- Natural gas prices are down over 4% this week and are hovering around a critical support level of $2.50 per million British thermal units (mmBtu). While the fundamentals haven't changed much, the price is dipping.

- It's currently warmer than usual, but not scorching hot.

- Demand for gas is expected to rise in the coming weeks, peaking in late July or early August. This increase is due to higher electricity needs for cooling. Don't forget, hurricane season starts mid-August, which could disrupt gas production.

A breakdown of the key factors for NATGAS:

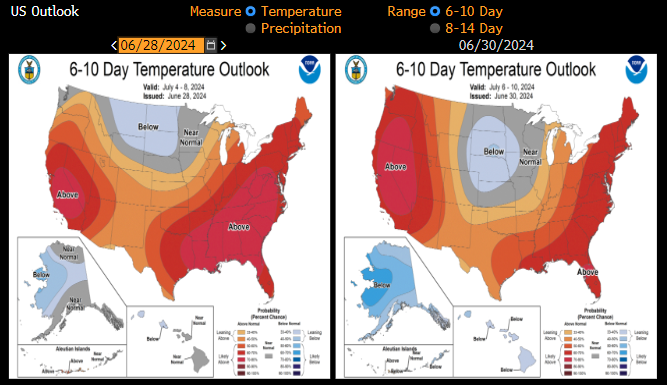

Weather Forecast:

Compared to last Friday, the temperature outlook hasn't changed dramatically. It might be slightly cooler in the central US. Source: Bloomberg, NOAA

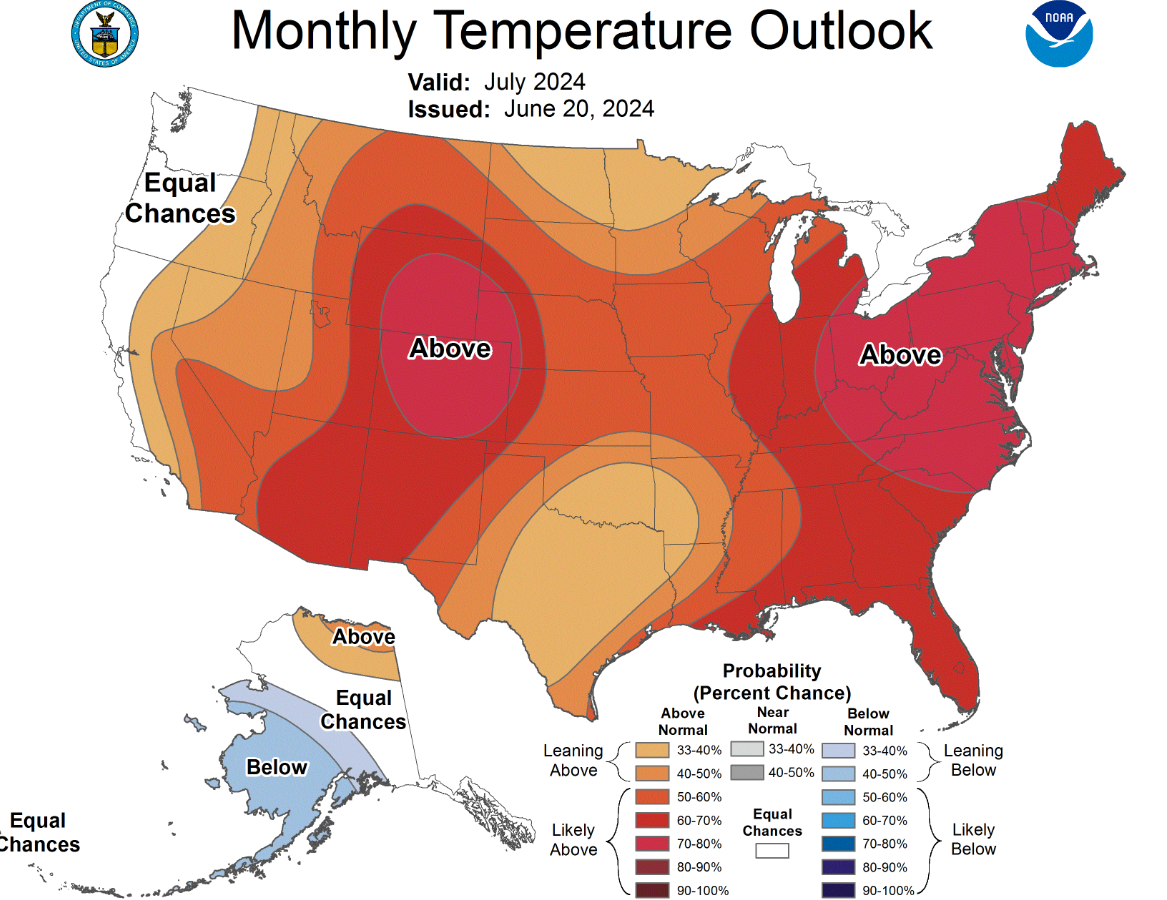

July Outlook:

A report from June 20th by NOAA indicates a high chance (60-80%) of above-average temperatures across most of the US. Source: NOAA

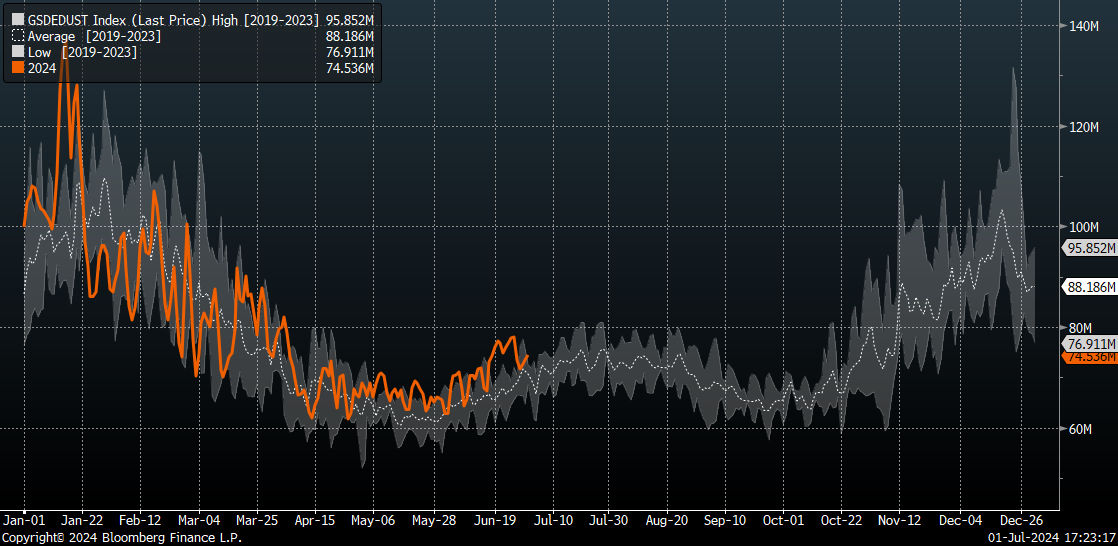

Gas Demand and Cooling:

The number of cooling degree days (a measure of cooling needs) is rising, but the forecast for this week isn't significantly higher than the previous two weeks. This could be contributing to the price pullback. However, the peak demand season is still to come in late July and early August. Source: Bloomberg Finance LP, XTB

The number of cooling degree days (a measure of cooling needs) is rising, but the forecast for this week isn't significantly higher than the previous two weeks. This could be contributing to the price pullback. However, the peak demand season is still to come in late July and early August. Source: Bloomberg Finance LP, XTB

Demand vs. Seasonal Average:

Gas demand has recently returned to around the 5-year average, and it's expected to climb further in the coming weeks based on seasonality. However, daily fluctuations shouldn't exceed 4-6 billion cubic feet per day (bcfd). Source: Bloomberg Finance LP, XTB

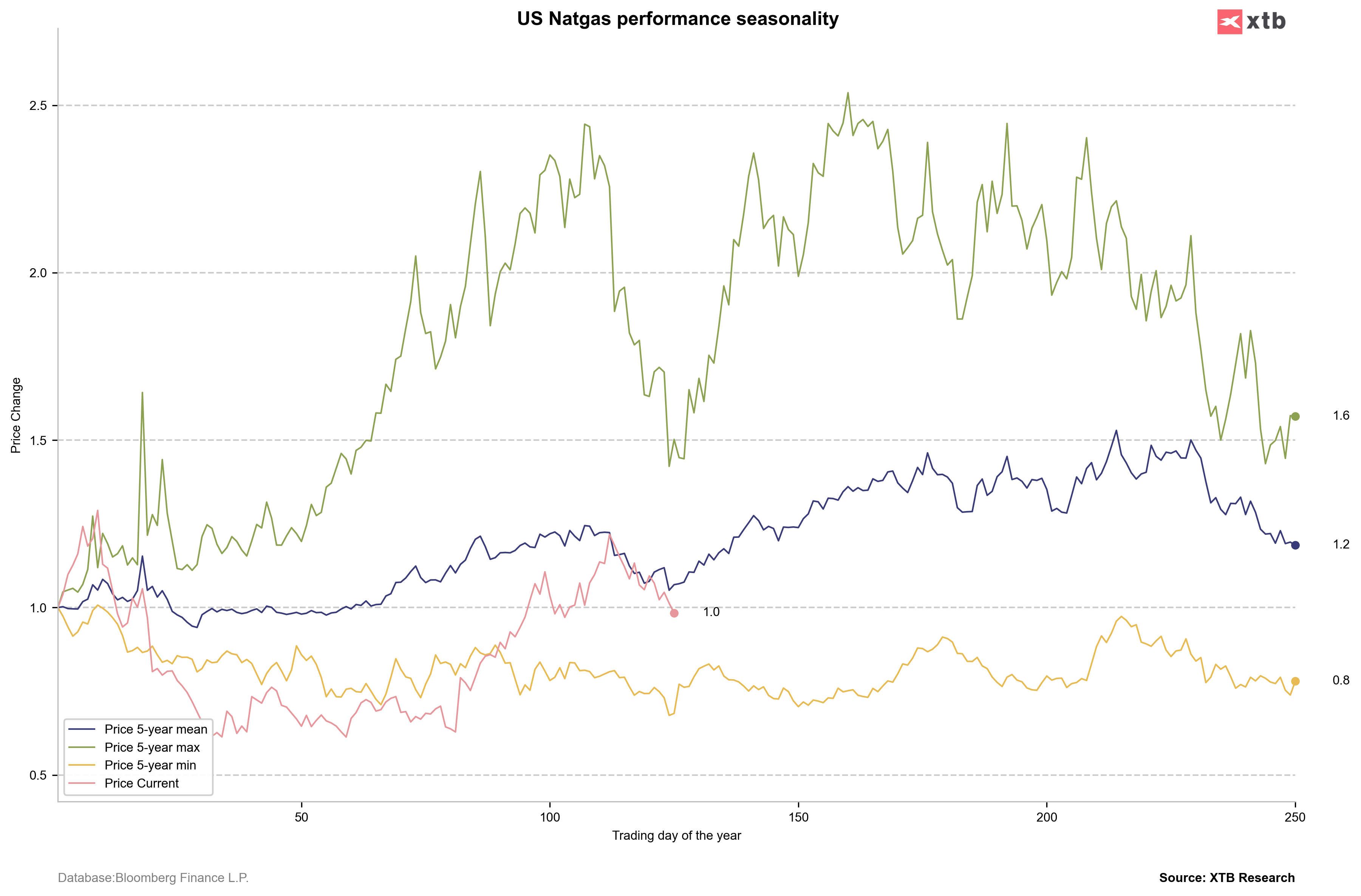

Seasonal Low:

Based on historical prices over the past five years (average, minimum, and maximum), we might be past the seasonal low point. But it's important to consider that some of the average price increases are due to the upward sloping price curve for future contracts (contango). Source: Bloomberg Finance LP, XTB

Production Rebound:

Natural gas production is bouncing back, currently about 4 bcfd below its record highs. This is happening even though the number of drilling rigs has significantly declined. (Source: Bloomberg Finance LP, XTB)

Technical outlook:

The price has decreased more than 4% in the beginning of July and is testing crucial support of 2.5 USD/MMBTU, slightly above 200-SMA average (purple line). If the price does not recover from the current area, it will be possible to go down even to the zone at the level of USD 2.2-2.3/MMBTU. On the other hand, the seasonality shows that the local low should be already behing us. Source: xStation5

The price has decreased more than 4% in the beginning of July and is testing crucial support of 2.5 USD/MMBTU, slightly above 200-SMA average (purple line). If the price does not recover from the current area, it will be possible to go down even to the zone at the level of USD 2.2-2.3/MMBTU. On the other hand, the seasonality shows that the local low should be already behing us. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.