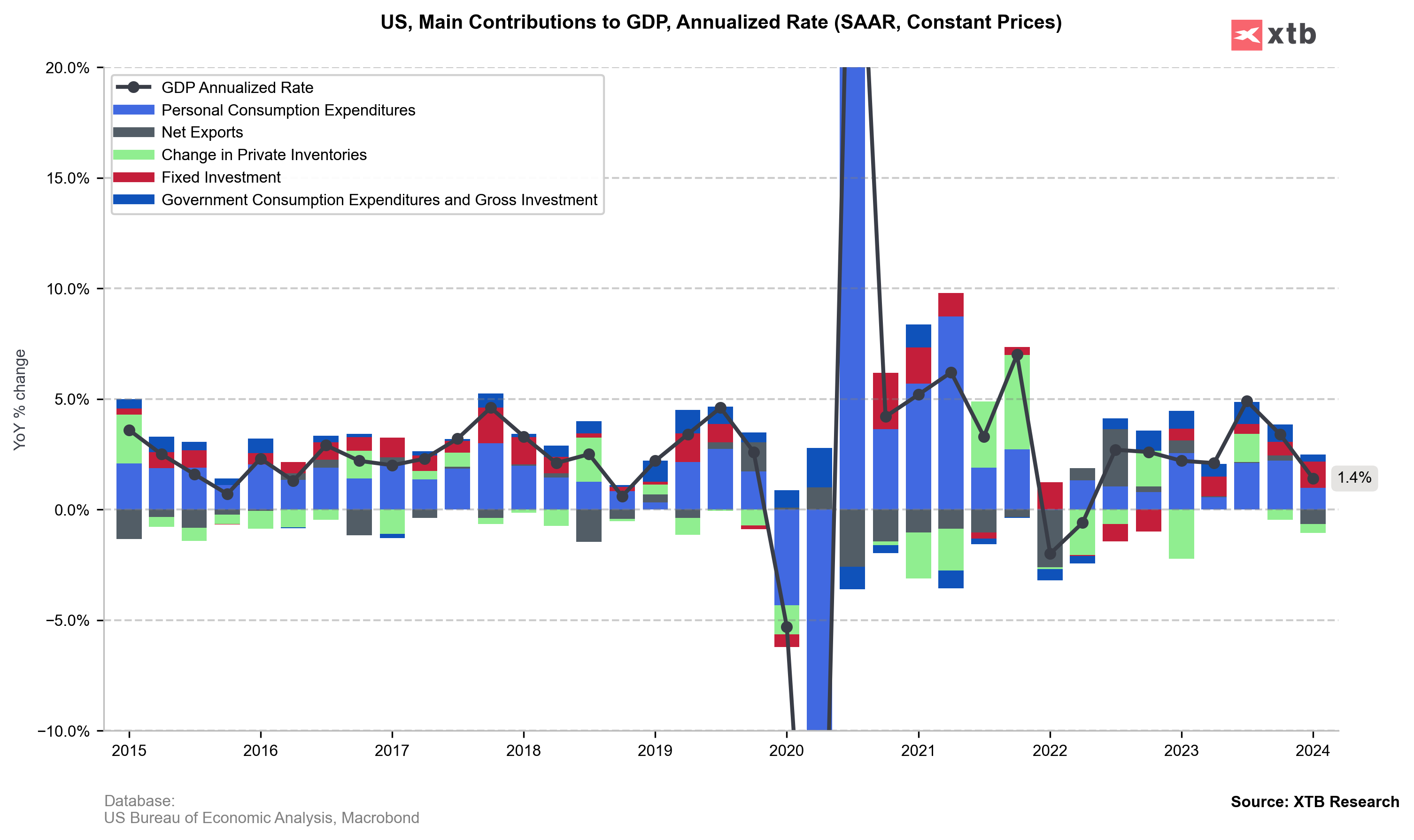

The US GDP report is probably the most important macro reading this week. It is expected that the second quarter was better than the previous one, although the change in Q2 is still expected to be significantly lower than in the last quarter of last year.

According to the Atlanta Fed, economic growth in Q2 is still largely driven by consumer spending and private investments. However, it is worth noting that retail sales have been slightly worse recently, although market expectations indicated even worse data.

It is worth recalling Powell's words from one of the Fed meetings when he mentioned that growth is still largely driven by private consumption. Consumer spending in Q1, on an annualized basis, was only 1.5%, so it will not be difficult to beat this result. What are the market expectations for today's report?

- Annualized GDP is expected to increase by 2.0% compared to the previous growth of 1.4%.

- The GDP deflator is expected to drop to 2.6% from 3.1%.

- Core PCE is expected to rise by 2.7% q/q compared to the previous level of 3.7% q/q.

- Private consumption is expected to increase by 2.0% compared to the previous level of 1.5%.

The market consensus seems to be quite conservative. Bloomberg Intelligence indicates a reading of 2.1%, Bloomberg's Nowcast quantitative model indicates a reading of 2.3%, while the GDPNow model from the Atlanta Fed suggests growth at the level of 2.6%.

Growth in the first quarter was limited by net exports and inventories. It is expected that in Q2, the negative impact will come from net exports, but it will be larger than in Q1. However, in the second half of the year, economic growth may be influenced by a weakening labor market, which could lead to reduced spending. It does not seem that today's report will significantly change expectations for the Fed meeting next week or the anticipated rate cut in September. However, it may affect expectations for further moves this year. Source: Macrobond, XTB

How will the market react?

The consensus remains relatively low, so it will be quite easy to beat it. Stronger growth should positively impact the dollar and limit the current declines in index futures. Market attention will also be focused on the Core PCE price index and the deflator. Significant declines are expected in this regard, which should reinforce the Fed's communication about the need for rate cuts. However, if there is not a substantial drop, it could further strengthen the dollar and potentially resume larger declines in US indices.

EURUSD

EURUSD is rebounding slightly this morning, despite negative data from Germany. Good data from the USA could push the pair back towards the 1.0800 level. However, if the GDP change falls below 2.0% and inflation data drops more than expected, a return to around the 1.0900 level is possible. Source: xStation5

EURUSD is rebounding slightly this morning, despite negative data from Germany. Good data from the USA could push the pair back towards the 1.0800 level. However, if the GDP change falls below 2.0% and inflation data drops more than expected, a return to around the 1.0900 level is possible. Source: xStation5

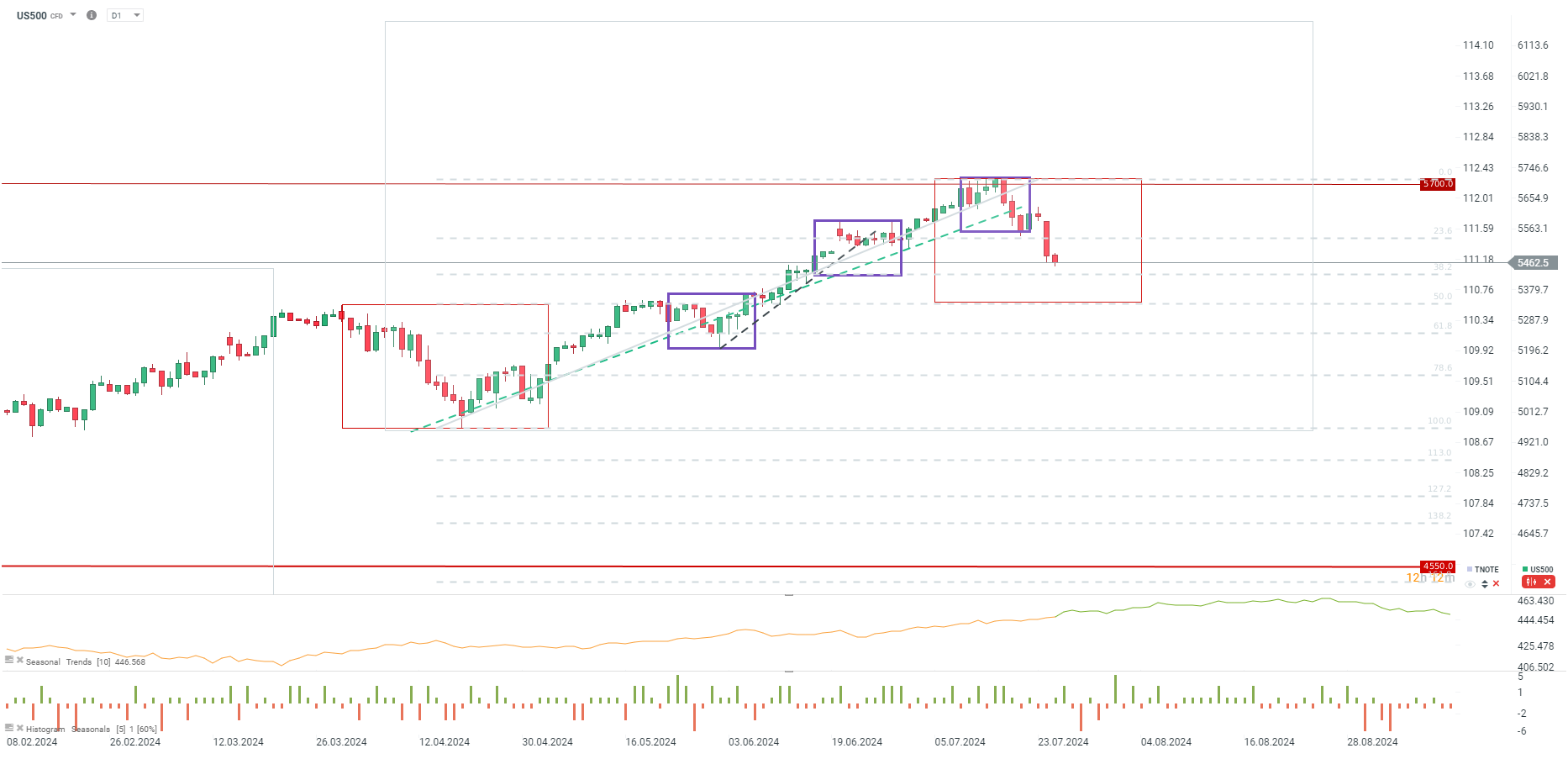

US500

Index futures continue the declines that started last week, although the biggest drops occurred during yesterday's session. US500 is breaking through important support levels. Theoretically, strong GDP and a drop in price indexes should lead to a revival in the index, but strong GDP and a smaller decline in the deflator and Core PCE could reduce expectations for further Fed cuts and deepen the declines. In that case, the key support level will be 5430 during today's session and 5340 in the coming weeks. Source: xStation5

Index futures continue the declines that started last week, although the biggest drops occurred during yesterday's session. US500 is breaking through important support levels. Theoretically, strong GDP and a drop in price indexes should lead to a revival in the index, but strong GDP and a smaller decline in the deflator and Core PCE could reduce expectations for further Fed cuts and deepen the declines. In that case, the key support level will be 5430 during today's session and 5340 in the coming weeks. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.