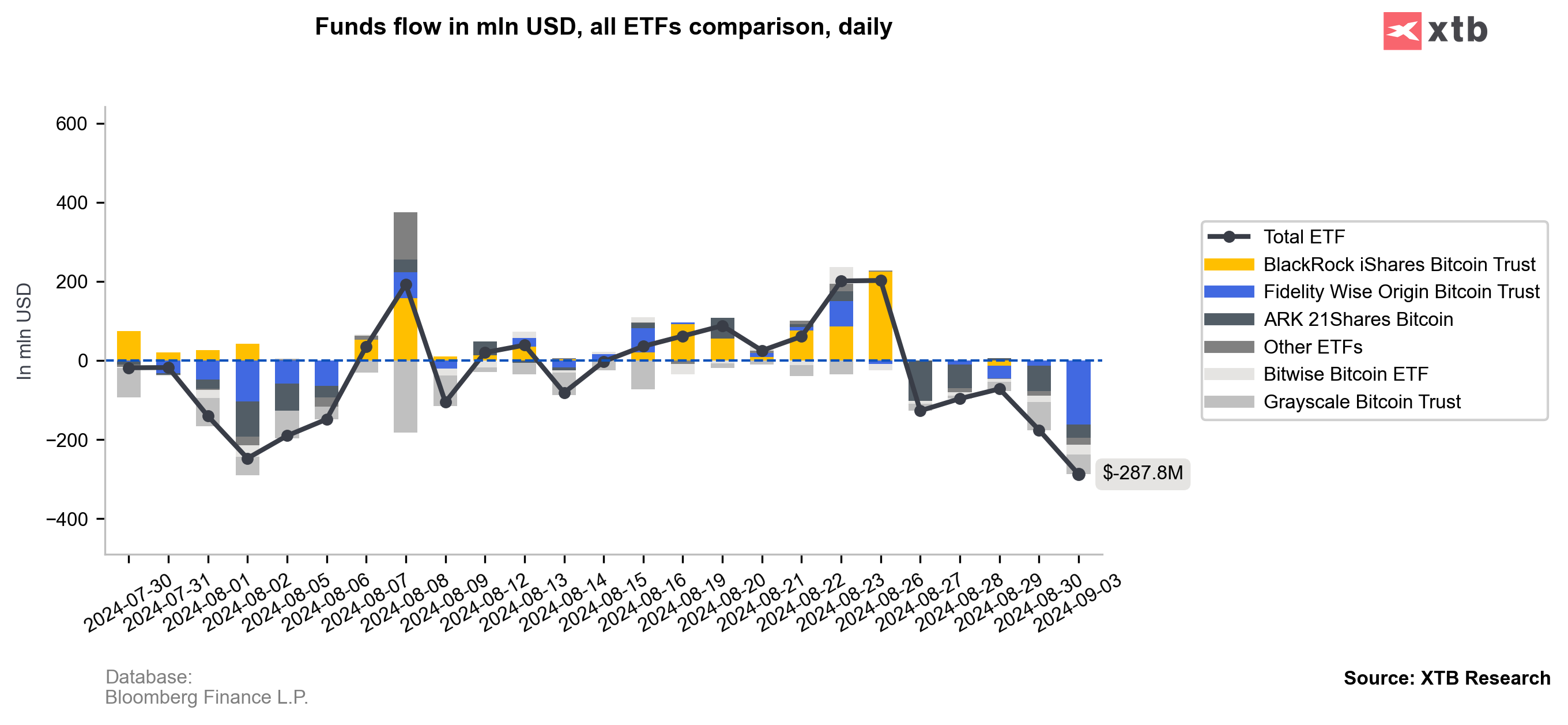

Ethereum is down nearly 3% amid risk aversion and stock market uncertainty, where sentiment is putting pressure on all risky assets. Net outflows from Bitcoin ETFs amounted to approximately -$287 million yesterday; the highest since early August.

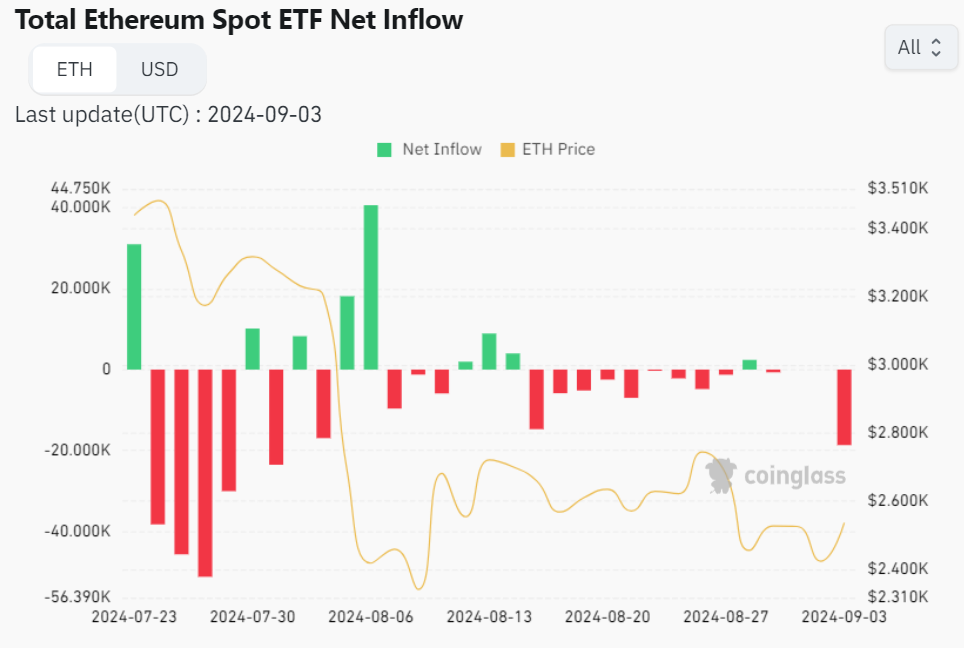

- Yesterday, Ethereum ETFs recorded net outflows, selling nearly 18,000 ETH. We also observe weaker sentiment in the Bitcoin market, which has fallen below $57,000, alongside a weakening dollar and a drop in the yield on 10-year U.S. Treasury bonds to around 3.8%, following weaker-than-expected U.S. ISM manufacturing data for August. Bitfinex analysts expect that the first Fed rate cut in September could trigger a sell-off of Bitcoin by as much as 20%, down to $45,000-$40,000.

- The team believes that such a scenario would suggest a likely 'bottom' for Bitcoin in the still ongoing post-halving 'bull market'. BTC mining difficulty increased by 9% month-on-month in August, potentially putting broader pressure on BTC miners, some of whom are forced to sell reserves. In August, Bitcoin miners' stocks listed on U.S. exchanges lost an average of about -15%. Only three companies' stocks among them performed better than Bitcoin itself during this time. Mining difficulty has increased by 4% since the spring halving.

ETFs have been selling Bitcoins over the last 5 sessions. Source: Bloomberg Finance L.P.

Net outflows for Ethereum have been observed almost continuously since mid-August. Source: CoinGlass

Ethereum (D1 interval)

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.