Bank of England is scheduled to announce its next monetary policy decision at 12:00 pm BST today. Bank is not expected to cut rates, but the importance of the meeting increase yesterday, when UK CPI data for May showed headline inflation to the 2% target for the first time since 2021. Let's take a look at what is expected from and priced in for today's BoE meeting.

What markets expect from BoE?

Economists and money markets are in agreement that we will not see a chance in the level of UK interest rates today.

None out of over 40 economists surveyed by Bloomberg expects Bank of England to chage rates today. A decision to hold rates unchanged is expected to be made with 7-2 split (7 votes for holding and 2 for cutting) - just as it was the case back in May. BoE members Dhingra and Ramsden are expected to retain their dovish bias and continue to vote for cuts.

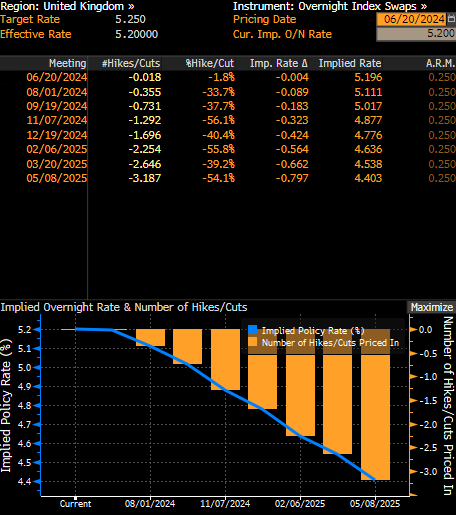

Money markets are currently pricing in a less than 2% chance of Bank of England and an around-35% chance of BoE rate cut at August meeting. However, pricing for September suggests an over-70% chance of Bank of England delivering a 25 basis point rate cut then.

Money markets do not price in a rate cut at today's or August meetings, but see an over 70% chance of a 25 basis point cut in September. Source: Bloomberg Finance LP

Too early for a cut, but traders will look for guidance

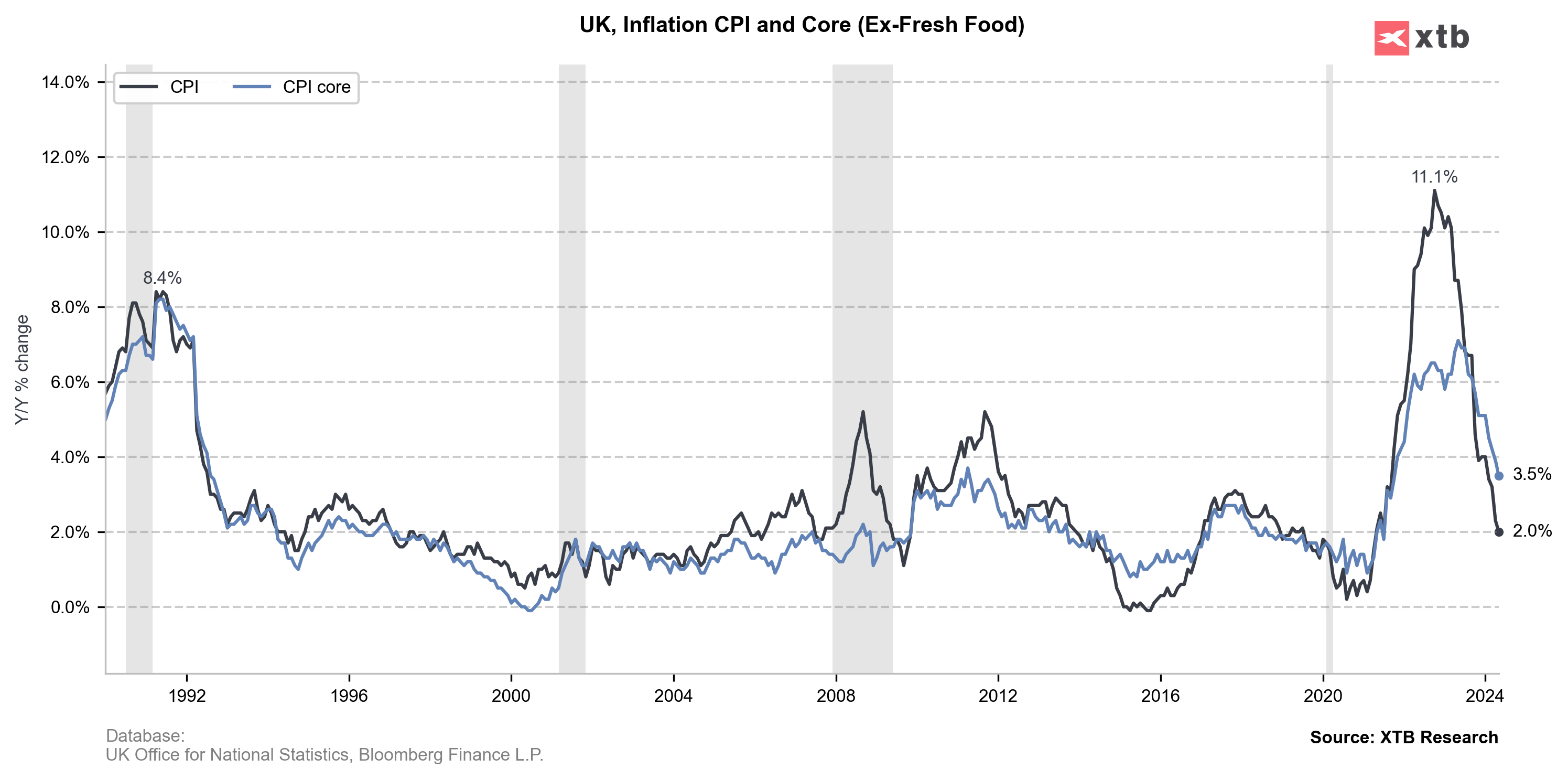

Just because today's meeting is not expected to result in the change in the level of rates does not mean that it will be a non-event. UK CPI data for May was released yesterday in the morning, and it showed headline inflation returning to 2% target for the first time since 2021! This is an important development, even though a less-volatile core measure still sits above the target (3.5%). While this is unlikely to encourage BoE to cut rates as soon as today, the Bank may offer some hints that rate cuts are coming soon. Still, any clear hint is not the base case scenario, with BoE being expected to retain its previous messaging of placing increasing emphasis on upcoming data releases.

Another factor that makes it unlikely for a rate cut to be delivered today is political in nature - UK elections will be held at the beginning of July and central banks usually refrain from making unexpected policy moves ahead of such events in order not to be accused of political motivations. What further supports the view that Bank of England will remain cautious today is pre-election blackout period. Bank of England has cancelled all public statements after general elections were called, meaning that should markets misinterpret today's decision, the Bank will be unable to clarify it until after July 4, 2024 (election date).

Headline UK CPI inflation return to 2% target in June this year for the first time since 2021. Source: Bloomberg Finance LP, XTB Research

Headline UK CPI inflation return to 2% target in June this year for the first time since 2021. Source: Bloomberg Finance LP, XTB Research

A look at GBPUSD

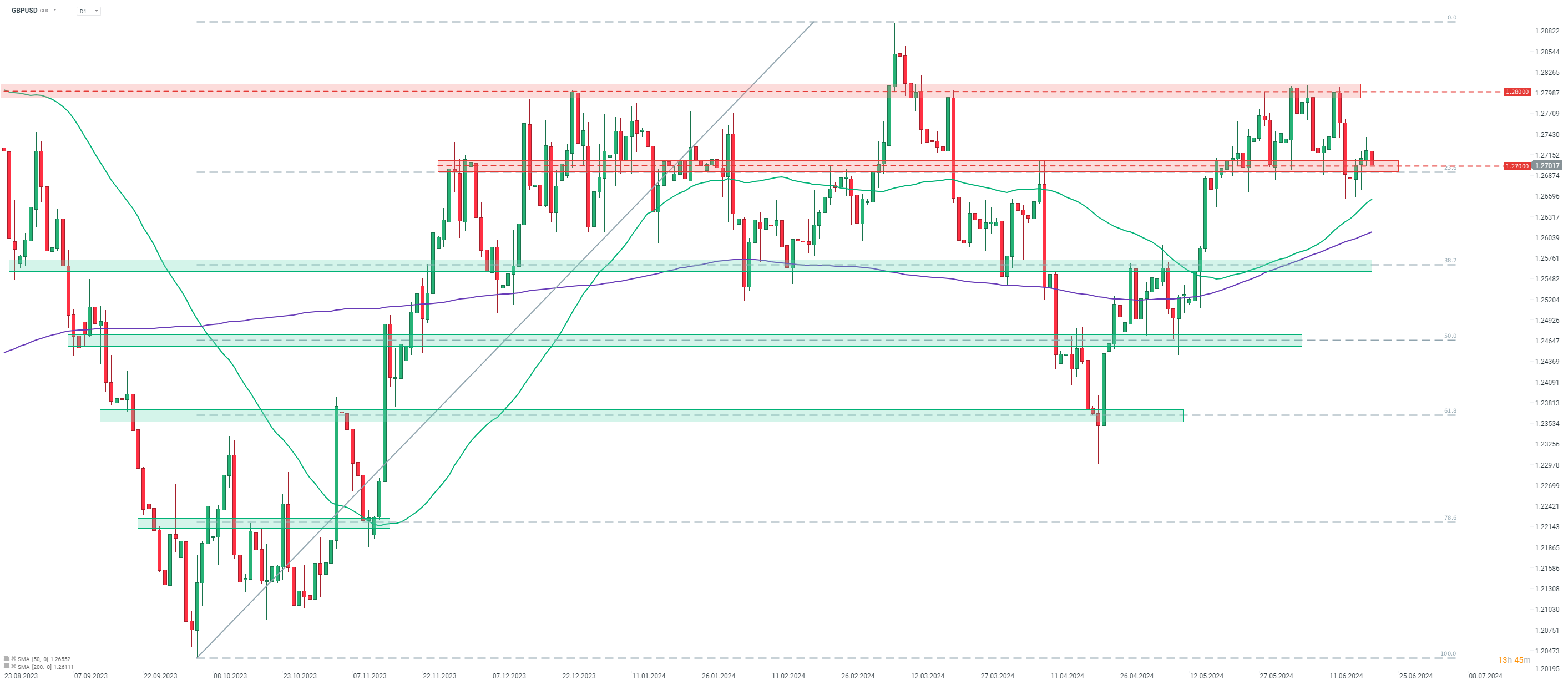

As we have already said, it is highly unlikely that Bank of England will surprise today, with a decision any other than keeping rates unchanged. Clearer hint that the rate cut will come at the next meeting in August would be seen as a dovish surprise and would likely trigger GBP weakening. On the other hand, suggestion that rate cuts will not be delivered until Q4 2024 or that they won't be delivered this year at all would be a hawkish surprise and would see GBP strengthen. However, as we have said, Bank of England is likely to be cautious today due to the upcoming elections. Having said that, moves on GBP market may be limited.

Taking a look at GBPUSD chart at D1 interval, we can see that the pair enjoyed strong gains in late-April and in May, but has begun to trade sideways in June. Price moves have been limited to the 1.2700-1.2800 range since. Bears attempted to push the pair below the lower limit of the range recently, but the downside breakout proved to be short-lived and the pair returned above 1.2700 mark.

Source: xStation5

Source: xStation5

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Economic calendar: US CPI in the spotlight (13.02.2026)

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.