- Small-cap companies are once again favored by investors

- The dollar loses 0.15%

- Bond yields are also recorded lower

Markets in the USA open the last trading session of this week definitely in an optimistic mood. PCE data came out as expected, which did not cause a significant market reaction. In the early hours of trading, we observe strong gains in the sector of smaller capitalization companies. The US2000 index gains 1.40% to 2270 points. However, the US500 and US100 also perform well, gaining 0.88% and 0.80%, respectively.

Start investing today or test a free demo

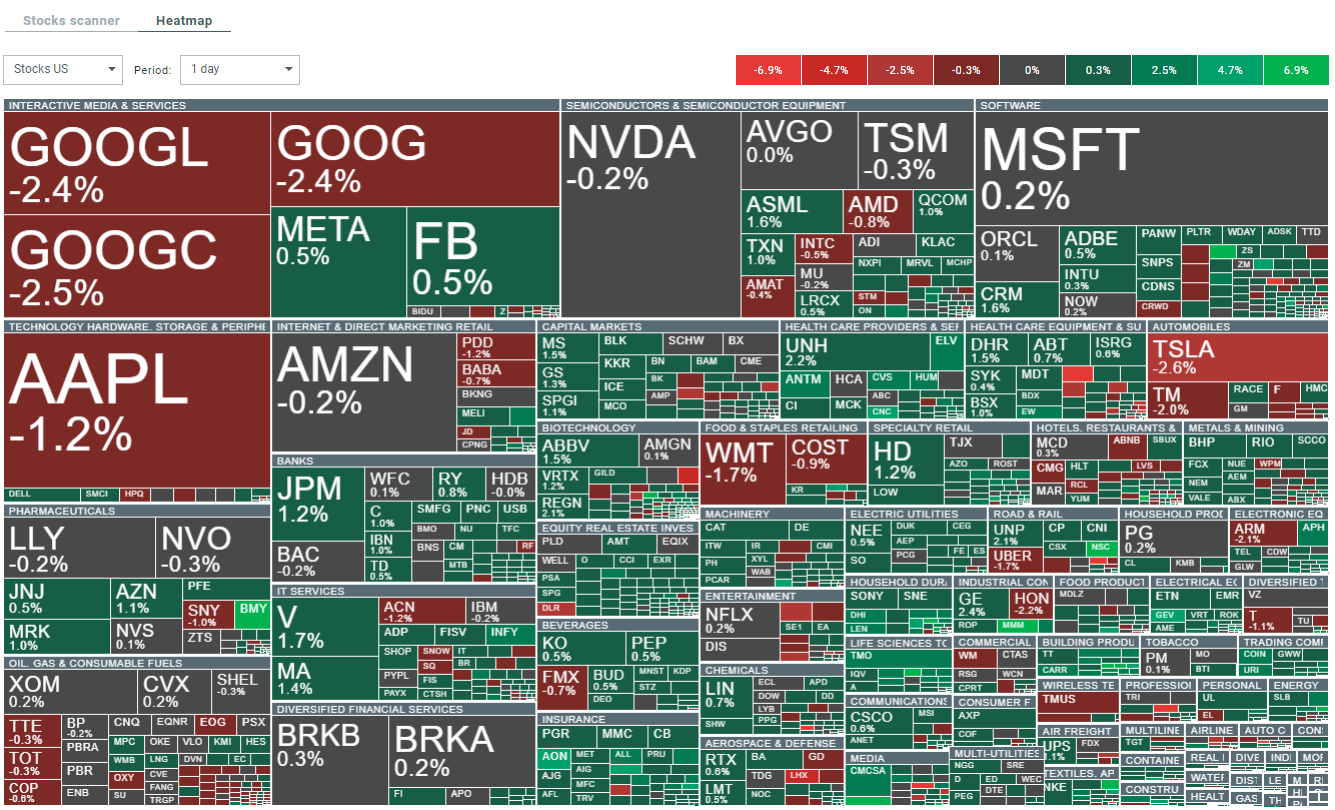

Open real account TRY DEMO Download mobile app Download mobile appThe increases are mainly dominated by smaller companies. In BigTech, we observe mixed sentiments with Apple, Alphabet, and Tesla recording losses. Source: xStation 5

US2000

The index price has remained in a consolidation range. Currently, we observe a price rise to the upper limit below the 2300 point level. If bulls manage to break through this zone, we can expect a continuation of increases. The direction of exit from the current consolidation between 2200-2300 points will be key.

Source: xStation 5

Corporate news

Coursera (COUR.US) stock gained 42% following strong quarterly results, significantly fueled by the growing demand for generative AI courses. CEO Jeff Maggioncalda highlighted that the success was largely due to over two million enrollments in AI-related courses. For fiscal year 2024, Coursera has reaffirmed its revenue expectations to be between $695 million and $705 million, aligning with analyst estimates around $699.91 million. Additionally, the company expects its adjusted EBITDA to range from $24 million to $28 million, which supports its goal of an approximate 4% EBITDA margin.

Boston Beer (SAM.US) initially decreased by more than 4% after the company reported disappointing second-quarter results. However, the stock has rebounded strongly and are currently trading at +4% note. The earning report shows the revenue fell by 4%, primarily due to a decline in sales volumes, although this was somewhat mitigated by price increases. The brand's depletion rate and shipment volume also saw reductions, largely due to weak performance in the Truly Hard Seltzer brand.

DexCom's (DXCM.US) stock experienced a significant drop of over 41% after releasing mixed second-quarter results. Despite a 15% year-over-year increase in revenue, the company's future revenue outlook was lower than anticipated. DexCom now projects third-quarter revenue to be between $975 million and $1 billion, missing the $1.15 billion consensus. For the full year, the company anticipates revenue to be between $4 billion and $4.05 billion, which is below the expected $4.33 billion.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.