Two cryptocurrencies, LITECOIN and BITCOINCASH have been gaining vigorously recently and continued their gains today as Bitcoin tries to climb above $31,000. Bitcoincash has risen with gains of nearly 100% over the past week and with Litecoin they are are practically the two oldest cryptocurrencies, which the SEC did not list in its filing in which it indicated which cryptocurrencies it considers 'securities'.

- Both Litecoin and Bitcoincash are built on Bitcoin's source code, and during the recent bull rallies have been unable to match the scale of growth of new projects, including Ethereum (which the SEC is also hesitant to designate as a commodity).

- Institutional exchange EDX Markets, backed by Citadel, Virtu Financials and Charles Schwab, has made cryptocurrency trading available on its platform - only 'old school' cryptocurrencies like Bitcoin, Ethereum, Litecoin and Bitcoincash are listed there.

- EDX CEO Jamil Nazarali conveyed that he is extremely comfortable with the fact that none of these four cryptocurrencies have been recognized as 'securities' by the SEC. The relatively low liquidity and depth of the market, as well as the lack of regulatory uncertainty around the projects, has helped the bulls

- According to DeCrypt data, the rally in Litecoin's spot price since June 15 has been supported mainly by retail investors as the value of trades in the $10 to $10,000 USD range has far exceeded the volume of larger trades in recent times.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appLITCOIN is climbing to record levels since April 2022, the price has overcome the 23.6 Fibonacci retracement of upward wave from June 2022, and if the dynamic rally continues - the key for the bulls will be a decisive break of resistance at $100, which could open the way to new yearly peaks. Source: xStation5

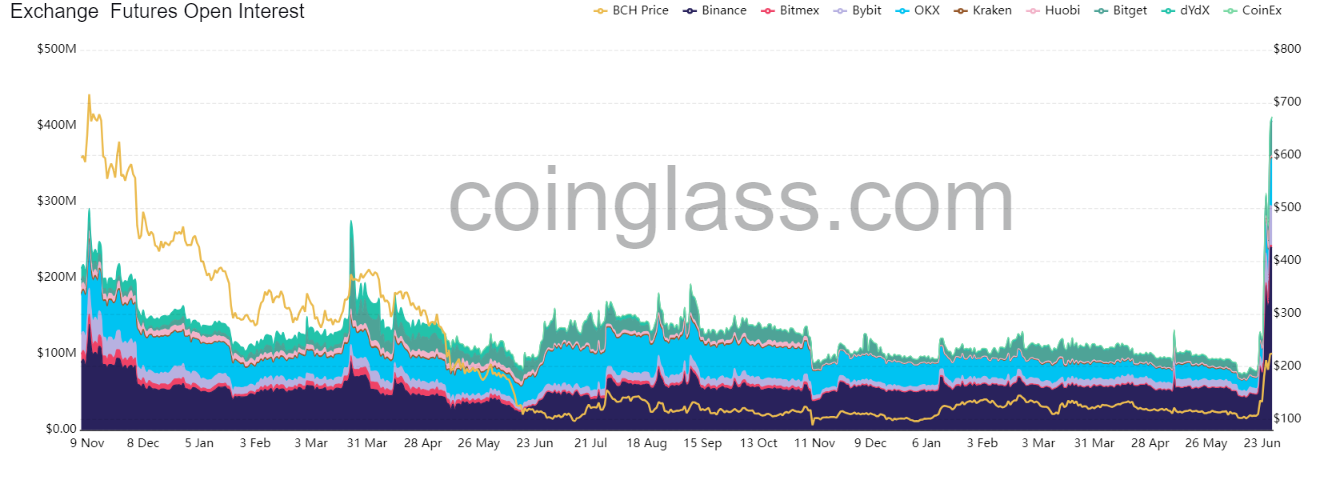

Following the opening of trading on EDX Markets, interest in Bitcoincash futures trading has increased to levels from the 2021 bull market. Source: Coinglass

Following the opening of trading on EDX Markets, interest in Bitcoincash futures trading has increased to levels from the 2021 bull market. Source: Coinglass

The price of BITCOINCASH is fighting a key resistance zone - the SMA200 on the W1 interval (red line). Overcoming it could mean a more permanent change in the downward trend. Source: xStation

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.