Copper futures (COPPER) are trading down more than 1.5% today and are retreating after an impressive August rebound. China's copper stocks, in June this year, reached historic highs with 336,000 tons, but have been on the decline since then. At the same time, also in June, China's copper exports reached a record 158 thousand tons, which only confirms that demand in the domestic economy, which is struggling with the crisis in the construction sector - is (or at least was) very weak.

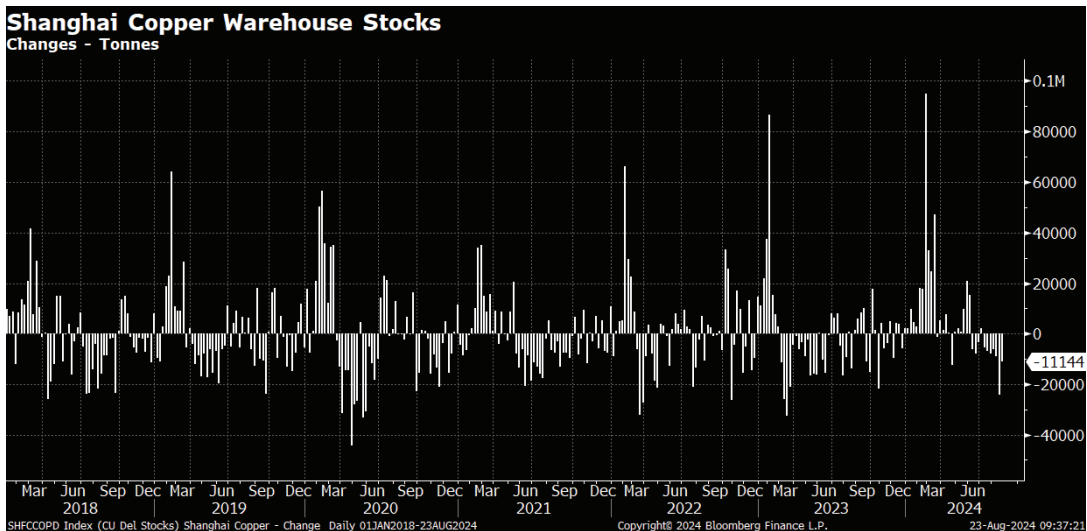

- In July, however, China's copper exports unexpectedly fell by 70,000 tons, as stocks on the Shanghai exchange steadily declined. The last two weeks, according to the Hightower report, saw the largest drop in domestic copper stocks, in all of 2024 (24 and 11.1 thousand tons, respectively). As a result, investors are beginning to reconsider whether this is a seasonal effect and an anomaly, or whether demand for copper in China's economy has really begun to slowly recover.

- Since the beginning of August, copper contracts have risen nearly 8%, on a wave of falling Chinese inventories, a weakening dollar and increasing chances of Federal Reserve rate cuts. Now that contracts have reached a resistance zone, investors may again be 'weighing' the fundamental factors behind sustaining the rebound at a time when the outlook for the global economy, including China's, remains uncertain.

- Investment in the construction sector, in China - although higher y/y is encountering weak demand. In addition, inventories on the London Stock Exchange (LME) remain high, and 'mixed' data out of China may continue to limit market euphoria associated with monitoring inventory levels in Shanghai. Saxo analysts pointed out that the rebound in August was driven by newly built hedge fund positions. We can expect, that if global economy will not slow down meaningfully, US rate cuts may support copper prices.

Shanghai copper stocks are trading down slightly, but are up more than 220,000 tons from their 2023 peaks. They are currently at their lowest since March (seasonally, stocks are lowest in December, then record a seasonal spike, at the beginning of the year, when China is in a 'lunar year'). During this seasonal period, they have risen by more than 94,000 tons this year, a historic high. Source: Bloomberg Finance L.P.

COPPER (D1 interval)

Copper futures are down 1.5% today, with the rise halted at the 38.2 Fibonacci retracement level of the 2022 upward wave. Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.