Markets are often driven by emotion, rather than economics. Find out more with this lesson.

Markets are often driven by emotion, rather than economics. Find out more with this lesson.

In this lesson you will learn:

- Why market sentiment could play an important role in trading

- How to measure the sentiment

- What could we know from the positioning data

Although prices of assets depend mainly on fundamental and technical factors, they can be also influenced by market sentiment. In fact, markets are largely driven by emotion, and sentiment can be reflected in prices.

For example, the market reacted with nervousness to a Donald Trump win in the US presidential election of 2016. While the majority of polls predicted a victory for Hillary Clinton, the markets entered a state of shock when Trump emerged as the winner. A nervous reaction led to a sell-off of the US dollar and US indices, but as soon as the nerves were calmed, traders started to buy the greenback and stocks. Why? Because Trump’s policy was seen as a positive for the US economy. However, the first reaction was determined mainly by the sentiment, not by fundamental factors. That is why it is important to take sentiment into consideration while trading and to know which indicators could be helpful in this area.

What exactly is market sentiment?

Market sentiment could be defined as the overall attitude of investors toward a particular asset or the market as a whole. It is a feeling or tone of a market, or its psychology, as revealed through the activity and price movement. It’s important to remember that sentiment is not always based on fundamentals. That means that investors could have a particular view based on what they feel rather than what they see. ‘Buy the rumour, sell the fact’ springs to mind.

The sentiment could be described as bearish, neutral or bullish. When the bearish mood prevails, stocks are going down. The same applies to the currency - bearish sentiment would weigh on it. On the other hand, a bullish view is a positive one that supports stocks and currencies.

How is it measured?

This is the tricky part. How do you measure something that is strictly connected with psychology? In the financial markets, everyone has their own opinion, and everyone is looking for an edge. However, there are several indicators based on polls that are conducted among market participants. Here are some of the most popular ones:

- AAII Bull and Bear - The AAII investor sentiment survey is probably the most popular survey that refers to Wall Street. It is conducted among AAII members that answer the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors.The AAII Investor Sentiment Survey has become a widely followed measure of the mood of individual investors. The weekly survey results are published on websites such as Bloomberg and are widely followed by market participants.

- CNN Fear and Greed index - Fear and Greed index is a bit different in its construction. It’s not based on the survey conducted among investors, but takes into account various measures, including those that refer to market’s sentiment such as the VIX index. The results are shown on a scale from 0 to 100. The higher the reading, the greedier investors are being. A level of 50 is seen as neutral.

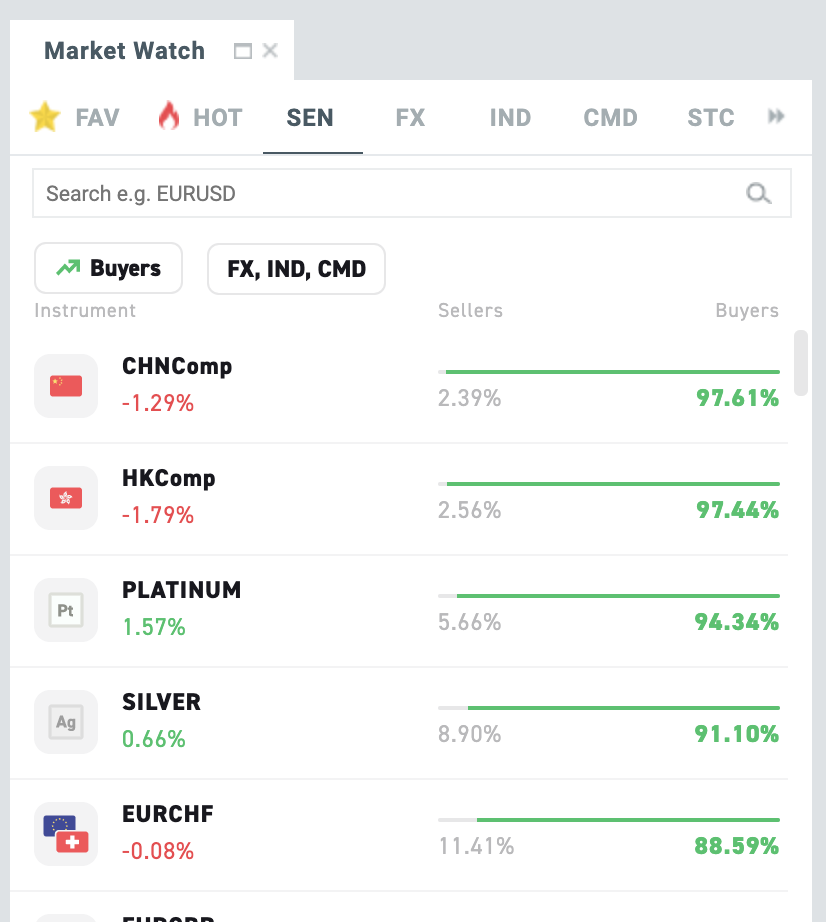

- XTB's Market Sentiment - Market sentiment can also be checked in xStation 5, our most advanced platform. All you need to do is log in and select the Market Watch section.

There are also other indicators and surveys that are looked at, but these three are updated regularly and are popular among traders.

Positioning - another approach to market sentiment

Positioning could be another indicator of the market’s sentiment. While sentiment surveys describe the market’s view, positioning shows it in the form of opened trades. That means that the bullish or bearish view could be seen in the number of opened longs or shorts in a specific currency, commodity or indices futures. For example, if a report shows a solid increase in long positions in the US dollar, that means that the market’s outlook is bullish on the currency.

The most popular and the most important reports on positioning are the CFTC commitments of traders’ reports. They provide a breakdown of each Tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the report levels established by the CFTC. CFTC reports essentially show the net long or short positions for each available futures contract for three different types of traders: commercial traders, non-commercial traders and non-reporting traders. As for us, the most important are trades that were opened by non-commercial traders as they have the biggest impact on prices of assets.

Please note that past performance or future forecasts do not constitute a reliable indicator of future performance.

Source: Bloomberg

Let’s see how it works on an example. Look at the chart above - as you can see, the line shows the net-long speculative positioning on oil. That means that it shows a difference between long and short positions. The higher it is, the more directional the sentiment. As we can see, the number of net-long speculative positions is quite high, which means that the mood is rather bullish.

Each report from the CFTC could be analysed this way and each will provide similar information. As such, let’s focus on how this could be used in your trading.

How to use this in practice:

Now you know what exactly is the market sentiment and how it can be measured. You also know how to analyse the positioning data that is provided not only by CFTC, but by banks and other institutions. However, it’s still yet to be said how to use the information in practice. As you know, if the market is bullish, it means that it expects indices or currencies to rally. In such a situation the positioning should show a lot of opened long positions. That may mean that if something unexpected occurs, then investors will have to close their trades rapidly, which may lead to a significant fall of the price of such asset. As you can see, a similar situation happened in March 2015 with the US dollar. The market was long the dollar and the net-long positioning was at extremely high levels.

Please note that past performance or future forecasts do not constitute a reliable indicator of future performance.

The Fed, however, decided in its meeting not to send a hawkish signal, which forced traders to close their dollar long. That led to dramatic fall of the US dollar that sent the EURUSD from 1.05 to 1.10 in less than 3 hours, as shown on the chart below.

Please note that past performance or future forecasts do not constitute a reliable indicator of future performance.

What’s more, sentiment data could be also used to determine if there’s potential for recent moves to continue. For example, if you see a nice upward trend on stock indices, but the sentiment remains extremely bullish and the positioning is also high, that may mean that there’s not much potential for the move to continue. If the whole market is long, then who would buy stocks further?

All that glitters is not gold

As we have shown, market sentiment could be a helpful tool in analysing the market. It could act as a contrarian indicator, but could also show if there’s fuel left for the recent move to continue. However, one thing should be remembered. Sentiment and positioning indicators are lagging ones, which means that it’s quite usual to see a change in them after, not before a specific move. That is why they should be used as an additional tool, and not the sole indicator to analyse a market’s behaviour.

This article is provided for general information and educational purposes only. Any opinions, analyses, prices or other content does not constitute investment advice or recommendation. Any research has not been prepared in accordance with legal requirements required to promote the independence of investment research and as such is considered to be a marketing communication. XTB will accept no liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly for use of or reliance on such information.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results.