Cryptocurrencies have failed to erase the sell-off of recent days and are trading under pressure - amid fears of market regulation. Cryptocurrency companies in the US are facing reluctance from the banking system. This is a big negative factor slowing down the possible adoption of cryptocurrencies. The market is also closely examining the issue of the largest crypto exchange Binance. Frightened investors have once again started withdrawing funds from exchanges. '

Crypto market highlights.

Kezdjen befektetni még ma, vagy próbálja ki ingyenes demónkat

Élő számla regisztráció DEMÓ SZÁMLA Mobil app letöltése Mobil app letöltése- Since the SEC's lawsuit against the Binance exchange, the crypto market capitalization has fallen by $80 billion (7%). The exchange will stop accepting deposits from U.S. customers and asked for withdrowals until end of this week. Industry commentators pointed out that this will deprive it of many large private customers (according to the SEC, U.S. customer assets amount to $2.2 billion);

- The market began to fear even the prospect of a repeat of FTX but on a much larger scale. As a result, BINANCECOIN has lost mightily and is near December 2022 levels;

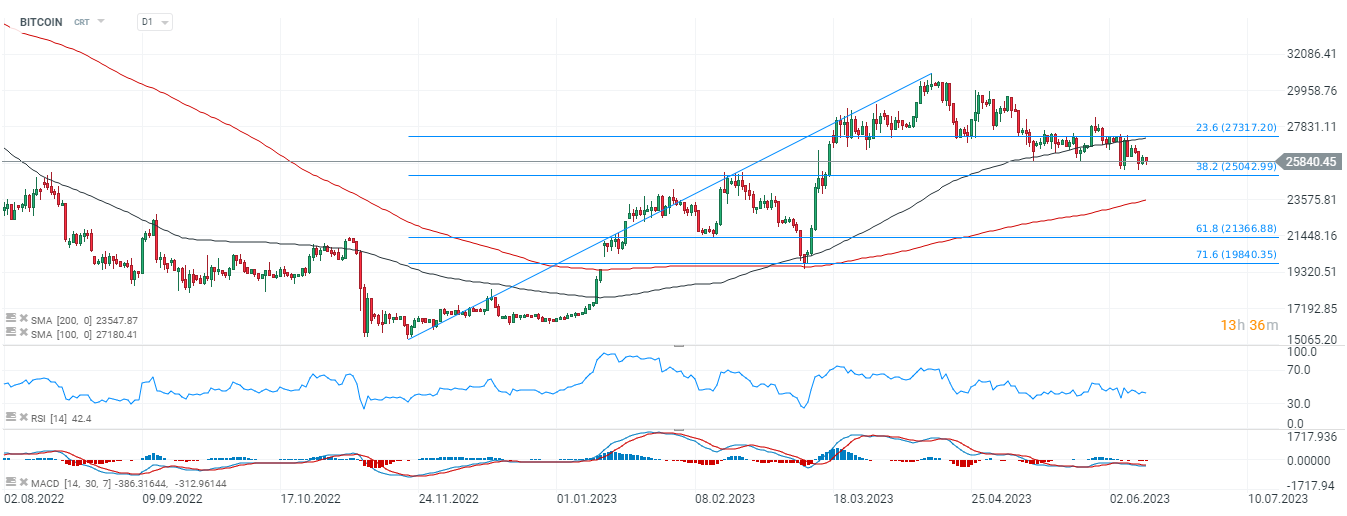

- BITCOIN remains below $26,000 but still respects support in the form of 38.2 Fibo elimination and SMA200;

- POLYGON and CARDANO prices have fallen in the face of SEC recognition as securities - a total of 68 different cryptocurrencies were mentioned by US regulators;

- The SEC, in its lawsuit against Binance, pointed out that the exchange's customer assets were in accounts linked to the exchange's head Chanpeng Zhao (Merit Park Limited);

- Gary Gensler, in an interview with Bloomerg, pointed out that there are similarities between Binance and FTX - the main one in the form of a complex organizational structure centered around Zhao;

- Investors once again rushed to withdraw funds from crypto exchanges, which may foreshadow further systemic problems (withdrawal volumes 400% above average).

- Analysis by Nansen and DefiLlam indicated huge outflows from Binance (last 7 days, after SEC lawsuit). Nansen showed $2.36 billion in outflows (+120 million from the US subsidiary - BinanceUS). DefiLama's data, on the other hand, indicated an even larger outflow - $3.35 billion US. Glassnode estimates that the balance of BTC on Binance fell by almost 6% (about $1 billion) over the week.

- However, the head of Binance CZ conveyed that the outflows are smaller because the data collected by analysts does not take into account the movements of arbitrage investors, who move funds between exchanges during periods of higher volatility.

- According to the Binance CEO, $392 million was expected to flow out of the exchange on June 9, compared to a record $7 billion daily outflow last November. He called the situation standard given the price volatility.

- Despite Binance's attempt to calm the market, investors have consistently sold off Binancecoin.

BINANCECOIN, D1 interval. The price of the cryptocurrency has fallen powerfully, with the RSI pointing to the 20-point level indicating a massive sell-off. Massive deposit outflows are once again weighing down the valuation of the Binance exchange token. Now it's testing levels from December. Source: xStation5

BINANCECOIN, D1 interval. The price of the cryptocurrency has fallen powerfully, with the RSI pointing to the 20-point level indicating a massive sell-off. Massive deposit outflows are once again weighing down the valuation of the Binance exchange token. Now it's testing levels from December. Source: xStation5

Outflows from Binance are the largest among the major centralized crypto exchanges (CEX). Over a 7-day horizon, they trump Crypto.com's outflows by almost 60 times and are 9 times higher than them counting the last 24 hours. Considering even the scale of assets held, the scale is impressive. Meanwhile, positive inflows are recorded by Asian OKX - regulatory uncertainty in Asia is lower. Source. Cointelegraph

Outflows from Binance are the largest among the major centralized crypto exchanges (CEX). Over a 7-day horizon, they trump Crypto.com's outflows by almost 60 times and are 9 times higher than them counting the last 24 hours. Considering even the scale of assets held, the scale is impressive. Meanwhile, positive inflows are recorded by Asian OKX - regulatory uncertainty in Asia is lower. Source. Cointelegraph

BITCOIN, D1 interval. The price is above the 38.2 Fibonacci retracement of the upward wave from the fall of 2022, at $25,000 (supported by price reactions). The level is likely to prove crucial for the trend going forward. A drop below could mean pressure to test $20,000. On the other hand, uncertainty is reflected by the price below the SMA100 - an average that has turned from support to resistance - at $27,000. Source: xStation5

BITCOIN, D1 interval. The price is above the 38.2 Fibonacci retracement of the upward wave from the fall of 2022, at $25,000 (supported by price reactions). The level is likely to prove crucial for the trend going forward. A drop below could mean pressure to test $20,000. On the other hand, uncertainty is reflected by the price below the SMA100 - an average that has turned from support to resistance - at $27,000. Source: xStation5

What can help?

An important catalyst in the next 48 hours could be the receipt by Ripple's lawyers of documents that reveal private SEC correspondences whose subject was cryptocurrency regulation. Former SEC director Hinman referred to cryptocurrencies as commodities in a speech, and the court admitted the evidence from the SEC at the request of Ripple's lawyers. Ripple's lead attorney, Deaton indicated June 13 as the date the documents will be received (tomorrow). Possibly positive comments from Ripple could improve market sentiment. Ripple was sued by the SEC back in 2020 - also on charges of violating securities laws. Lawyers expect the court to finalize the case by the end of September. Ripple's precedent - if it ends in a win - could support others in confrontation with the SEC. RIPPLE, H4 interval. While the market has seen massive declines, the price of the cryptocurrency has lost relatively little. Potentially, this could mean that the market sees Ripple as a potential winning party in the protracted case against the SEC. Source: xStation5

RIPPLE, H4 interval. While the market has seen massive declines, the price of the cryptocurrency has lost relatively little. Potentially, this could mean that the market sees Ripple as a potential winning party in the protracted case against the SEC. Source: xStation5

Didn't the correction mess up the fundamentals?

Glassnode has created a tool to help determine market dynamics, following the collapse of FTX. The tool tracks a total of 8 fundamental indicators, in 4 categories .When a minium of 5 is met a light blue (current) color appears. Currently all 8 are fulfilled.

- The BTC price is above the SMA200 and the realized price (average bid price for all BTC holders)

- The overall development of the BTC network from the side of the number of transactions and the growth of the number of users is also performing positively according to Glassnode

- Glassnode points to an overall improvement in investor profitability (lower selling pressure) and a sizable improvement in profits among long-term investors, in whose hands the majority of BTC is held.

Currently, all 8 components of the indicator are still positive. According to Glassnode, despite the decline in BTC, the underlying trend is still recovery from the disastrous 2022. Source: Glassnode

Currently, all 8 components of the indicator are still positive. According to Glassnode, despite the decline in BTC, the underlying trend is still recovery from the disastrous 2022. Source: Glassnode CARDANO, D1 interval. The price has fallen sharply below the SMA200 (red line) and has hit the November 2022 lows. RSI, despite the ongoing rebound, still shows extreme oversold at 26 points. Source: xStation5

CARDANO, D1 interval. The price has fallen sharply below the SMA200 (red line) and has hit the November 2022 lows. RSI, despite the ongoing rebound, still shows extreme oversold at 26 points. Source: xStation5

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.