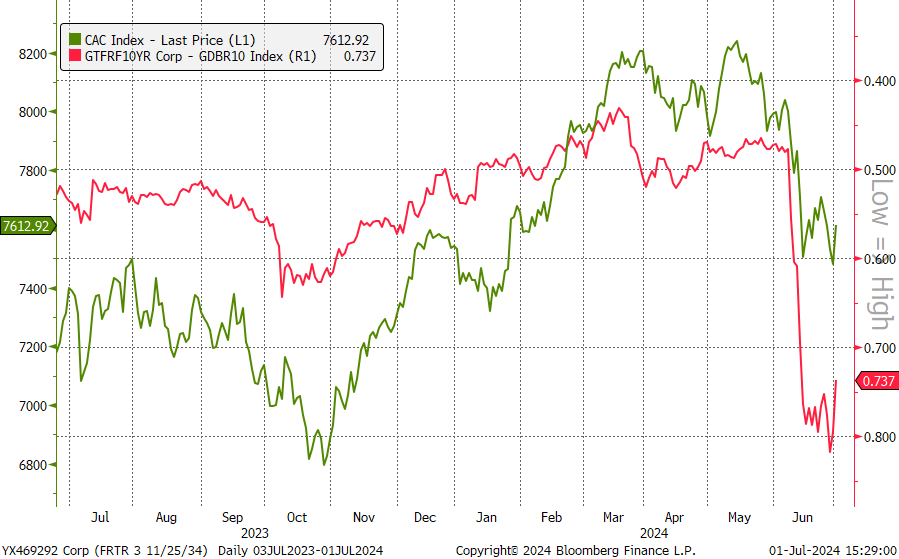

The first round of accelerated elections in France is behind us. As many people expected, it led to a reduction in investor concerns about France's future, resulting in a rebound in the euro, a decrease in the spread between French and German bond yields, and ultimately a recovery in the French stock index CAC 40 (FRA40).

The elections, as expected, were won by the National Rally led by Marine Le Pen, which received just over 33% of the vote with a turnout of almost 67%. The "center" of current President Emmanuel Macron garnered 21% of the vote, slightly better than expected. Although the far-right is likely to take control of the government for the first time in recent years, it will not be a majority government. It is expected that some parties may decide to field a single candidate against National Rally candidates in some districts, which could lead to an even greater decline in support for Marine Le Pen's party.

Previously, the market was greatly concerned about the takeover by the anti-European and populist party. However, it seems that the National Rally will not be able to govern alone, which may mean a lack of radical policy changes. It also appears that the potential takeover by far-left parties is unlikely, as the New Popular Union received exactly 29%, which was in line with expectations.

In response, we observed a noticeable decrease in the yield spread between French and German bonds. However, it's worth noting that overall yields rebounded during today's session. Source: Bloomberg Finance LP, XTB.

The FRA40 is bouncing back today but is largely reducing its gains and nearly closing the entire gap formed at the opening. Earlier, the contract tested recent local peaks at the 7735-point level, which also serves as the neckline of a potential double bottom formation. The range of this formation indicates a target around 8000 points, very close to where the contract was before the accelerated elections were called (8045 points). More importantly, the lower limit of the previous major correction range is maintained at 7415 points. A potential factor supporting the continuation of the FRA40 rebound will be the formation of an inverse head and shoulders pattern on the EURUSD, although the neckline is only around the 1.085-1.090 level. Only a break above these levels could confirm the pattern.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.