Rivian Automotvie following news of Volkswagen's investment of $1 billion this year and $5 billion in total over the next few years, gained more than 36% at the opening yesterday. Today, Rivian's stock was down more than 14% from last session's highs. The high volatility on the company is due to the market's big surprise at Volkswagen's decision, which is hard to value properly. Therefore, some investors might have decided to take profit on quickly gains on stock price, creating today's declines.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appRivian, looking at its financial results in recent years, despite its strong revenue momentum (the company has increased its revenue in LTM terms to $5 billion in just 2 years from $0.2 billion in 1Q22, although it is worth noting that the LTM data for 1Q22 covers only 3 quarters) has been struggling with creating a positive operating profit. It has been at negative levels ranging from $-1.8 to $-1.3 billion per quarter for many quarters. Hence, investors are approaching the company with a great deal of caution.

Source: Rivian Automotive

Source: Rivian Automotive

Attitudes toward the EV manufacturer were somewhat altered by yesterday's news of Volkswagen's investment. The investment from automotive market veteran laid the groundwork in the eyes of investors that the company has a chance not only to improve its balance sheet, but also to benefit strongly from Volkswagen's scale and capabilities. For Volkswagen, meanwhile, the partnership with Rivian is expected to be a remedy for the software problems.

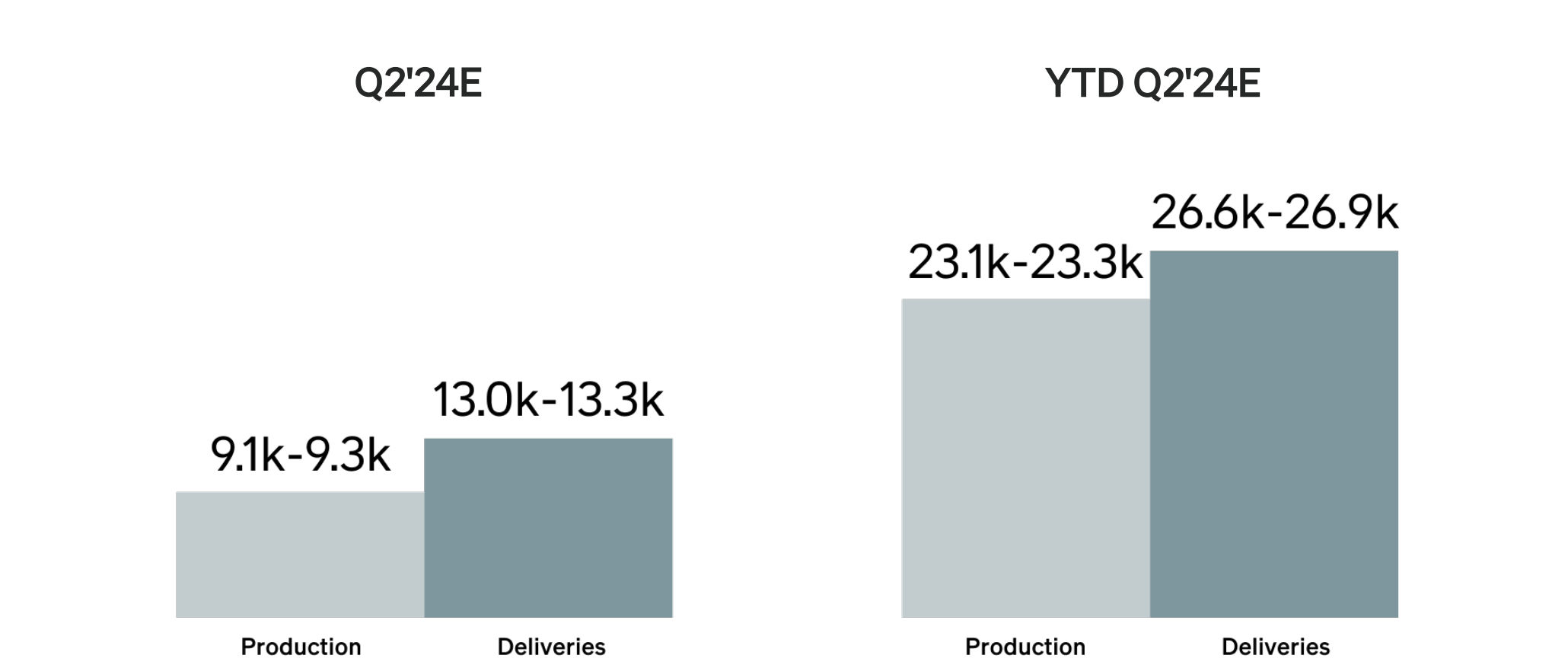

Today, as part of Investor Day, Rivian presented its plans for the coming years. The company reinforced its prediction of producing 57 thousand units in 2024, which would mean a 5% year-on-year increase. As of 2Q24, the company expects to produce between 9.1-9.3 thousand units and 13-13.3 thousand deliveries.

Source: Rivian Automotive

Source: Rivian Automotive

From a cost perspective, the company's biggest burden remains the cost of materials, which translates into the cost of the final vehicle produced. The company expects that by the end of the year, the cost of materials will fall by 20% and, relatively to the cost of the manufactured product itself, it will amount to 75% of the total value. It is in this area that the company expects the greatest improvement, and it is due to this reduction that it forecasts positive gross profit in 4Q24 (for the first time since the IPO).

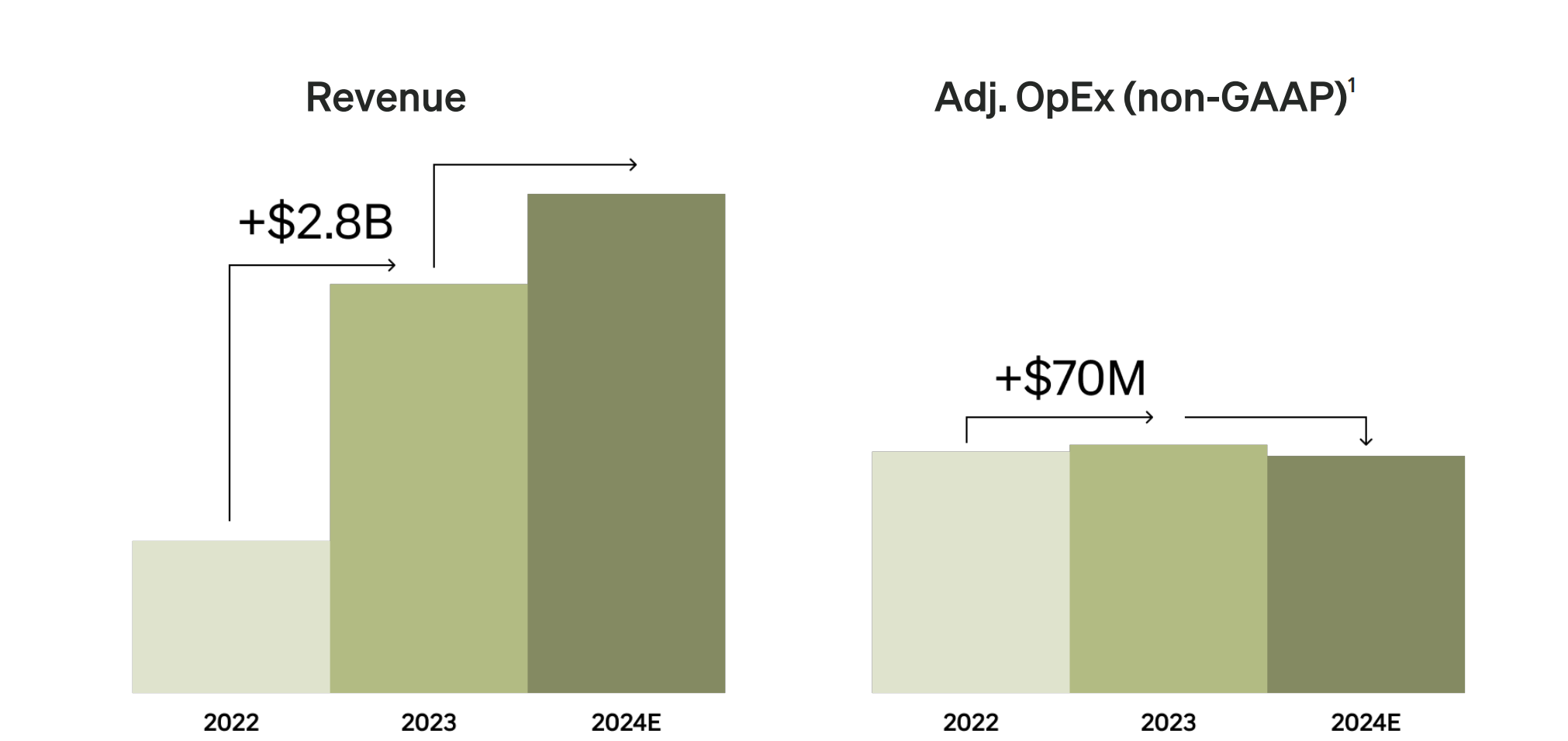

Improved profitability is expected to be helped by an appropriate cost policy, which is expected to keep costs relatively flat in 2024, while revenue growth rates are expected to remain high. Key to this is expected to be successful renegotiation of the company's contract terms.

Source: Rivian Automotive

Source: Rivian Automotive

In addition to managing the cost of goods sold, Rivian announces a reduction in CAPEX by $2.5 billion in aggregate over the 2023-25 period. The largest component affecting the reduction in development costs is the decision to build two in-house R2 factories, which should result in $2.25 billion in savings over the 2024-25 period.

The company's long-term goals are to achieve positive adjusted EBITDA and 25% gross margin (on a GAAP basis) in 2027. The company also wants to achieve a 10% free cash flow margin by this time.

The company's presentation was very well received by the market, which partially erased Rivian's declines, which today lost -7% and is currently trading at levels only 2.7% below yesterday's closing price. Source: xStation

The company's presentation was very well received by the market, which partially erased Rivian's declines, which today lost -7% and is currently trading at levels only 2.7% below yesterday's closing price. Source: xStation

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.