The French political scene was jolted by an unexpected turn of events the same evening the European elections took place, on June 9. Not because the radical right won a majority of seats in the parliament – since this was already predicted by preliminary polls –, but rather because the President took the sudden decision to dissolve the National Assembly. As a result, the citizens will head back to the polls on June 30 and July 7, with the threat of facing another cohabitation. How did the stock market react after the news ?

AN AMBITIOUS CAMPAIGN DESPITE THE DEFICIT

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

The early stages of the legislative campaign were marked by intense turmoil within political parties, leading to the formation of polarized alliances: the Rassemblement National (rallied by the Républicains and Reconquête), the Nouveau Front Populaire (NFP), and the presidential coalition Ensemble pour la République. Current projections give them 36%, 29%, and 20% of the vote, respectively.

Election campaigns are focused on current major issues such as the previous pension reform, purchasing power, security, and culture. Highlighted proposals include the NFP's push to raise the minimum wage, the RN's plan to partly exonerate employer contributions on salary increases, and a shared intent of revoking the pension reform.

However, these promising agendas hit a major snag with the European Commission's decision on June 19 to place France under excessive public deficit procedure. Countries facing this sanction also include Italy, Hungary, Belgium, Slovakia, Malta, and Poland (only Italy and Hungary have higher deficits than France, which stands at 5.5% of GDP). A collective punishment that could be seen as less contentious than targeting a single nation.

The main risk for these countries? A potential fine of 0.1% of GDP (about 2.5 billion euros for France) if they fail to reduce the deficit by 0.5 percentage points annually. Although such a penalty has never been enforced, it could be seen as a signal sent by the European Union to the candidates ahead of the elections: the timing isn’t in favor of an increase in public spending, and they should instead focus on debt reduction. Moody’s has also noted a potential downgrade in France's credit rating, citing the increased risks in managing public finances due to the political situation.

Furthermore, the European Central Bank has indicated it will not resort to quantitative easing in case of disruption in the French bond market. Therefore, the next government will need to avoid raising the risk premium demanded by creditors for French debt during future auctions.

CDS HEDGING MOVEMENT OBSERVED

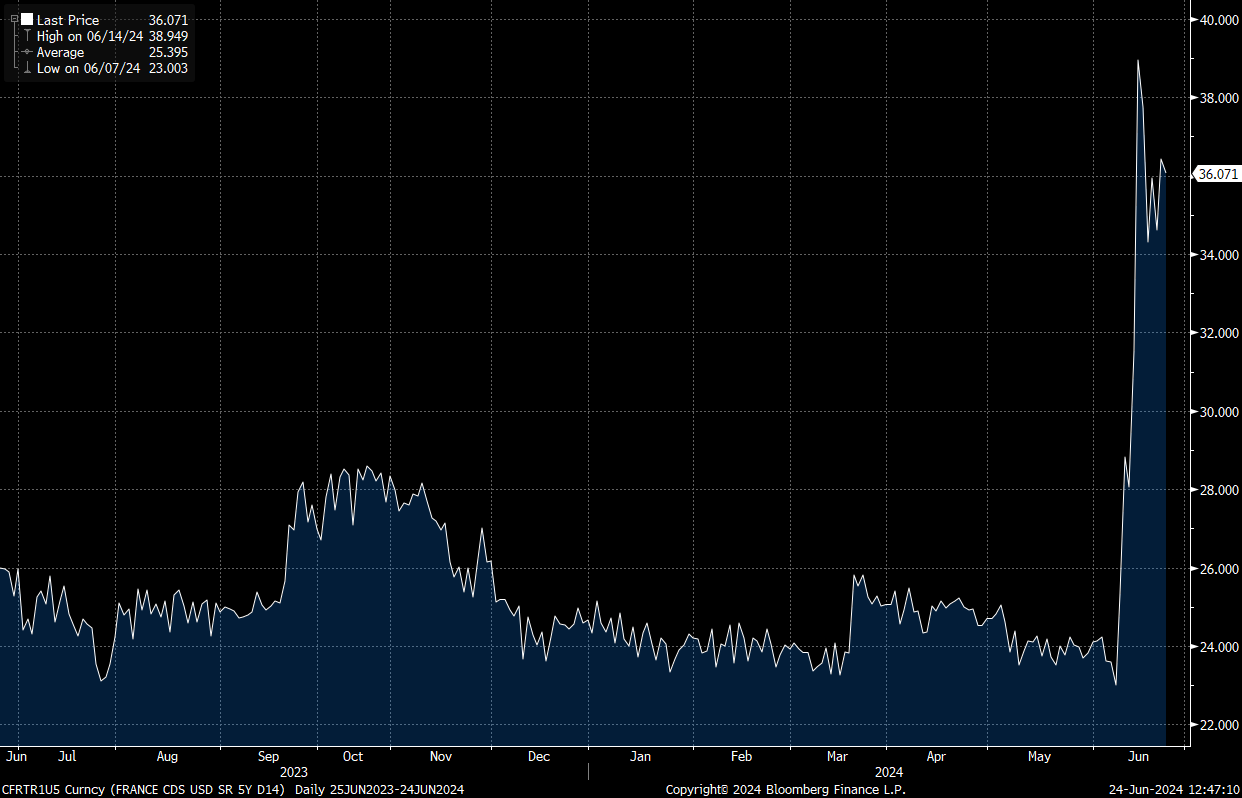

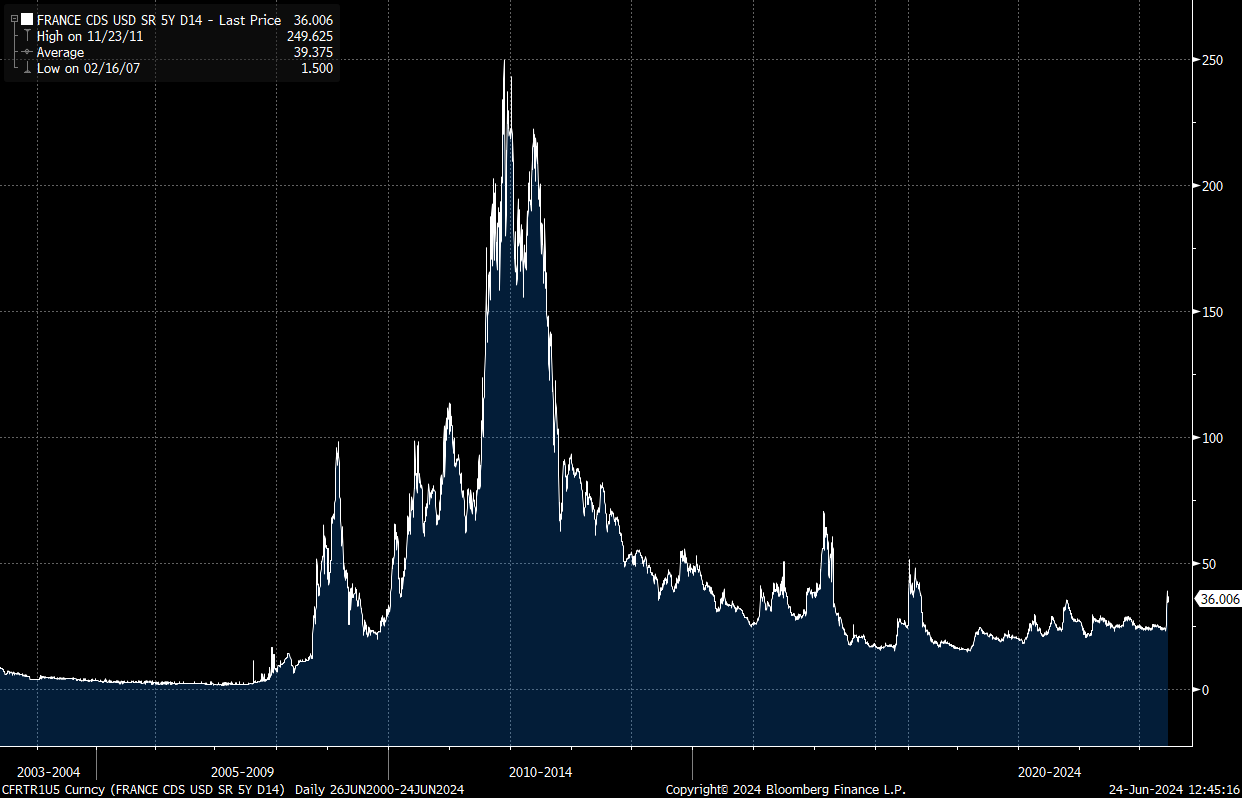

While the short-term risk of default on French debt, indicated by its credit default swap (CDS), has increased significantly, the long-term curve shows the recent increase isn’t alarming yet :

CDS France, 5 years. Source : Bloomberg.

CDS France, 5 years. Source : Bloomberg.

Credit default swaps (CDS) are derivatives often likened to insurance against default.

PRICES TELL US EVERYTHING WE NEED TO KNOW

Markets love to find excuses to move. They usually wait for news from an economic calendar event to react, with prices poised at support levels ready to bounce, or at resistance levels ready to be rejected.

What happened to the CAC 40 (the benchmark French index of the 40 largest capitalizations) following the announcement of the European election results and Macron's dissolution of the National Assembly?

On January 16, we highlighted a red zone confluent between various institutional trader profit targets, located at 8028 and 8269, just below a major geometric resistance (M1 period).

Major resistance zone in FRA40, M1 Period, Chart Generated February 23, 2024. Source: xStation.

On June 11, we observed the expected downard reaction. With the events of June 9, fundamentals were aligned with technicals to justify the drop in prices :

Major resistance zone in FRA40, M1 Period, Chart Generated June 21, 2024. Source: xStation.

Rejection of the major resistance zone highlighted by the news (FRA40 on the D1 Period). Source: xStation.

The next support levels for the CAC 40 are 7515 and 7340. Breaking below 7290 would be a bearish signal on the medium-term with the long-term support range being located at 6950 - 6635.

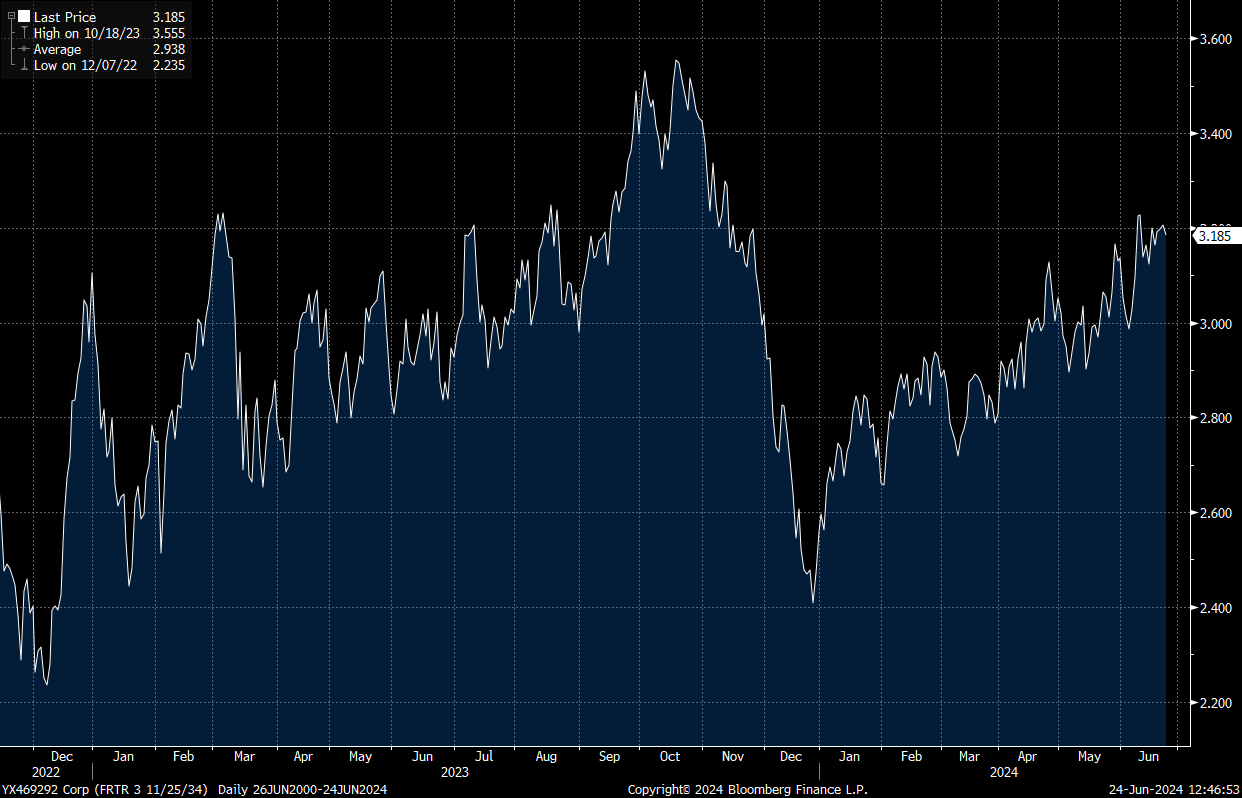

The French 10-year bond yield is in an uptrend in 2024. Prices are perfectly contained within an ascending channel, which needs to be broken to the downside for this political upheaval to be actually considered as a non-event. To achieve this, the key level of 3.05% must be broken; otherwise, French debt will remain vulnerable to speculative attacks.

French sovereign bonds yield for 10 years maturity. Source : Bloomberg.

By Antoine Andreani, Head of Research at XTB France

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.