The US Dollar Index faces a critical juncture ahead of Wednesday's CPI data, with market expectations tilted toward persistent inflation pressures potentially delaying anticipated Fed rate cuts. Core inflation remains stubbornly elevated, while political transition adds new layers of uncertainty to the dollar's trajectory.

Key Market Statistics:

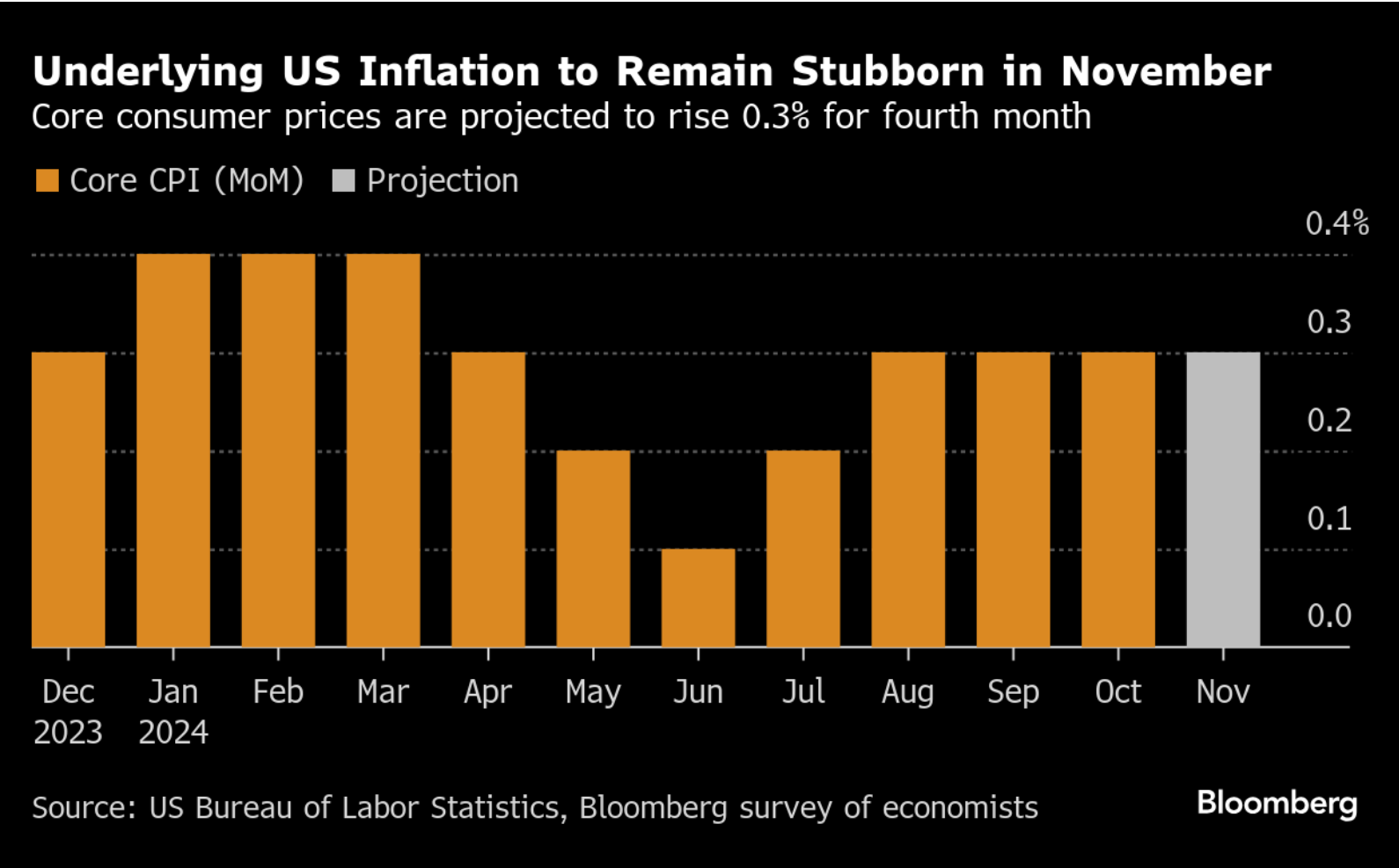

- Core CPI expected at 0.3% MoM for November, marking fourth consecutive month of firm readings

- Market-implied probability of December rate cut declining as inflation concerns mount

- Dollar finds technical support as Treasury yields maintain 4% floor across key tenors

The dollar's near-term direction hinges critically on Wednesday's inflation report, with forecasters anticipating another month of sticky price pressures. The core consumer price index, excluding food and energy, is projected to maintain its 0.3% monthly pace, suggesting the Federal Reserve's path to its 2% target remains challenging.

Core CPI forecast. Source: Bloomberg

Notable inflationary pressures persist across several sectors, with used car prices expected to rise 1.2% in November, following a 2.7% increase in the previous month. Housing costs continue to show limited signs of meaningful deceleration, with Owner's Equivalent Rent projected to increase between 0.3% and 0.4%, maintaining its above-pre-pandemic pace.

The technical picture shows increased caution among institutional investors, with recent flow data revealing significant duration reduction and selling of long-dated securities by mutual funds. This positioning adjustment, combined with year-end portfolio rebalancing, suggests heightened potential for market volatility.

Market Implied Rate Cuts. Source: Bloomberg

Looking ahead, market attention remains firmly focused on today's CPI release and its implications for Fed policy. While traders still largely anticipate rate cuts in the coming months, the persistence of elevated core inflation readings may prompt a more gradual approach to monetary policy easing than currently priced.

The political transition adds another layer of complexity to the dollar outlook, with proposed policies including potential tariffs and tax cuts potentially creating new inflationary pressures. Some businesses are already adjusting pricing strategies in anticipation of these policy shifts, potentially complicating the Fed's inflation-fighting efforts.

The market's overwhelmingly dovish positioning creates potential for significant dollar movement if inflation data surprises to the upside. Deutsche Bank economists note that while a December rate cut remains possible, the Fed's messaging is likely to emphasize a more gradual pace of easing going forward, particularly if inflation continues to show resistance to monetary tightening.

As we approach year-end, the interplay between persistent inflation pressures, potential policy shifts, and market positioning suggests the dollar may face increased volatility. Wells Fargo projects the journey to the Fed's 2% inflation target could extend through 2026, with limited progress expected in the year ahead.

USDIDX (D1 interval)

The US Dollar Index is currently trading above the 38.2% Fibonacci retracement level. A break below this level could lead to a retest of the July highs at 105.728. Conversely, bulls are targeting the 23.6% Fibonacci retracement level as the next resistance, with an eye toward an all-time high (ATH) retest.

The RSI is beginning to trend higher, signaling potential bullish divergence, which suggests strengthening momentum. Meanwhile, the MACD is tightening, indicating a likely crossover that could confirm bullish momentum in the coming sessions. These factors position the index at a pivotal point, with critical levels acting as decision markers for its next move. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.