Exchange traded funds (ETFs) have revolutionized the investment landscape, making it easier for millions of individuals to invest. This asset class provides a convenient way to gain exposure to global financial markets. Whether it's the gold market, stocks of major companies in the United States and Europe, bonds, or emerging markets, ETFs cover it all. In essence, ETFs encompass everything from Wall Street bull market cycles to technology stock rallies and precious metals investments. Thanks to ETFs, passive investing has gained immense popularity.

One of the key advantages of ETFs is that they offer diversified exposure to the markets. Unlike traditional investing, they do not require expert knowledge of company valuations or constant monitoring of daily market movements. By investing in ETFs that track specific sectors, indices, commodities, or resources, investors can ensure they don't miss out on market opportunities and long-term trends. Gone are the days when one had to invest in individual companies separately. With index funds, investors can easily gain exposure to well-established stock market indexes like the S&P 500 or the widely recognized Nasdaq 100.

This article aims to provide readers with a comprehensive understanding of how ETFs work. Starting from the basics, we will explain in simple terms what an ETF is and delve into its strengths and weaknesses as an investment vehicle. Additionally, we will present two fundamental strategies for investing in ETFs.

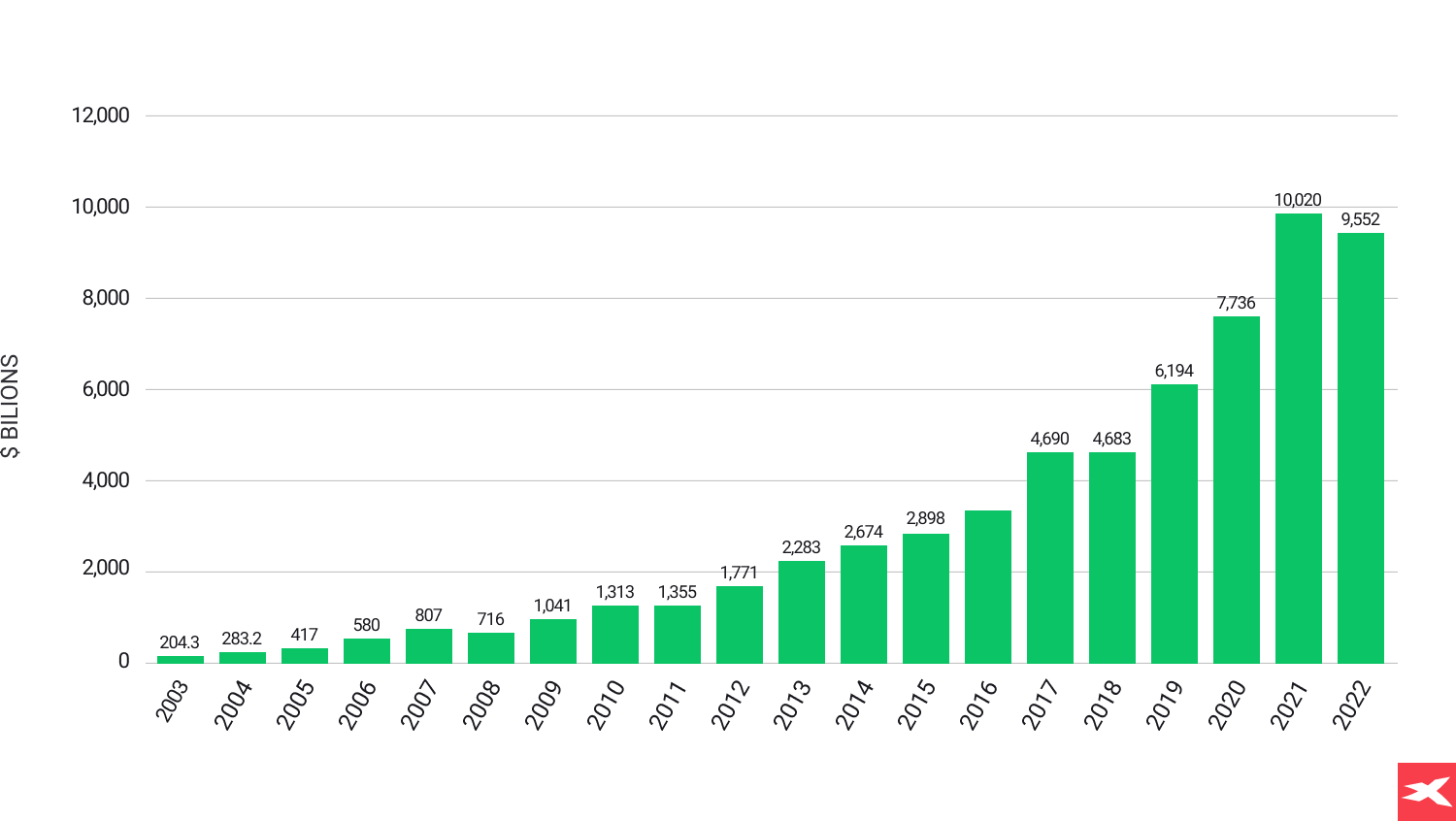

The popularity of investing in ETFs has surged, particularly in passive investing, such as index funds like S&P 500 or Nasdaq. The cash inflow into ETFs has steadily increased from $204 billion in 2003 to $9.55 trillion in 2022. Source: Statista

The popularity of investing in ETFs has surged, particularly in passive investing, such as index funds like S&P 500 or Nasdaq. The cash inflow into ETFs has steadily increased from $204 billion in 2003 to $9.55 trillion in 2022. Source: Statista

Please note that information and research based on historical data or results do not guarantee future profits.

Overview

- Exchange traded funds (ETFs) resemble shares in the stock market, as they are priced and traded on open exchanges.

- Two primary ETF investment strategies exist: passive and active, making them suitable for various long-term investment plans.

- ETFs offer access to diverse assets such as gold, index funds, specific sectors, bonds, emerging markets, and real estate.

- They provide high liquidity, broad investment opportunities, and diversification, including geographical diversification.

- ETF fees are typically lower than those of traditional mutual funds.

- ETFs can be bought and sold during stock market trading hours.

What exactly is an ETF?

An Exchange Traded Fund (ETF) is a type of security that mirrors the performance of a sector, index, commodity, or another asset. This versatility makes ETFs a crucial component of any investment strategy. Similar to regular stocks, they are traded on exchanges. The structure and focus of an ETF are determined by its creators' strategy. Consequently, an ETF can track anything from a single commodity's price to a diverse portfolio of securities.

ETFs can also offer exposure to bonds, precious metals like gold, and the commodities sector. Their simplicity, diversification, and flexibility have made them increasingly popular among investors. But what exactly are ETFs? Essentially, they are investment vehicles enabling you to buy and sell diversified portfolios of stocks, bonds, or other assets. Investing in ETFs closely resembles stock trading on an exchange, providing convenient access to various investment opportunities.

How ETFs function

ETFs are created and managed by fund providers who issue shares that can be bought and sold on the stock market throughout the trading day. There are two main types of ETFs: Passive and Active. Passive ETFs track specific indices, sectors, or commodities, while Active ETFs involve fund managers making investment decisions to outperform a benchmark index. The mechanics of ETF trading involve authorized participants creating and redeeming large blocks of shares called creation units, facilitating liquidity in the market. Tax implications for ETF investments include capital gains taxes on gains from selling ETFs and dividends received.

Exploring Different Types of ETFs

A wide variety of ETFs are available, offering investors numerous investment opportunities. While commodity and bond ETFs are common, there are many other options to consider. Among the most popular are index funds and sector-specific ETFs, which hold stocks in particular industries. Some stock ETFs utilize financial leverage in their underlying assets to enhance returns.

Another notable type is the Real Estate Investment Trust (REIT) ETF, which focuses on stocks categorized as REITs. These ETFs provide exposure to the real estate sector, offering investors a unique opportunity for portfolio diversification. With such a diverse range of ETFs to choose from, investors can customize their portfolios to match their investment goals and risk tolerance.

Advantages and Drawbacks of Investing in ETFs

Investing inevitably comes with its advantages and disadvantages. Here are six key points highlighting the pros and cons of investing in ETFs.

Advantages

- Diversification and Reduced Fees

- Tax Efficiency and Day Trading Capability

- Reduces Capital Gains Taxes Compared to Mutual Funds

- Enhanced Investment Control

- Enables Different Trading Strategies

- Ability to Trade Throughout the Day, Like Stocks

Drawbacks

- Diminished Expected Returns

- Consistent Underperformance Compared to Top Stock Companies or Managers

- Diversification May Pose Challenges, Missing Bull-Cycles

- Risk of Weak Assets in Holdings

- Certain ETFs, Especially Actively Managed Ones, May Not Mirror Specific Sector Performance

- Limited Liquidity in Less Popular ETFs

Three Possible Limitations of Investing in ETFs

Despite the numerous advantages of ETF investing, there are some potential downsides to consider.

- For example, actively managed ETFs often entail higher fees compared to passive index funds due to increased research and management costs. This may lead to diminished returns, particularly if the actively managed ETF fails to outperform its benchmark index.

- Another potential issue is limited diversification in certain sector-specific ETFs. While these funds may provide targeted exposure to a particular industry or commodity, their narrow focus can result in heightened risk and volatility compared to more diversified ETFs.

- Lastly, liquidity can pose a concern for ETFs with low trading activity. In such instances, investors might encounter challenges in swiftly buying and selling shares at fair prices. Despite these potential drawbacks, the benefits of ETF investing typically outweigh the risks, making them a valuable component of many investment portfolios.

Pros and Cons of ETF Investments

Investing in ETFs is often considered a safer option due to their fundamental structure, yet like any investment in the financial market, it carries risks along with potential benefits and drawbacks. Let's explore some of them.

Pros

ETFs offer lower costs by minimizing transaction fees associated with individually buying each stock in the portfolio. This cost reduction is achieved by consolidating transactions, resulting in lower overall position costs.

Exchange traded funds provide direct exposure to a diverse range of assets, including commodities, regional property yields, bonds, and index funds. This exposure is not easily achievable through traditional stock market investments.

Investing in ETFs grants access to a broad spectrum of stocks across various industries, thereby reducing investment risk while maintaining focus on preferred market sectors.

Effective risk management is crucial for success in the market. By diversifying or allocating the portfolio strategically, the likelihood of investment failure due to the bankruptcy of any single company is significantly reduced.

Some ETFs are backed by physical reserves of specific commodities or precious metals, acquired in the market on behalf of ETF investors. This allows investors to gain exposure to assets like gold or silver without the need to purchase physical holdings.

Cons

ETFs, due to their diversified nature, may not offer as much return potential as individual stocks, as gains in one stock may be offset by losses in another. This aligns with the principle that lower risk typically corresponds to lower returns.

Exchange traded funds may include inappropriate or weak assets in their holdings, potentially increasing investment risk beyond expectations. It's advisable to conduct thorough research on an ETF's portfolio before investing.

ETFs focused on specific industries may experience value depreciation or slower growth, even if the sector itself is performing well. This discrepancy can result from factors unrelated to the overall sector performance.

Investing in an ETF supposedly dedicated to cloud computing or robotics may include holdings from unrelated industries or companies where these sectors are not primary to their core business. This misalignment can be disadvantageous, as it may lead to investments that do not reflect sector performance or align with investor preferences.

Strategies for investment and the associated risks

Typically, ETFs are favored by long-term investors. Nonetheless, two popular investment strategies stand out and remain in high demand. Let's explore some examples of these strategies.

Passive "wait and see" approach

In this scenario, investors rely on long-term projections and purchase ETF shares with a view to long-term investment. Passive investors opt to hold onto ETF shares as part of their long-term portfolio, akin to Warren Buffett's investment strategy, which emphasizes fundamental valuation and confidence in a company's growth trajectory and management. If exposure to global markets through World ETFs like iShares MSCI World UCITS (IWRD.UK) or similar isn't adequate, ETFs offer a plethora of alternatives. Passive investors make decisions based on various assumptions, some of which are outlined below.

4 cases

Investors who have confidence in the long-term growth prospects of Emerging Markets economies and financial markets may opt to invest in related ETFs. The impressive GDP growth of countries like India and Vietnam, coupled with China's status as the world's largest commodity producer, make ETFs such as iShares Core MSCI Emerging Markets (EIMI.UK) an attractive investment option for believers in emerging markets.

For those who foresee continued growth in U.S. businesses and their expanding global market share, the S&P 500 Index offers diversified exposure to the 500 largest and potentially best businesses in the United States. With the index continually evolving to reflect the current state of U.S. businesses, ETFs like iShares Core S&P 500 UCITS (CSPX.UK) provide investors with confidence in long-term performance.

Investors bullish on new technologies such as artificial intelligence, cloud computing, or semiconductors may consider investing in the entire Nasdaq 100 index. Known for its concentration of U.S. technology companies like Nvidia and Alphabet (Google), the Nasdaq index offers exposure to overall technological growth through ETFs like iShares Nasdaq 100 UCITS (CNDX.UK)

For those anticipating long-term increases in gold prices, ETFs that provide direct exposure to gold, like iShares Gold ETF (IGLN.UK), may be appealing. Similarly, investors optimistic about oil or gas prices may explore a range of ETF options. Dividend investors may find ETFs focused on dividend-paying companies, such as Vanguard FTSE All-World High Dividend Yield UCITS (VHYD.UK), of interest.

ETFs offer long-term investors a wide range of investment opportunities, spanning from private equity to selected property yields or technology sectors. For those seeking to construct a diversified investment plan, these options are particularly noteworthy.

Active “momentum” strategy

Some investors find long-term investments unattractive or prefer to actively trade, seeking higher potential yields at the cost of increased risk. ETFs can be traded like stocks, allowing investors to hold positions for hours, days, weeks, or months. Whether you're a contrarian investor or interested in timing the markets, ETFs provide numerous opportunities to pursue these strategies.

4 cases

- Investors who anticipate higher inflation in the context of a still robust global economy may seek exposure to the oil or oil & gas sectors. While predicting commodity prices is challenging, investors who closely monitor OPEC decisions or macroeconomic data may consider purchasing shares in ETFs such as WisdomTree WTI Crude Oil (CRUDE.UK) or iShares Oil & Gas Exploration & Production (IOGP.UK).

- Those who believe in the transformative potential of new technologies like AI, robotics, or automation may opt for exposure to these trends through ETFs such as iShares Automation & Robotics (RBOT.UK) or Global X Robotics & AI (BOTZ.UK). Given the higher volatility inherent in technology sectors, these ETFs may also attract short-term traders.

- Contrarian or high-yield bond investors seeking exposure to the aggressive bond market or real estate may consider ETFs like iShares Fallen Angels High Yield Corp Bond (WIAU.UK), iShares High Yield Bond UCITS (EUNW.UK), iShares Developed Markets Property UCITS (IDWP.UK), or iShares Asia Property Yield (IASP.UK).

- Active ETF traders may utilize riskier leveraged ETFs, which amplify the returns of underlying assets, such as WisdomTree S&P 500 x 3 Daily Leveraged (3USL.UK) or Lyxor Nasdaq 100 x2 Leveraged Daily UCITS (LQQ.FR). Conversely, there are less common reverse ETFs that attract "short sellers" and speculators anticipating declines in natural gas prices or the German stock market. Examples include WisdomTree Natural Gas x3 Daily Short ETC (3NGS.UK) or Lyxor Daily ShortDAX x2 (DSD.FR).

ETFs can serve as significant catalysts for any investment strategy and portfolio. Their potential extends far beyond the examples provided earlier. However, conducting thorough investment research is always strongly advised, and each ETF is typically extensively described.

By reviewing an ETF's holdings, investors can gain insights into its portfolio composition, which ultimately defines its investment quality and prospects. It's crucial not to rely solely on brief descriptions but to delve deeper into the assets held by any ETF before making an investment decision. This is particularly vital for ETFs that focus on stocks.

Diverse Investor Types

Active investing appeals to risk-tolerant investors, while those seeking to minimize risk may prefer passive investing.

Costs associated with trading

Active investing typically incurs higher transaction costs as a result of frequent trading and a larger number of positions opened. Conversely, passive investing tends to have lower transaction costs because of the infrequent trading activity.

Managers employing an active approach

While active managers may achieve superior results over passive investors in the short term, sustaining exceptional performance over the long term is challenging. Ultimately, ETFs are primarily suited for medium to long-term investments.

Movement in prices

The objective of active investing is to capitalize on short-term fluctuations in prices, while long-term price trends and broader market movements also significantly influence investment strategies.

Creating an Investment Strategy

Crafting a robust investment strategy is pivotal for achieving success in ETF investing. An investment strategy delineates a blueprint for making informed investment decisions, predicated on your objectives, risk tolerance, and anticipated capital requirements. A flourishing investment strategy might encompass:

- Establishing objectives

- Assessing risk tolerance

- Conducting thorough research and choosing ETFs

- Implementing diversification in investments

- Periodically reassessing and adapting the strategy, particularly if adopting a long-term bullish approach where market timing may be unnecessary

Continuously monitoring and adjusting your investment strategy ensures that your portfolio stays in line with your objectives and risk preferences, allowing you to seize emerging opportunities and adapt to market changes. Keep in mind that a carefully crafted investment strategy forms the bedrock of successful investing and the accumulation of long-term wealth, extending beyond just the realm of ETFs.

Begin your journey into ETF investing

Starting your ETF investment journey entails several crucial steps. First, you'll need to establish a brokerage account, a process that involves supplying personal and financial details. Once your account is verified, you're poised to delve into researching and handpicking ETFs that align with your investment objectives. This phase requires thorough analysis and consideration of factors like expense ratios, asset allocation, and historical performance. With your chosen ETFs identified, you can proceed to execute your investment strategy and begin building your portfolio.

Starting your ETF investment journey entails several crucial steps. First, you'll need to establish a brokerage account, a process that involves supplying personal and financial details. Once your account is verified, you're poised to delve into researching and handpicking ETFs that align with your investment objectives. This phase requires thorough analysis and consideration of factors like expense ratios, asset allocation, and historical performance. With your chosen ETFs identified, you can proceed to execute your investment strategy and begin building your portfolio.

Setting up a Brokerage Account

Setting up a brokerage account is a simple process that involves providing personal details such as your name, address, and date of birth, along with financial information including income, net worth, and investment goals. Online brokers may also require document verification for address and ID confirmation.

After your brokerage account is established, you can commence investing in ETFs by adhering to these guidelines:

- Deposit funds into the account and await clearance.

- Utilize the ETF's ticker symbol (typically a four-letter code representing the fund) to execute an order.

- Commence constructing your ETF portfolio.

Conducting research and choosing ETFs

When exploring and picking ETFs, it's crucial to take into account various factors, including:

- Expense ratios

- Investment goals

- Administrative costs

- Commissions

- Trading Volume

- Portfolio Holdings

- Long-term performance of the ETF

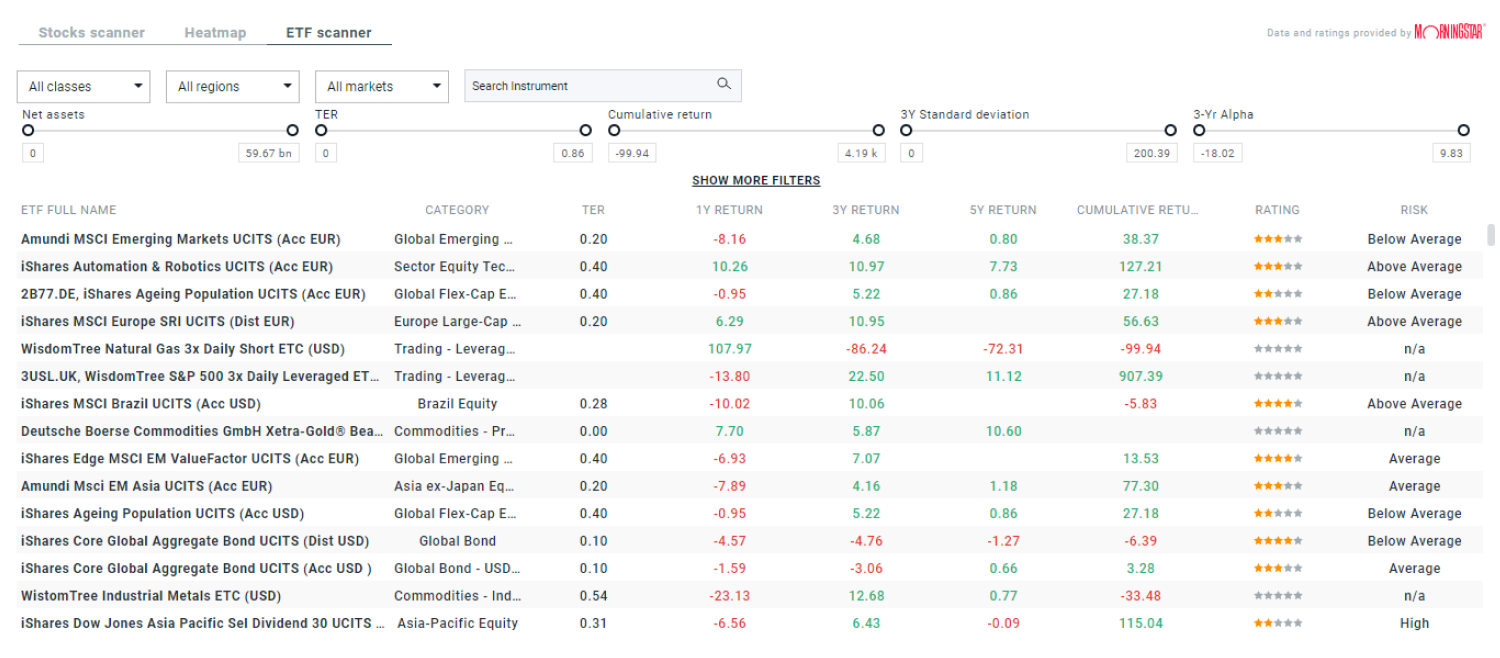

To enhance the search for suitable ETFs, investors can utilize the "ETF scanner" available on the XTB platform. This tool includes a Morningstar rating and provides a display of dividends history, aiding investors in making informed decisions.

Please note that information and research based on historical data or results do not guarantee future profits.

Please note that information and research based on historical data or results do not guarantee future profits.

The expense ratio, indicative of the annual management fees associated with the ETF, is a pivotal consideration impacting overall returns. Particularly for novices, passive index funds are often recommended due to their lower fees in contrast to actively managed funds, coupled with their historical tendency to outperform over extended periods. Incorporating index funds into your ETF research is imperative to ensure alignment with your investment objectives and risk tolerance.

Diversification plays a pivotal role in successful investing, prompting the selection of ETFs spanning various sectors, asset classes, and geographical regions to mitigate risk and enhance returns. Moreover, integrating uncorrelated assets can further diminish overall portfolio risk.

Through diligent research and thoughtful ETF selection, you can construct a well-diversified portfolio tailored to meet your specific investment objectives.

Conclusion

In conclusion, ETF investing presents a significant opportunity for investors aiming to diversify their portfolios, reduce fees, and access various asset classes. By grasping the fundamentals of ETFs, conducting thorough research, and selecting appropriate funds, investors can embark on a successful investing journey. It's important to emphasize discipline, diligence, and goal orientation for long-term investment success.

For a deeper understanding of the markets, exploring psychological aspects of investing and cognitive biases can be beneficial. While investments don't guarantee profits, they inherently involve risk in financial markets. It's crucial to always consider the risk premium and maintain a "margin of safety," especially during ETF investing. Typically, both are more pronounced when asset prices are low and risk aversion is prevalent. However, employing a "contrarian buying" strategy at discounted prices may not suit everyone. ETFs can serve as a component of a well-rounded portfolio.

Trading hours of ETFs

ETF trading hours vary depending on the exchange and are crucial information for both day traders and long-term investors. Typically, ETF trading occurs from Monday to Friday when stock exchanges are operational. However, these trading hours are subject to the schedule of each specific exchange.

ETF trading hours vary depending on the exchange and are crucial information for both day traders and long-term investors. Typically, ETF trading occurs from Monday to Friday when stock exchanges are operational. However, these trading hours are subject to the schedule of each specific exchange.

During weekends, exchanges are closed, resulting in static ETF prices. Conversely, throughout the week, ETF prices experience continuous fluctuations.

In Europe, ETF trading sessions usually span from 8 AM BST to 4 PM BST. Meanwhile, the US trading session commences at 2:30 PM BST. It's important to consider time zones when planning trades across different regions. Additionally, it's common for exchange markets to close on significant national holidays such as Independence Day in the US, New Year, or Christmas.