UK stocks say yes to Starmer, as political focus shifts to France and the US

The reaction to the UK election result has mostly been felt in the UK stock market. The FTSE 250 is higher by more than 1.5% and the FTSE 100 is up 0.2% so far today. Unsurprisingly, the best performers in the UK equity space are the housebuilders, who were always seen as the big winners from a Labour victory. Five out of the top ten performers in the FTSE 100 so far today are housebuilders, with Persimmon, Vistry and Barratt taking the top three spots. Persimmon is the top performer and is higher by more than 3% on Friday, as investors wait for Labour to act on their pledges on planning reform and to build more homes.

What will the economy look like under Labour?

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appAs we have mentioned, Sir Keir Starmer does not have the fiscal headroom to throw money at all the UK’s problems. The focus will be on whether he can deliver the growth that he has promised. Early in his tenure as Prime Minister, we expect a blitz of legislation, including the employment rights bill, which will look to ban zero hours contracts, strengthen trade unions and improve workers’ rights from the first days of employment. This is normally something that sends shivers down the spine of business and stock markets, however, Labour have promised to consult business as this law makes its way through parliament. Thus, ahead of this election, Labour has reached out to business and these bonds could be keeping financial markets calm in the aftermath of the largest majority for Labour since 1997.

The market reacts to Labour

In the last 5 days, UK banks have also performed well, which is a sign that the market sees a Labour win as a boost to the UK economy. The performance of a country’s banking stocks is a sign of the health of the overall economy and faith in its government. UK banks have massively outperformed banks in France, who have struggled since the announcement of the French election. We expect the UK’s water utility companies to continue to underperform, as the Labour government have singled them out for harsh punishments under a Labour government due to their failures on sewage being pumped into UK rivers.

French voters expected to say oui to chaos

While we wait for the official handover of power to Sir Keir Starmer and the Labour party, the focus will quickly shift to political issues elsewhere. The second round of French elections take place on Sunday. Financial markets in France are calm ahead of the vote. One of the last polls before Sunday’s vote, shows the far-right National Rally party falling short of winning an outright majority, and it suggests that the alliance of the centrists and the left have been effective to stop Marine Le Pen’s party from winning power. The National Rally is expected to win less than 220 seats, they need 289 seats to form a government. This makes it unlikely that they will be able to hobble together a coalition. Instead, a hung parliament is likely. There cannot be another vote in France for one year after this vote, so it could usher in a period of political stasis for France. The market does not seem to mind this option, and the spread between French and German 10-year bond yields, which has fallen from 80bps to 65 bps. If the prospect of a far-right government is ruled out on Sunday, then we may see a further narrowing of this spread. French stocks are also on course to be the one of the best performers in the European stock index space this week and the Cac 40 is higher by more than 3%. This has been driven by domestic French stocks, Société General is higher by more than 7% this week, Carrefour is up by 7.6%, and Teleperformance is higher by 16%. We may see an extension of this recovery rally after Sunday’s result, if the polls are correct.

Payrolls could boost expectations for a September rate cut

Looking ahead, the US will also be in focus today. Payrolls for June will be released at 1330 BST. The market expects a slowdown in the US labour market, with 190k jobs expected to have been created last month. The unemployment rate is expected to remain unchanged at 4%, and average hourly earnings are expected to decline to 3.9%. After a spate of weaker US data this week, the probability of a September rate cut from the Federal Reserve has risen to 73%. This has weighed on US Treasury yields and the dollar this week. We expect a weak labour market report to see a continuation of these market trends, with US stocks doing well, as bond yields fall and the dollar struggles.

The Fed more important for US markets than politics, for now

Politics could also be in focus this weekend in the US, as pressure continues to build on President Biden. This seems like a make or brake weekend for the President, and if he fails to boost his popularity there could be even more pressure for him to quit the Presidential race and allow someone else to become the Democratic nominee. It’s hard to know what this would mean for the markets. The prospect of a win for Trump temporarily spooked the US Treasury markets last week, however, it has not had a long-term impact on US yields, suggesting that the Fed is a much bigger influence on US asset prices rather than the current political drama.

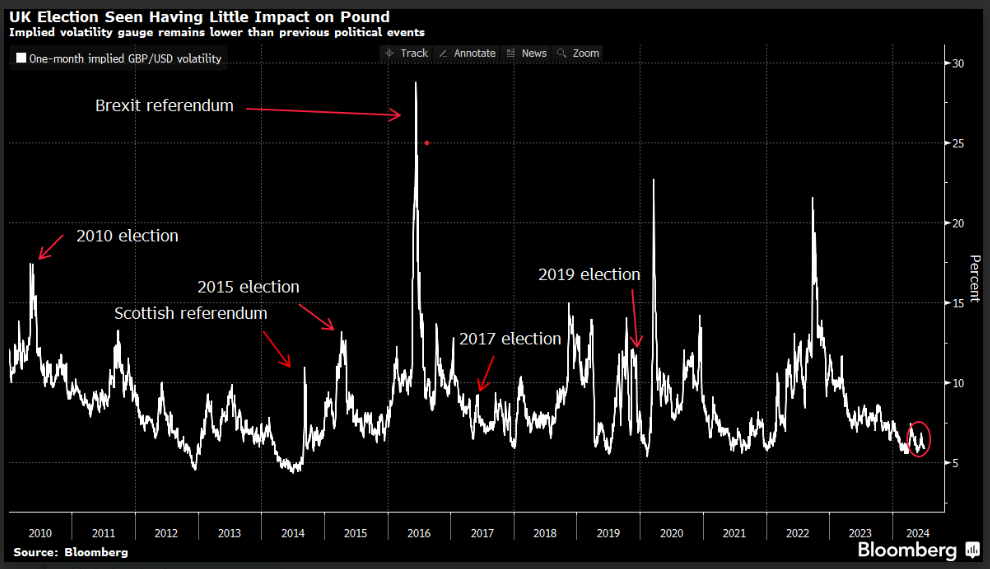

Source: The low volatility election for GBP

Source: Bloomberg

Source: Bloomberg

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.