- Market expects lowest PCE inflation reading this year

- Core inflation is expected to slow to as low as 2.6% y/y, monthly readings are expected to be in line with achieving the inflation target on time

- There will be a smaller base effect in the second half of the year

- The reading should indicate that inflation remains under control

Market expectations

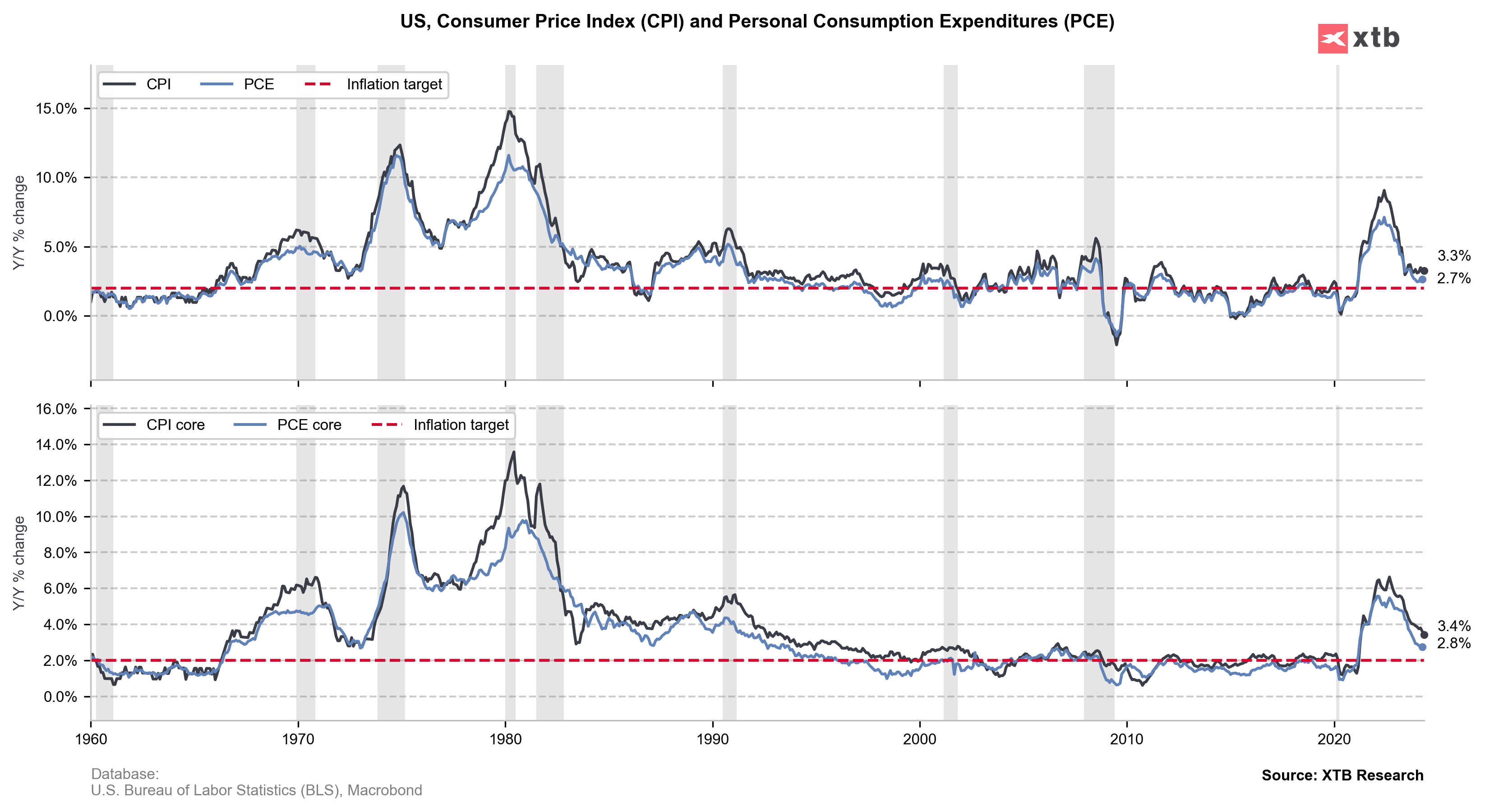

Inflation is finally expected to show that it remains under the control of the monetary authorities. The preferred measure of inflation is expected to show the lowest reading this year. PCE and core PCE inflation are expected to slow to 2.6% y/y, but it is core inflation that is expected to slow all the way from 2.8% y/y. Monthly expectations are also optimistic: 0.0% m/m for the headline reading and 0.1% m/m for the core reading. The Fed is assuming 0.2% growth, which is consistent with meeting the inflation target within the forecast timeframe. However, it is worth bearing in mind that this is data for May.

We are most likely to see less of an impact from transport and financial services, which have previously had a fairly pronounced impact on the inflation rebound. It is worth noting, however, that health-related services are a big influence in PCE inflation, which, due to underlying factors, is rebounding this year.

In addition to the inflation data itself, we will learn about earnings and spending data. High wages and spending may somewhat reduce the positive perception in the context of the Fed decision. However, inflation in line with expectations or lower should lead to positive comments on inflation from the Fed, which could result in opening the door to an interest rate cut in September, which could be communicated in July. Of course, by that point we will also know labour market data and then CPI data as well, which will complete the view on inflation trends.

PCE inflation shows a better inflation picture than CPI, which surprised with a lower reading recently. Source: Bloomberg Finance LP, XTB

How will the market behave?

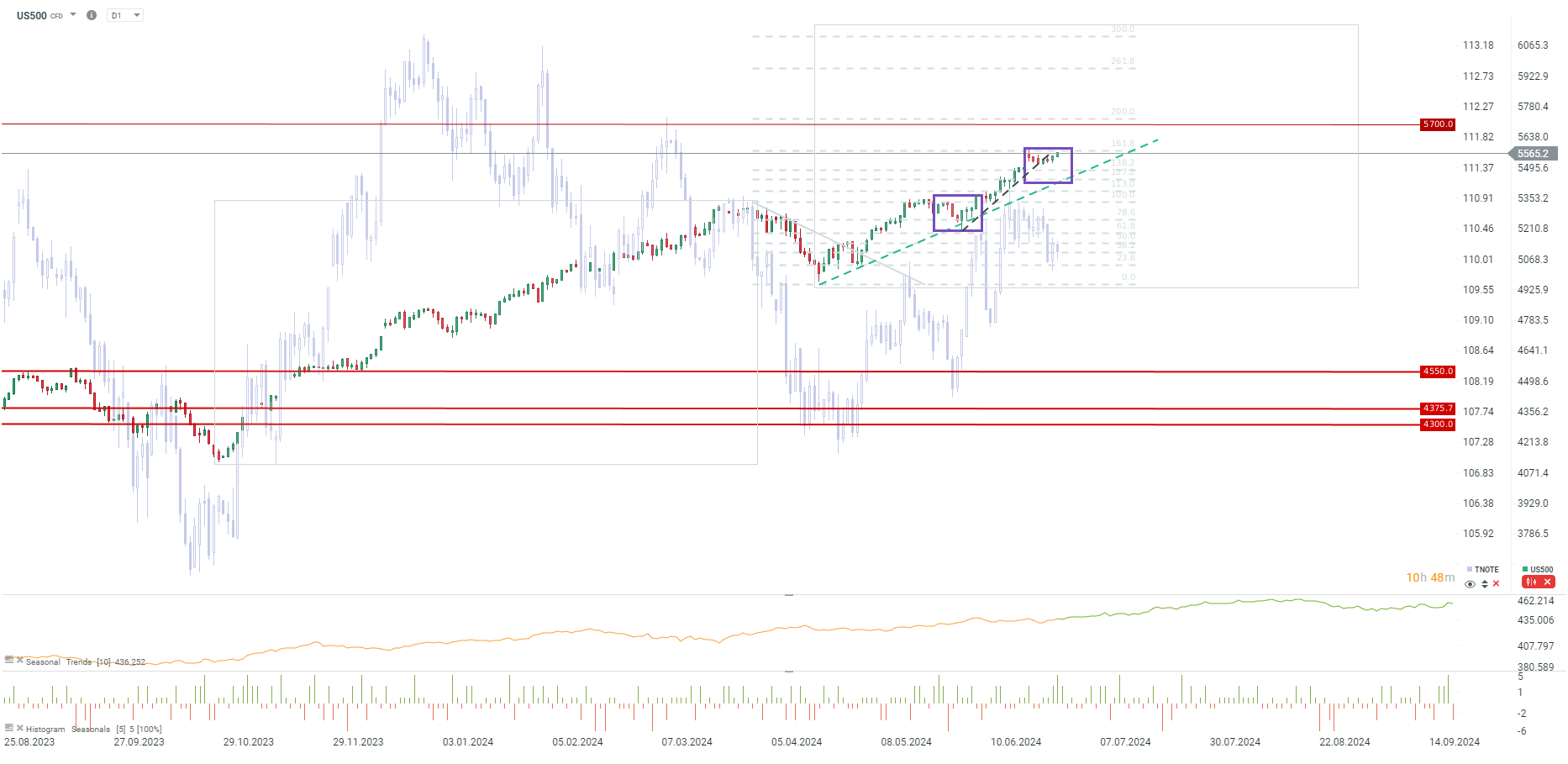

Investors are optimistic about today's reading, which creates some risk when the reading comes out significantly higher than expectations (in which case the correction could be deeper than the nearest support - the 5200 level was an important level to watch). Nevertheless, if inflation shows that it is under control, this will open the way for the US500 to test recent local highs. Although the upside on the US500 has been driven in 30% by the rise of Nvidia and largely AI-related companies, expectations of rate cuts could open the way for further upside on the US500. The 5590-5600 zone is a short-term resistance zone and a profit-taking attempt at this level cannot be ruled out (especially looking at the close of the quarter). Key support is located at 5500 and then at 5430. In the longer term, there is a chance that the US500 will continue to rise not only to 5700, but also to the 6000-6200 zone.

Source: xStation 5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.