Oil prices are jumping over 2.5% today, following another increase in tensions in the Middle East. Two high-profile assassinations took place in the Middle East in the past 24 hours, increasing the risk of a broader conflict in the region, which would have a big implication for the oil markets.

Ismail Haniyeh, chief of Hamas political wing and the group's key negotiator in ceasefire talks with Israel, has been assassinated in Teheran, Iran, while attending the inauguration of the new Iranian president. His death was confirmed by both Hamas and Iran. A few hours earlier, Fuad Shukr, Hezbollah's second-in-command, has been targeted in a missile strike in Beirut, Lebanon. There are conflicting reports on the outcome of Shukr's assassination attempts, with Hezbollah claiming he survived, while other sources claim he was killed. Shukr is said to have been responsible for a weekend missile strike in Golan Heights, which resulted in number of Israeli civilian casualties.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appWhile no one has claimed responsibility for the attacks, the identity of the targets - senior commanders of Iranian proxies - caused the blame to be quickly put on Israel. While such high-profile assassinations have taken place in the past in the Middle East, this time observers fear a strong response from Iran and its regional proxies. This is because Haniyeh was assassinated in Teheran, capital of Iran, while visiting the country on invitation of Iranian authorities. This is a huge reputational blow to Iranian security forces and Iranian authorities has already vowed to take a revenge.

Tensions in the Middle East are on the rise, and whether they led to a broader regional conflict will likely depend on the scale of Iranian response.

Iranian response to April's strike on the consulate in Damascus involved 300 missiles being fired at Israel, but almost all of them have been shot down by Israel and its allies, causing little to no damage on the ground. Should potential Iranian retaliation to today's attacks play out in the same way with similar outcome, a broader conflict may be avoided. However, should it cause a significant damage to Israel, Israel would likely respond with its own retaliatory strikes, and it could trigger a broader war in the Middle East.

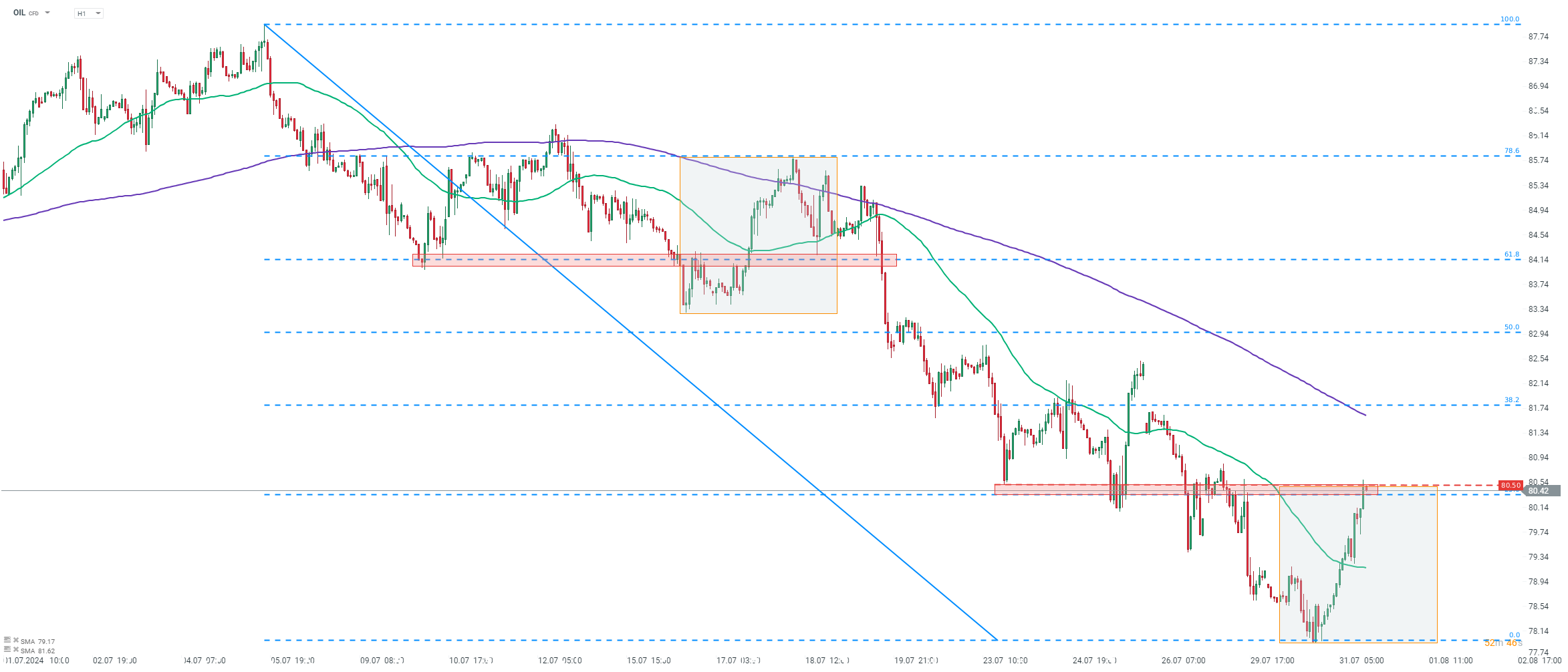

As the Middle East is responsible for around a third of global oil supply, broader war in the region could significantly disrupt oil trade and lead to higher prices. Brent (OIL) and WTI (OIL.WTI) are trading around 2.5% higher today. Taking a look at OIL chart at H1 interval, we can see that the price is attempting to break above a key resistance zone in the $80.50 per barrel area. This zone is marked with previous price reactions, 23.6% retracement of the ongoing downward impulse as well as the upper limit of local market geometry, therefore a break above it could, in theory, signal short-term trend shifting to bullish.

Source: xStation5

Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.