New York Fed survey indicated a drop in inflation expectations. Stock indexes gain after dismal opening:

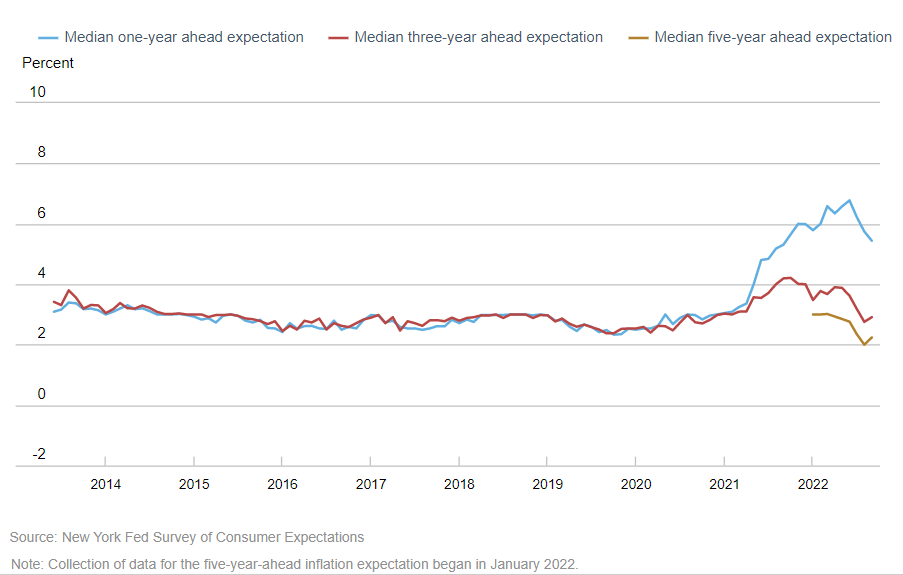

- Inflation expectations are an important measure from the Fed's point of view. They can be compared to a 'self-fulfilling prophecy'; when consumers expect ever-higher prices (high inflation expectations), the inflationary spiral tends to spiral upward. A drop in expectations also translates, in a piecemeal fashion, into a drop in wage pressures, which can be an additional important factor in holding back inflation;

- Markets have speculated recently regarding the risk of persistently high inflation expectations not falling enough despite the Fed's hawkish moves. This scenario could herald the significant damage the economy would suffer from tightening in a high-inflation environment. The NY Fed survey has calmed Wall Street somewhat;

- Thursday's reading of the U.S. inflation report for September is still in question. A decline in CPI and core inflation below expectations could give financial markets a breather and reduce the likelihood of a prolonged cycle of rate hikes. On the other hand, in an environment of continued declines in inflation expectations, the market may begin to slowly price in that 'regarding rising inflation, the worst is over'.

Inflation expectations have decisively declined on a year-over-year basis, which is positive and dampens the risk of damage the Fed could do with aggressive tightening in an environment of persistently high inflation expectations and inflation. At the same time, longer-term 3- and 5-year expectations have delicately increased, which could mean that the Federal Reserve may have trouble getting inflation to its 2% target. Source: New York Fed

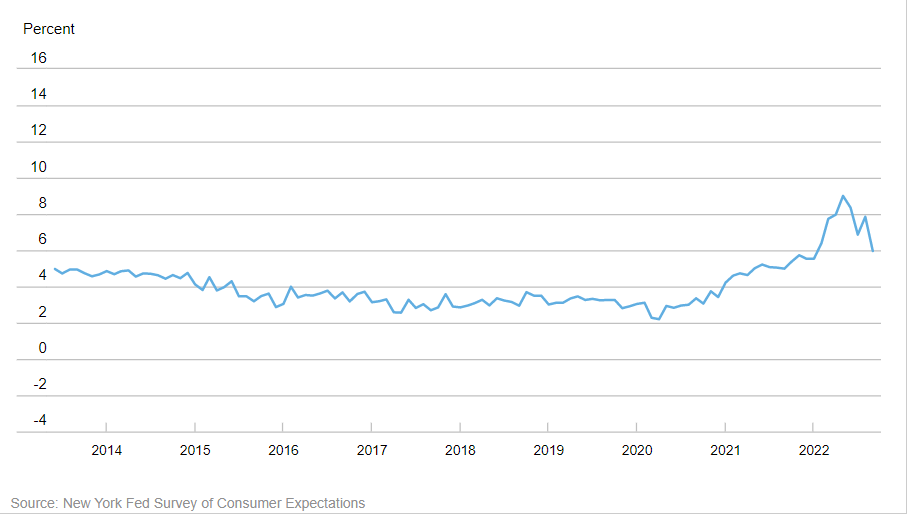

Inflation expectations have decisively declined on a year-over-year basis, which is positive and dampens the risk of damage the Fed could do with aggressive tightening in an environment of persistently high inflation expectations and inflation. At the same time, longer-term 3- and 5-year expectations have delicately increased, which could mean that the Federal Reserve may have trouble getting inflation to its 2% target. Source: New York Fed  Consumer price expectations fell sharply and broke an upward trend, returning to levels seen in early 2022. Source: New York Fed

Consumer price expectations fell sharply and broke an upward trend, returning to levels seen in early 2022. Source: New York Fed

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉