- The dollar gains slightly in the first part of the day

- US bond yields also gain

- Indexes on Wall Street open slightly higher

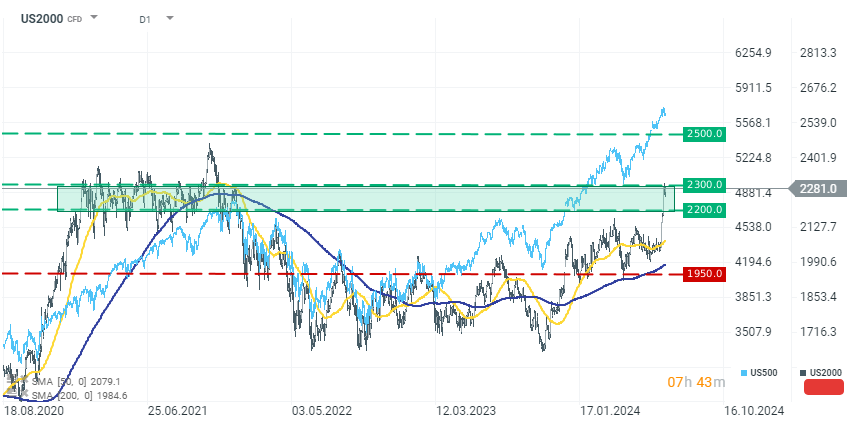

The indices on Wall Street open slightly higher again on Thursday. However, the US500 and US100 remain in consolidation at key levels. Capital continues to favor smaller companies, with the US2000 index gaining 0.55% to 2280 points. In contrast, the US500 gains 0.27% to 5670 points and the US100 gains 0.33% to 20100 points. Although the dollar gains slightly at the start of the session today, overall it remains in a strong downtrend initiated by the US CPI report.

US2000

The smaller-cap index has been posting impressive gains in recent days. After yesterday's consolidation, today investors are starting the day in an optimistic mood. The momentum has slowed down below the key resistance zone around the 2300 point level. After such significant increases, a correction is not excluded. In that case, the 2200 point level is worth keeping an eye on. However, if the bulls manage to break through the resistance level at 2300 then the next potential range would be around 2400 points.

Source: xStation 5

Company news

Taiwan Semiconductor (TSM.US) gains 1.10% after a strong Q2 earnings report. Investors reaction to the publication shows that strong results were mostly expected. Revenue surged by 40% year-over-year to NT$673.51 billion, with net income increasing by 36%. The company also projected Q3 revenue between $22.4 billion and $23.2 billion, surpassing analyst expectations and marking a significant year-over-year increase.

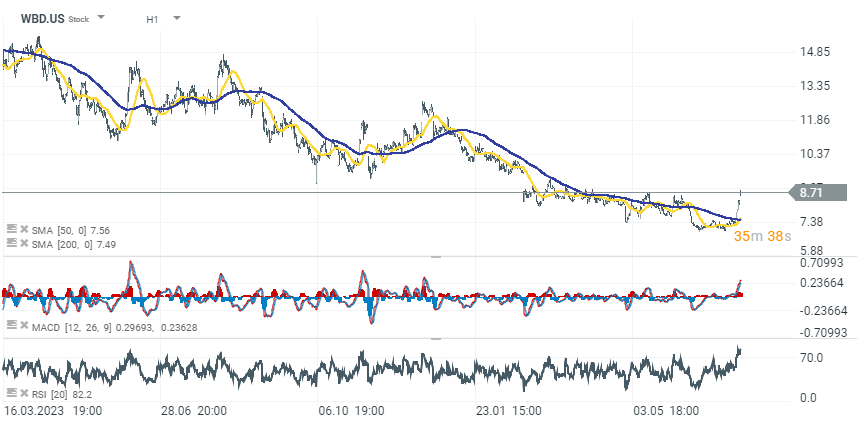

Warner Bros. Discovery (WBD.US) gains as much as 4.60% amid speculation about strategic options, including asset sales or a spinoff of its streaming service and movie studios. This potential separation could isolate the high-growth streaming business from the debt-laden legacy TV networks.

Nokia (NOK.US) dips 5.45% after an 18% decline in Q2 sales and a 32% fall in operating profit due to weak demand for its 5G equipment. CEO Pekka Lundmark highlighted the significant impact of a challenging comparison period, as the prior year saw a peak in India's 5G deployment, which accounted for most of the decline.

Beyond Meat (BYND.US) plunged by almost 10.00% after the plant-based meat company published an announcement about ongoing discussions with bondholders about balance-sheet restructuring. With significant cash burns and dwindling liquidity, Beyond Meat is exploring options with a group holding over $1 billion of its convertible notes. The company's cash reserves have dropped from $258.6 million to $157.9 million, with long-term debt at $1.139 billion, raising investor concerns.

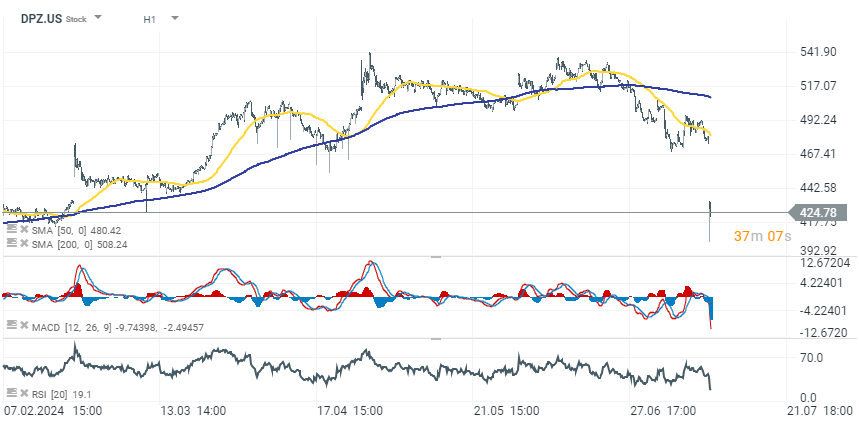

Domino's Pizza (DPZ.US) also saw nearly 10.00% decline after mixed Q2 results. Domino's lowered its international store growth target for 2024 due to franchisee challenges and paused its long-term plan of opening over 1,100 new stores globally each year.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.