Today's cash session in the USA is moderately bullish, extending dynamic gains in European markets in the first part of the day. However, there is one sector that stands out in the market, semiconductors. Companies from this sector are recording several percentage points of declines, along with Nvidia, which is down 4.9% to $120 per share.

The situation is exceptional given that so far, only about 36 out of 120 trading sessions have seen Nvidia's shares diverge from the US500 index. Most of these instances were bullish sessions for Nvidia. Nvidia's shares also accounted for about 30% of total returns this year, exerting a significant impact on the benchmark. Therefore, a lasting reversal of the bullish trend in the semiconductor sector could potentially negatively impact the mood in the broader stock market.

Nvidia (NVDA.US) is the worst-performing stock within the US100. Right behind Nvidia are other companies from the AI and semiconductor sectors like Broadcom (AVGO.US) and Qualcomm (QCOM.US).

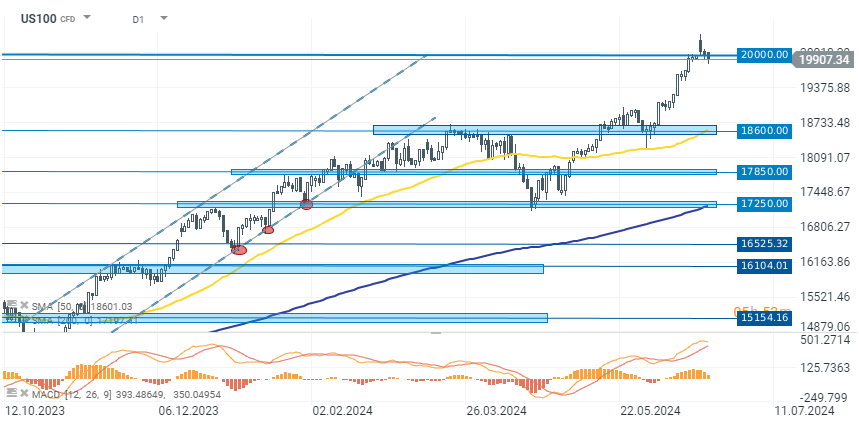

US100 (D1)

The technology companies index (US100) is down today by 0.35%, with declines largely caused by the semiconductor sector. Recent dynamic gains stopped after encountering a key resistance zone at the 20,000-point level and since then, the index has been consolidating below.

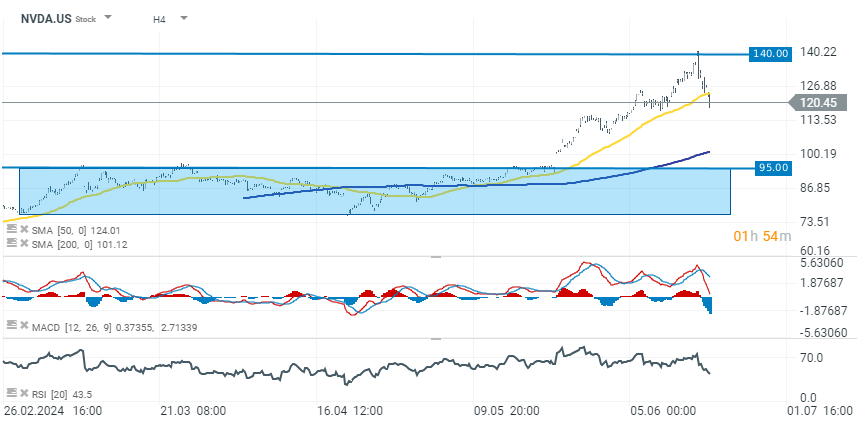

Nvidia (H4)

Until recently, Nvidia was a catalyst for growth in technology companies. However, for the past few sessions, we have observed a deeper correction, which at the time of publication reaches over 15% from the peaks at the level of $140 per share. The company is experiencing the largest correction since the consolidation period before the publication of quarterly results, which were directly a catalyst for the next wave of growth above $1,000 per share (before the 1:10 split). If the declines are not halted at the current support levels, the next nearest support for the current downward movement may turn out to be the $108-112 per share zone, and then the $95 per share level. It is also important to remember that the current correction seems to be caused solely by investors' profit taking strategy. From a fundamental standpoint, the company still offers a promising growth prospects in the coming quarters.

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

STM is growing stronger thanks to a new partnership with AWS!

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.