- US500 records flat session; US100 and US30 gain slightly

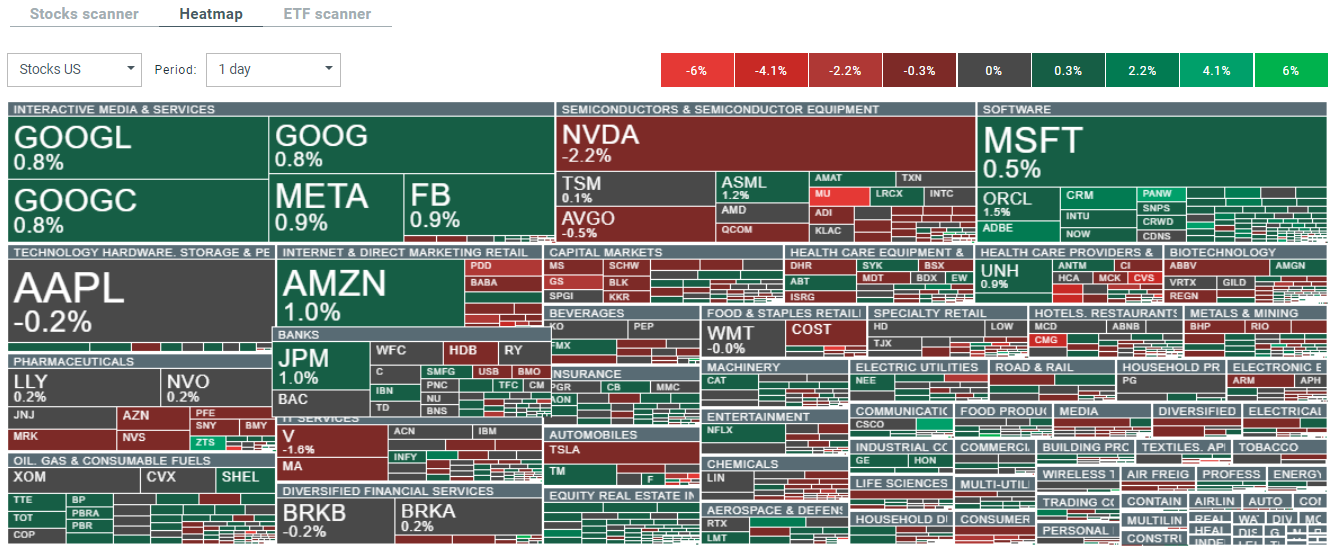

- Weakness in semiconductor sector offsets growth in software companies

- Arista Networks (ANET.US) gains nearly 4% after raising recommendation at Citi, analysts pointed to AI

- Levi Strauss (LEVI.US) shares lose more than 15% on wave of weak wholesale results

- Chinese ADRs, Pinduoduo (PDD.US) and Alibaba (BABA.US) lose on a wave of weaker sentiment in China

Today's data from the United States came in above forecasts; Q1 GDP rose 1.4% vs. 1.3% expectations, but markedly slowed the pace of expansion from 3.4% k/k previously. Benefit claims came in marginally below expectations, and preliminary PCE data showed an increase of 3.4%, compared to 3.3% expected; core PCE also rose. However, markets are waiting until tomorrow for key data. Nvidia shares are trading more than 2.5% ahead today, and Micron is trading close to a 7% retreat; weakness in the sector is offset, however, by a fairly steady session of BigTech companies and gains in the software segment, with Salesforce and Palo Alto Networks trading close to 5%.

US macro data

- PCE (Q1): Current: 3.4% forecast 3.3%; previously 1.8%;

- Core PCE (Q1): Currently: 3.7% forecast 3.60%; previously 2.00%;

- Private consumption: Currently: 1.5% forecast 2.0%; previously 2.0%

- GDP (Q1): Currently: 1.4% QoQ forecast 1.3% k/k; previously 3.4% k/k;

- GDP Deflator (Q1): Currently: 3.1% QoQ forecast 3.1% k/k; previously 1.7% k/k;

- Jobless claims. Currently: 233k vs. 236k forecast; 238k previously;

- Regional Kansas City Fed Composite index came in at -8 vs -4.5 forecast and -2 previously

- Kansas County manufacturing reading fell to -11 vs. -1 previously

- Fixed asset orders (m/m, for May): 0.1% vs -0.5% forecasts and 0.6% previously

Noticeably weaker sentiment is seen today in the semiconductor and automotive sectors. Goldman Sachs (GS.US) shares are also losing more than 2%. Source: xStation5

US500 (M5 interval)

Looking at the contracts on the S&P500 index, we see that on the series of new contracts, sellers are consistently prevailing after the recent roll-up, and we also see strong selling volume in today's session.

Source: xStation5

News from companies

Shares of apparel manufacturer Levi Strauss (LEVI.US) are seeing a sizable sell-off today, following weak second-quarter results for the year. As a result, the company's shares are trading down today to March levels.

- The company's direct to customer (DTC) business was expected to deliver significant results and lower costs, but results indicated that consumers remain cautious, making it likely that the effects of the new sales channel and strategy will have to wait longer than investors had hoped.

- Direct sales rose 12% y/y - a result that did not please Wall Street. Wholesale sales fell in single digits, with the Dockers brand reporting weak results. Levi's c/z valuation remains about 10% higher than the sector average and currently stands at 16. Levi's second-quarter revenue rose 7.8% to $1.44 billion, vs $1.45 billion expected by analysts.

- Adjusted earnings per share came in f $0.16 and was slightly higher than expected. The company affirmed previous full year outlook (sales rise 1% to 3% year-over-year, and adjusted EPS of $1.17 to $1.27), which according to Goldman Sachs was disappointing, because Wall Street expected a raise.

LEVI.US (D1 interval)

Levi's & Strauss shares are trading nearly 20% above their 200-session moving average. Source: xStation5

Arista Networks (ANET.US) has already managed to rebound nearly 40% from its local low in April and is trading today at new historic highs. Citi today raised its recommendation for the company to 'buy' with a target price of $385 per share.

- According to the analysis, the company, as a major provider of AI-based network switches and data centre service infrastructure, is still well positioned to benefit from the early stages of AI deployment. According to a June 25 Barclays analysis,

- Supermicro and Arista will benefit from the higher CAPEX of technology companies investing in data centres, including in 2025, according to a June 25 Barclays analysis.

- The cloud computing tech giants are expected to increase CAPEX by 41% this year, and the growth according to the investment bank will continue in 2025 by another 15% year-on-year ($218 billion this year and $251 billion next year).

- Analysts believe, however, that spending will ultimately turn out to be even higher, and will mainly include AI server equipment (GPUs and ASICS). Demand in the sector is mostly driven by spending by Alphabet, Amazon, Meta Platforms, Microsoft and Oracle.

Source: xStation5

Source: xStation5

ملخص السوق: ارتفاع أسعار النفط وسط التوترات الأمريكية الإيرانية 📈 مؤشرات أوروبية هادئة قبل صدور تقرير الوظائف غير الزراعية الأمريكية

التقويم الاقتصادي: بيانات الوظائف غير الزراعية وتقرير مخزونات النفط الأمريكية 💡

ملخص اليوم: بيانات أمريكية ضعيفة تُؤدي إلى انخفاض الأسواق، والمعادن الثمينة تتعرض لضغوط مجدداً!

شركة داتادوغ في أفضل حالاتها: ربع رابع قياسي وتوقعات قوية لعام 2026"