- European indices finished today's session mostly higher, with the benchmark Stoxx 600 adding 0.1% and the German DAX rising nearly 0.5%, thanks to solid performance of stocks from tech and oil sectors.

-

FTSE 100 extended losses for a third consecutive session, dragged by healthcare and materials stocks.

-

Ahead of the first anniversary of the Russian invasion of Ukraine, NATO Chief Stoltenberg said that the alliance has observed indications that China is perhaps considering sending weapons to Russia. Meanwhile Germany’s Chancellor Scholz informed Chinese representatives that sending weapons to Russia is not acceptable.

-

Wall Street indices launched today's session higher, supported by upbeat earnings from Nvidia and Alibaba. However moods soured later in the session after as investors digested a slew of economic data.

-

US Q4 GDP was downwardly revised, while the core PCE price index, the Fed's preferred inflation measure, was adjusted to show a softer slowdown. Meanwhile weekly jobless claims fell unexpectedly, adding to concerns that the labor market remains tight.

-

Yesterday's FOMC minutes were considered as moderately hawkish. Fed members were in favor of further monetary policy tightening and some policymakers voted for a 50 bp hike, which may indicate that the number of hawks may increase ahead of the next FED meeting.

-

JPMorganChase CEO Jamie Dimon said that US economy is doing quite well and although we slightly lost control over inflation, soft landing is still possible

-

Macroeconomic concerns pushed FX traders towards the US dollar and the Japanese yen, while the British pound, Aussie and the Swiss franc lag the most. EURUSD is currently testing support at 1.0580, a level not seen since early January 2023.

-

Precious metals continue to move lower amid a stronger dollar. Gold breaks below major support at $1820, while silver is moving towards recent lows at $21.15.

-

Energy commodities are trading higher. Nagas moved further away from recent lows at $2.0 after US utilities pulled 71 bcf (billion cubic feet) of gas from storage during the week ended February 17, 2023, slightly more than market expectations of a 67 bcf drop.

-

Oil prices jumped nearly 2.0% despite the latest EIA report showed that US inventories rose by 7.648 million barrels to 850.6 million in the week ending February 17th, the highest level since September.

-

Bitcoin weakens again and sinks below $24,000. At the same time Tezos, which yesterday announced a partnership with Google Cloud, struggles to uphold recent bullish momentum. Other projects are also facing downward pressure.

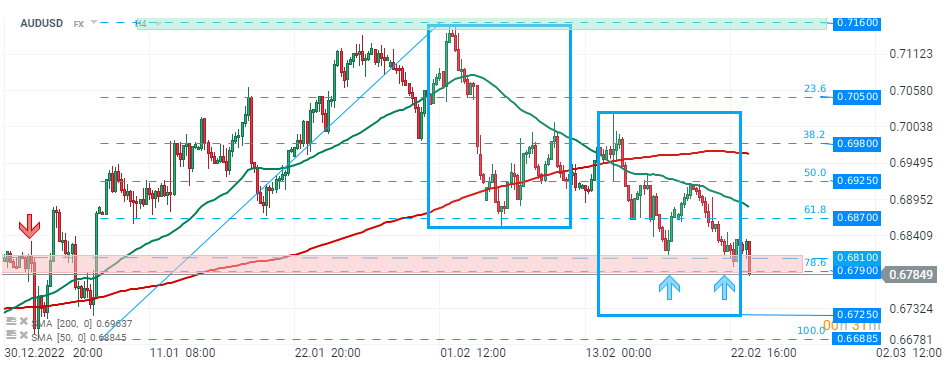

AUDUSD - Australian dollar is one of the worst performing G10 currencies today. Pair broke below the crucial support zone around 0.6800, which potentially opens the way towards the lower limit of the 1:1 structure at 0.6725. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.