No chances for a cut today, but markets fully price in a move in September

Money markets only price in an around-3% probability of a rate cut by the Fed at today's meeting. None of the 110 economists surveyed by Bloomberg sees a chance for a cut today, although there was speculation that the Fed could surprise, given the unfavorable base effects to inflation starting from September this year. However, it is worth emphasizing that the Fed uses fairly clear communication, so the desire to surprise by the Fed is rather unlikely. On the other hand, the market fully prices in a cut in September. This became certain for the market after the last CPI inflation reading, which showed a deceleration to 3.0% YoY. Confidence regarding inflation should also be bolstered by PCE inflation. Although we will still get many macroeconomic readings before September, including key ones on inflation and the labor market, they are not expected to be very surprising.

The market fully indicates a rate cut in September. Source: Bloomberg Finance LP, XTB

What will Powell say?

Statement itself should not contain any surprises, therefore it will be Powell's press conference that will drive market's reaction. However, if the statement mentions that a cut may be warranted in upcoming meetings, one may expect a significant dovish reaction. Nevertheless, this is not the base scenario, so the market will rather look for any signals from Powell. He is also unlikely to say much, due to the vast amount of data that increases uncertainty (although fundamental factors suggest that a rebound in inflation by September is unlikely) and the symposium in Jackson Hole in the second half of August, which will be a better time to communicate such a move. Powell will most likely acknowledge that recent data provides more certainty, but more data is needed. Indicating that if future data aligns with assumptions, cuts may be warranted could be interpreted by the market as a gateway to a September cut. This should also be treated by markets as dovish.

Will the cuts come too late?

It is worth noting that almost every cycle of rate cuts heralded a recession or started at the onset of one. The Fed has been waiting with cuts for a long time but wants to be sure not to repeat the situation of the '70s and '80s, when inflation rebounded strongly after initial successes. However, the labor market has already cooled noticeably, some data signals a slowdown in the economy, and consumers are postponing purchases, saving more of their funds.

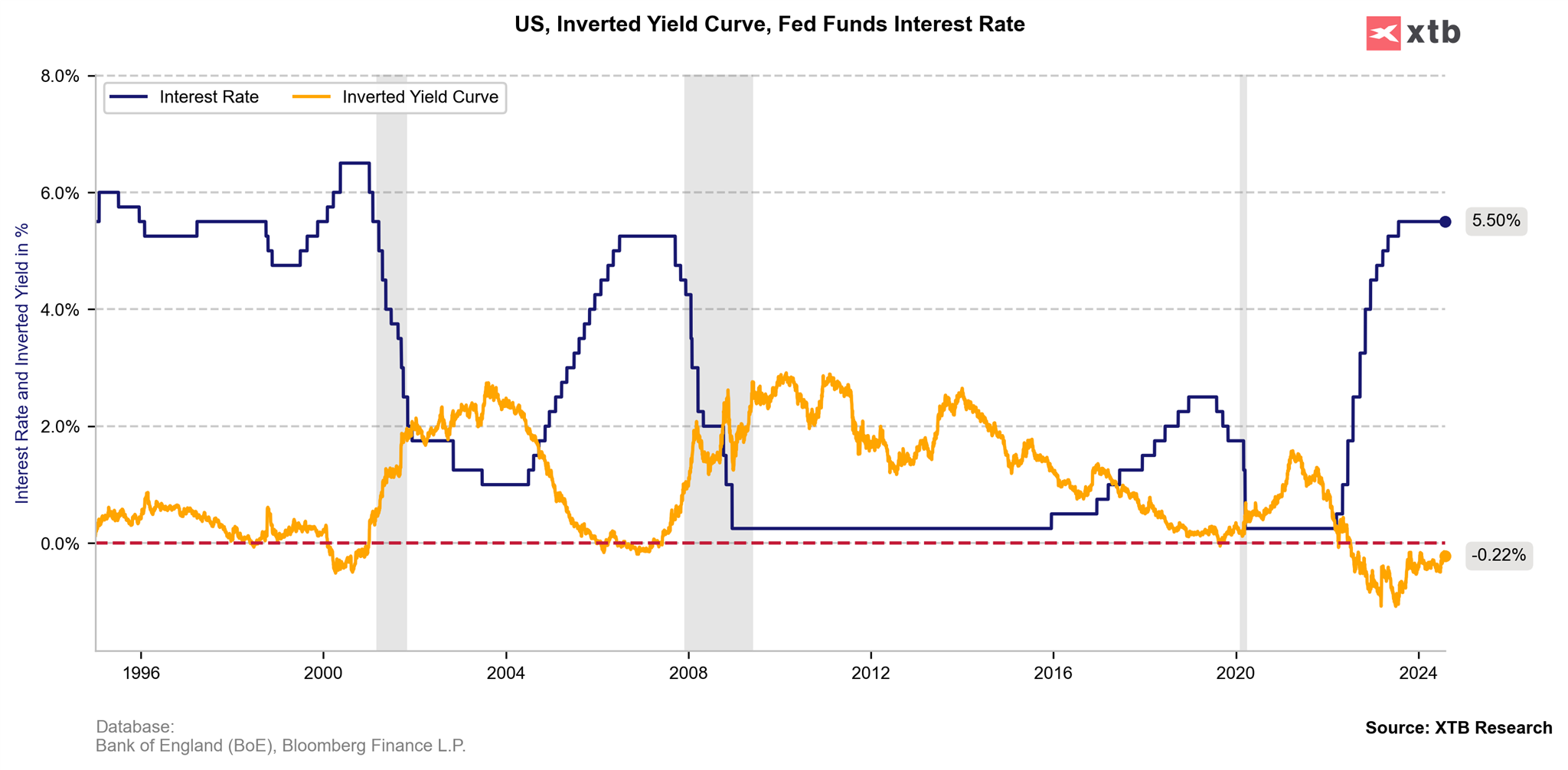

We are currently observing a return of the yield curve to its normal shape. Of course, it is still inverted (10-year yields are lower than 2-year yields), but it is very close to normalizing. It usually returned to normal during cuts, which also typically marked the beginning of a recession.

Fed rates and the yield curve (difference between 10-year and 2-year yields). Source: Bloomberg Finance LP, XTB

How will the market react?

We are observing a small rebound on EURUSD, which is related to improvement in overall market sentiment. USDJPY is dropping, following a decision to hike rates by the Bank of Japan. Significant moves since the end of last week have been observed in gold. Gold returns above 2400 USD today, after testing the 50-period average last week. Although yields remain very high, TNOTE (bond prices) rises to the highest level since March, giving a chance for continuation of gold price rebound. If the Fed strongly communicates a cut, we should see continued upward pressure on gold prices until September, possibly reaching new historic highs. If the current meeting does not bring any changes in communication compared to June, the market may have doubts, retest 2350 USD per ounce, and wait for the Jackson Hole economic symposium.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.