Stock market session has been rather calm so far and things look similar on the FX market... at least when it comes to major currencies. USD is among the weakest G10 currencies and EM currencies greatly benefit. The Fed remained dovish, declining US yields make the US dollar less attractive compared to EM currencies. Turkish lira and South African rand are among top performers. TRY trades 1.1% higher against USD while ZAR gains 1.3% against greenback. Hungarian forint (HUF) gained 0.8%. There are also some country-specific reasons behind the outperformers. Hungarian central bank has launched a rate hike cycle, benefiting the currency. Lira got a lift after data today showed that Turkish manufacturing PMI reached a 6-month high at 54 pts in July. ZAR is recovering from a recent drop caused by uncertainty over social unrest. South African rand is also supported by pick-up in gold price. However, the major factor benefiting those currencies is the weakness of the US dollar.

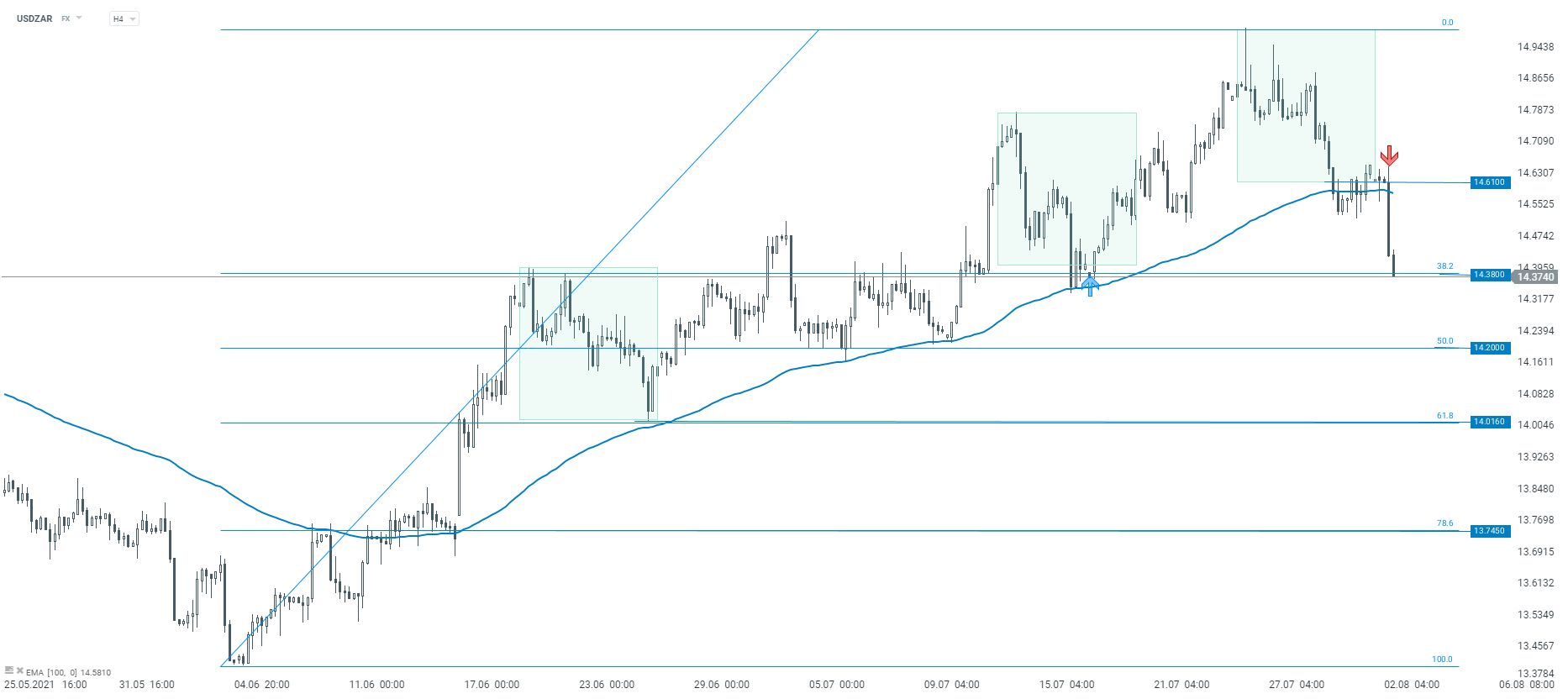

USDZAR is dropping following a recent upward move, triggered by social unrest in South Africa. The pair dropped below the lower limit of the Overbalance structure as well as the 100-period EMA (H4 interval) that acted as a support before. The pair is currently testing support marked with 38.2% retracement of the recent upward move. Source: xStation5

USDZAR is dropping following a recent upward move, triggered by social unrest in South Africa. The pair dropped below the lower limit of the Overbalance structure as well as the 100-period EMA (H4 interval) that acted as a support before. The pair is currently testing support marked with 38.2% retracement of the recent upward move. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.