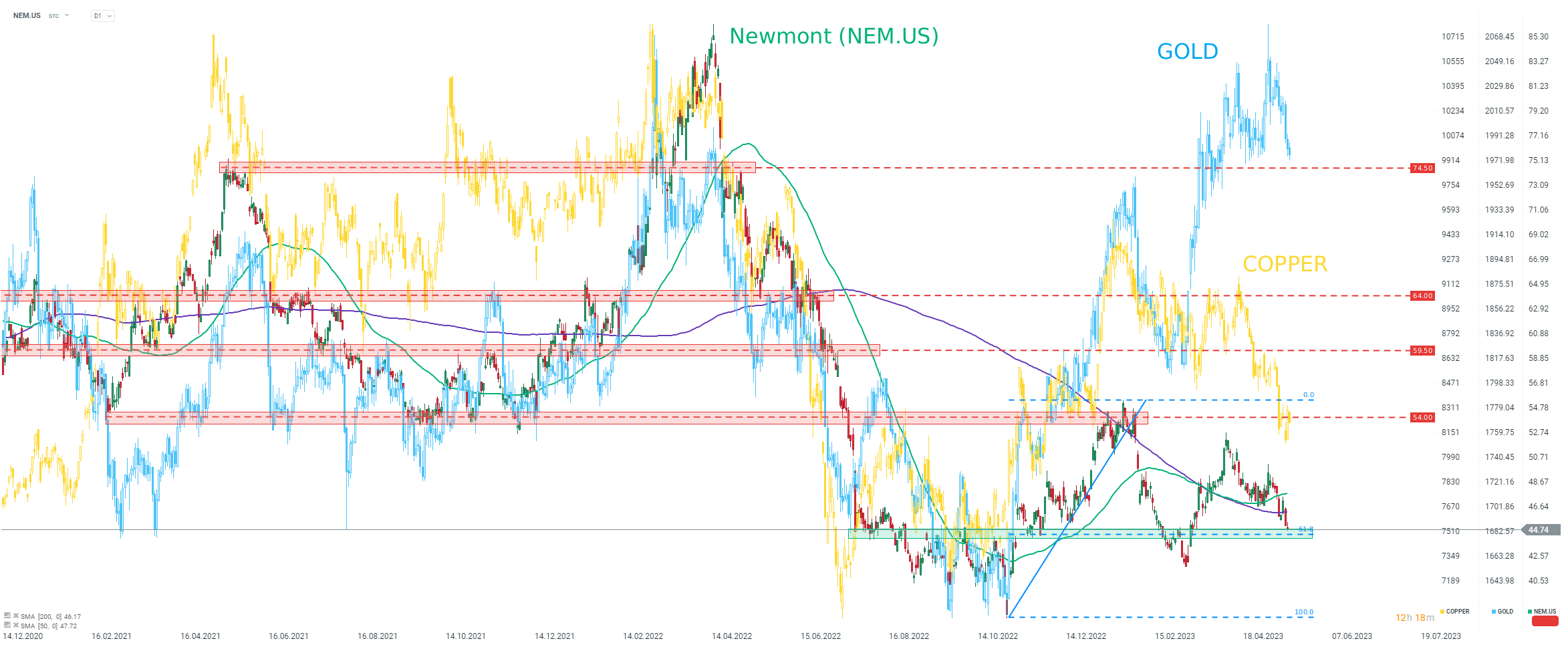

A look at the chart

Taking a look at a chart of Newmont Mining (NEM.US) plotted against GOLD (light blue overlay), we can see that the company's stock has been underperforming the precious metal as of late. While gold has managed to reach fresh local highs after recovering from the February 2023 sell-off, Newmont failed to climb back above the late-January 2023 high. While GOLD reached fresh intraday all-time high recently, Newmont trades almost 50% below its record high from April 2022. Interestingly, recent performance of Newmont looks to be more closely correlated with COPPER (yellow overlay). Recent pullback on Newmont shares pushed the stock back below 200-session moving average (purple line) with price dropping to support zone marked with 61.8% retracement.

Source: xStation5

Source: xStation5

Gazdasági naptár: NFP-adatok és amerikai olajkészlet-jelentés 💡

Live Trading - 2026.02.10.

🌍 Gyorsjelentési szezon az XTB-vel

🌍 Gyorsjelentési szezon az XTB-vel

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.