Oracle's (ORCL.US) 1Q24/25 results beat consensus expectations, with the company's sales driven by continued strong demand for AI-related cloud services. It is noteworthy that the company delivered strong results despite overall weakness in the technology sector.

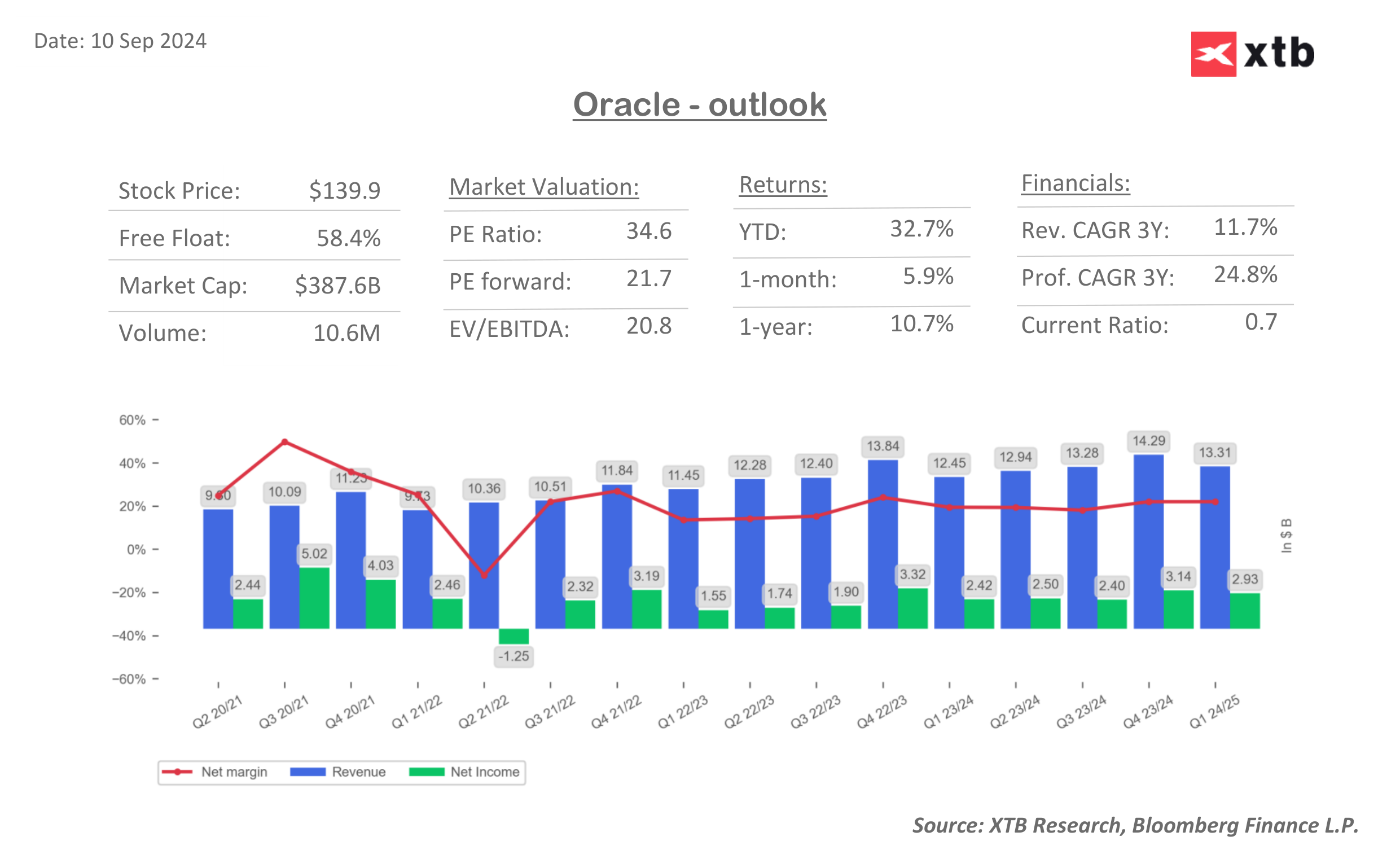

Oracle generated revenue of $13.31 billion in 1Q24/25 (+6.9% y/y), maintaining its uninterrupted positive y/y revenue growth for more than 12 quarters. Seasonally, Q1 of the company's fiscal year performed the weakest, hence in q/q terms the company recorded a decline of 7%. However, it is worth noting that the revenues achieved for the last 3 months turned out to be the highest quarterly excluding 4Q22/23 and 4Q23/24. The strongest dynamics can be seen in the cloud revenue segment, where sales increased by 22% y/y (both in reported and constant currency terms). These results remain in line with expectations.

The company performed significantly better on cost discipline, pushing adjusted operating profit to $5.71 billion (vs. $5.59 billion forecast) and resulting in an adjusted operating margin of 43% (vs. 41% a year earlier and 42.2% forecast).

The company continues to increase its partnerships with leading technology giants, with agreements with Microsoft and Google ensuring continued strong growth in the database segment.

On top of that, Oracle announced a partnership with Amazon, which is further expected to help bolster revenue growth throughout the 2024/25 fiscal year.

In pre-open market trading, the company is up more than 8%, thus setting a new historical peak at $152. Source: xStation

FINANCIAL RESULTS 1Q24/25

- Adjusted revenue $13.31 billion, +6.9% y/y, estimates $13.26 billion

- Revenue in constant currency +8%, estimates +7.43%

- Adjusted EPS $1.39 vs. $1.19 y/y, estimate $1.33

- Cloud revenue (IaaS plus SaaS) $5.6 billion, +22% y/y, estimate $5.61 billion

- Cloud revenue (IaaS plus SaaS) in constant currency +22%, estimate +22.4%

- Cloud Infrastructure revenue (IaaS) $2.2 billion, +47% y/y, estimate $2.2 billion

- Cloud Infrastructure revenue (IaaS) in constant currency +46%, estimate +45.7%

- Cloud Application revenue (SaaS) $3.5 billion, +13% y/y, estimate $3.41 billion

- Cloud Application revenue (SaaS) in constant currency +10%, estimate +11.6%

- Cloud services and license support revenue $10.52 billion, +10% y/y, estimate $10.51 billion

- Cloud services and license support revenue in constant currency +11%, estimate +10.9%

- Applications cloud services and license support revenue $4.77 billion, +6.7% y/y, estimate $4.75 billion

- Infrastructure cloud services and license support revenue $5.75 billion, +13% y/y, estimate $5.96 billion

- Cloud license and on-premise license revenue $870 million, +7.5% y/y, estimate $731 million

- Cloud license and on-premise license revenue in constant currency +8%, estimate -9.2%

- Hardware revenue $655 million, -8.3% y/y, estimate $690.3 million

- Service revenue $1.26 billion, -8.7% y/y, estimate $1.35 billion

- Adjusted operating income $5.71 billion, +13% y/y, estimate $5.59 billion

- Adjusted operating margin 43% vs. 41% y/y, estimate 42.2%

شركة كونغسبيرغ غروبن بعد إعلان الأرباح: الشركة تلحق بركب القطاع

ملخص السوق: المؤشرات الأوروبية تحاول التعافي بعد موجة البيع القياسية في وول ستريت 🔨

حصاد الأسواق: عمليات بيع مكثفة في قطاع التكنولوجيا (06.02.2026)

تراجعت أسهم أمازون بنسبة 10% مع تراجع المستثمرين أمام ثمن هيمنة الذكاء الاصطناعي.