BlackRock Inc. (BLK.US) reported strong fourth quarter 2024 results Wednesday, with shares climbing as much as 2.7% in premarket trading as adjusted earnings surpassed analyst estimates. The world's largest asset manager demonstrated robust growth across its platforms, particularly in ETFs and private markets, though assets under management slightly missed expectations. The implied earnings surprise was positive with EPS beating estimates by 4.1%.

BlackRock delivered exceptional Q4 performance with notable strength in ETF flows and private market expansion, while its technology services segment showed continued momentum. The company benefited from increased client engagement and significant growth in alternative investments.

BlackRock Q4 2024 results:

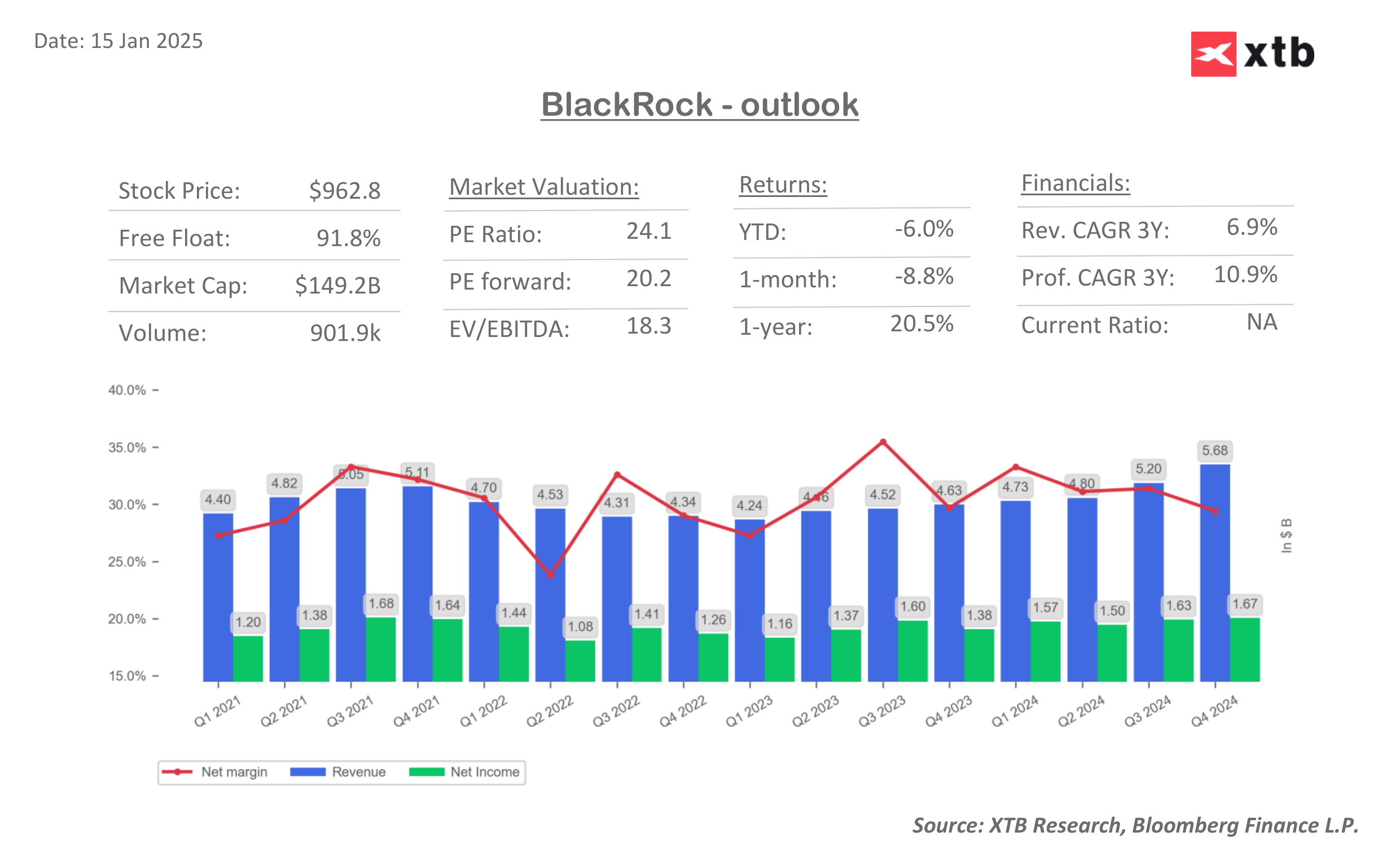

- Revenue: $5.68 billion vs $5.59 billion expected (+23% YoY)

- Adjusted EPS: $11.93 vs $11.46 expected ($9.66 YoY)

- Assets under management: $11.55 trillion vs $11.66 trillion expected (+15% YoY)

- Net inflows: $281.42 billion vs $198.41 billion expected (+194% YoY)

- Base fees and securities lending revenue: $4.42 billion vs $4.38 billion expected

- Technology services revenue: $428 million vs $417.5 million expected

- Adjusted operating margin: 45.5% vs 44.8% expected

Segment Performance:

- Long-term inflows: $200.67 billion (vs $159.93 billion expected)

- Equity net inflows: $126.57 billion (vs $73.47 billion expected)

- Fixed Income net inflows: $23.78 billion

- Institutional net inflows: $53.38 billion

- Retail net inflows: $4.65 billion

- Investment advisory performance fees: $451 million (vs $369.5 million expected)

Strategic Developments and 2025 Outlook:

- Completed $12.5 billion acquisition of Global Infrastructure Partners

- Pending closures of HPS Investment Partners ($12 billion) and Preqin Ltd. ($3.1 billion) acquisitions

- Bitcoin ETF launch showing strong growth with over $50 billion in assets

- Annual ETF business attracted $390 billion in total flows for 2024

- Record total annual inflows of $641 billion across all products

CEO Larry Fink expressed strong confidence in the firm's trajectory, stating "BlackRock enters 2025 with more growth and upside potential than ever. This is just the beginning." The company's strategic expansion into private markets through recent acquisitions positions it to compete with industry leaders like Blackstone, KKR, and Apollo Global Management.

The company announced several leadership changes, including Joe DeVico becoming head of the Americas client business and the establishment of a new global partners office to oversee relationships with major investors, following the departure of Mark Wiedman, a 20-year veteran of the firm.

The stock gains 2.7% in premarket trading to $989. Source: xStation

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.