Nvidia (NVDA.US) will release its Q4 2024 financial report today after the close of trading on Wall Street. The report for the calendar period from November 2023 to January 2024 will be released around 09:20pm GMT and will show whether the company's results are in line with the AI trend that has pushed the company's shares to record levels. The company is having a weak session today, with its shares losing more than 3%.

Today's declines are largely due to a change in investor positioning in the options market. An increase in the involvement of market sellers (for speculative/hedging purposes) has pushed the put/call ratio down to 0.64. However, it is worth mentioning that back at the beginning of February, this option positioning indicated a ratio of 0.57.

- Nvidia (NVDA.US) Put/Call: 309.43K/4482.52K Net Option Delta Today = -619.50K shares

- Rivian (RIVN.US) Put/Call: 66.16K/104.91K Net Option Delta Today = 153.07K shares

- Lucid (LCID.US) Put/Call: 36.99K/49.12K Net Option Delta Today = -176.77K shares

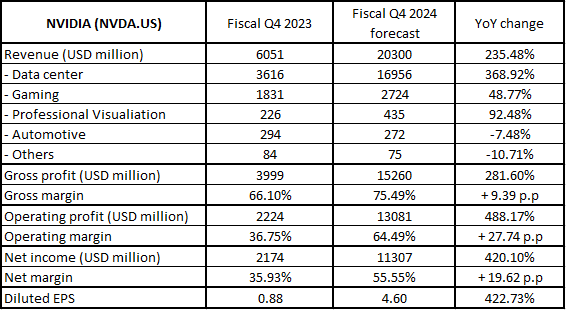

Expectations for Nvidia's fiscal Q4 financial results. Source: Bloomberg Finance LP, XTB Research

Beating them and raising annual forecasts may be necessary to maintain bullish momentum in the broad market. Implied volatility indicates a resultant variance of +/- 10%, or a change in the company's capitalisation of around $166bn.

Source: xStation

Source: xStation

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.