Greater imports in Asia

Asia's oil imports rebounded in August after a July that saw the lowest imports in two years. China, the world's largest oil importer, increased imports by more than 1 million barrels per day compared to July, which could be an important factor from the perspective of building a further trend in the oil market.

The increase in imports can be partly attributed to seasonality, as importers increase purchases in the third quarter to build up fuel stocks for peak winter demand. However, lower oil prices also played a significant role.

In August, Asian countries imported about 26.74 million barrels of oil per day, an increase of 2.18 million barrels per day compared to July. China alone increased its oil imports in August to 11.02 million barrels per day, up from 9.97 million barrels per day in July. The recent drop in prices most likely favored Chinese purchases. Moreover, it's worth noting that China also imports a lot of oil from Russia and Iran, so the final figures may differ slightly from the official ones. Nevertheless, not bad import data from China coincided with weak PMI index data. PMI manufacturing fell to its lowest level since March for August.

OPEC+ intends to increase production

At the same time, it is worth noting that OPEC+ is still expected to restore production from its voluntary cut from October at 180,000 barrels per day per month, which is expected to be completed next year (for a total of 2.2 million barrels per day). The earlier cuts, in turn, are to be maintained until the end of 2025.

Libya resumes some production

Libya has only partially restored oil production at around 200,000 barrels per day for its own consumption. In view of this, the oil market appears to be under short-term pressure at the moment, but is vulnerable to the return of more supply in the medium term. Despite good news from Asia on demand, it is uncertain whether this is a one-time bounce or the start of a new trend.

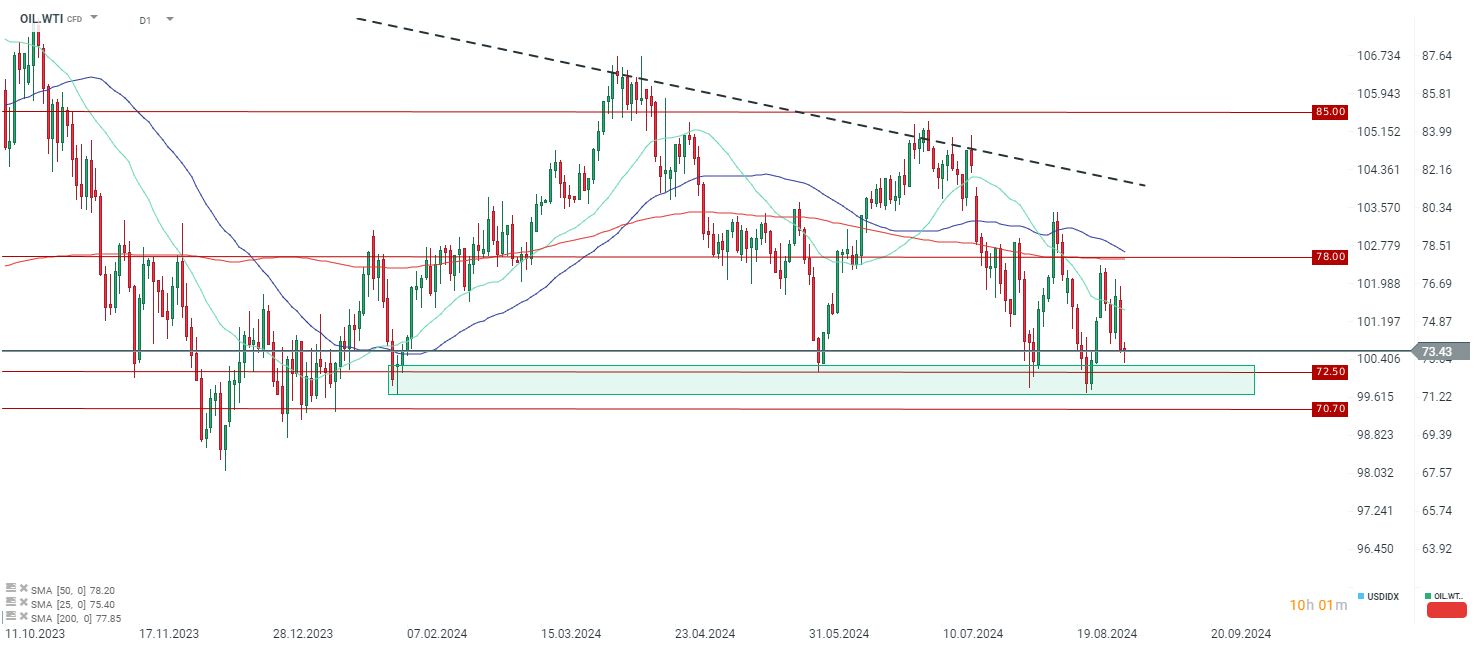

The price fell for the first part of the day today, but is now trying to rebound. However, it is worth remembering that today we will not have a US session, which means that volatility in the market may decrease. The oil futures market is only open today until 8:30 p.m. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.