The dollar-yen pair remains near critical levels as traders weigh policy divergence between the Fed and BOJ amid increasing intervention risks and Japan's record budget approval.

Key Market Statistics:

- Current Price: 157.55

- 2024 High: 158.08 (December)

- Weekly Change: +0.8%

- YTD Performance: +10%

- Key Level: 160 (Intervention risk zone)

- Post-BOJ Meeting Range: 153.34-158.08

BOJ Policy Dynamics

Recent BOJ meeting opinions reveal mixed views on rate hike timing, with some members seeing conditions aligning for a near-term move while others advocate patience given uncertainties around incoming President Trump's policies. The central bank's new earnings estimates show potential losses of up to $13 billion under a 2% rate scenario, highlighting the challenges of policy normalization.

Political and Fiscal Landscape

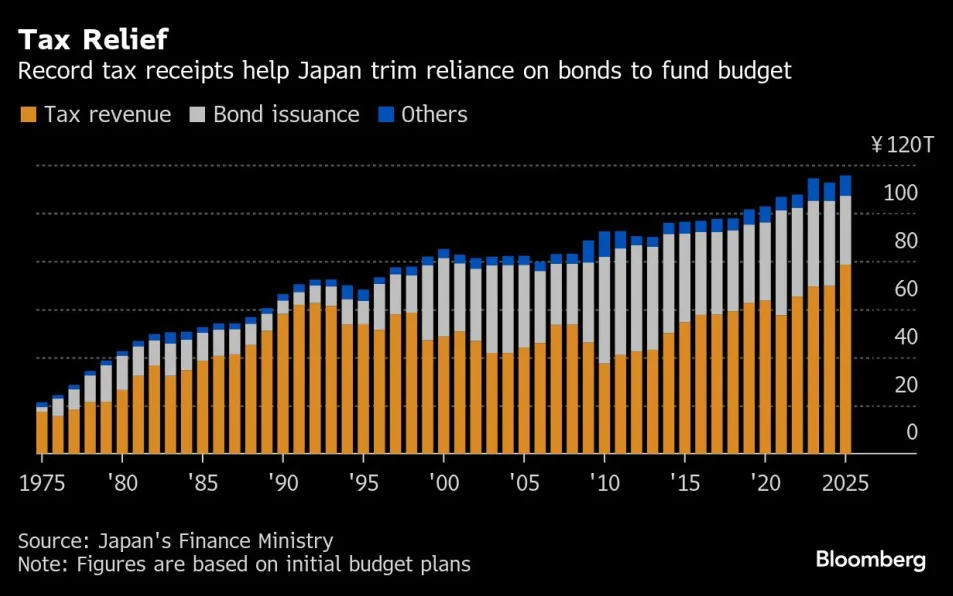

The approval of Japan's record ¥115.5 trillion budget for FY2025 marks a key test for PM Ishiba's minority government. The 2.6% spending increase, coupled with reduced bond issuance, signals fiscal consolidation efforts. However, political uncertainty around budget passage could influence BOJ's January rate decision.

Source: Bloomberg

Intervention Risk

Finance Minister Kato's renewed warnings against excessive currency moves have heightened intervention speculation as USD/JPY approaches 160. The recent climb to five-month highs has prompted increased official rhetoric, though actual intervention thresholds remain unclear.

2025 Outlook

While markets now price a 42% chance of January BOJ hike, rising to 72% by March, the trajectory remains highly dependent on wage trends and U.S. policy clarity. The interplay between monetary normalization, political stability, and currency market dynamics suggests continued volatility ahead, with 160 emerging as a key psychological and intervention risk level.

USDJPY (D1 Interval)

The USDJPY pair is approaching the late-April highs of 157-158, a level that previously prompted FX intervention. Following such intervention, USDJPY retraced to the 50-day EMA, suggesting that for bears, the target could be around 153.167.

Bulls, on the other hand, may aim for a retest of the all-time highs in the 160-161 zone. The RSI is consolidating near the overbought zone, which has historically signaled an additional leg up before a potential correction. Meanwhile, the MACD continues to gain but is narrowing, indicating that momentum may be diminishing. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.