Good morning. Yesterday's session on Wall Street ended in a relatively positive mood, with the major stock market benchmarks finishing higher. Nevertheless, yesterday's session was very volatile and much of the gains were erased. Volatility in the US put pressure on Asian markets, which are recording losses.

On the calendar today, first and foremost: PMI data for services and manufacturing in Europe, the US and the UK; retail sales in Canada and durable goods orders in the US.

Start investing today or test a free demo

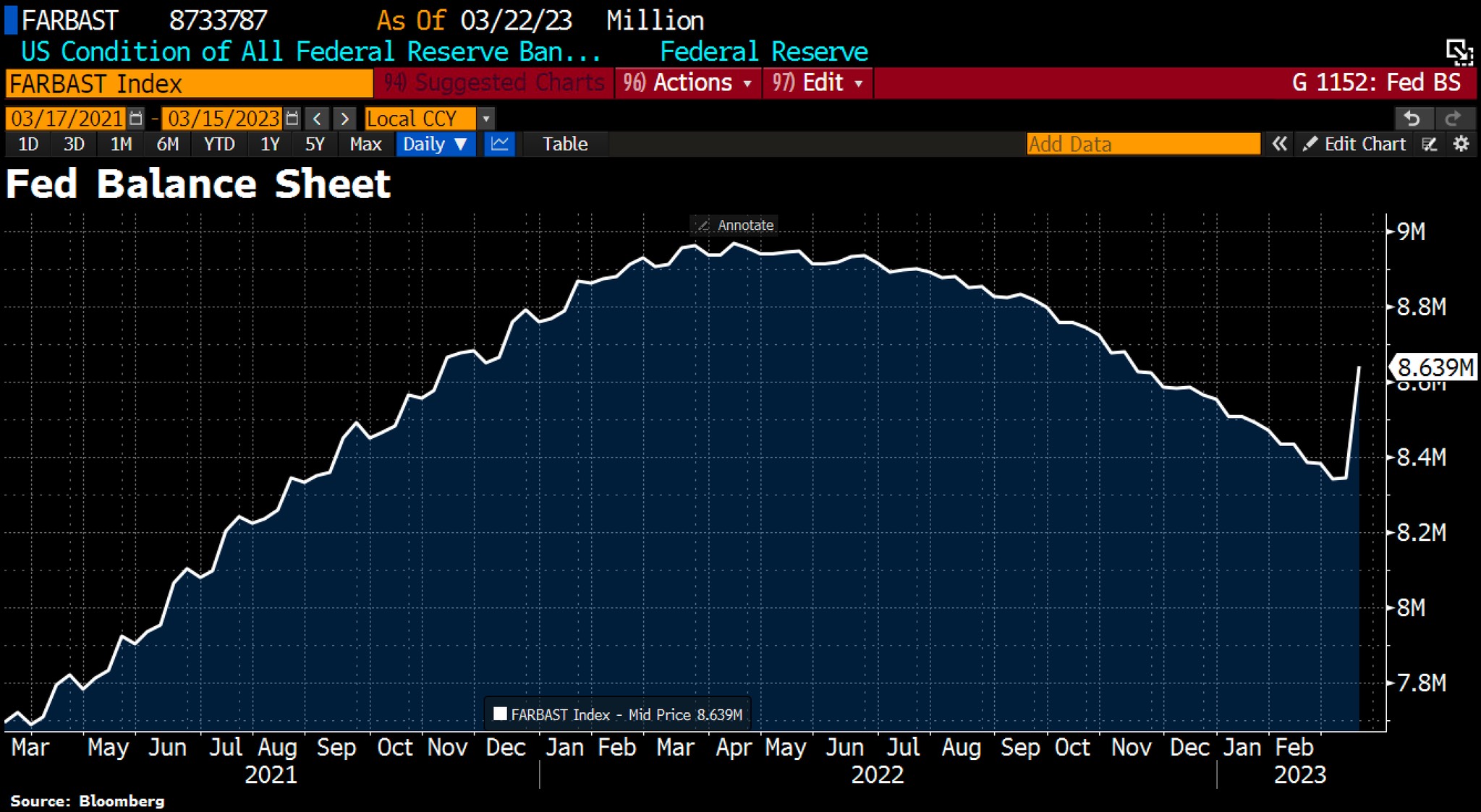

Create account Try a demo Download mobile app Download mobile appInvestor attention is focused on the Fed's balance sheet, which continues to grow. Total assets increased by $94.5 billion to $8.734 trillion. Borrowing under the discount window fell to $110.2 billion from $152.8 billion, and funds against the new 'Bank Term Funding Program' jumped to $53.7 billion from $11.9 billion. Lending to banks under the FDIC jumped to $179.8 billion from $142.8 billion. At the same time, it is worth noting that the Fed has started to do repo with foreign banks. Short-term positive data for the market due to more excess liquidity in the sector.

Klaas Knot of the ECB Governing Council commented that it would be appropriate to raise interest rates at the May meeting

The US Department of Justice (DOJ) has launched an audit investigation into UBS and Credit Suisse. The regulator will investigate whether the Banks assisted Russian oligarchs in evading imposed sanctions.

The USDJPY pair continues its downward wave and has broken out to new six-week lows.

The Japanese yen is the best performing G10 currency in the FX market. The New Zealand dollar is the worst performer at the moment.

Economic data from Japan pleased investors. The CPI inflation reading for February showed a decline in inflationary pressures to 3.3% y/y against an earlier reading of 4.3% y/y. The underlying reading, on the other hand, came in line with expectations at 3.1% y/y. The January reading was 4.2% y/y.

Crude oil extended declines due to concerns about potential oversupply.

US Secretary of Energy, Ms Jennifer Granholm commented yesterday that it could take many years to replenish the Strategic Petroleum Reserve (SPR). Granholm told a House of Representatives hearing that the government wants to buy back oil at a price below $72 per barrel. On the other hand, Russia's Deputy Prime Minister Alexander Novak confirmed a smaller cut in oil production than previously indicated. Oil production is expected to reach 9.7 million barrels per day (previously it was 9.4 million barrels per day).

Precious metals are losing slightly ahead of the opening of the European session. Gold continues to remain close to the psychological barrier of 2 000 USD. Bitcoin, which is currently being considered by global capital as a safe haven, is behaving similarly. The major cryptocurrency remains above support at 28 000 USD.

Overall liquidity has increased by 366 billion USD in the last 2 weeks (a week ago it was 440 billion USD). However, this is short-term liquidity that will be reduced over time by the Fed. Source: Bloomberg

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.