Major U.S. banks will kick off the U.S. financial sector earnings season tomorrow. Fed interest rates remain at record highs for decades, and US consumers have betrayed some signs of weakness in recent months. The market will be listening closely to comments from major US lenders: J.P Morgan (JPM.US), Bank of America (BAC.US), Citigroup (C.US) and Wells Fargo (WFC.US). Consensus (FactSet) suggests that banking sector earnings in Q2 2024 could fall by about 10% year-on-year. The question is, what could be their catalyst in the context of potential rate cuts and lower interest income?

This quarter, the focus will be primarily on the scale of loan-loss provisioning, which could increase as the US economy and labor market record a noticeable cooling. Wall Street expects bank profits to decline, indirectly due to falling US bond yields. Management comments and the results themselves may also affect the estimated scale of the recent economic slowdown, as well as the pricing of recession risk. All three banks, except for Bank of America (results July 16) will report tomorrow, i.e. July 12, before the opening of the US session. The options market is pricing a relatively modest reaction of bank stocks to the quarterly reports; about 2.5 to 3.5%. What to expect?

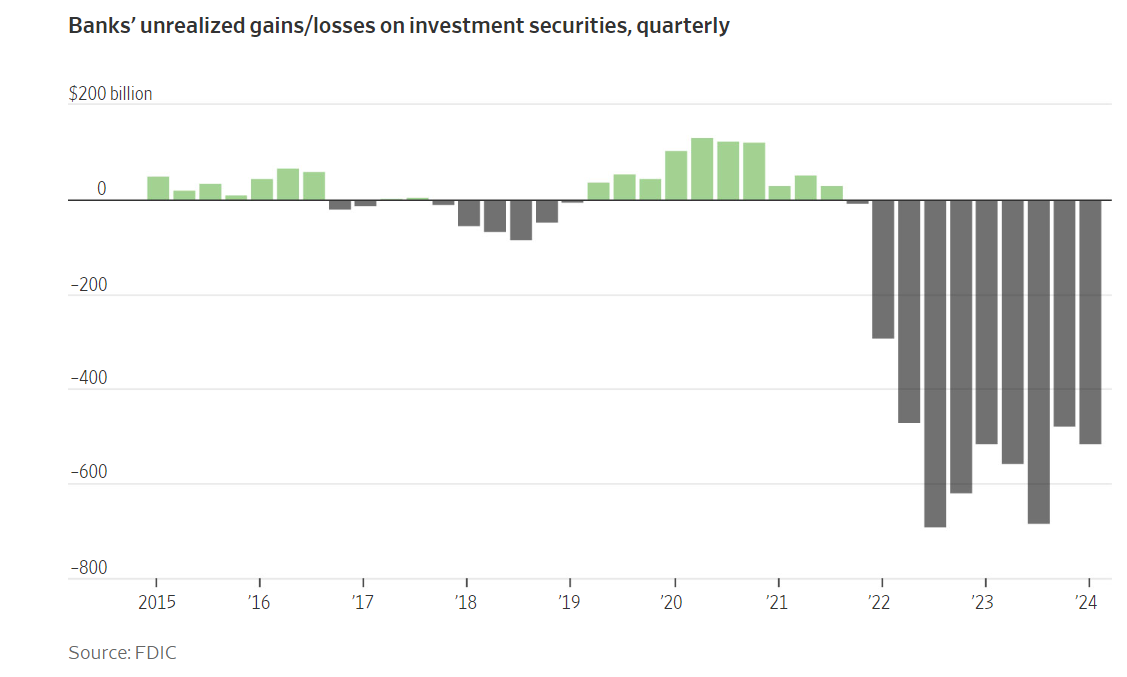

The rise in US bond prices also has some bright side for banks. Unrealized losses on bond portfolios may slowly diminish under the pressure of falling yields - if the prospect of Fed policy easing in the fall in the eyes of the market becomes real. Source: FactSet, FDIC

What will Wall Street pay attention to?

- Profit margins of flagship U.S. banks are likely to have fallen, by rising expectations of Fed interest rate cuts in the second half of the year.

- Yields were marginally negative for banks in the second quarter, but slightly less so than in the first. Yields on 10-year U.S. Treasury bonds rose 17 bps to 4.37% in the second quarter (compared to more than 30 bps k/k increase in the first quarter).

- Wells Fargo estimated that its net interest income will fall between 7% and 9% in 2024, following an 8% year-on-year decline in the first quarter.

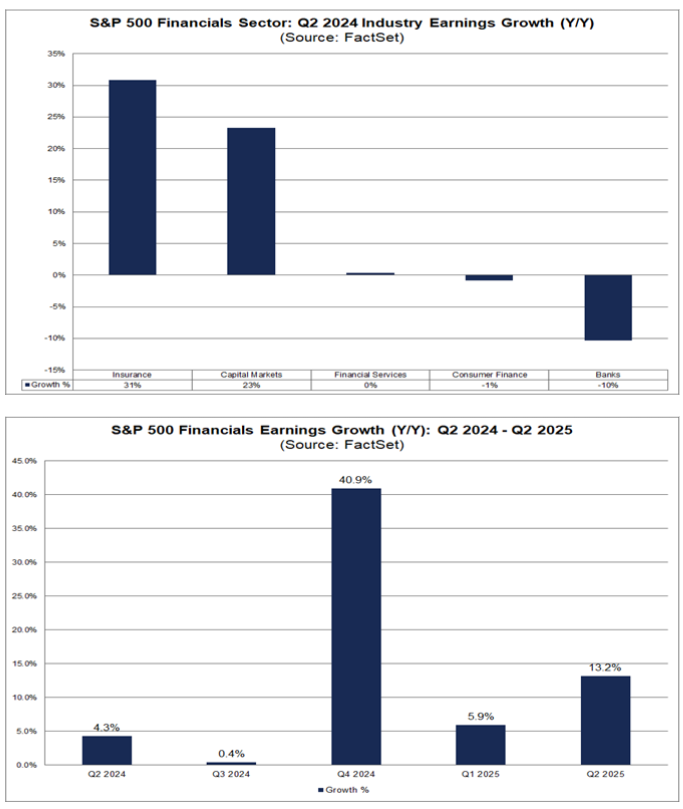

- According to FactSet, U.S. banks' earnings growth rate is expected to fall 10% year-on-year in the current second quarter. Analysts predict that loan loss provisions will increase, especially due to problems in the commercial real estate sector

- The aforementioned 4 largest banks in terms of deposits - JPMorgan Chase, Bank of America, Citigroup and Wells Fargo according to analysts' forecasts will make loan loss provisions of $7 billion in Q2 (50% year-on-year increase)

- Major banks have already seen their profits fall in Q1 due to rising funding costs (depositors have turned to high-interest savings accounts, and banks' offerings need to be competitive with bonds and other fixed-income instruments to avoid capital outflows).

- Also, slowing credit growth could be a major factor affecting earnings and long-term prospects (especially in the retail and real estate sectors)

- According to a Bloomberg survey, investment banking revenues at the big five banks, including JPMorgan Chase, Goldman Sachs, Morgan Stanley, Bank of America and Citigroup, will grow by an average of 30% year-on-year in Q2 - partially offsetting problems in other sectors - mainly commercial

- Higher investment transaction volume, however, is likely to benefit banks with large investment units like JP Morgan, Goldman Sachs and Morgan Stanley; to a lesser extent Wells Fargo, Citigroup and Bank of America.

- Higher mergers and acquisitions (M&A) and IPO activity was driven by loosening liquidity conditions central banks have halted hikes, and some (ECB, BoC, among others) are in the process of easing policy.

What results to expect on Friday, July 12?

J.P Morgan (JPM.US)

J.P. Morgan's performance is expected to be particularly supported by a strong result in investment banking, supported by a favourable equity market, which likely translated into improved earnings in the Trading division. Bloomberg Intelligence expects solid interest income, with continued growth in the card loan segment. J.P Morgan's performance will be watched most closely, as it is the largest bank in the US, priced at a sizable premium to its competitors; so Wall Street expects the premium to be justified, at least to a significant extent, by a solid report, guidance and relatively lower loan loss provisions than its competitors. JP. Morgan expects CET1 capital requirement to increase by 40 basis points in Q4 2024

Expectations

-

Earnings per share (EPS): $4.5 (down 2% y/y). Revenue 11% higher y/y

- Net interest income 2.65%, down 6 bps q/q (down 2% q/q, up 4% y/y)

- Provisioning of $550 million (total of $2.8 billion) compared to release of $72 million in Q1 2024

- Revenues from fixed-income instruments up 2% y/y; equity trading up 4% y/y

- FICC up 2% vs. 2Q23; equities up 4%. Profits in investment banking up 22% y/y

- Operating expenses up 14% y/y ($23.3 billion vs. $20.4 billion)

Citigroup (C.US)

According to a Bloomberg analysis, credit card net charge-off ratio above the 5.75-6.25% range in Q2 vs. 6.32% in Q1. Total loss provisions may reach $2.6 billion and expenses around $13.45 billion, in line with annual projections.

Net interest income may decline slightly compared to Q1. Relatively less intensive interest rate trading may weigh negatively but will be balanced by slightly higher demand for credit and equity trading

Expectations

- Expected earnings per share (EPS): $1.39 (up 2% y/y)

- Revenue flat y/y (service division may see about 6% annual growth). Citigroup's expected CET1 rate cut of 20 bps in Q4 still has a chance to materialize

- Loan loss provisions: $2.6 billion, in line with mid-June guidance. Increase to $235 million

- USD million compared to USD 62 million in Q1;

- Deposits unchanged; loans up 1% y/y and cards up 2% y/y

- Net interest rate 2.39%; down 3 basis points from Q1 2024

- Equity and FICC (fixed-income instruments) trading up 2% y/y

Wells Fargo (WFC.US)

Wells Fargo's net interest rate ratio is slowing. Bloomberg Intelligence expects that its growth rate may be slightly more favorable, however, than the bank's forecast of a 7-9% annual decline. Performance in the investment banking sector should support the quarterly report. Operating expenses may be flat compared to 2Q23, and remain at similar levels for the full year. Provision for credit losses up 8% y/y and 11% y/y increase in provisions for customers in corporate and investment banking.

Expectations

-

Expected earnings per share (EPS): $1.29, up 3% y/y

- Revenues down about 2% y/y; Net interest income down 1% quarter-on-quarter; NII down 1% and 8% y/y

- Average deposits up 1% y/y; Provisions for loan losses $70 million vs. $219 million in Q1 2024

- Costs flat y/y at about .$12.7 billion; Mortgage banking income down 7% k/k but 5% higher y/y

J.P. Morgan shares (JPM.US)

Shares of the largest lender in the United States are doing quite well, but the bulls have recently encountered another resistance, around $208 per share. Key support runs at $200 (set by the SMA50 and SMA100) and around $170 (previous price reactions and 2021 peaks). It is worth noting that the recent increases are quite similar in magnitude (and stretch) to those of 2020-2022. Recall; in Q1, JPMorgan Chase, the largest bank in the US, reported lower-than-expected net interest income and presented quite disappointing forecasts for 2024.

Source: xStation5

Analysts estimate earnings growth for the financial sector at 0.4%, 40.9% and 5.9% in Q3 2024, Q4 2024 and Q1 2025, respectively. At the same time, they believe that banks' y/y profits will prove to be unreplicable this quarter; they are expected to fall 10% y/y.

Source: FactSet

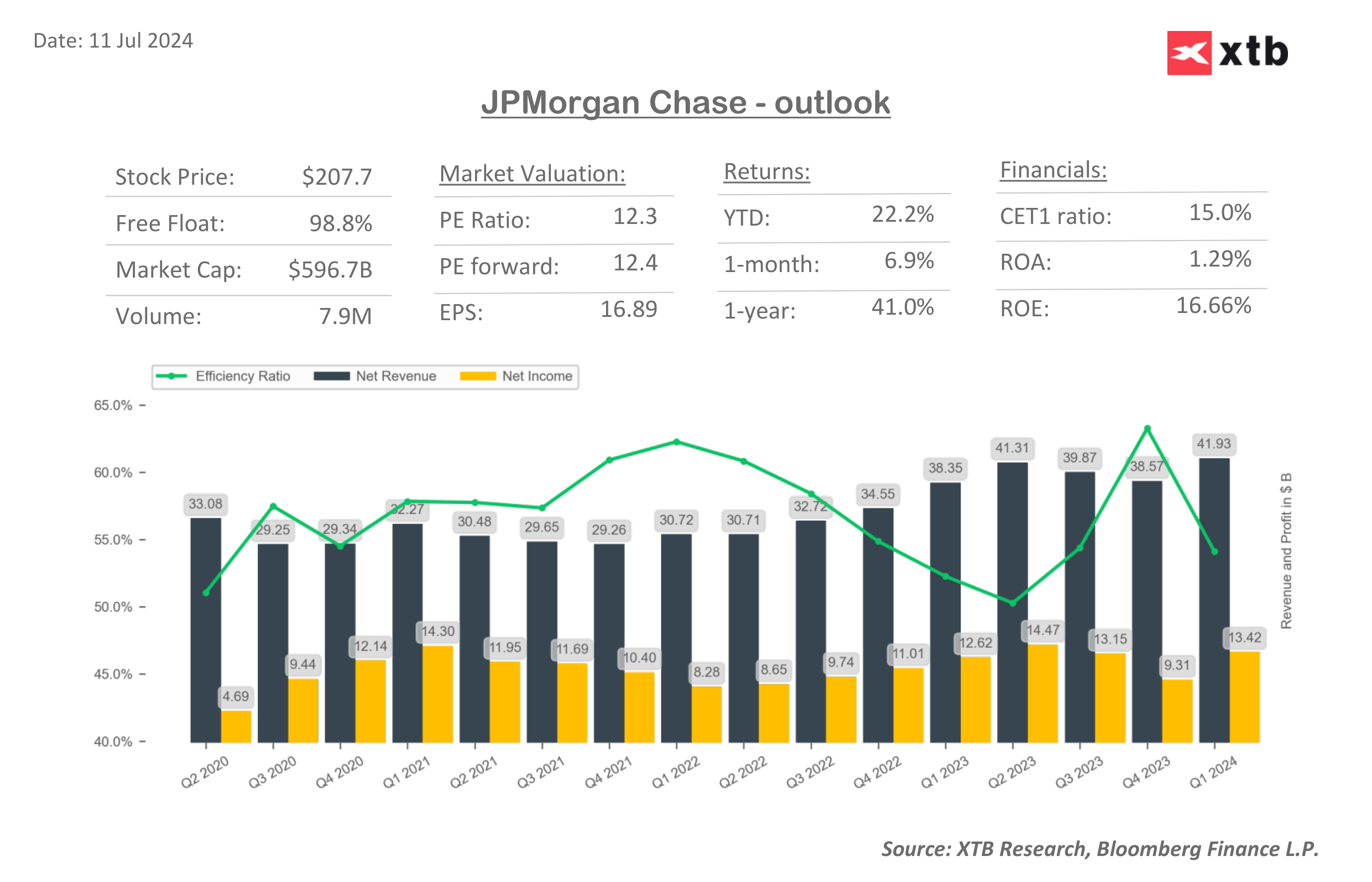

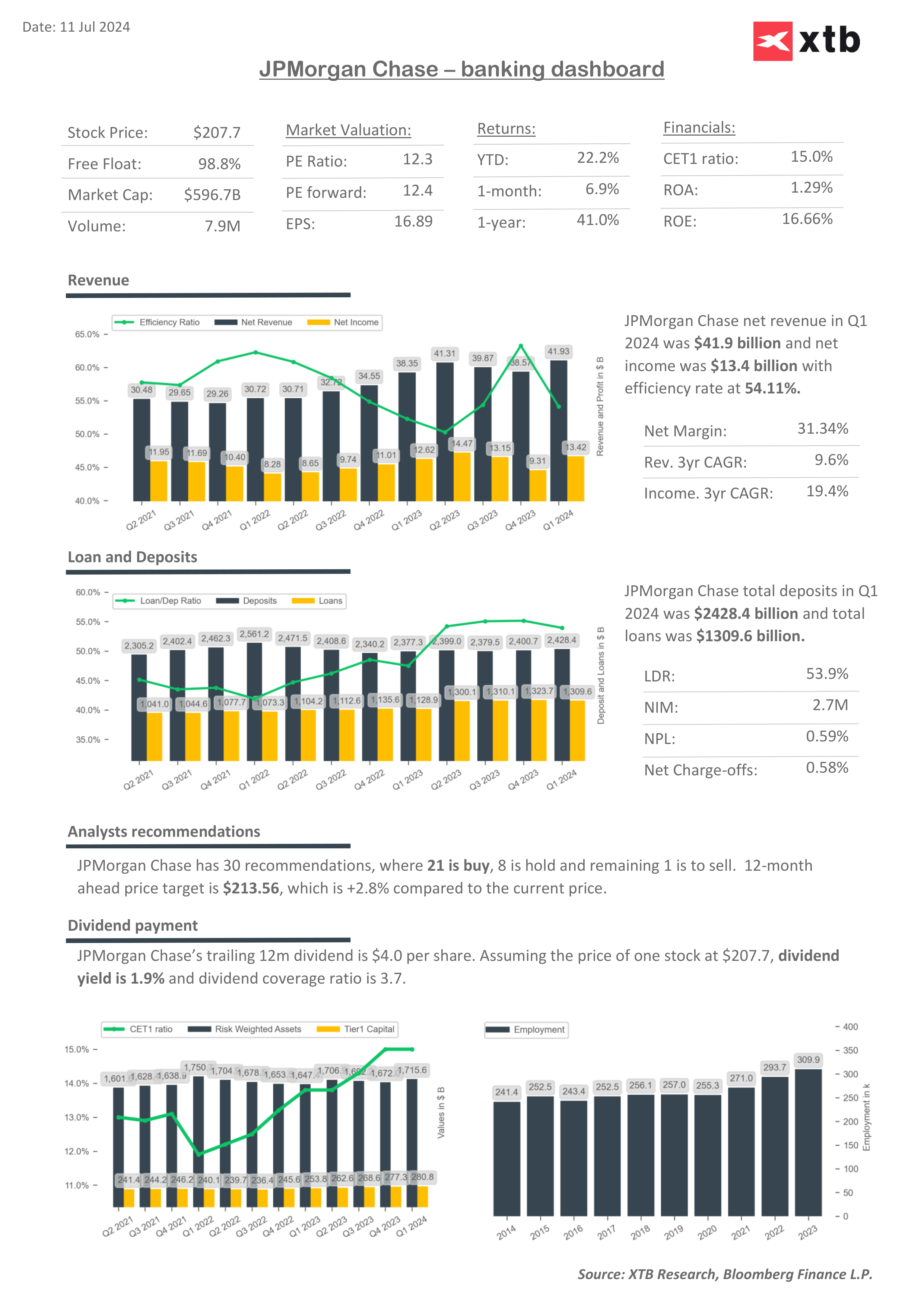

J.P. Morgan financial dashboards and valuation multiples.![]()

Source: XTB Research, Bloomberg finance L.P.

Source: XTB Research, Bloomberg finance L.P.

الولايات المتحدة: هل تشير الأرقام القياسية للرواتب إلى مسار أبطأ لخفض أسعار الفائدة؟

ملخص السوق: ارتفاع أسعار النفط وسط التوترات الأمريكية الإيرانية 📈 مؤشرات أوروبية هادئة قبل صدور تقرير الوظائف غير الزراعية الأمريكية

التقويم الاقتصادي: بيانات الوظائف غير الزراعية وتقرير مخزونات النفط الأمريكية 💡

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!