Sterling remains under pressure as UK inflation uptick complicates BOE policy outlook, with markets scaling back rate cut expectations for 2025 amid persistent price pressures and wage growth concerns. All eyes turn to today's Federal Reserve decision, where a 25bp rate cut appears nearly certain, potentially adding downward pressure on cable as policy divergence between the Fed and BOE widens.

Key Market Statistics:

- UK CPI rises to 2.6% in November (from 2.3% in October)

- Services inflation holds steady at 5.0%

- Core inflation increases to 3.5% (from 3.3%)

- GBP/USD trading around 1.27 level

Rate Cut Expectations

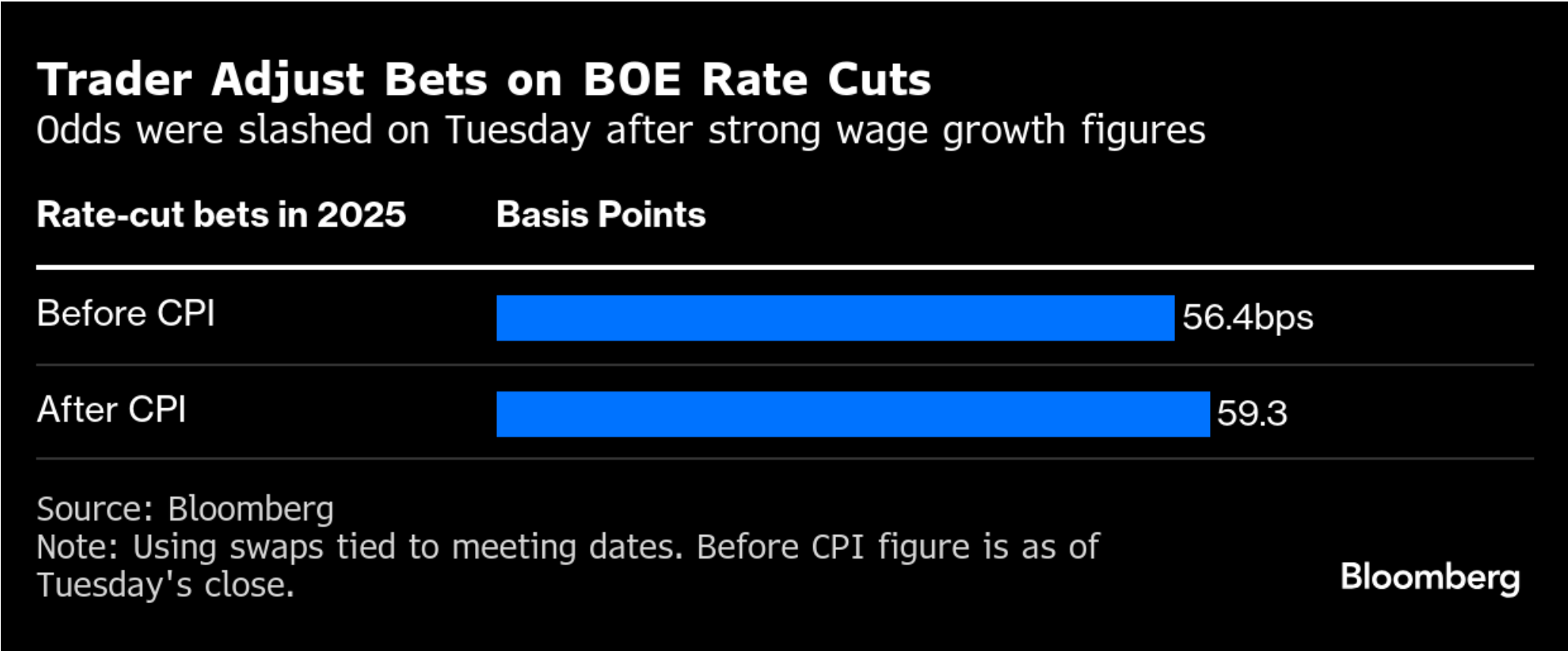

The pound's movement reflects growing market recognition that the BOE faces a more complex policy path than its global peers. While traders had previously priced in three rate cuts for 2025, expectations have now shifted to just two cuts, highlighting the stubborn nature of UK inflation compared to other major economies.

Rate Cuts in 2025 after yesterday’s data. Source: Bloomberg

Services Sector and Wage Pressures

The sustained high services inflation at 5.0% (above BOE's 4.9% projection) coupled with accelerating wage growth at 5.2% suggests persistent domestic price pressures. The underlying "core" services inflation, excluding volatile components, has actually picked up to 5.3% from 5.1%, indicating broader-based inflationary pressures.

UK CPI Contributions in November. Source: Bloomberg

Policy Divergence Emerging

While the Fed and ECB show increasing openness to rate cuts, the BOE appears positioned to maintain a more hawkish stance. Markets are now pricing approximately 60 basis points of easing through 2025, with the probability of a February cut at around 60%. This policy divergence could provide some support for sterling, though economic growth concerns may limit upside potential.

Market Implied Rate Cuts. Source: Bloomberg

2025 Outlook

The combination of sticky inflation, labor market tightness, and potential fiscal policy impacts from the Labour government suggests the BOE will likely maintain a cautious approach to monetary policy easing. Analysts now project the bank rate to end 2025 at 3.75%, reflecting a measured quarterly pace of cuts rather than the more aggressive easing previously anticipated.

The complex interplay between persistent inflation, wage pressures, and growth concerns suggests continued volatility in sterling pairs through early 2025, with policy divergence remaining a key driver of currency movements.

GBPUSD (D1 Interval)

GBPUSD is currently trading below the 23.6% Fibonacci retracement level, a key inflection point that has held firm for over 19 trading days, leading to breakouts and signaling strong resistance.

For bulls, the primary target is the 38.2% Fibonacci retracement level at 1.28484, with the first challenge being a successful breakout above the 50-day SMA. Conversely, bears will aim for the November lows at 1.24866 as their key target.

The RSI shows slight bearish divergence with lower highs but remains in the neutral zone, providing no definitive signal. Similarly, the MACD has remained tight for several days, reflecting market indecision and the absence of a clear directional bias. Source: xStation

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.