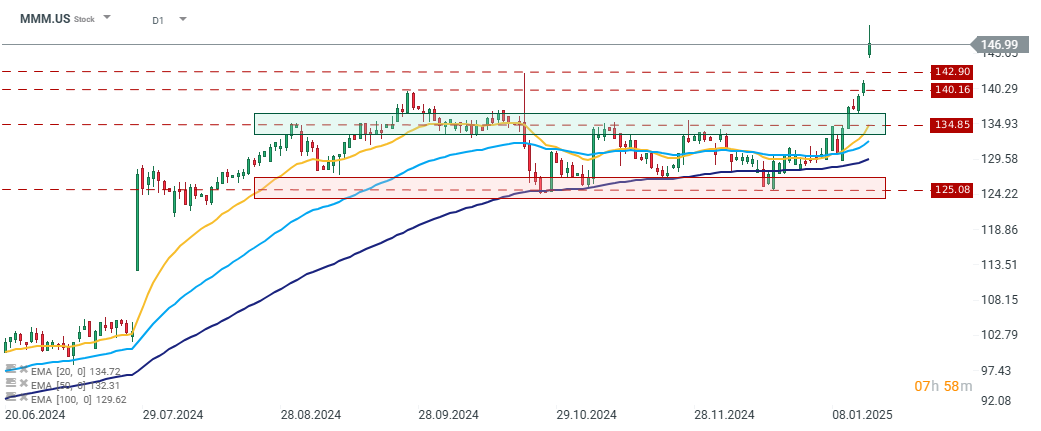

3M (MMM.US) released its Q4 2024 results today. Most of the figures exceeded expectations, and first trading reactions indicate a positive reception by the market. The company's stock is up by approximately over 4% at the start of the session.

The company posted $6 billion in revenue for Q4, showing flat year-over-year growth. On a comparable basis, revenue grew by 2.1% year-over-year, marking the strongest growth in recent quarters and exceeding consensus estimates by 1.2 percentage points. The security and industrial segment recorded the highest growth, a positive signal given its dominant contribution to total revenues, accounting for 45% of the company's Q4 2024 revenue.

Operationally, this segment also delivered the highest operating margin at 21%, surpassing the company's overall core margin by 3 percentage points. Year-over-year, this margin improved by 1 percentage point. For the full year 2024, the security and industrial segment's margin reached 23%, up 2 percentage points compared to 2023.

In 2024, the company returned $3.8 billion to shareholders, with nearly 30% distributed in Q4 alone. 3M also provided its 2025 outlook, which aligns closely with prior estimates. The company forecasts adjusted EPS in the range of $7.60 to $7.90, with the midpoint of $7.75 nearly matching the consensus estimate of $7.78. On a comparable sales basis, 3M expects growth of 2.5%, signaling continued acceleration in growth rates compared to previous quarters, though currency fluctuations may pose headwinds.

FINANCIAL RESULTS:

- Revenue: $6.0 billion; estimates: $5.78 billion (flat year-over-year)

- Adjusted EPS: $1.68; estimates: $1.66 (-2% year-over-year)

- Full-year sales: $24.6 billion; adjusted sales: (+1.3%), GAAP sales: (-0.1% year-over-year)

- Full-year GAAP EPS: $7.26; previous year: -$15.17

- Full-year adjusted EPS: $7.30; previous year: $6.04 (+21% year-over-year)

- Free cash flow: $1.3 billion (Q4); full year: $4.9 billion

- Shareholder returns: $1.1 billion (Q4); full year: $3.8 billion (through dividends and share buybacks)

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้