Bitcoin is trying to defend key support near $15,500. Cryptocurrencies came under pressure again amid reports from Bloomberg, which citing its sources indicated that lending cryptocurrency giant Genesis will file for bankruptcy if it does not receive external funding:

- Momentary speculation around the proof of reserves of the Grayscale Bitcoin Trust ceased after Coinbase presented the complete reserves it holds for the trust (a report released showed the reserve balance as of October 30), and Bernstein analysts indicated that the ownership structure does not expose the trust to collapse if Genesis Capital declares bankruptcy. Both entities are part of the Digital Currency Group, created by Barry Silbert;

- Genesis Capital is drowning in problems in the face of the debt of its lending division, whose debt at the end of September this year stood at nearly $2.9 billion. The company similarly to the bankrupt Celsius Network lent unsecured loans in the bull market. An investigation by Quartz analysts revealed the scandalous practices Genesis used to lend funds. In addition to unsecured loans devoid of thorough verification, some of the 'secured' loans were to be backed by collateral from other customers creating structural risk;

- Reuteres reports indicate that Genesis was to lend funds 'secured' by the currently virtually worthless FTT token to the collapsed Alameda Research fund, the extent of losses from this is not yet known. The fund was also supposed to lend its own clients' collateral to other borrowers, which brings to mind practices, from the 2008 crisis. The fund gained popularity in the 2018 bull market when it lent funds to financial institutions at attractive low interest rates, reducing paperwork to the bare minimum, unlike its competitors.

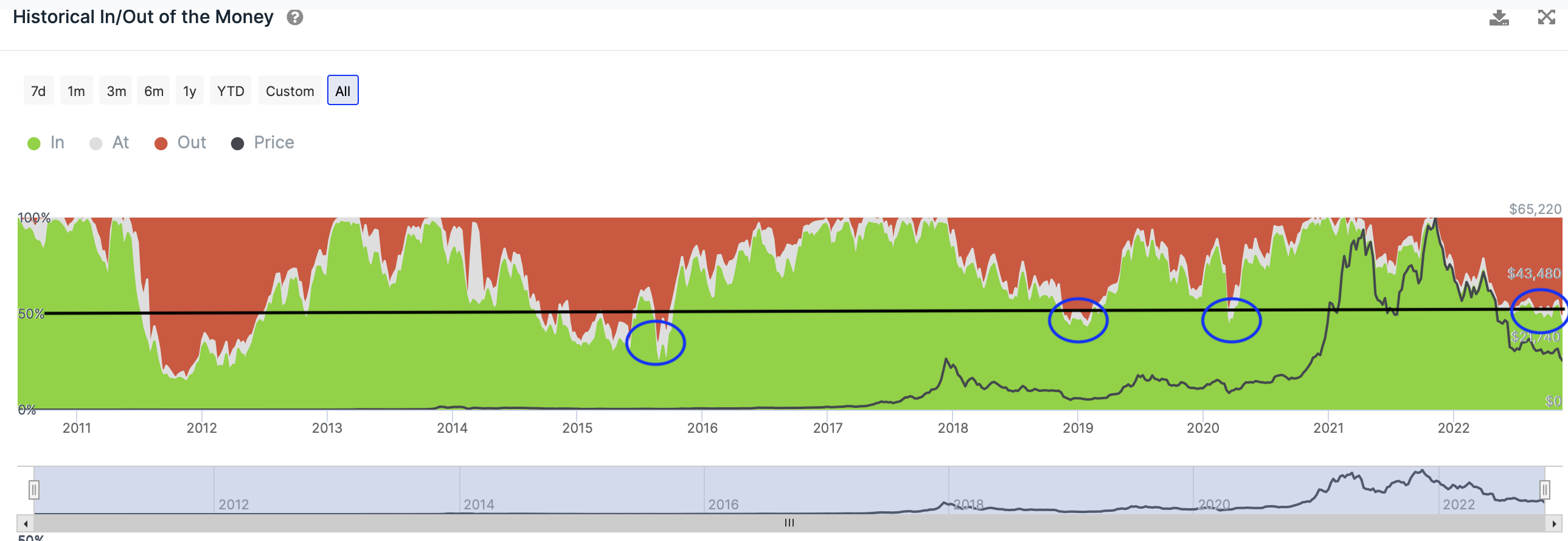

24.6 million addresses out of a total of 47.9 million are currently recording losses on Bitcoin investments, according to data provided by analyst firm IntoTheBlock. This means that nearly 51% of the BTC market has an unrealized loss. About 45% have an unrealized gain, while roughly 3 to 4% are near the 'break even' level, i.e. roughly neutral. By comparison, however, in January 2019, the percentage of addresses at a loss (out-of-the-money) was even higher at 55%. Bitcoin then reached a bottom near $3200 and began a bull market three months later. In contrast, the percentage of addresses at a loss reached 62% during the 2015 bear market. Situations when the majority of addresses holding Bitcoin record losses are rare, the last time such a situation occurred was during the March 2020 coronavirus crash. While past data does not guarantee future performance, it may indicate that the percentage of losing addresses in the bottoms of each successive bull market is getting smaller, which could herald an impending bullish momentum. On the other hand, it is still unclear how far the systemic domino effect caused by the collapse of FTX will 'pull' Bitcoin to even lower levels. Source: IntoTheBlock The chart shows that the total supply in the hands of long-term investors fell by nearly 85,000 BTC in the face of FTX's collapse, signaling a scale comparable to the collapse of Luna when the LTH group reduced reserves by 101,000 BTC. The scale, however, is still smaller than June's sell-off and July's rally, when LTH addresses distributed some reserves. Source: Glassnode

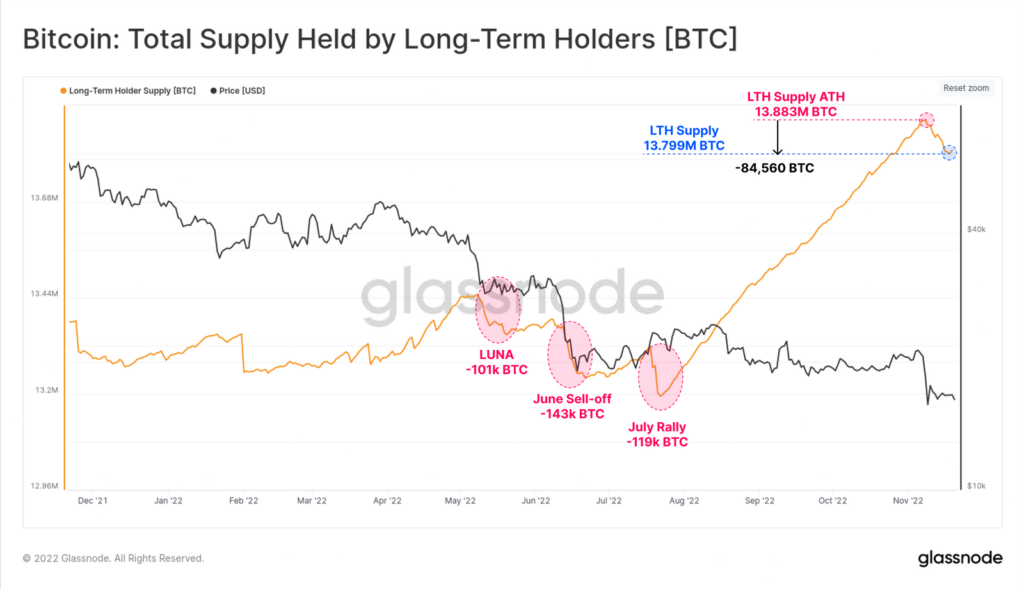

The chart shows that the total supply in the hands of long-term investors fell by nearly 85,000 BTC in the face of FTX's collapse, signaling a scale comparable to the collapse of Luna when the LTH group reduced reserves by 101,000 BTC. The scale, however, is still smaller than June's sell-off and July's rally, when LTH addresses distributed some reserves. Source: Glassnode

Bitcoin chart, H4 interval. The major cryptocurrency is moving in a downtrend and testing the levels of the annual lows of November 10. Buyers last night halted declines below $15,500 and are struggling to exhaust supply forces. If the bulls manage to hold this level, we can expect an upward correction toward $17,000. If not, the way to levels near $14,000 i.e. the June 2019 peaks is likely to be opened. Source: xStation5

🚨 A Bitcoin 69 000 dollárra esett vissza 📉 1:1 korrekciós forgatókönyv?

Talpra Tréder - 2026.02.09.

Reggeli összefoglaló (06.02.2026)

Talpra Tréder - 2026.2.2.

Ezen tartalmat az XTB S.A. készítette, amelynek székhelye Varsóban található a következő címen, Prosta 67, 00-838 Varsó, Lengyelország (KRS szám: 0000217580), és a lengyel pénzügyi hatóság (KNF) felügyeli (sz. DDM-M-4021-57-1/2005). Ezen tartalom a 2014/65/EU irányelvének, ami az Európai Parlament és a Tanács 2014. május 15-i határozata a pénzügyi eszközök piacairól , 24. cikkének (3) bekezdése , valamint a 2002/92 / EK irányelv és a 2011/61 / EU irányelv (MiFID II) szerint marketingkommunikációnak minősül, továbbá nem minősül befektetési tanácsadásnak vagy befektetési kutatásnak. A marketingkommunikáció nem befektetési ajánlás vagy információ, amely befektetési stratégiát javasol a következő rendeleteknek megfelelően, Az Európai Parlament és a Tanács 596/2014 / EU rendelete (2014. április 16.) a piaci visszaélésekről (a piaci visszaélésekről szóló rendelet), valamint a 2003/6 / EK európai parlamenti és tanácsi irányelv és a 2003/124 / EK bizottsági irányelvek hatályon kívül helyezéséről / EK, 2003/125 / EK és 2004/72 / EK, valamint az (EU) 2016/958 bizottsági felhatalmazáson alapuló rendelet (2016. március 9.) az 596/2014 / EU európai parlamenti és tanácsi rendeletnek a szabályozási technikai szabályozás tekintetében történő kiegészítéséről a befektetési ajánlások vagy a befektetési stratégiát javasló vagy javasló egyéb információk objektív bemutatására, valamint az egyes érdekek vagy összeférhetetlenség utáni jelek nyilvánosságra hozatalának technikai szabályaira vonatkozó szabványok vagy egyéb tanácsadás, ideértve a befektetési tanácsadást is, az A pénzügyi eszközök kereskedelméről szóló, 2005. július 29-i törvény (azaz a 2019. évi Lap, módosított 875 tétel). Ezen marketingkommunikáció a legnagyobb gondossággal, tárgyilagossággal készült, bemutatja azokat a tényeket, amelyek a szerző számára a készítés időpontjában ismertek voltak , valamint mindenféle értékelési elemtől mentes. A marketingkommunikáció az Ügyfél igényeinek, az egyéni pénzügyi helyzetének figyelembevétele nélkül készül, és semmilyen módon nem terjeszt elő befektetési stratégiát. A marketingkommunikáció nem minősül semmilyen pénzügyi eszköz eladási, felajánlási, feliratkozási, vásárlási felhívásának, hirdetésének vagy promóciójának. Az XTB S.A. nem vállal felelősséget az Ügyfél ezen marketingkommunikációban foglalt információk alapján tett cselekedeteiért vagy mulasztásaiért, különösen a pénzügyi eszközök megszerzéséért vagy elidegenítéséért. Abban az esetben, ha a marketingkommunikáció bármilyen információt tartalmaz az abban megjelölt pénzügyi eszközökkel kapcsolatos eredményekről, azok nem jelentenek garanciát vagy előrejelzést a jövőbeli eredményekkel kapcsolatban.