- Wall Street indices open mixed

- US30 breaks above 40,000 pts mark

- Deere & Co drops after lowering full-year profit outlook

Wall Street indices launched today's cash session more or less flat - S&P 500 gained 0.1% at session launch, Nasdaq traded flat and small-cap Russell 2000 dropped 0.2%. Disappointing housing market and industrial production data from the United States released earlier today failed to trigger any major market moves. There is a number of speeches from Fed members scheduled for today, which may help move the markets should central bankers touch on the topic of yesterday's inflation data.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appDow Jones (US30) was the best performing major Wall Street index at launch of cash session today but has erased gains since. The move higher was to a huge extent driven by Walmart, which surges 6% after earnings release. Taking a look at US30 chart at H4 interval, we can see that the index trades above the psychological 40,000 pts mark and has almost fully erased downward correction from the first half of April 2024. The near-term resistance zone to watch can be found in the 40,300 pts area and is marked with all-time highs.

Company News

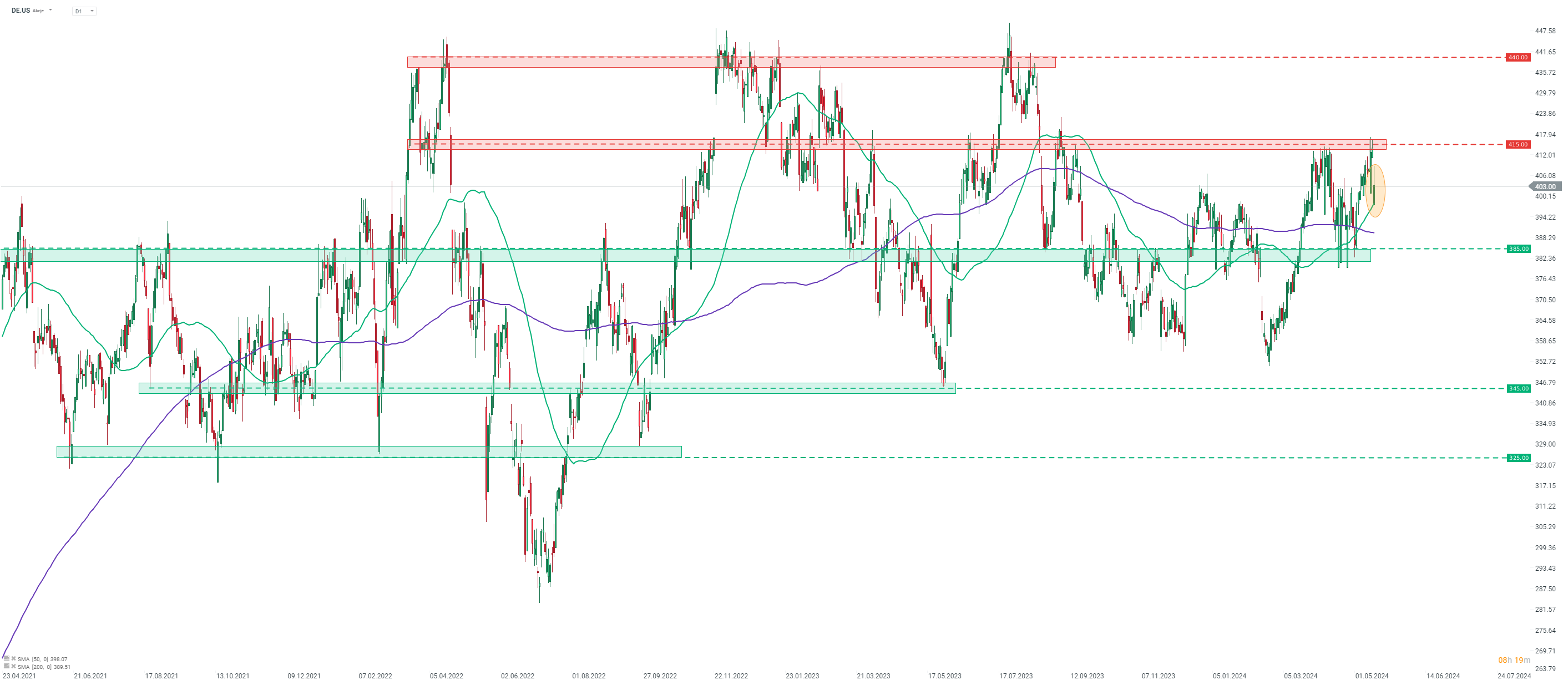

Deere & Co (DE.US) is pulling back following release of fiscal-Q2 2024 results. Company reported 15% YoY drop in net sales to $13.61 billion (exp. $13.20 billion). Net sales were year-over-year lower in each of three major segments - Production & Precision Agriculture, Small Agriculture & Turf and Construction & Forestry. However, only sales in Small Agriculture & Turf segment missed expectations. Company reported net income of $2.37 billion, higher than $2.16 billion expected but 17% lower than a year ago. However, what determined market's reaction was full-year net income forecast - Deere lowered full-year profit outlook from $7.50-7.75 billion to $7.00 billion (exp. $7.53 billion).

Palo Alto Networks (PANW.US) gains after the company announced a partnership with IBM. Aim of the partnership is to deliver AI-powered security offerings to customers. Palo Alto Networks will become IBM's preferred cybersecurity partner in network and cloud. As part of the agreement, Palo Alto Networks agreed to acquire IBM's QRadar SaaS assets. Transaction is expected to close by the end of September 2024.

Chubb (CB.US), US insurer, rallies at a double-digit pace today. The gain was triggered by an announcement from Berkshire Hathaway, an investment conglomerate run by legendary investor Warren Buffett. Berkshire Hathaway unveiled a $6.7 billion stake in Chubb.

Analysts' actions

- Coupang (CPNG.US) upgraded to 'buy' at UBS. Price target set at $26.00

Deere & Co (DE.US) drops after issuing a disappointing full-year net income outlook. Stock launched today's cash trading with an around-4% bearish price gap. However, stock found support at the 50-session moving average (green line) and has recovered a big part of initial drop already. Source: xStation5

Deere & Co (DE.US) drops after issuing a disappointing full-year net income outlook. Stock launched today's cash trading with an around-4% bearish price gap. However, stock found support at the 50-session moving average (green line) and has recovered a big part of initial drop already. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.