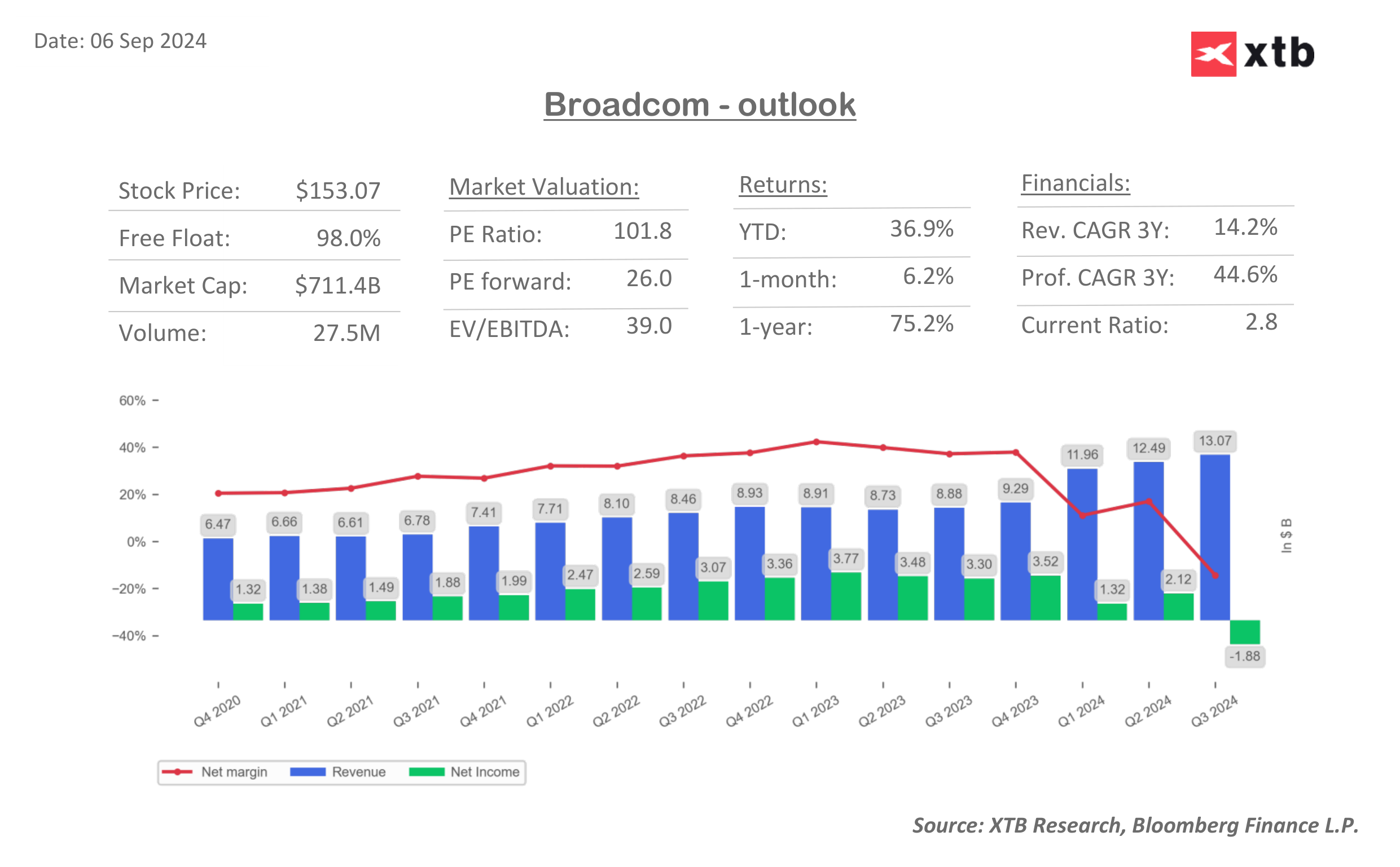

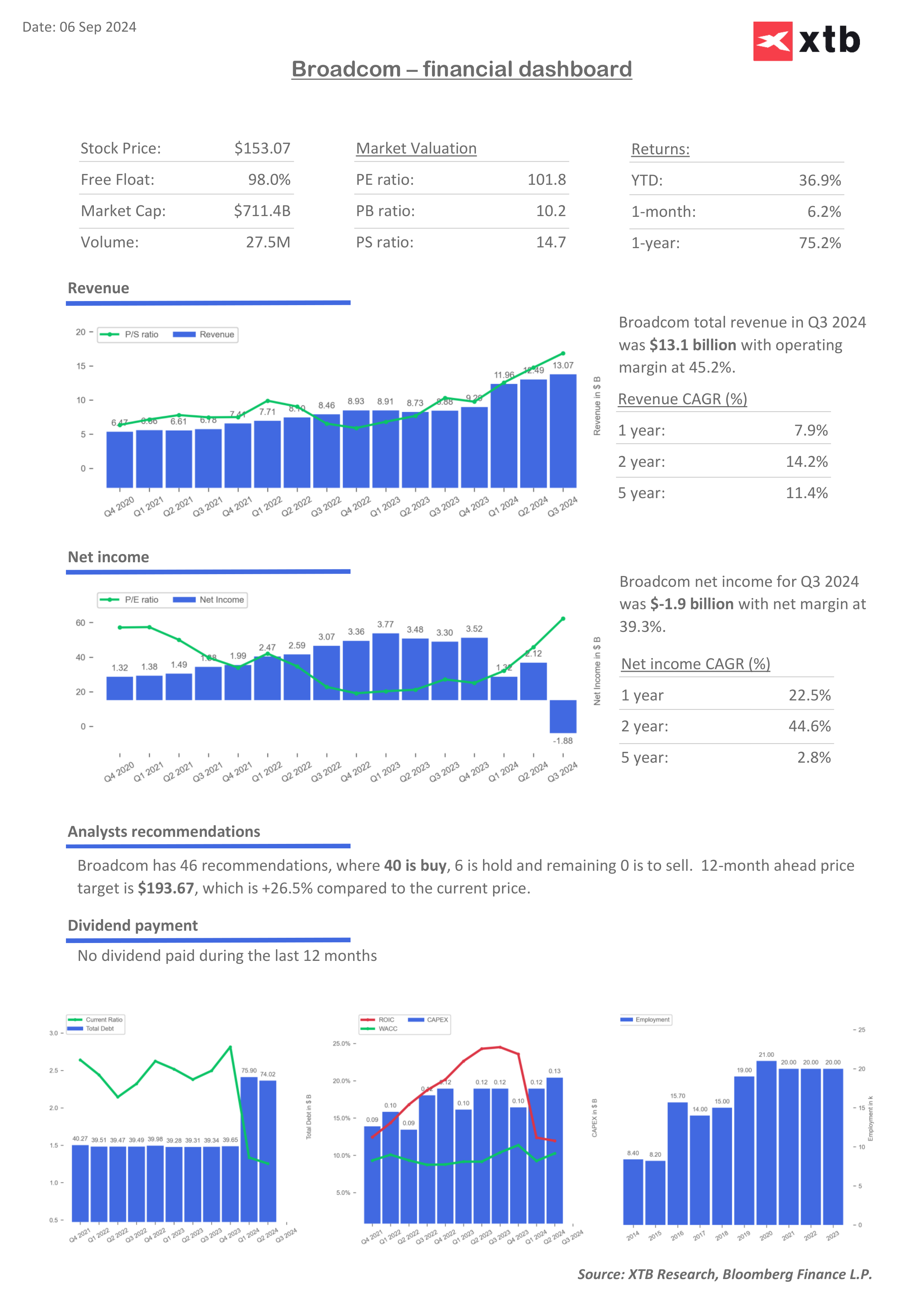

One of the biggest US-based chip producers, Broadcom (AVGO.US) loses almost 10% today, after quarterly results (fiscal quarter ended 4 August 2024). Analysts expectations out beat wasn't spectacular, and the company expects sales in current quarter almost in line with investor expectations, while FY 2024 outlook was only slightly raised, while valuation is still

- Broadcom beaten expectations on earnings per share (18% YoY) and revenue (47% YoY). However, without the positive contribution from the VMWare acquisition, the company's revenue would have grown only 4% y/y and chip demand on its Broadband business was soft.

- The company raised its full-year revenue forecast to $51.5 billion vs $51 billion before, however, this more cautious outlook is the effect of weak cyclical semiconductors demand. Some investors expected faster rebound of it, this year

- Earnings per share came in $1.24 vs. $1.22 forecasts, and sales came in at almost $13.1 billion vs. $12.98 billion expectations. However, the magnitude of the beat in market revenues and EPS forecasts was relatively small

- A forecast for the current quarter, although raised, 'disappointed' expectations; the company expects $14 billion in sales; Wall Street's model forecasts suggested $14.1 billion.

- For the full year, the company expects $12 billion in revenue from AI products; at the start of 2024 it expected $11 billion. However, rising demand for AI chips failed to improve sentiments

- Broadcom reported that broadband revenue declined 49% YoY in the last fiscal quarter, with non-AI networking dropping almost 41% YoY. More 'cyclical' demand for other semiconductors than custom chips and networking was still soft

- Rising AI demand was offset by weak, dropping demand in other, strategic divisions. In consequence, the company reported a loss of $1.88 billion GAAP vs 3.30 billion GAAP in profit in the last year

- GAAP net loss was affected by an on-time event, a discrete non-cash tax provision of $4.5 billion (transfer of intellectual property rights to the United States)

After company earnings, US-based semiconductor stocks are also dropping, leading to weaker sentiments in Nasdaq 100 index; Nvidia (NVDA.US) drops almost 4% in pre-market after the Broadcom quarterly report.

Broadcom chart (AVGO. US, D1 interval)

Current pre-market AVGO price is near to the 38.2 Fibo retracement of the upward wave since 2022 (GPT debut) and SMA200 level, at $138 per share, potentially triggering higher volatility after US market open.

![]() Source: xStation5

Source: xStation5

Source :XTB Research, Bloomberg Finance L.P.

Source :XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

الولايات المتحدة: النفط باهظ الثمن للغاية بالنسبة لوول ستريت!

مزيد من التصدعات في سوق الائتمان الخاص: شركة بلاك روك تحد من عمليات السحب

ملخص السوق: عمليات بيع مكثفة في أسواق الأسهم الأوروبية وسط أزمة الطاقة 🔔

بوينغ ترتفع أسهمها وسط أنباء عن طلبية ضخمة محتملة من الصين لشراء طائرات 737 ماكس 📈

Source: xStation5

Source: xStation5