Summary:

- Ivey PMI 61.8 vs 64.2 exp

- USDCAD moves higher in the initial reaction

- The pair tests long term trendline

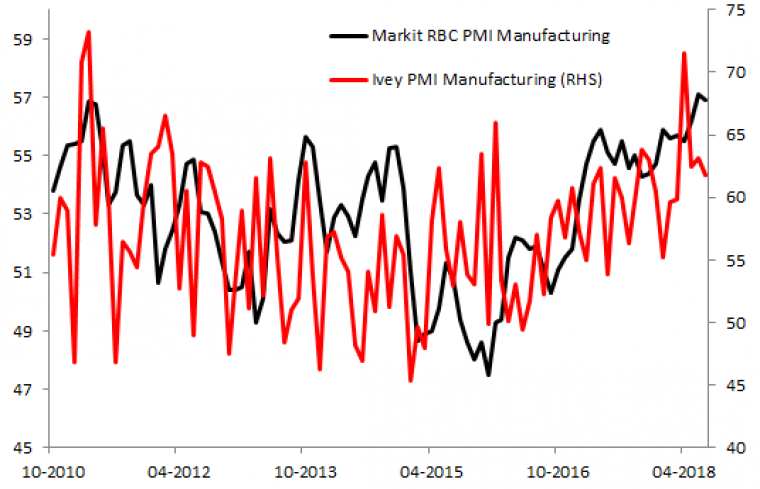

It’s a fairly quiet day on the economic calendar with the biggest release this afternoon the Canadian Ivey PMI. The figure itself was softer than expected with a reading of 61.8 well below the 64.2 expected, marking the second time in the last 3 releases that this indicator has disappointed. Last time out the reading was 63.1 and given the fairly good correlation between this metric and the Markit RBC PMI manufacturing equivalent, it could be seen as a sign of caution going forward.

The latest Ivey PMI disappointed and this could be seen as a worrying sign for the Markit RBC equivalent, given the fairly close historical correlation between the two. Source: XTB Macrobond

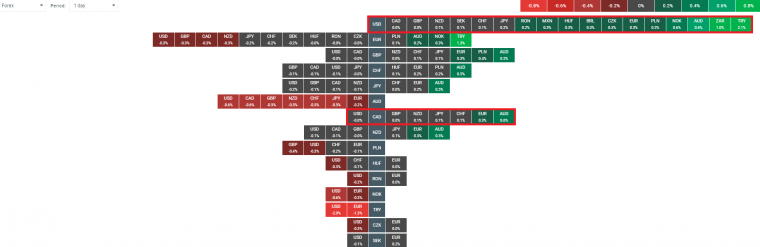

The Canadian dollar is trading a little lower on the day, despite some gains seen in the Oil price. Having said that the only real declines of note are seen against the AUD and EUR, with the other major currencies barring the USD making marginal gains. The fact that the Canadian dollar is a little weak may be more clearly seen by looking at the USD line on the heatmap, where it clearly shows that all other currencies are gaining more against the USD than CAD.

The Canadian dollar is trading lower today, with the latest Ivey PMI failing to provide any good news for the Loonie. Source: xStation

The bigger picture for the Canadian dollar against its southern counterpart is interesting at the moment, with the market bouncing from a long term trendline going back to the low seen at the start of the year at 1.2247. There is still some way to go for today’s session but a bullish hammer may be forming on D1, from the aforementioned trendline. Recent lows around 1.2960 now take on a potentially greater significance and as long as they remain in tact then a push higher may occur.

USDCAD has bounced from a rising trendline and lows around 1.2960 could now be seen as an important support level. Source: xStation

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.