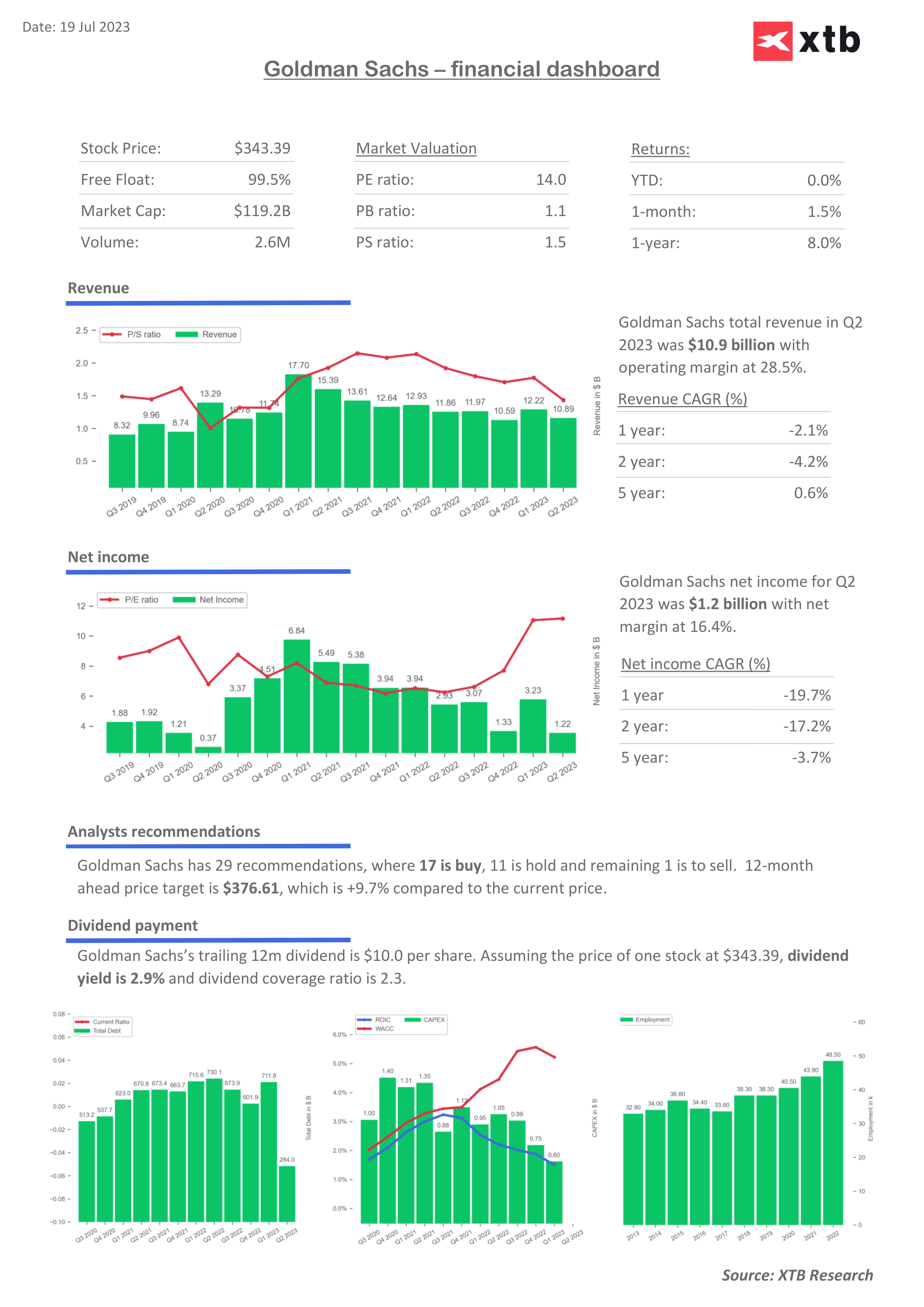

Goldman Sachs reported Q2 2023 earnings that fell short of expectations, the only miss among the six largest U.S. banks. Its earnings dropped to $1.07 billion or $3.08 a share, down from $2.79 billion or $7.73 a share in the same period last year. This was below the analyst expectations for per-share earnings of $3.16. The bank's Q2 revenue decreased to $10.9 billion from $11.86 billion, beating the analyst estimate of $10.61 billion. Goldman also increased its quarterly dividend to $2.75 per common share from $2.50 per share. Despite these results, CEO David Solomon is confident about a turnaround in investment banking and executing the plans to exit the consumer business.

Key financial metrics:

Kezdjen befektetni még ma, vagy próbálja ki ingyenes demónkat

Élő számla regisztráció DEMÓ SZÁMLA Mobil app letöltése Mobil app letöltése- Earnings: fell by over half to $1.07 billion, or $3.08 per share, from Q2 2022's $2.79 billion, or $7.73 per share, missing the $3.16 per share analyst estimate.

- Revenue: decreased to $10.9 billion from Q2 2022's $11.86 billion, exceeding the analyst estimate of $10.61 billion.

- Quarterly dividend: increased to $2.75 per common share from $2.50 per share.

- A $504 million goodwill impairment charge related to the GreenSky consumer lending business was noted.

- Operating expenses: increased by 12% to $8.54 billion, exceeding the analyst estimate of $7.67 billion.

- Investment banking fees: decreased by 20% to $1.43 billion, falling short of the $1.49 billion analyst estimate.

- Asset and Wealth Management revenue: decreased by 4% to $3.05 billion, below the estimate of $3.69 billion.

- Global Banking and Markets revenue: decreased by 14% to $7.19 billion, exceeding the analyst estimate of $6.65 billion.

Goldman Sachs held its Q2 2023 earnings conference call with the participation of David Solomon, CEO, and Denis Coleman, CFO. Solomon noted that despite some challenges, the company generated net revenues of $1.9 billion and earnings per share of $3.88 with a Return on Equity (ROE) of 4% and Return on Tangible Equity (ROTE) of 4.4%. He attributed the decline in earnings to a challenging macro-environment, headwinds facing their specific mix of businesses, and their strategic shift towards a less capital-intensive model. However, Solomon pointed out that there are signs of increasing activity, particularly in equity capital markets and M&A.

Goldman Sachs held its Q2 2023 earnings conference call with the participation of David Solomon, CEO, and Denis Coleman, CFO. Solomon noted that despite some challenges, the company generated net revenues of $1.9 billion and earnings per share of $3.88 with a Return on Equity (ROE) of 4% and Return on Tangible Equity (ROTE) of 4.4%. He attributed the decline in earnings to a challenging macro-environment, headwinds facing their specific mix of businesses, and their strategic shift towards a less capital-intensive model. However, Solomon pointed out that there are signs of increasing activity, particularly in equity capital markets and M&A.

Denis Coleman provided a detailed financial update. The company reported Q2 net revenues of $10.9 billion and net earnings of $1.2 billion. This led to earnings per share of $3.08. These results were impacted by three factors: a gain from the sale process of the Marcus unsecured loan portfolio, losses from principal investments within Asset & Wealth Management, and results related to GreenSky. As part of its strategy to reduce capital intensity, Goldman Sachs continues to execute on its $30 billion share repurchase program and has recently announced a 10% increase to its quarterly dividend.

Key takeaways from the earnings call:

- Goldman Sachs generated net revenues of $1.9 billion and earnings per share of $3.88 in Q2 2023.

- Their results were affected by a challenging macro-environment and headwinds facing their specific mix of businesses.

- The company is strategically transitioning towards a less capital-intensive business model.

- There are indications of increased levels of activity in the equity capital markets and M&A.

- Goldman Sachs continues to execute on its $30 billion share repurchase program and has recently increased its quarterly dividend by 10%.

- Despite lower results due to challenging macro-economic conditions and strategic transition, Goldman Sachs remains confident in delivering mid-teens returns and significant shareholder value.

Goldman Sachs (GS.US), D1 interval, source xStation 5

Goldman Sachs (GS.US), D1 interval, source xStation 5

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.