Polish zloty is not doing well in recent days. The current week started calmly, but on Tuesday and Wednesday the zloty was under selling pressure. Interestingly, the zloty was trading lower despite the generally good sentiment on the global stock market, which in theory should support emerging market currencies. However, the recent sell-off of the zloty is caused by reports that the polish central bank (NBP) may cut interest rates in the first quarter of 2021. Speculations about this appeared after the bank Chairman A. Glapiński said that although the current level of interest rates in Poland is appropriate and corresponds to the current situation, a reduction is possible in Q1. He also said that the NBP was analyzing the current situation and possible effects that could be caused by lowering the interest rates.

There have been speculations on the market that it may be a verbal intervention aimed at weakening the zloty before today's fixing, which was set at the level (EUR / PLN 4.6148) and thus generating a higher NBP profit that could support the state treasury (weaker the zloty means that the value of the reserves is increasing). If it was indeed the goal of the NBP, then a correction on the pairs with the Polish zloty is possible.

Start investing today or test a free demo

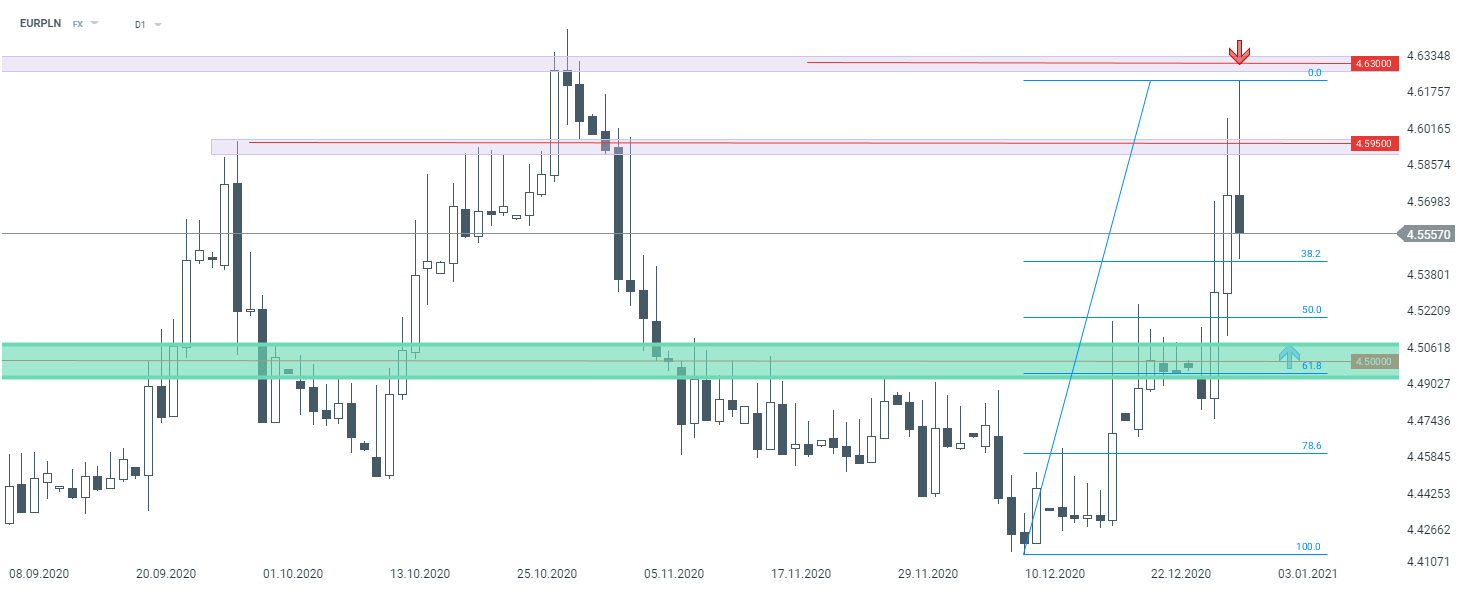

Open real account TRY DEMO Download mobile app Download mobile app The zloty started to recover recent losses after today's NBP fixing. Source: xStation5

The zloty started to recover recent losses after today's NBP fixing. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.