Reserve Bank of Australia is scheduled to announce its next monetary policy decision tomorrow at 5:30 am BST. Rates are expected to remain at 12-year highs, with markets expecting the bank to retain its hawkish bias. However, should the bank hint that cut is more likely than hike as the next move, it would be seen as a dovish surprise. Let's take a quick look what to expect from the meeting.

What markets expect?

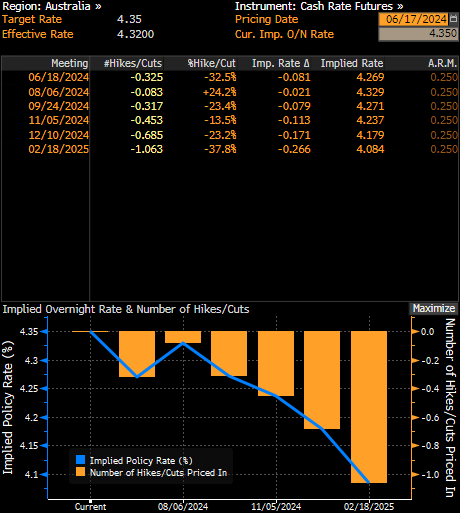

Economists surveyed by Bloomberg are unanimous - all 32 forecasts compiled by Bloomberg point to the Reserve Bank of Australia keeping rates unchanged tomorrow, with cash rate staying at a 12-year high of 4.35%. Situation looks different when we take a look at money market's pricing. Cash rate futures pricing in an over-30% chance of RBA delivering a rate cut today. However, a full 25 basis point rate cut is not priced in until early-2025.

Money markets see an over 30% chance of RBA delivering a 25 basis point rate cut at a meetning tomorrow.

Is there a chance for a rate cut?

Is there really a chance that Reserve Bank of Australia will decide to cut rates tomorrow? Of course there is. However, given current macroeconomic outlook, it looks rather unlikely.

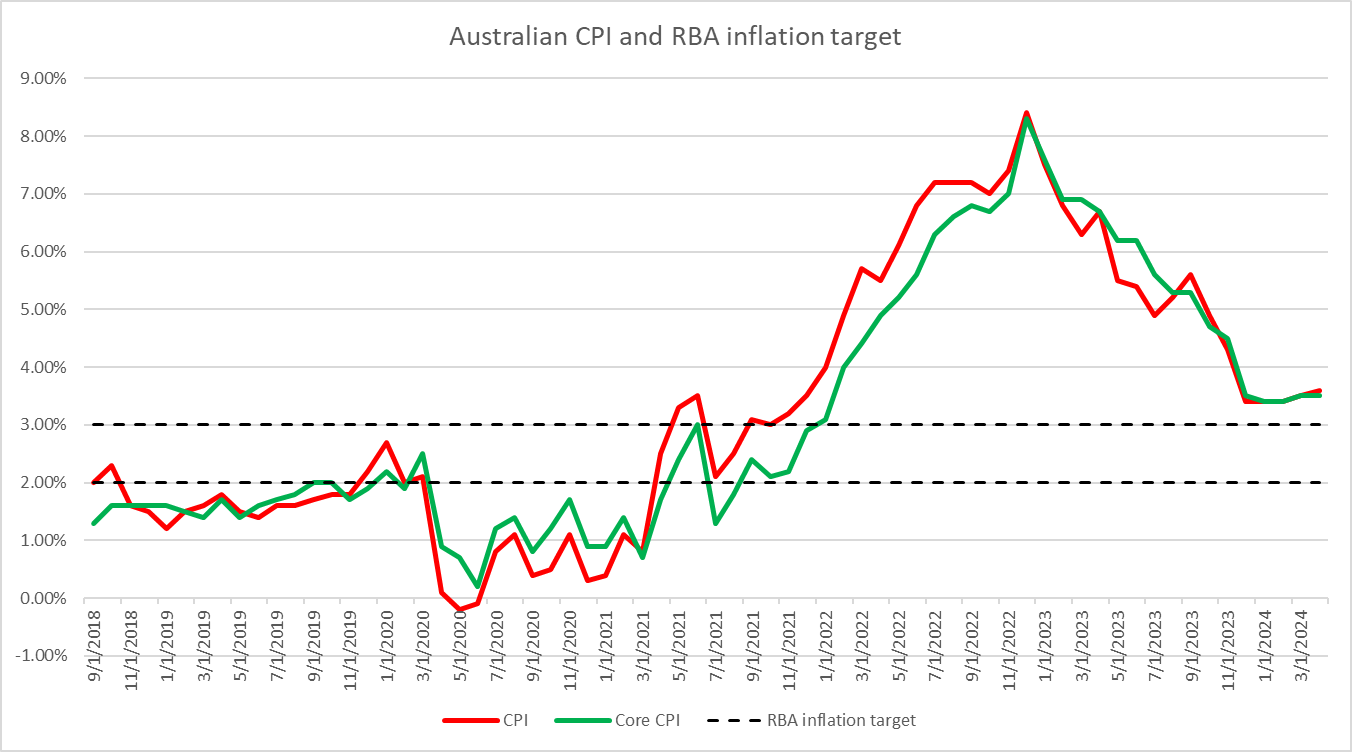

First of all, the inflation remains above RBA's 2-3% target. Inflation data for April turned out to be stronger-than-expected and, overall, CPI and core CPI held firm around 3.5% since the beginning of the year, giving an impression that price growth deceleration may have bottomed out. Such a development is more supportive of a rate hike, which RBA is likely to discuss at tomorrow's meeting but unlikely to deliver.

Secondly, economic growth data for Q1 2024 disappointed. While this could hint that the economy may need monetary support, it also hints that high rates are having an impact on demand, which should ultimately bring inflation further down. This plays well into recent RBA rhetoric of keeping rate trajectory higher-for-longer.

Last but not least, RBA own projections do not suggest that headline inflation as well as core inflation will return 2-3% target before late-2025. Also, wage growth is expected to decelerate at a slower pace than inflation, meaning that real wage growth should be positive and it will exert upward pressure on inflation. Labour market remains tight, which should also make it harder for RBA to bring inflation down to the target sustainably.

CPI and core CPI inflation in Australia has decelerated significantly from 2022/23 peaks, although it still remains above RBA's 2-3% inflation target. Moreover, it looks like inflation has bottomed out in 2024 and remained around 3.5% since the beginning of the year. Source: xStation5

A look at AUDUSD chart

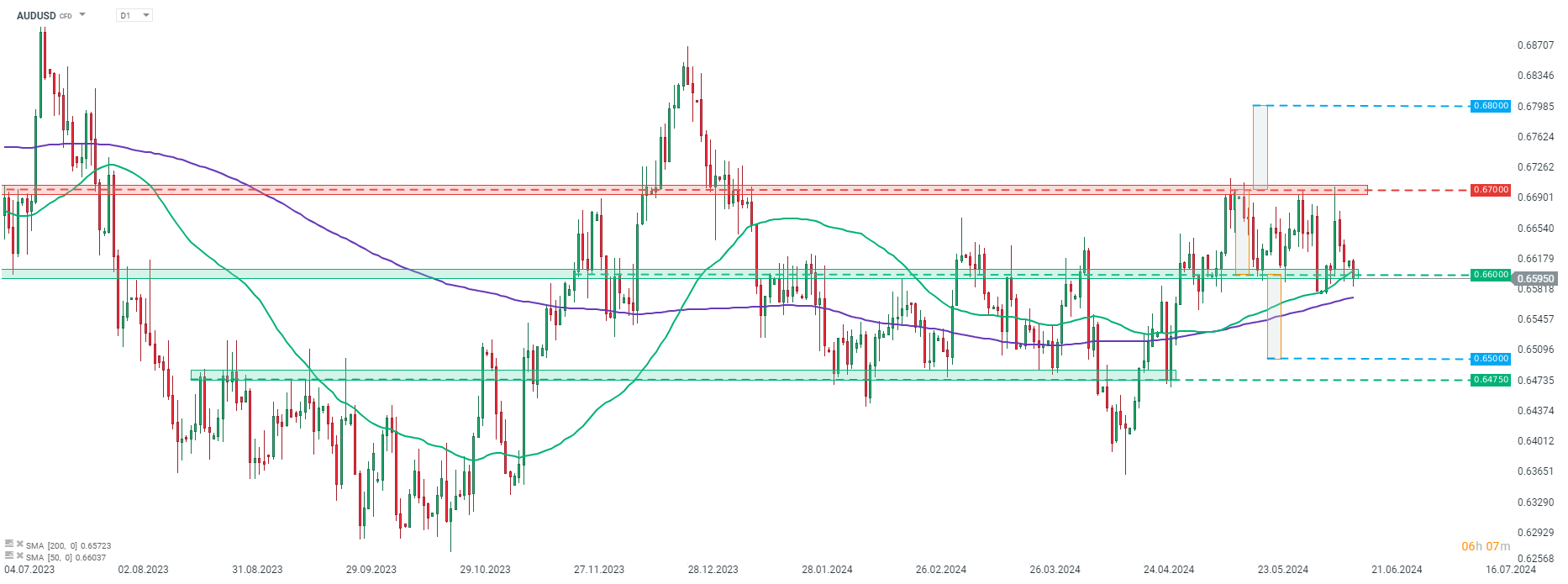

It is hard to guess market's reaction to tomorrow's policy announcement. Of course, a surprise rate cut would likely weight on the Australian dollar, while a surprise rate hike would likely give a boost to AUD. However, neither of those two outcomes are expected. Having said that, guidance and statement wording will be key.

Should RBA retain its hawkish bias and continue to acknowledge inflation stickiness, which is likely after April CPI data, this could provide some support for AUD and push markets odds for a rate cut even further back. However, market reaction should not be too large as it would mean keeping the current status quo. On the other hand, should RBA indicate that rate cut is now more likely than a rate hike, instead of keeping both options on the table, it could be a headwind for AUD and trigger a drop on AUDUSD market.

Taking a look at AUDUSD chart at D1 interval, we can see that the pair traded mostly sideways in the 0.6600-0.6690 range since the beginning of May 2024. Bulls made another failed attempt at breaking above the 0.6700 resistance zone and the pair pulled back to the lowest limit of the range, where the 50-session moving average (green line) can now be found as well. Should RBA deliver a dovish message today and the pair breaks below the lower limit of the range, declines may deepen to as low as 0.6500 area, where the textbook target of a downside breakout from the range can be found. Additional AUD volatility may also be present at 6:30 pm BST, around an hour after the decision as RBA Governor Bullock will hold a press conference.

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS