Taiwan Semiconductor Manufacturing (TSM.US) shares dipped nearly 8% yesterday, after the market discounted disappointing expectations in the ASML (ASML.NL) report and the prospect of tighter technology transfer between China and the US. Oversold stocks from the semiconductor sector pushed the Nasdaq 100, which yesterday recorded its weakest session since December 2022. However, today after TSMC's Q2 report for the year, we see some recovery on pre-market. Due to concerns about tightening US technology exports to Asia, TSMC has erased more than $50 billion in market capitalization in recent days.

Yesterday, Donald Trump also conveyed that Taiwan will have to pay for its own protection because the U.S. interest is no different from an insurance company, and so far the island'gives nothing to America. As a result, this opened the door to speculation about the potential impact of such comments on the closely held U.S. business of TSMC, Asia's largest company and one of the world's largest, which today reported second-quarter results for the year. Earnings rose 36% year-on-year, and the business momentum leads investors to believe that TSMC is among the beneficiaries of the AI trend.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appFollowing the results, TSMC's pre-market shares are already gaining more than 3%, with Nvidia (NVDA.US), Intel (INTC.US) and AMD (AMD.US) joining the gains

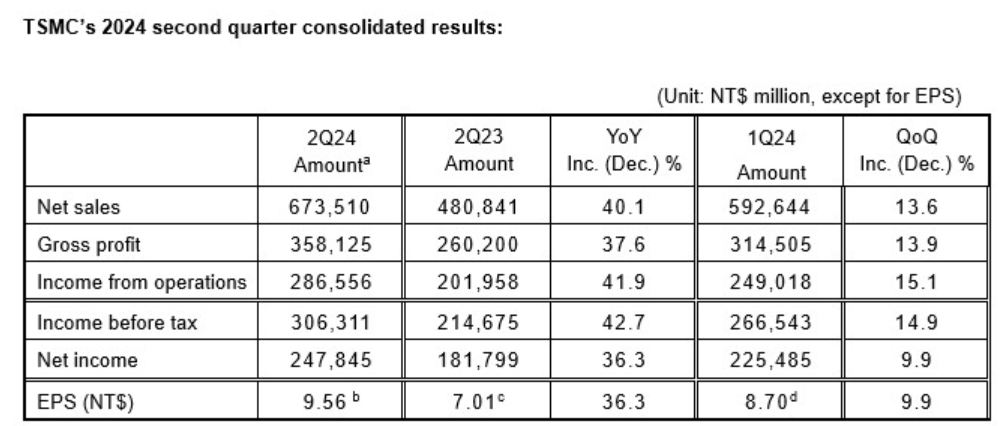

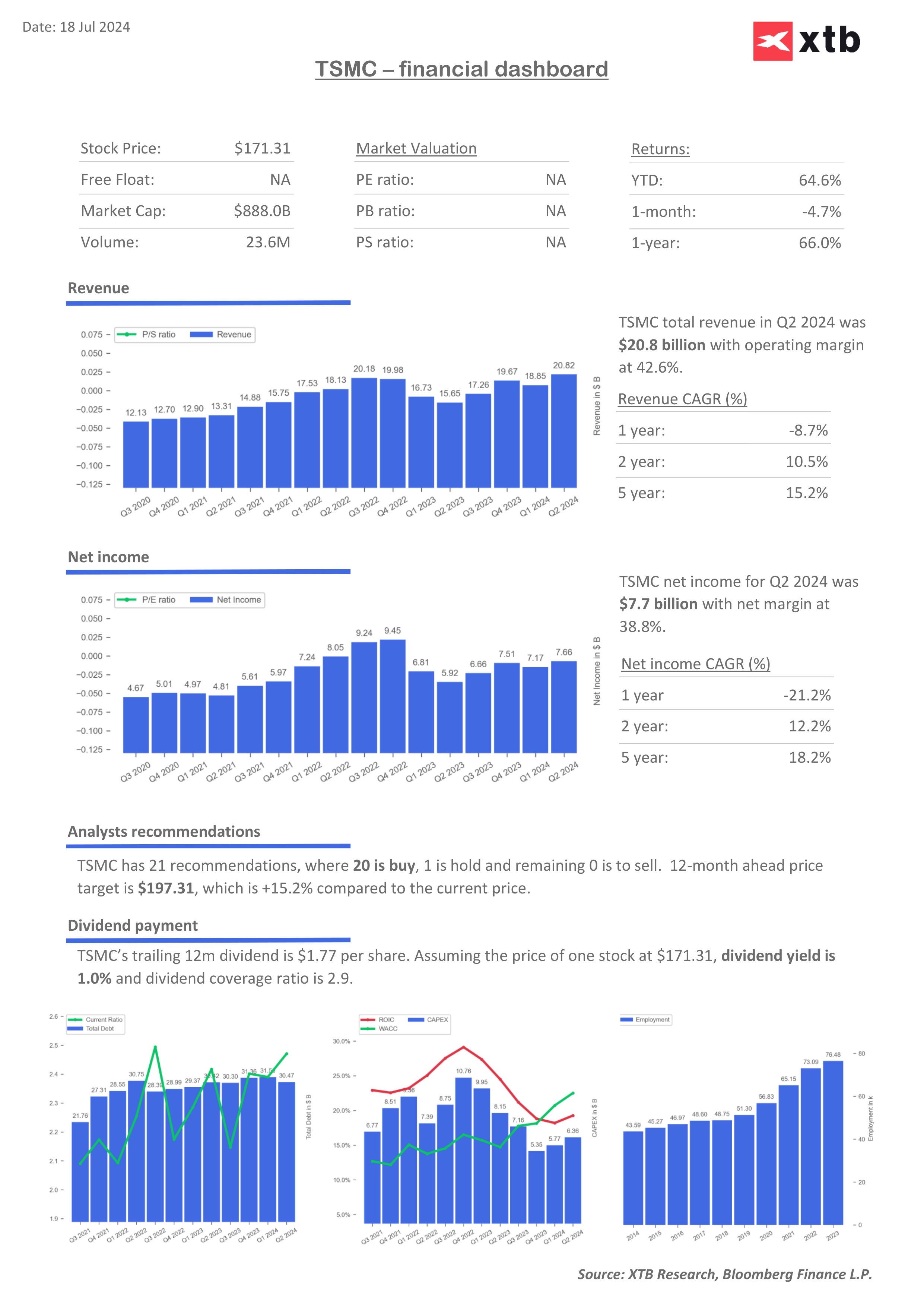

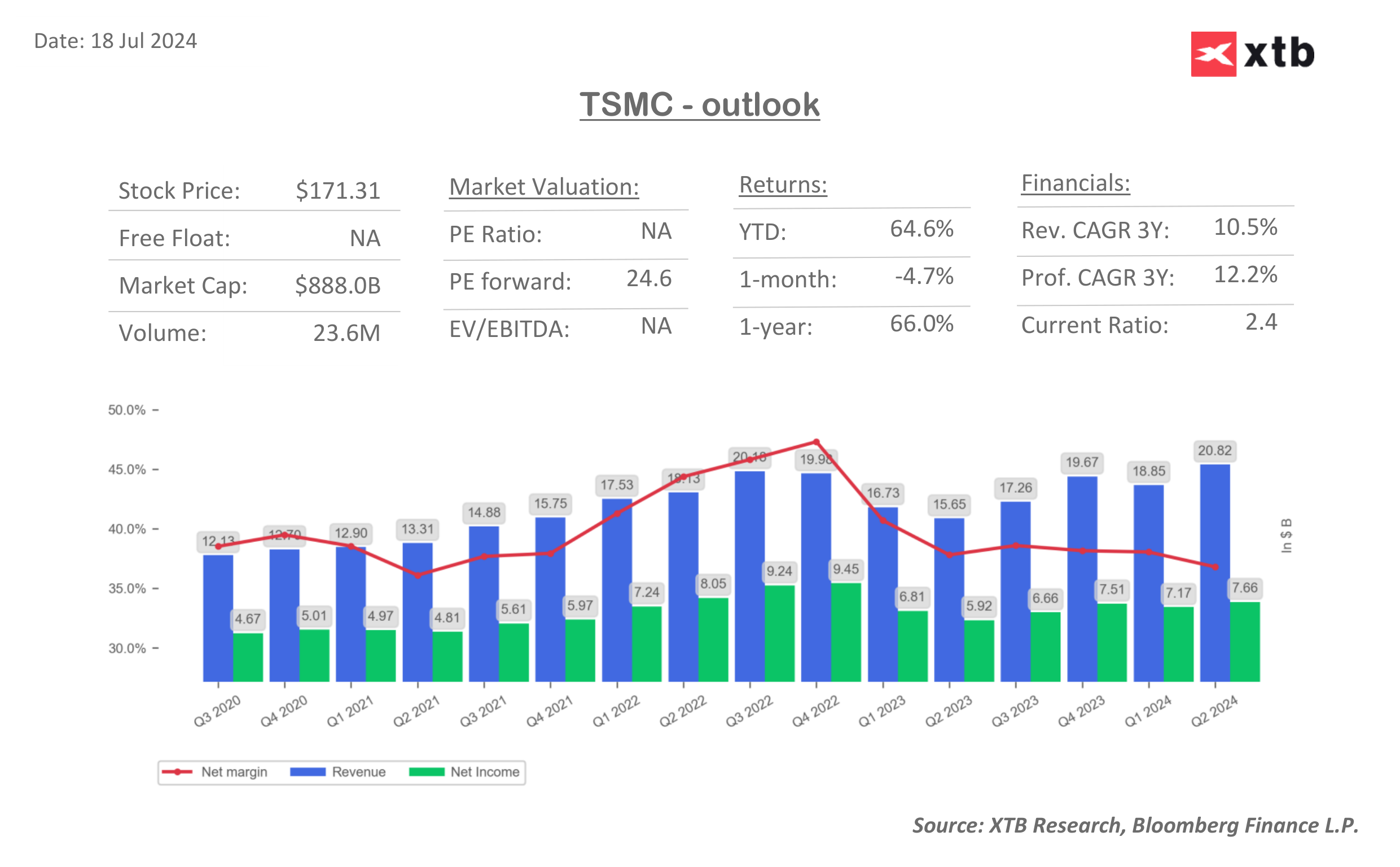

- Revenue: $20.82 billion while the company previously expected max. NT$20.4 billion (up 32.8% y/y and 10.3% k/k in U.S. dollars and 40.1% and 13.6% in Taiwanese currency NT$)

- Net income: NT$247.85 billion, vs. NT$238.8 billion LSEG forecasts (up 36.3% y/y and 9.9% k/k)

- Gross margin: 53.2%, operating 42.5%, net 36.8%

- Expectations: $22.4 to $23.2 billion in revenue for Q3 2024 ($17.2 billion in Q3 2024) and improved gross margins of 53.5 to 55.5%, with operating between 42.5% (current) and 44.5% (upper range)

Source: TSMC

Source: TSMC

Supply not keeping up with demand

Deliveries of 3nm chips accounted for 15% of total revenues, 5nm chips for 35%, and 7nm chips for 17% of revenues; together, the most advanced chips accounted for 67% of sales. According to the company, some pressure on sales and demand for 3nm and 5nm chips was imposed by seasonally lower demand for smartphones, but the company expects consistently high demand related to its largest customers' AI solutions.

- Counterpoint Research pointed out that the results prove that TSMC will be a significant beneficiary of the generative AI trend, thanks to its 3nm technology chips and superbly managed manufacturing processes. According to estimates by U.S. regulators, Taiwan accounts for 92% of the state-of-the-art chip market.

- TSMC's CEO indicated that the development process for 2nm AI chips is going well and they are expected to go into production in 2025, while the company's production is still lagging behind rising demand. The year 2024 is expected to be a record year for TSMC, with slowly rebounding smartphone demand in Q3 expected to add to the results.

- TSMC has increased its budget to $30-32 billion from $28-32 billion previously (70 to 80% will be used for technology development and possible conversion of 5nm to 3nm production). Counterpoint Research data shows that the company has increased its market share in global chip foundries to 62% from 59% a year earlier.

Taiwan Semiconductor Manufacturing (TSM.US, D1 interval)![]()

Source: xStation5

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.