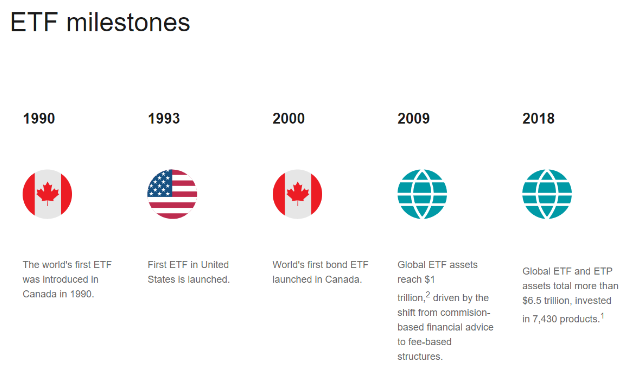

Over the past few decades, ETFs have surged in popularity, solidifying their place as a major global asset class since the inception of the first index fund by Vanguard's John Bogle in 1976. Fourteen years after the creation of the first index fund, Vanguard S&P 500, the Toronto Stock Exchange introduced the first Exchange Traded Fund. Today, ETFs offer millions of investors worldwide the opportunity to invest in well-defined asset classes, contributing to the growth of major ETF issuers like BlackRock (iShares), which has recorded billions in profits due to rising ETF inflows.

ETFs have simplified and diversified investment, allowing investors to access global markets directly and affordably, without the high costs associated with mutual funds. Many investors are drawn to ETFs due to the long-term success of the US stock market, with indices like the S&P 500 consistently outperforming 10-year treasury bonds by 5 percentage points over the long term, averaging 10% yearly returns over the last century. This success is attributed to both economic trends and monetary policies, attracting significant investments into the S&P 500 and other ETFs.

ETFs have played a crucial role in democratizing financial markets, providing access to the stock market for millions through index funds and sector-specific funds, including commodity, technology, and bond ETFs. In the upcoming post, we will highlight seven popular ETFs and discuss the advantages and disadvantages of investing in them. These assets, along with Investment Plans, can greatly contribute to building a robust long-term investment portfolio. Let's explore how below.

ETFs - Advantages and Disadvantages

ETFs do not provide a guarantee of investment returns. The returns they offer are contingent upon market pricing of the assets held within their portfolios (such as stocks, bonds, etc.) or the performance of the assets they track (e.g., gas prices, gold, silver, etc.). They come with both advantages and disadvantages, which we outline below to assist prospective investors in assessing their potential and risks. Here are a few of them.

Advantages

- Ideal for long-term investors inclined towards a passive investment approach

- Low entry requirements, minimal fees (TER), and excellent liquidity

- Offers risk mitigation and potential for portfolio diversification

- Reduces investment value volatility

- Suitable for investors at all levels, from novices to seasoned professionals

- Provides access to various asset classes such as indices, bonds, and commodities

- Assures investors that index funds replicate the performance of stock indices like the S&P 500 or Nasdaq 100 accurately

Disadvantages

- May not suit traders or short-term investors favoring an aggressive investment strategy

- Lower risk is counterbalanced by potentially lower returns

- Investor-selected ETFs might lag behind leading companies or indices during bullish market conditions

- Diversification doesn't assure returns and can result in losses

- A handful of ETFs in a portfolio may overshadow the performance of stronger-performing ones

- Risk of misalignment of ETFs within a portfolio

- Overconcentration of capital in passive investments could restrict allocation options toward higher-risk assets, potentially limiting exceptional returns

Please note that information and research based on historical data or results do not guarantee future profits.

Please note that information and research based on historical data or results do not guarantee future profits.

Index fund ETFs typically provide investors with the assurance that they will precisely mirror the returns of the underlying instrument over the long term. For instance, the iShares Core S&P UCITS ETF tracks the S&P 500 Net Total Return Index. Interestingly, the performance of this iShares index ETF appears to be even more favorable, boasting a Total Return of 204% since 2013 compared to the 194% return of the S&P 500 NTR. Source: Bloomberg Finance LP

Top ETFs in terms of popularity

ETFs provide investors with exposure to nearly every asset class:

- Stock market indices (U.S. indices, European indices, emerging markets, etc.)

- Selected sector ETFs (such as new technologies, banks, biotechnology, etc.)

- Green and ESG investments (including renewable energy, electric cars, etc.)

- Bonds (including corporate high-yield bonds, US 10-year “treasuries”)

- Energy and materials (e.g., commodity ETFs on natural gas, copper)

- Precious metals (such as gold, silver)

- Dividend equity ETFs ("distributing" model ETFs)

Useful information

- The performance of any exchange-traded fund (ETF) is significantly influenced by future developments in global markets and the economy, which are often unpredictable in the short term.

- In the long run, a robust global economy is generally viewed as a positive factor for the stock market. Increased consumption typically translates into higher corporate profits and the potential to surpass analysts' expectations.

- Decisions made by central banks can impact not only the stock market but also other assets like bonds (and bond ETFs), precious metals, or energy commodities.

- It's essential for investors to conduct their own research and enhance their financial knowledge, even when investing passively.

- A fundamental financial principle suggests that lower risk is associated with lower potential returns on investment. Conversely, taking higher risks may lead to higher rewards but also higher losses.

- Detailed information about each ETF can be found on the issuer's website. For iShares ETFs, BlackRock is the institution responsible for their issuance.

- Investors have the flexibility to sell ETFs whenever they desire, as long as the stock exchanges are open.

Some of the most popular ETFs include:

- iShares Core MSCI World UCITS EUNL.DE: Provides diversified exposure to developed countries' stock markets.

- iShares S&P 500 UCITS SXR8.DE: Offers shares of the 500 largest US companies listed on the S&P 500 index.

- iShares Nasdaq 100 UCITS SXRV.DE: Tracks the Nasdaq 100 index, comprising leading US technology companies.

- iShares MSCI World SRI UCITS 2B7K.DE: Invests in companies with a high ESG (Environmental, Social, and Governance) index.

- iShares Core MSCI Europe UCITS IMAE.NL: Focuses on the largest stock market companies in Europe.

- iShares Core MSCI World EM IMI UCITS IS3N.DE: Provides broader exposure to equities from emerging markets.

- iShares MSCI Asia EM UCITS CEBL.DE: Invests in Asian companies, including those from China.

The mentioned exchange-traded funds are indeed highly popular but constitute only a small portion of the numerous funds providing diverse exposure to various segments of the financial market. For long-term investors, the expense ratio holds significant importance, so we have included that information for the ETFs listed below:

iShares Core MSCI World

Tailored for long-term investors, this ETF could serve as a cornerstone in assessing growth prospects over the long haul, particularly in developed nations. The MSCI World index encompasses approximately 85% of listed equities across 23 economies, offering geographical diversification and allocation among developed nations such as the US, Canada, Germany, Switzerland, and the United Kingdom. Within its portfolio, this ETF holds well-established companies with global operations, providing substantial exposure to the US market.

- Investing goal: Tracking stock performance of companies from developed countries

- Number of holdings: 1513

- TER (Total Expense Ratio): 0,2%

- Distribution policy: Accumulating

- 15 Biggest stock holdings: Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, Meta Platforms, United Health, Eli Lilly, Berkshire Hathaway, Exxon Mobil, JP Morgan, Johnson & Johnson, Visa, Broadcom

- Sectors: Technology (22%), Financials (14,7%), Health Care (12,7%), Industrials (10,7%), Consumer Discretionary (10,7%)

- Standard deviation (3yr): 17,64% (as for 30 September 2023)

- Cumulative return (5yr): 42,49% (as for 30 September 2023)

- ESG Rating: A

- Rebalancing: Quarterly

iShares S&P 500 UCITS

The ETF ensures exposure to 500 well-established publicly traded companies in the US, many of which operate on a global scale. Tracking the S&P 500 Net Total Return Index entails mirroring the index's return alongside the dividends distributed (subject to withholding tax) by the constituent companies. Given that the composition of the S&P 500 index evolves over time—with companies entering and exiting—the ETF adjusts accordingly, alleviating the need for active portfolio management by the investor. By investing in this ETF, individuals can rest assured that its prices will closely mirror those of the S&P 500 index, irrespective of economic conditions, and over the long term.

- Investing goal: Tracking performance of S&P 500 NTR (Net Total Return Index)

- Number of holdings: 503

- TER: 0,07%

- Distribution policy: Accumulating

- 15 Biggest stock holdings: Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, Meta Platforms, United Health, Eli Lilly, Berkshire Hathaway, Exxon Mobil, JP Morgan

- Sectors: Technology (28%), Health Care (13,3%), Financials (12,6%), Consumer Discretionary (10,5%), Communication (9%)

- Standard deviation (3yr): 17,85% (as for 30 September 2023)

- Cumulative return (5yr): 57,98% (as for 30 September 2023)

- ESG Rating: A

- Rebalancing: Quarterly

iShares Nasdaq 100 UCITS

Investing in this ETF provides extensive exposure to various sectors within the US technology industry, including software, hardware, semiconductors, digital advertising, and artificial intelligence. Additionally, it encompasses companies operating in biotechnology, retail, wholesale, and telecommunications sectors, serving as a benchmark for investment. Dominated by large and medium-cap companies, this index is renowned as a benchmark reflecting global sentiments and momentum in the technology sector.

- Investing goal: Tracking performance of 100 largest non-financial) companies listed on Nasdaq

- Number of holdings: 101

- TER: 0,33%

- Distribution policy: Accumulating

- 15 Biggest stocks: Apple, Microsoft, Amazon, Nvidia, Meta Platforms, Tesla, Alphabet, Broadcom, Costco Wholesale, Adobe, Pepsico, Cisco, Comcast, AMD, Netflix

- Sectors: Technology (49%), Communication (16%), Consumer Discretionary (13,9%), Healthcare (7%), q (6%)

- Standard deviation (3yr): 22,49% (as for 30 September 2023)

- Cumulative return (5yr): 97,15% (as for 30 September 2023)

- ESG Rating: A

- Rebalancing: Quarterly

iShares MSCI World SRI UCITS

The index comprises numerous companies with exceptionally high ESG (Environmental, Social, Governance) scores, emphasizing factors such as clean energy, ecological sustainability, social responsibility, and corporate governance. It meticulously evaluates companies regarding their involvement in industries like defense (including nuclear weaponry and contentious firearms), alcohol, gambling, or genetically modified organisms. Furthermore, it imposes supplementary constraints on green energy and environmental preservation, particularly targeting companies in coal, oil sands, power generation, gas, and oil extraction sectors. This aspect is particularly appealing to investors prioritizing ethical and environmental considerations in their investment decisions.

- Investing Goal: Tracking index composed of companies from developed countries with high ESG rating

- Number of holdings: 415

- TER: 0,2%

- Distribution policy: Accumulating

- 15 Biggest stocks: Tesla, Microsoft, Home Depot, Novo Nordisk, Adobe, ASML, Pepsico, Coca Cola, Walt Disney, Danaher, Intuit, Amgen, Texas Instruments, Verizon Communications, S&P Global

- Sectors: Financials (17%), Technology (15%), Consumer Discretionary (15%), Health Care (15%), Industrials (13%), Consumer Staples (8%)

- Standard deviation (3yr): 16,14% (as for 30 September 2023)

- Cumulative return (5yr): 65,89% (as for 30 September 2023)

- ESG Rating: AA

- Rebalancing: Quarterly

iShares Core MSCI Europe

This ETF provides investors with broader exposure to the stock market by focusing exclusively on European equities. With a substantial array of diversified stocks from developed countries, it aligns with a long-term perspective on Europe as a significant global player in various sectors. These sectors include finance (Swiss banking - UBS), automotive (Volkswagen, BMW, Porsche, or Mercedes), consumer discretionary (Nestle), healthcare (NovoNordisk), and luxury brands (LVMH).

- Investing Goal: ETF is tracking performance of biggest listed companies from European countries only

- Number of holdings: 428

- TER: 0,12%

- Distribution policy: Distributing (dividends payable semi-annual)

- 15 Biggest stocks: Nestle, Novo Nordisk, ASML, Shell, LVMH, AstraZeneca, Novartis, Roche, HSBC, Total Energies, SAP, Sanofi, Unilever, BP, Siemens

- Sectors: Financials (17%), Industrials(16%), Health Care (15%), Consumer Staples (11%), Consumer Discretionary (11%), Materials (7%)

- Standard deviation (3yr): 15,59% (as for 30 September 2023)

- Cumulative return (5yr): 34,9% (as for 30 September 2023)

- ESG Rating: AA

- Rebalancing: Quarterly

iShares MSCI Asia EM

This ETF provides investors with diversified exposure to Asian equities, including stocks from India, Vietnam, and other countries in the region. These markets offer significant growth potential, particularly in comparison to China, driven by population growth and the presence of numerous successful technology companies.

- Investing Goal: Tracking performance of selected “Asian only” companies from selected emerging economies (MSCI EM Asia Index Net Total Return)

- Number of holdings: 642

- TER: 0,18%

- Distribution policy: Accumulating

- 15 Biggest stocks: China Construction, HDFC Bank, SK Hynix, Hon Hai Precision, Tata Consultancy, Netease, Ping an Insurance, Baidu, Mediatek, JD Com, Samsung, Bank Central Asia, BYD Ltd, Bank of China, POSCO

- Sectors: Technology (24%), Financials (23%), Consumer Discretionary (15%), Communication (10%), Industrials (5%)

- Standard deviation (3yr): 19,64% (as for 30 September 2023)

- Cumulative return (5yr): 3,38% (as for 30 September 2023)

- ESG Rating: BBB

- Rebalancing: Quarterly

iShares Core MSCI World EM IMI

Access to emerging markets may be restricted for certain investors, but the iShares Core MSCI World EM IMI ETF aims to address this issue. This index provides exposure to over 2,800 companies located in countries like China, Brazil, India, and even Vietnam. As a result, investors can tap into the growth potential of smaller companies beyond developed economies. While this ETF may carry higher risk due to the inclusion of smaller countries and 'exotic' markets, it can still serve as a crucial core component of a diversified global portfolio.

- Investing Goal: Tracking index composed of large, mid and small companies from emerging markets

- Number of holdings: 3186

- TER: 0,18%

- Distribution policy: Accumulating

- 15 Biggest stocks: Taiwan Semiconductor, ISH MSCI China, Tencent Holdings, Samsung, Alibaba, Meituan, Reliance Industries, PDD Holdings, Infosys, Icici Bank, China Construction, HDFC Bank, SK Hynix, Hon Hai Precision, Tata Consultancy

- Sectors: Technology (20%), Financials (20%), Consumer Discretionary (13%), Communication (8%), Materials (8%)

- 15 Biggest stocks: Taiwan Semiconductors, Tencent Holdings, Samsung,

- Standard deviation (3yr): 17,49% (as for 30 September 2023)

- Cumulative return (5yr): 6,44% (as for 30 September 2023)

- ESG Rating: BBB

- Rebalancing: Quarterly

*Using the iShares Nasdaq 100 UCITS ETF as an example, a Total Expense Ratio (TER) cost of 0.33% translates to $33 in fees for the first year after a $10,000 investment. The TER includes management fees, trustee fees, custody fees, registration fees, and other operating expenses. It's important to note that the data provided above may change over time, and this information reflects the average as of October 9, 2023.

The content of this article is for general information and educational purposes only. Any opinions, analyses, prices or other content does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs. Past performance is not a reliable indicator of future results, and any decision to act on such information is entirely at your own risk. CFD trading involves a high degree of risk and is not suitable to all investors. You are solely responsible for such decisions. XTB is regulated by the DFSA.