Shares of Mark Zuckerberg's company, Meta Platforms (META.US), are gaining slightly today ahead of the fourth quarter results the company will report after the US trading session. Investors will pay attention to how the company's massive investment in artificial intelligence has affected its profitability from advertising. The market is also likely to be listening to whether 'concerns' about DeepSeek's effectiveness will cause the company to cast doubt on its recently announced massive AI CAPEX of $65 billion. The company's stock is up nearly 45% in 2024 and nearly 650% from its 2022 lows. As a result, any 'stumble' in the report could trigger profit-taking.

Wall Street expectations

-

Revenue between $45-48 billion, up 17% year-over-year.

- Earnings per share (EPS) of $6.75, a 27% increase over Q4 2023.

These results will be analyzed in the context of Meta's plans for capital expenditures (capex) in the range of $60-65 billion in 2025, most of which will be spent on AI infrastructure development. At the same time, the market will pay attention to potential competition from DeepSeek. Digital advertising will continue to be the dominant source of revenue, accounting for 98% of total sales. The question is how much it will be accelerated by new AI tools and higher ad prices.

In the last quarter, the number of Meta ad impressions increased by 7% y/y and the average price by 11% y/y. A continuation of this momentum, with still impressive growth in the number of active app users (Facebook, WhatsApp, Instagram; 5% y/y growth in Q3 to 3.29 billion users) could translate into improved sentiment around the company's stock.

CAPEX on AI and EU legal suits

-

A potential CAPEX warning for 2025 could involve a drop in sentiment around a number of AI-related companies such as Nvidia (NVDA.US), and Arista Networks (ANET.US). On the other hand, if the company leaves CAPEX unchanged, the market may take this as 'good coin' and consider the reaction to DeepSeek as completely unjustified and not a 'game changer' in the technology market.

- Ultimately, the company may also benefit from Donald Trump, who indicated in Davos that the penalties the European Union intends to impose on US BigTech, including Meta, will be met with criticism from the US administration. Investors can expect communication in this regard as well, although it is highly uncertain that Meta will make any declarations in this regard.

-

Investors expect Meta to guide for 2025 CAPEX of about $52 billion, a 31% increase from the possible $39 billion in 2024. The consensus 2025 CAPEX estimates from analysts have increased 9% since Q3 2024 earnings release in October 2024 and 42% from a year ago. Any surprise regarding 2025 capex guidance may impact shares, but the reason behind the guidance will be very important.

-

For example, lower AI infrastructure spending may even boost the company earnings, if AI will contribute to profitability positively. On the other hand, weaker net results and falling CAPEX may signal that the company is set to analyse its AI strategy again.

Meta Platforms (META.US)

Meta Platforms' stock has been on a powerful upswing spurred by earnings expansion, reduced operating costs and an additional catalyst in the form of artificial intelligence, the positive impact of which on the advertising market is 'quickly apparent' business-wise (better personalization of content and efficient analysis of user data). The options market, as probable indicates about 7% price change after today's financial results. Based on this assumption, a test of both $620 and $715 is realistic.

Source: xStation5

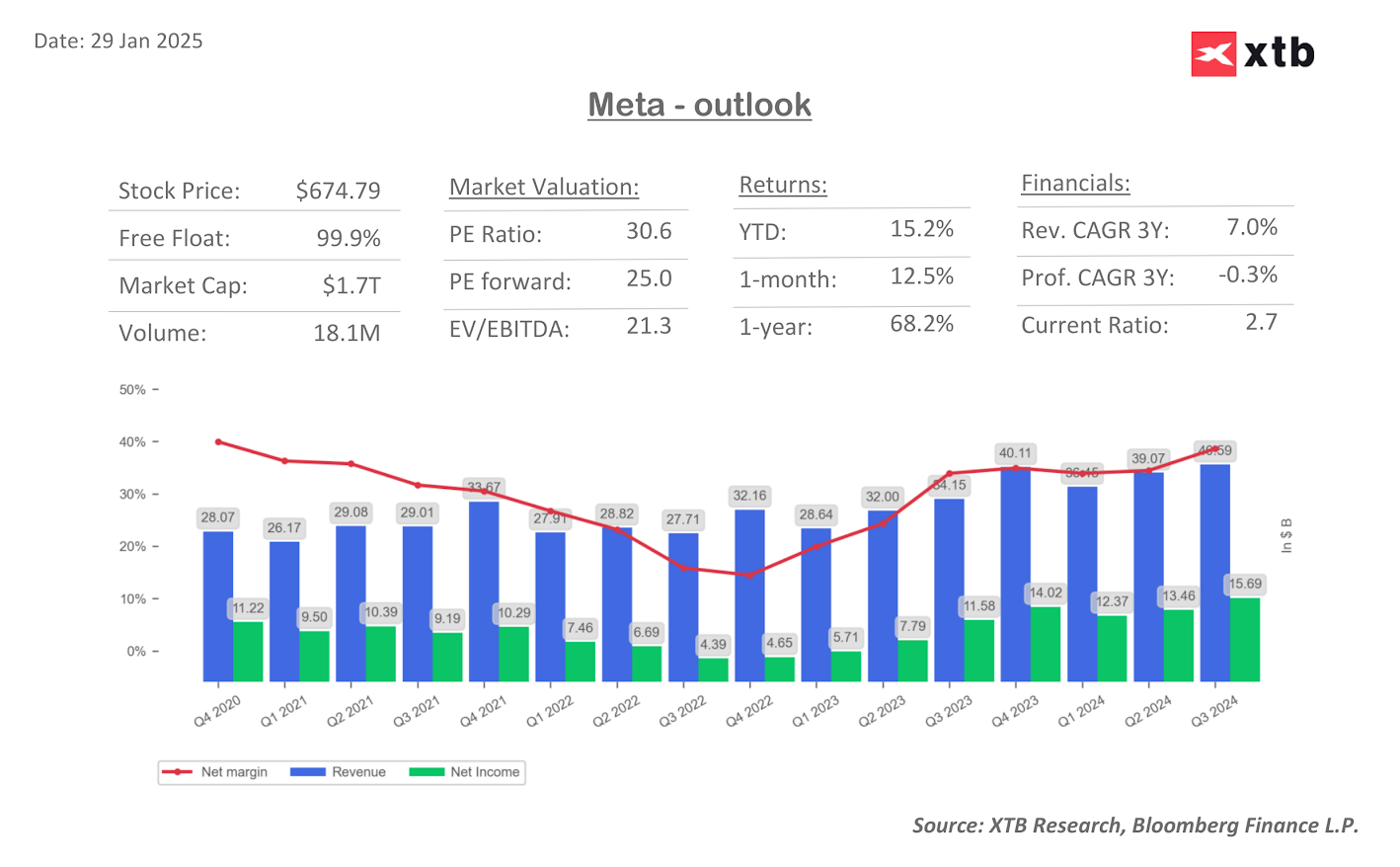

Meta Platforms' multiple valuation is roughly in line with the average of companies in the Nasdaq 100 index, and the forward P/E is clearly below the current P/E (price/earnings) ratio. Investors expect strong profitability growth from the company and will analyze today's results from this perspective.

Source: XTB Research, Bloomberg Finance L.P.

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.