The largest lodging company that does not own a single property, we are talking about Airbnb (ABNB.US) has demonstrated its ability to scale the business effectively, achieving profitability for the first time in 2022 while simultaneously improving margins. In addition, ultra-low rates may be placed on your 2026 convertible notes, while competitors may be left looking for possible methods to avoid refinancing at higher rates. The efficient use of working capital has positioned an Airbnb for success with respect to a potential economic downturn. Something that could be imminent in the second half of 2023 and that could influence the psychology of the market and drive down the share price in the second half of the year.

Given the current state of the market, it is hard to be confident that Airbnb (ABNB) will continue to rise through the remainder of 2023. Rather, with the expectation that the effects of Fed decisions over the past year will linger strongly on the second half of the year, suggested a wait-and-see approach to ABNB's stock. With strong underlying financials, a significant cash position and extremely low borrowing rates, ABNB is not in a position of financial concern, but the effects of market psychology and the size of the looming recession remain to be seen.

Market conditions

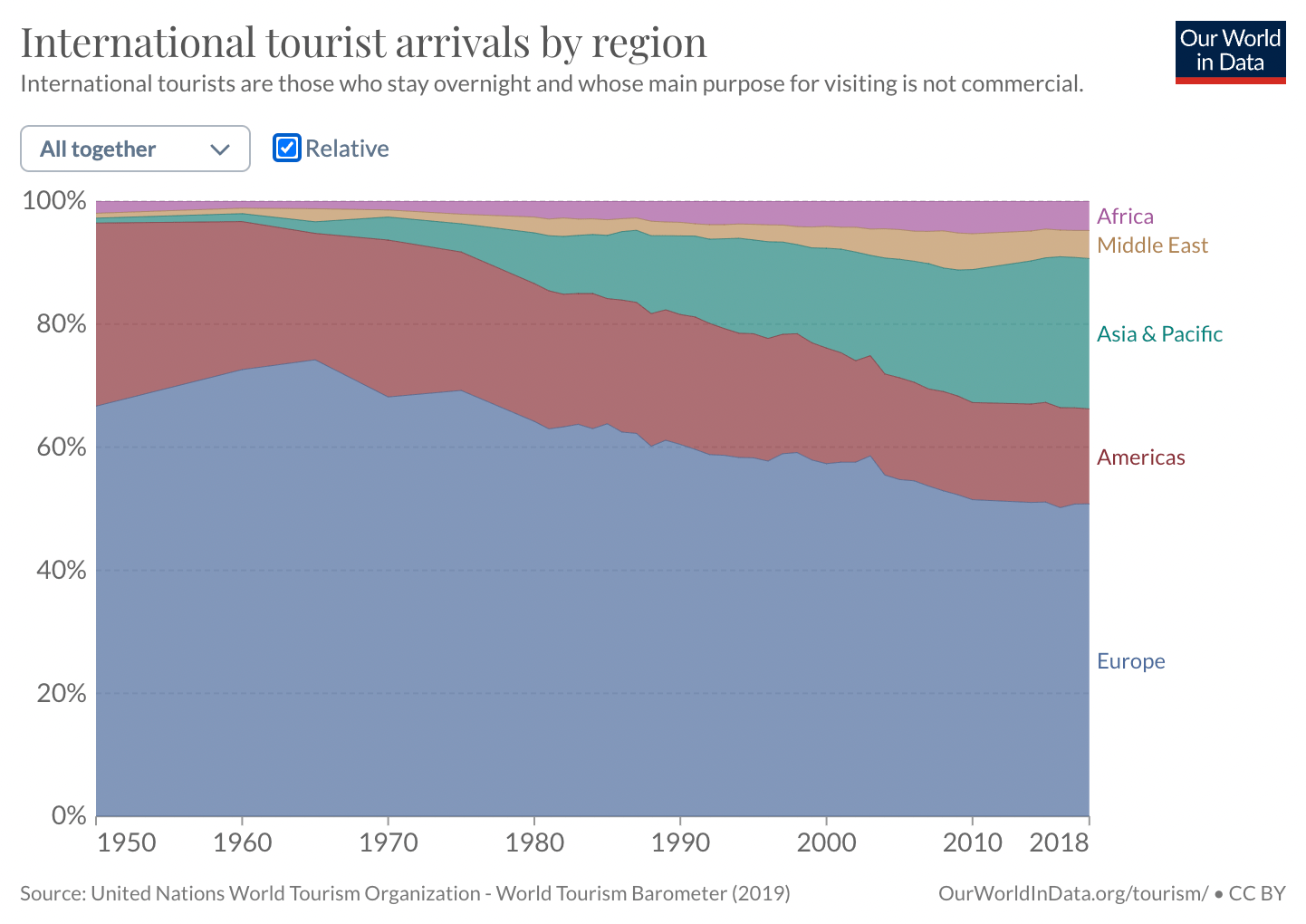

As a travel and leisure product, Airbnb's ability to generate revenue will inherently be driven in large part by demand in the travel industry, which often proves susceptible to economic changes. The COVID-19 pandemic proved catastrophic for the industry as a whole, leaving many wondering if travel would return to normal. In the first half of 2020, female tourists fell 65%, compared to just 8% during the 2008 global financial crisis. However, as the pandemic recedes and travel begins to pick up, the travel vacuum has created an opportunity for companies like Airbnb to thrive, offering services like zero-touch check-ins and full accommodations to reduce the risk of infection for travelers.

As a result, 2022 was a record year for Airbnb, posting profit for the first time as a public company. Although the return to normality has not been without its drawbacks. The pandemic has resulted in mass layoffs around the world as businesses struggle to generate income with people stuck at home, forcing the Federal Reserve to change its approach entirely. After 2019's focus on quantitative easing to combat the effects of quantitative easing policies after the great financial crisis, the planes immediately reversed once again as the Fed was forced to lower rates to help stimulate the economy and expand its balance sheet to all-time highs. From the first quarter of 2020 to the second quarter of 2022, the total value of Treasury securities held on the Fed's balance sheet increased nearly 130%, from around $650 billion to more than $1.5 trillion.

Macroeconomic context of interest rates and inflation

While Fed policies may have been crucial at the time given the circumstances, as the impact of the COVID-19 pandemic has worn off and people are able to return to work, the excessive stimulation of the economy has created inflationary levels. not seen since 1980. In response, the Fed has completely reversed course yet again, having raised the federal funds rate by 475 basis points over the past year to the 5.00%-5.25% range. last week. The objective in doing so has been clear: to aim for a reduction in inflation of around 2%. While the size of rate hikes has slowed in recent months, the unemployment rate has moved very little.

source: FRED, St. Louis Fed

source: Atlanta Fed

source: Atlanta Fed

The Core Sticky CPI refers to the less elastic components of GDP, such as services, including employee wages. When the unemployment rate remains too low, wages can rise due to a limited supply of workers, helping to increase the persistent inflation rate. The Fed has established that the main measure used to quantify inflation is the PCE Base. The goods component of the PCE actually dropped during 2022.

Since services make up a significant part of the base PCE, the Fed's objective of controlling inflation will not come without an increase in unemployment. There has been little movement so far and unemployment has been flat since the start of the rate hike cycle last year. The current non-cyclical unemployment rate is 4.43%, almost one percentage point higher than the unemployment rate of 3.5% in March. As a result, consumer prices for services have risen continuously throughout 2022 and into 2023, according to the chart above. Coupled with a significant increase in the price of goods in the first quarter of 2023, I don't envision a cut for at least several months, probably towards the end of 2023.

As we move into the second half of the year with interest rates still elevated and corporate debt maturing, companies will be forced to refinance in higher rate environments than in previous years. To make matters worse, the proportion of debt issued rated BBB or borderline investment grade (before going high yield) is growing every year. As a result, several companies may find themselves on the "fallen angel" list, making it even more difficult to find affordable financing.

source: global S&P

Having contextualized the effect of inflation, interest rates and unemployment, how does this relate to the travel industry? For starters, if the Fed's goal comes true, large numbers of people will be out of work, which in turn forces them to consider every last dollar carefully before spending. Someone with no income will generally not spend their savings on travel. While it still pales in comparison to the decline in travel during COVID, the fact that the number of tourists worldwide fell by 8% during the great financial crisis helps to illustrate the impact of an economic downturn on the Buyer decision making.

Market psychology will also play a huge role in the impact of the next recession. The companies that generally navigate recessions well are the ones that provide people with basic necessities. That doesn't include consumer discretionary products, including travel and leisure. Using monthly data going back to 2004, the consumer discretionary tracking Consumer Discretionary Select Sector Fund (XLY) ETF maintains a 0.99 correlation with the S&P 500. That is, when the market is underperforming, it is It is reasonable to assume that the consumer discretionary industry will follow suit. As a result, any company, even those that might do well financially, could fall victim to market psychology by association.

Financial analysis

Airbnb first achieved profitability in 2022. This came just two years after a disastrous 2020, the worst year for travel in recent memory. Even then, gross margins remained consistent, implying economies of scale.

Airbnb 10-K

Airbnb 10-K

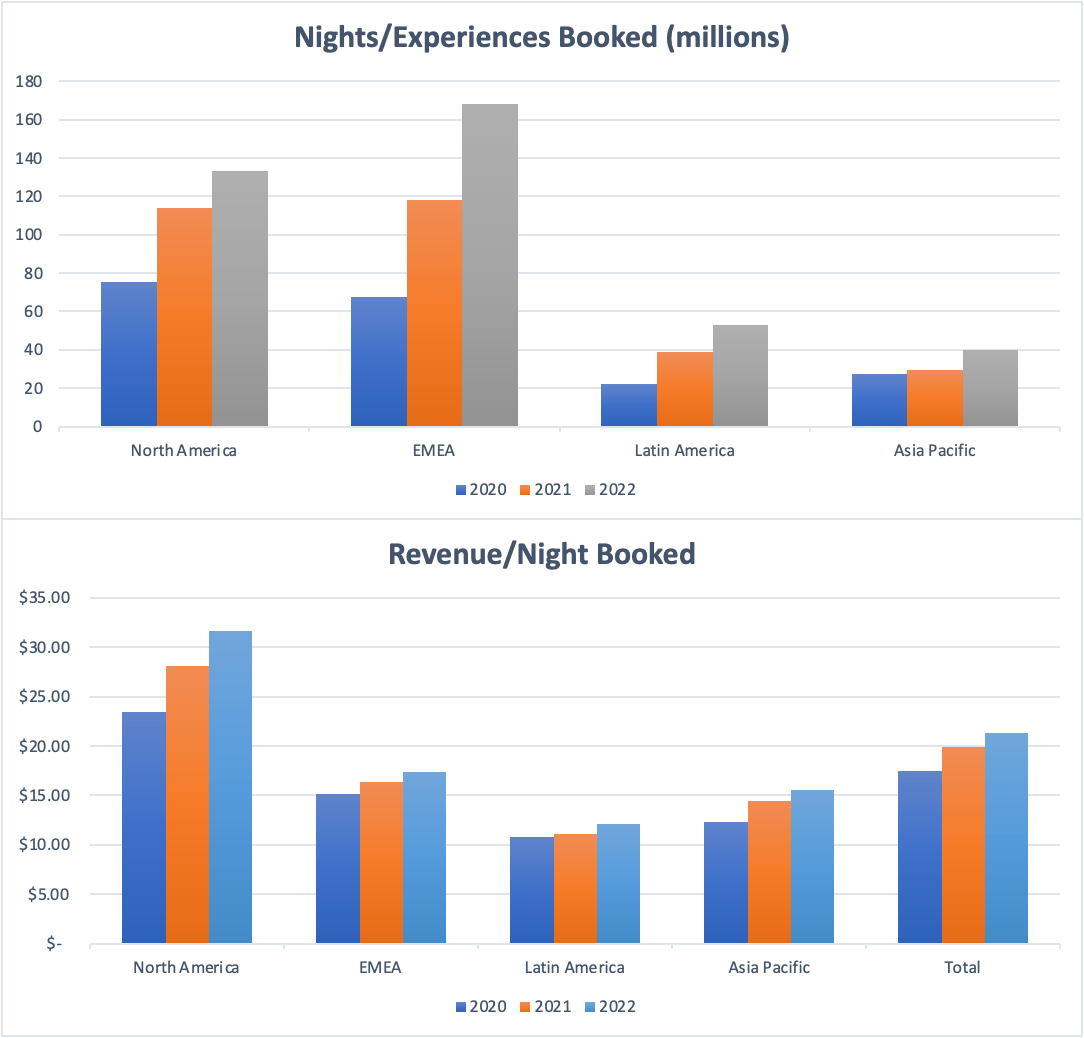

A large part of the revenue growth and operating margin improvements over the last two years can be attributed to the impact of COVID, which severely deflated the 2020 numbers. Even excluding the 2020 results as an anomaly, a common practice within For industries severely affected by the pandemic, results have improved year-over-year since 2019 despite fewer total bookings in 2021 than in 2019, a testament to Airbnb's improved ability to maximize individual booking revenue. With travel returning to normal, Airbnb's improvements have not been the result of growth in any one singular area. Gross bookings have improved over the last three years in all geographic regions and gross booking/revenue values per night have improved as well.

Airbnb 2022 10-K

Geographical segmentation

North America remains Airbnb's top revenue generator, despite fewer total bookings over the past two years than the combined Europe, Middle East and Africa (EMEA) region, earning roughly twice the revenue per night reserved than any other region ($31.65/night in 2022 in North America compared to $16.05/night in the other regions).

Both metrics per night represent growth. Given the lack of diversity in Airbnb's revenue streams, growing international presence in terms of total bookings and revenue generated per booking is a high priority. Failure to grow into new markets can leave the company susceptible to changing scenarios around its main revenue drivers. In 2021, the United States was responsible for 50% of the total revenue generated. In 2022, that number dropped to 46% of domestic revenue, with no single international country accounting for more than 10% of Airbnb's total revenue. Therefore, the Asia Pacific region, in particular, offers Airbnb a great opportunity for growth.

source: UN World Tourist Organization, via Our World in Data

source: UN World Tourist Organization, via Our World in Data

In 2022, only 10.2% of all Airbnb bookings were booked in the Asia Pacific region, indicating strong growth potential in a region that continues to increase its share of the international tourism market. As the company continues to increase its overseas presence, I expect more stable growth and revenue streams, resulting in less reliance on the North American region.

With its asset-light business model, we shouldn't expect Airbnb to return to non-profitability, despite potential economic changes. Having such little confidence in the ownership of physical assets reduces exposure to potential declines in the fair value of investments, helping liquidity to remain stable. In fact, a high-rate environment can work in your favor compared to competitors for two reasons: less incentive for homeowners to sell and lower debt costs. As interest rates continue to rise or remain high, homeowners may find a smaller market for potential buyers.

Airbnb gives owners the opportunity to continue generating cash flow, providing flexibility even in times of economic uncertainty. If drops in demand drive revenue down, the company should be able to take the hit. Extrapolating operating expenses in addition to COGS (cost of goods sold, is the relationship between sales and the expenses necessary to produce and store a particular good) by their average annual growth rates from 2019 to 2022, operating income would have to drop 27% for the company to return to profitability. For reference, that would bring revenue down to around 2021 revenue, a period when the global travel industry was still reeling from the effects of the pandemic.

If Airbnb somehow becomes unprofitable again, the company still holds more than $7bn in cash and cash equivalents, enough to cover virtually all current liabilities, plus another $4.7bn in accounts receivable and $2.2bn in marketable securities. The last two balance sheet items have the potential to lose value with the rest of the market, but are unlikely to cause major concern. If that were to happen, Airbnb is unlikely to be hit as hard as the rest of the market. With an Altman Z-score (The Altman Z-Score model is an insolvency prediction model that is performed based on an iterative multiple discrimination statistical analysis, in which five measurement reasons are weighted and added to classify companies solvent or insolvent) of 5.08, bankruptcy is barely among the odds.

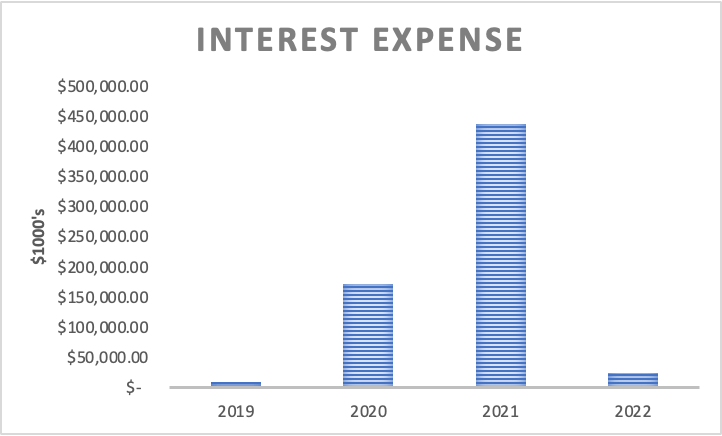

In March 2021, Airbnb repaid $2bn in debt, previously at effective interest rates of 9.5% and 15.1% with a $200m prepayment penalty, providing the flexibility to issue $2bn in convertible notes at a rate of 0.2%. This refinancing move, while costly at the time, allowed Airbnb to significantly reduce interest expenses, providing an opportunity to divert capital toward potential growth opportunities.

source: Airbnb 2021/2022 10-Ks

As a result, Airbnb proved to be much less susceptible to changes in interest rates during 2022. According to its 10-K, "a hypothetical 100 basis point increase in interest rates would have resulted in a $13.1 million decrease in our investment portfolio as of December". By comparison, a move half the size of interest rates (50bps instead of 100bps) would cost its main competitor, Expedia (EXPE), $115m in the fair value of its debt.

The notes, which can be converted into common shares at $228.64 per share (a 60% premium) in 2026, also mean that, unlike competitors, Airbnb will avoid the need to refinance later in the year, reducing significantly the possibility of bankruptcy in the near future. Given the limited amount of resources required to operate the business, it is unlikely that further funding will be needed in the immediate future.

The issuance of convertible notes exposes investors to potential share dilution risks. The $2 billion fundraiser opened the door for the issuance of nearly 7 million new shares once the notes enter the optional redemption period. The notes cannot be converted until 2026, giving shareholders plenty of time to exit their positions beforehand. However, there is a clause that allows the company to make the notes redeemable from March 2024, but that route is unlikely to be taken while the shares are trading at a premium.

Airbnb has taken some steps to help reduce investor exposure to shareholder dilution. In 2022, the company authorized up to $2 billion in share repurchases, and $1.5 billion of that total has since been executed. The company also attempted to reduce risk with "limited calls," preventing the notes from converting at share prices above $360.80. The company is currently trading at ~$125 per share, as opposed to the $180.40 per share the company was trading at when the notes were issued.

In either situation, if an investor finds himself in a situation where he has to worry about possible dilution, then, based on an entry at today's spot price, his position will already have doubled in value at least.

Valuation and analysis of competitors

Airbnb went public at the end of 2020, which means that the historical records for stock performance are relatively small. The company's shares were originally priced at $68 per share, but traded at $146 per share in the first cross on huge demand, a staggering 115% increase from the original price. Since then, stock prices have swung back and forth, and their value has declined since the shares began trading.

ABNB.US W1, Source: xStation

Through most of 2021 and into 2022, ABNB generally traded between $140 and $210 per share. The price decline in early Q2 2022 coincides with the Federal Reserve's initial rate hikes, even though Airbnb's limited financial reliance on rates remains low. By the summer, ABNB had dipped below $100 for the first time since its IPO and has struggled to break apparent resistance levels of $130 ever since.

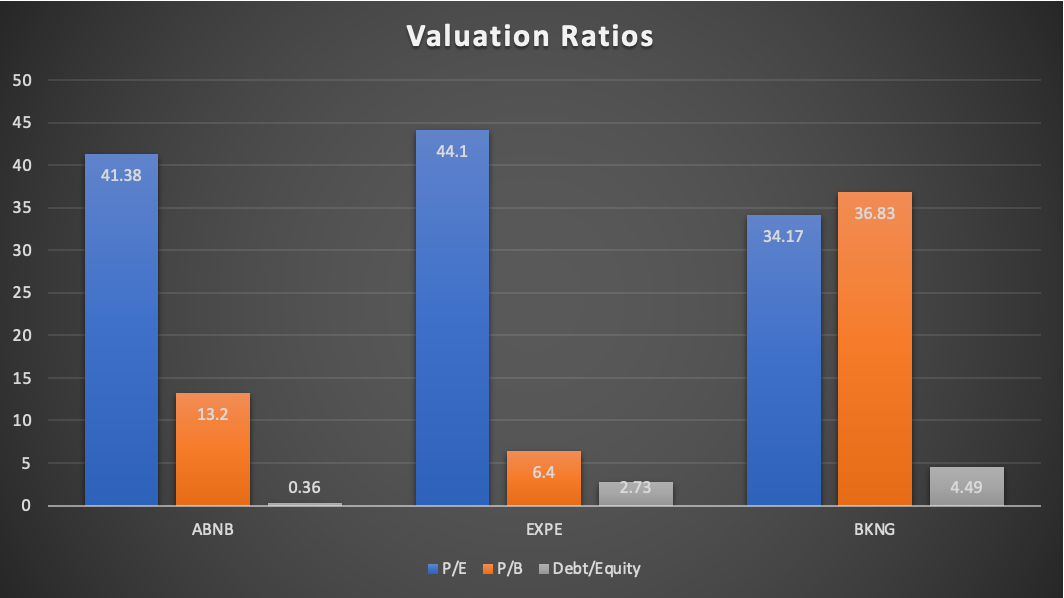

With a book value (EV) price currently at $13.78, ABNB appears to be more overvalued than most travel/leisure companies. However, it's also important to note that Airbnb requires far fewer physical assets than most other companies in the industry, which often require ownership of properties such as hotels. Airbnb's assets, on the other hand, consist of nearly 50% cash. Furthermore, its P/B ratio has been falling over time as shareholder values have risen, indicating that despite the apparent growth of the company, share prices have not moved quite in sync. The changes in share value are even more impressive compared to competitors including VRBO, a similar platform owned by Expedia Group, and Booking Holdings (BKNG) subsidiary of Booking.com.

source: Shareholder stock values for ABNB, EXPE and BKNG in billions of dollars (macrotrends)

The industry is projected to grow at a compound annual growth rate (CAGR) of 5.3% through 2030, opening the door for further revenue and capital expansion. The biggest driver for achieving greater market share will undoubtedly be Airbnb's ability to diversify revenue, both geographically and by increasing its revenue mix.

Two aspects provide a unique advantage to Airbnb in the context of the looming recession: capital efficiency and future debt obligations. Airbnb has used its capital very efficiently over the past few years, concentrating on generating revenue from its primary source and making a profit in the process. With a ROIC (return on invested capital) that far exceeds the WACC (weighted average cost of capital or the discount rate that should be used to determine the present value of a future cash flow), Airbnb has given itself the ability to explore new avenues of growth.

Source: GuruFocus

Source: GuruFocus

In particular, while Booking Holdings has achieved a similar level of capital efficiency, Expedia appears to be using its resources at unsustainable levels. As the market begins to turn and liquidity dries up, efficient use of capital will become crucial, putting Expedia at a disadvantage. On the other hand, Booking Holdings and Airbnb seem more poised for success despite the financial turmoil.

This may help explain why, despite occupying the same industry, BKNG is trading near record highs while EXPE is near record lows. However, Airbnb stock seems to have room to run despite operating more efficiently than both.

source: GuruFocus

Two things in particular stand out from the chart above: BKNG is trading at complete overvaluation compared to its fair value of equity, while ABNB maintains a much lower debt-to-equity ratio than both. The main driver of the massive increase in Booking Holdings' P/E ratio is due in large part to a massive increase in liabilities and total debt on its balance sheet over the course of 2022, reducing total shareholder equity in the process: total liabilities increased 29.3%, while debt increased 14%. Asset values only rose 7.2% over the same time period. Meanwhile, shares have continued to rise, resulting in shares trading at a premium. Despite a refinancing in November 2022, reducing short-term debt in favor of longer-term financing at high rates, current liabilities increased on its balance sheet by 35.7%. Booking Holdings isn't necessarily in financial trouble, but its struggle with debt could hamper prospects for potential growth, opening the door for Airbnb to steal market share. Booking has a larger cash balance than Airbnb and Expedia, but they may be forced to apply that cash to future debt obligations rather than growth.

Meanwhile, Expedia has an Altman Z score of 0.94, indicating financial trouble. With a credit rating bordering on high yield (Baa3 with Moody's and BBB- with Fitch's), finding more funding could spell trouble, and the company risks entering "fallen angel" territory. EXPE is trading at a better value than BKNG, and possibly even ABNB, but based on its financial situation, the lower valuation may be justified.

Conclusion

Those looking to properly price ABNB shares should carefully consider the state of the economy and where the markets are headed. Given the looming recession, market psychology could drive the stock price even lower. The PER for the last 12 months of the S&P 500 is currently x23.85. That figure typically drops as low as about 18x during downturns, which would imply at least about a 25% drop in market levels at current EPS levels. With a beta of 1.14, the move would instead turn into an estimated 28% drop for ABNB given the strong correlation of consumer discretionary stocks with the S&P 500, from the current price of $120 to around $85 per action, just above previous lows. Depending on your risk tolerance level, I would look for an entry should the price fall to anywhere in the $75-$90 range.

Meanwhile this is not a trading recommendation, those looking for a competitor arbitrage opportunity could go long ABNB and short through the CFD on BKNG.

Airbnb will deliver its first quarter results at the close of the session on Wall Street, therefore we will expect volatility starting at 22:00h CEST during extended trading hours.

Dario Garcia, EFA

XTB Spain

Gazdasági naptár: NFP-adatok és amerikai olajkészlet-jelentés 💡

Reggeli összefoglaló - 2026.02.11.

Live Trading - 2026.02.10.

Gazdasági naptár: Az indexek és az EURUSD az amerikai kiskereskedelmi adatok a középpontban

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.