Coinbase (COIN.US) is gaining over 9.0% following a remarkable fourth-quarter performance that surpassed Wall Street's expectations. The cryptocurrency broker reported earnings of $1.04 per share on a revenue of $954 million, notably exceeding analysts' forecasts of 2 cents per share on revenue of $826 million. This positive earnings report led to an increase in Coinbase stock, even though the stock is down almost 5% this year. However, it has more than doubled in the past six months, outpacing gains in Bitcoin and other digital assets.

Company earnings and management commentary

Coinbase's rebound in the digital-asset market significantly boosted its trading revenue, leading to a 51% jump in revenue to $953.8 million, far above the expected $826 million. The net income stood at $273 million, a sharp contrast to the $557 million loss a year earlier. The company’s transaction revenue surged to $529 million, with consumer transaction revenue almost doubling and institutional transaction revenue more than doubling quarter-over-quarter. Coinbase attributed this profitability to strong market conditions and strategic initiatives, although the company urged caution in extrapolating these results for future performance.

Forecasts for the coming years

However, looking ahead, Coinbase is optimistic, with forecasts indicating continued momentum. The company anticipates first-quarter subscription and services revenue to be between $410 million and $480 million, significantly higher than the $367.3 million estimate. Analysts have adjusted their views on Coinbase, with upgrades and positive revisions in revenue estimates for 2024 and 2025. However, the challenges concerning competitive market and legal issues remain valid. The company expects sales and marketing expenses in the first quarter to be between $85 million and $100 million and projects a modest increase in headcount to support product growth, reflecting an overall positive outlook for the near future.

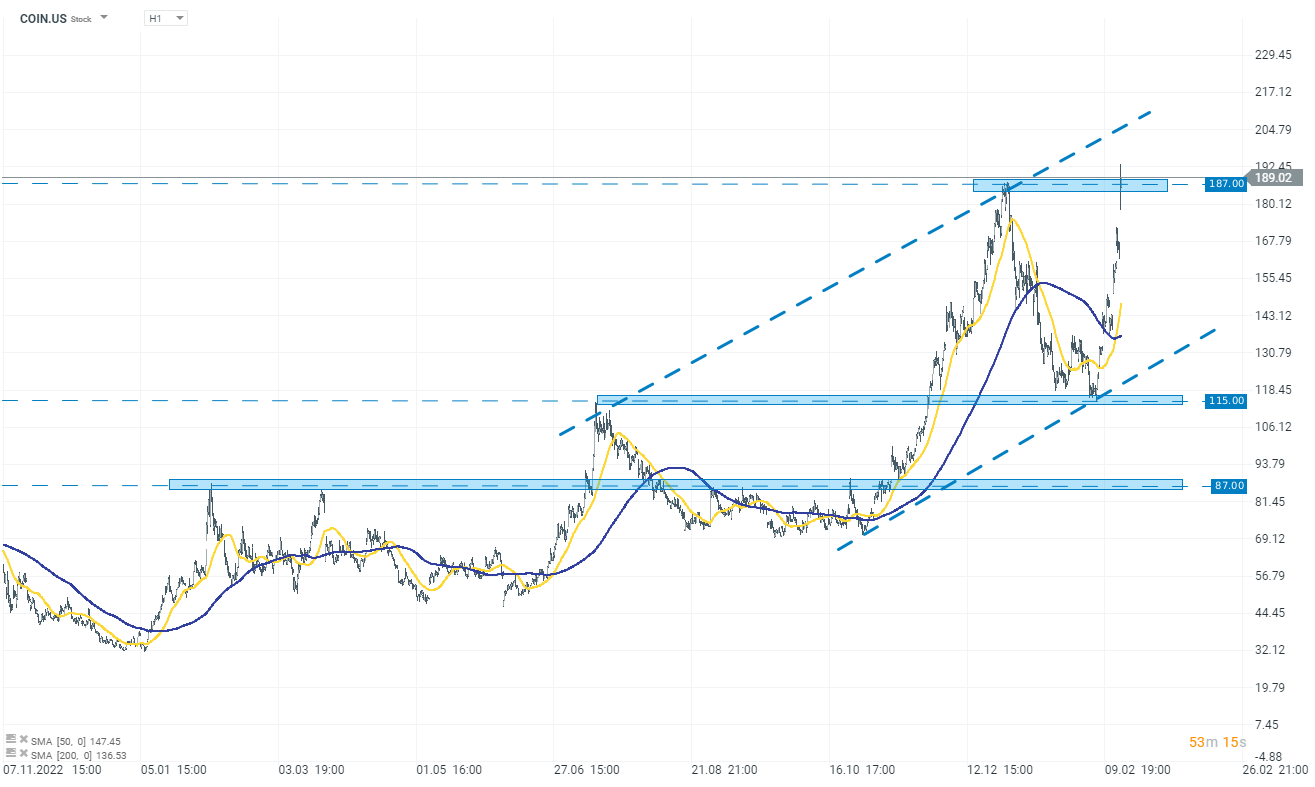

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.